In quest of perceived transaction cost’s impact on fintech users’ intention: the moderating role of situational factors

Theoretical development

Innovation diffusion theory

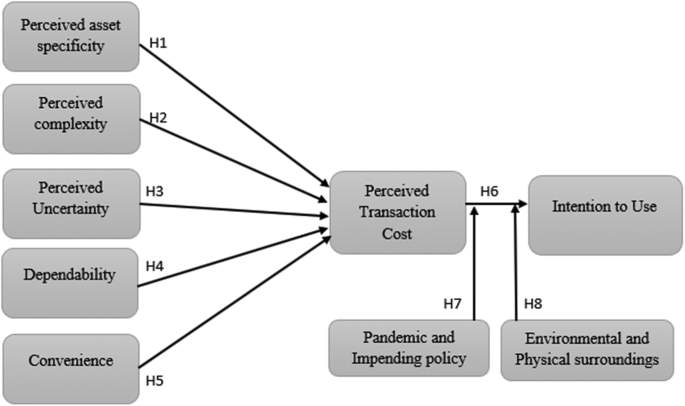

In contrast to other investigations, this one is unique. Instead of extending the TAM to look at the elements affecting user intention to use fintech, it primarily focuses on researching the components driving fintech use intention by combining IDT, TCE, and Belk’s theory.

IDT is a broad social psychology theory that seeks to expound adoption criteria, pinpoint processes, and assist in foretelling if or how innovations will be successful (Rogers 2010).

The concept has been the subject of a significant amount of study in several domains (Leerapong 2013), and it has consistently led to positive results in all of them, from studies related to journalism and health communication, therefore validating the diffusion process. Regarding the Diffusion of Innovation Theory’s limitations, adopted behavior performs better than halted or prevented behaviors. A person’s capacity to adapt to novel behavior (or creativity) is not considered (MacVaugh and Schiavone 2010; Miller 2015). IDT assists companies in comprehending how consumers engage with and use novel products or technology as time passes. Companies will employ it when introducing a novel product or service, changing an old product, or entering an emerging market (Leerapong 2013). The diffusion of innovation hypothesis’s most important feature is the idea of peer networks, which is essential to the theory. The critical mass reached via the impact of early adopters and pioneers who serve as decision leaders trigger the initial “take-off” moment in adopting innovation. To assess the usage of fintech and consider IDT for the given hypothetical situation, IDT is employed in the study (Fig. 1).

Transaction cost economics

Williamson (1979) developed his theory of transaction cost economics (TCE), which considers the interplay of two fundamental principles of human behavior (i.e., bounded rationality and opportunism) and three key transaction characteristics (i.e., frequency, uncertainty, asset specificity). TCE explains why a person who engages in transactions favors one transactional activity over another (Williamson 1996). Steinfield and Whitten (1999), who argued that TCE might be used to define the attraction of e-business to customers, broadened TCE literature (comprising consumers from institutions and individuals).

Belk’s theory

Belk coined the phrase “situational considerations” concerning consumer buying behavior to illustrate how various factors influence customers’ purchase decisions. Belk categorized these effects into situational and non-situational components gleaned from “a revised stimulus-organism-response paradigm” (Belk 1975). Non-situational elements signify universal and long-lasting peculiarities, such as a person’s character, intelligence, gender, and ethnicity, or a product’s brand recognition, endurance, size, and usefulness. Situational factors are portrayed as “all those elements relevant to a time and place of observation that is not generated from specific experience and sensory qualities and has a demonstrable and systematic influence on current behavior” (Ashraf et al. 2014). Situational elements entail the physical surroundings, temporal perspective, social surroundings, task specification, and antecedent states. A stimulus item’s physical surroundings comprise its geographic and organizational location, furnishings, sounds, odors, lighting, weather, and visual displays of objects or other materials. The social environment comprises other people, their presence, visible roles, and related reactions. Aspects of circumstances, such as temporal perspective, may be categorized in basic dimensions based on the time of day and the year. Task definitions are aspects of situations, like a purpose or need to choose, procure, or acquire information on a generic or particular buy. Antecedent states are fleeting feelings, conditions, or states that influence purchase decisions, including anxiety, pleasure, anger, having money on hand, being exhausted, and being ill. Then, some researchers offered up-to-date situational components (Fiedler 1964; Nicholls et al. 2002; Nicholls et al. 1996; Zhuang et al. 2006) and included these new variables in their model parameters for their field of study.

According to this study, we added certain situational elements to the use of fintech, such as EPS, and new elements depending on the world’s situation today, including a PIP. Other theories have also been put forward, such as “the contingency theory of leadership” (Shala et al. 2021). The Innovation Diffusion Theory claims consumers are more open to innovative ideas and new technologies (Branstad and Solem 2020). However, customers’ (or prospective users’) choice to accept or reject an innovation depends on their attitudes or views about the invention. Here, an experimental approach will study elements affecting purchasers’ expectations of how well Fintech would be received concerning situational factors.

This research combines IDT, TCE, and Belk’s theory to study the causes of PTC and how they affect customers’ IU. This study also advances theory in other ways (i.e., from TAM to IDT and TCE). Using “perceived asset specificity (PAS)” and “perceived uncertainty (PUC)” for the specified theoretical model, this work also evaluated TCE (Fig. 1).

Antecedents of perceived transaction cost

Positive and negative associations with the PTC and IU elements are shown in this research. The elements that make a transaction more costly positively correlate with the PTC. It implies that the PTC is increased. On the other hand, a negative association between a variable and the PTC indicates that the factor does not raise the PTC. This study has taken five antecedents, which are given below.

Perceived asset specificity

Long-term investments in favor of particular transactions are referred to as perceived asset specificity (PAS) (Cuypers et al. 2021). Investments have a lower potential return or opportunity cost than potential consumers’ prospective alternatives (Pan et al. 2022). There are two types of asset specificity: physical and human asset specificity. Purchasing specialized devices for online shopping, like laptops, smartphones, and modems, falls under physical asset specificity. Human asset specificity addresses the additional time and struggle required to develop online buying competence (Wang et al. 2019). Most users in Pakistan may thus devote a lot more finance, time, and energy to acquiring the necessary tools and abilities to participate in fintech usage than users in developed countries. These expenses result in higher transaction costs and lower adoption intentions due to customers’ perceptions of increasing asset specificity. The outcomes are as follows:

H1: PAS has a positive relationship with PTC.

Perceived complexity

Perceived complexity (PCX) (Huong et al. 2021) measures how challenging it is to grasp and apply a certain invention. The polar dissimilarity to ease of use measures how pleasant a person finds using a system (Al-Rahmi et al. 2019). Thus, in this research, PCX is exemplified as the user’s assessment of how difficult it is to utilize fintech. Users may have difficulties with innovation if it is thought to be complicated due to a want of user skill and knowledge (Ashta and Herrmann 2021; Le 2021). Users are less likely to accept an innovation if they perceive it as a complex system. The PTC increases when a client devotes time to something valued as money or if it seems bothersome. As a consequence, this research tests the following hypothesis:

H2: PCX has a positive relationship with PTC.

Perceived uncertainty

Perceived uncertainty (PUC) results from problems or complications in judging the actions or behavior of the other trader due to opportunism, restricted thinking, and information asymmetry (Ryu and Ko 2020). Transaction costs are significantly increased when there is a high level of PUC since both trade players have to invest more time and effort in the quest for goods and pertinent details, as well as inspecting and viewing the trading process. According to a researcher, there are two different forms of online purchase uncertainty: product uncertainty and online store behavioral uncertainty (Ashrafi et al. 2022). Because of perceived product uncertainty, evaluating the quality of purchased goods might be challenging. Consumers often wonder if the goods they buy will meet their goals before or during the buying process. When shopping in person, shoppers may examine an item before choosing whether or not to purchase it. When purchasing a product or service online, they focus on the quality assessment websites or apps do. Customers often express concern about the unpredictability of the performance of online-purchased goods (Wu et al. 2020). Product uncertainty results in higher transaction costs.

The behavioral uncertainty of shopping websites relates to buyers’ inherent issues when mistakenly appraising online businesses’ contractual or commercial performance, similar to the idea of performance ambiguity (Bhardwaj and Ketokivi 2021). Due to the parties’ inclination for opportunism, perceived behavioral ambiguity occurs inside the trading framework (Kim et al. 2021). Consumers are worried about online retailers making false claims, poor customer service, and a lack of vendor assurances, which are significant barriers to online purchasing.

H3: PUC has a positive relationship with PTC.

Dependability

Dependability (DPND) is the ability of a vendor or fintech network operator to provide the purchaser or user with outcomes that correspond to whatever they have ever promised or stated (Swan et al. 1988). DPND is the cornerstone upon which trust is formed. When using fintech for online shopping or services, consumers depend on weblogs and apps to complete respective financial activities and transactions, including assessing the particularity of items and providing after-sale inquiries. Customers that rely on the fintech program won’t have to spend additional hours and conscientiousness verifying the buying orders if they think fintech programs are trustworthy or reputable; if not, their PTC won’t increase (Teo et al. 2004), and vice versa.

H4: There is a negative relationship between the DPND of fintech and PTC.

Convenience

According to the research of Zhang and Kim (2020) on IU, we apprehend convenience (CONV) as the privileges (i.e., reducing time and energy required and buying whenever) that consumers experience via online shopping. Online shopping as a substitute for in-person browsing or shopping benefits customers since it saves them time and effort on product research. Additionally, clients may always make purchases from internet merchants. Therefore, we suggest the following idea:

H5: There is a negative relationship between CONV and PTC.

Perceived transaction cost and intentions to use fintech

The unit cost that a customer believes he pays while engaging in a certain activity, such as browsing or purchasing, is known as the PTC. Costs of discovering and gathering information, haggling, examining, and enforcing laws are examples of transaction costs (Alwi 2021). Businesses favor transactions with low transaction costs (Rangaswamy et al. 2020). Fintech is used by certain consumers when they purchase online since it cuts down on the time they need to spend finding product information. Consequently, adopting fintech for online buying has lower apparent transaction costs. Others, on the contrary, are against using fintech for online shopping or payment because it necessitates them spending extra time checking websites or apps to ensure their purchases or transactions are successful. Because of this, many consumers think that using fintech for online commerce or purchasing has a more significant transaction cost. Their desire to utilize fintech is affected by this (IU). The outcomes are as follows:

H6: There is a negative relationship between PTC and IU.

The moderating effect of situational factors

Pandemic and impending policy

A pandemic is seen negatively as a factor in an economy’s growth. Since the end of 2019, COVID-19 has spread like a global pandemic. About 724,000 individuals have died due to its spread to 213 countries (Sumaedi et al. 2020). Many individuals have reduced their time outside the house because of the corona. Fewer people are in the market, and fewer people engage in physical activity. People remain incapable of entirely using technology despite incorporating it into every aspect of modern life. People have begun working from home owing to the fear of coronavirus (De Haas et al. 2020). The pandemic has severely influenced conventional retail, but people still need to buy things to meet their necessities; therefore, they are turning to fintech platforms to conduct their business. So, it can be claimed that present situational circumstances, such as the PIP, have encouraged individuals to use fintech and allowed consumers to have experience using it despite any other issues, like PTC, that may impede consumers from using it. As a result, we suggest the following:

H7: The PIP moderates the relationship between PTC and IU.

Environmental and physical surroundings

This group of persons engages in less physical activities due to environmental issues such as difficult access to facilities, unfavorable neighborhood conditions, bad weather, and safety risks like heavy traffic, a lack of secure spaces, high levels of crime nearby, or unattended canines (Leung et al. 2021). Therefore, if a user finds himself in a situation where none of his demands for going outside are satisfied, he will probably stay home and do business using an online platform. Consumers will likely do this even if they have never utilized internet services or fintech. To put it another way, the scenario makes it necessary for customers to use fintech for virtual transactions or purchasing. This further modifies the nexus between the PTC and the inclination to use fintech. According to earlier research, consumers’ impulsive purchase behavior is influenced by situational variables such as time, money, and task availability (Jung Chang et al. 2014). The association between attitude and intention to utilize technology-based self-service is moderated by situational elements like time, according to Dabholkar and Bagozzi (2002). Similar findings have been made by E. Kim et al. (2017), who discovered how contextual variables, including proximity and CONV, modify the association between relative benefits, compatibility, complexity, and propensity to utilize online services. Crowding may limit or obstruct people’s objectives and discourage shoppers from visiting a busy aisle or making the intended transaction. The “butt-brush” effect caused the consumer to leave the congested area and give up looking for a specific item (Shekhawat and Dahima, 2016). Based on previous studies, we thus propose that:

H8: EPS moderates the relationship between PTC and IU.