In Silicon Valley, You Can Be Worth Billions and It’s Not Enough

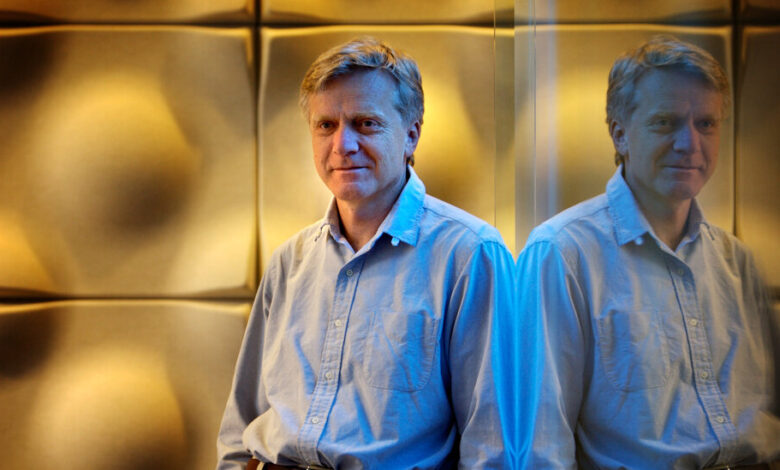

Andreas Bechtolsheim doesn’t like to waste time. The entrepreneur made one of the most celebrated investments in the history of Silicon Valley — the initial $100,000 that bankrolled a search engine called Google in 1998 — while on the way to work one morning. It took just a few minutes.

Twenty one years later, Mr. Bechtolsheim may have seized a different kind of opportunity. He got a phone call about the imminent sale of a tech company and allegedly traded on the confidential information, according to charges filed by the Securities and Exchange Commission. The profit for a few minutes of work: $415,726.

The history of Silicon Valley is full of big bets and abrupt downfalls, but rarely has anyone traded his reputation for seemingly so little reward. For Mr. Bechtolsheim, $415,726 was equivalent to a quarter rolling behind the couch. He was ranked No. 124 on the Bloomberg Billionaires Index last week, with an estimated fortune of $16 billion.

Last month, Mr. Bechtolsheim, 68, settled the insider trading charges without admitting wrongdoing. He agreed to pay a fine of more than $900,000 and will not serve as an officer or director of a public company for five years.

Nothing in his background seems to have brought him to this troubling point. Mr. Bechtolsheim was one of those who gave Silicon Valley its reputation as an engineer’s paradise, a place where getting rich was just something that happened by accident.

“He cared so much about making great technology that he would buy a house, not furnish it and sleep on a futon,” said Scott McNealy, who joined with Mr. Bechtolsheim four decades ago to create Sun Microsystems, a maker of computer workstations and servers that was a longtime tech powerhouse. “Money was not how he measured himself.”

Mr. Bechtolsheim was not trading for himself, the S.E.C. complaint said. He instead used the accounts of an associate and of a relative. Perhaps this was subterfuge, or perhaps it was a gift. The investor and his lawyer didn’t respond to emails for comment.

Insider trading is typically “a crime of passion,” said Michael D. Mann, a former S.E.C. enforcement official. “It’s based on information that is only valuable for a very short period of time. At the moment you get it, greed takes over, so you go out and trade on it. A rational person would say, ‘Is it really worth the risk?’”

Buying options in your own company right before a merger is announced is a red flag for regulators, and relatively easy for them to discover. Trading in another’s account, as Mr. Bechtolsheim was accused of doing, or in a company that is not directly involved in the deal but is likely to benefit from it, must seem less risky.

Insider trading prosecutions are relatively infrequent, so it is difficult to determine just what really goes on in the home offices, executive suites and office parks. But researchers who analyze trading data say corporate executives broadly profit from confidential information. These executives try to avoid traditional insider trading restrictions by buying shares in economically linked firms, a phenomenon called “shadow trading.”

“There appears to be significant profits being made from shadow trading,” said Mihir N. Mehta, an assistant professor of accounting at the University of Michigan and an author of a 2021 study in The Accounting Review that found “robust evidence” of the behavior. “The people doing it have a sense of entitlement or maybe just think, ‘I’m invincible.’”

Another recent Bay Area insider trading case shows how shadow trading works. Matthew Panuwat, an executive at the San Francisco biopharmaceutical company Medivation, was informed in August 2016 that Pfizer was acquiring his company. Minutes later, he bought shares in a third drug firm. When the deal for Medivation was announced, the third company became a hot prospect, and its shares soared, too. Mr. Panuwat’s profit: $107,066.

At his trial this spring, Mr. Panuwat said the timing was a coincidence. A jury didn’t buy it, and after only a brief deliberation on April 5 found him guilty of insider trading.

White-collar defense firms anticipate an explosion of new cases. “The successful prosecution of Mr. Panuwat has armed the federal government with a powerful new precedent,” Gibson Dunn, a San Francisco litigator, told clients.

The S.E.C. issued a brief statement after Mr. Panuwat’s verdict, saying that “there was nothing novel” about the case: “This was insider trading, pure and simple.” A lawyer for Mr. Panuwat didn’t return a request for comment.

The agency also considers Mr. Bechtolsheim’s case straightforward, though it was higher profile than usual. It was one of the few cases of wealthy company founders being charged since 2001, when the lifestyles guru Martha Stewart was tipped to sell her shares in a medical company before it announced bad news. Ms. Stewart was sentenced to five months in jail for obstruction of justice.

Mr. Bechtolsheim grew up in rural West Germany, developing an interest at a very early age in how things worked. “I spent all my free time just building stuff,” he once said.

He went to Stanford as a Ph.D. student in the mid-1970s and got to know the then-small programming community around the university. In the early 1980s, he, along with Mr. McNealy, Vinod Khosla and Bill Joy, started Sun Microsystems as an outgrowth of a Stanford project. When Sun initially raised money, Mr. Bechtolsheim put his entire life savings — about $100,000 — into the company.

“You could end up losing all your money,” he was warned by the venture capitalists financing Sun. His response: “I see zero risk here.”

Asked in a 2015 oral history what his social life was like during Sun’s early years, Mr. Bechtolsheim replied: “Social life? I didn’t have any social life. I was working day and night on designing new workstations and building the company. That was the only thing that mattered to me at the time.”

The wager paid off. Sun workstations filled a niche between the rudimentary personal computers of the era and high-end mainframes from IBM and others. Later, Sun expanded into computers that manage other computers called servers. At its peak in the late 1990s’ dot-com bubble, Sun had a stock market valuation of $200 billion.

It was Mr. Bechtolsheim’s funding of Google in 1998 that made him a permanent part of Silicon Valley lore. The deal happened at a moment when Google’s founders, Sergey Brin and Larry Page, weren’t even sure they wanted to build a company around their homemade search technology. They were focused on getting their Stanford doctorates.

The investment happened like this, according to Steven Levy’s 2011 history of Google, “In the Plex”: Mr. Brin emailed Mr. Bechtolsheim one evening around midnight. Mr. Bechtolsheim immediately replied, suggesting a meeting the next morning.

An impromptu demonstration was hastily arranged for 8 a.m., which Mr. Bechtolsheim cut short. He had seen enough, and besides, he had to get to the office. He gave them a check, and the deal was sealed, Mr. Levy wrote, “with as little fanfare as if he were grabbing a latte on the way to work.” The founders celebrated at Burger King.

Mr. Page and Mr. Brin couldn’t deposit Mr. Bechtolsheim’s check for a month because Google did not have a bank account. When Google went public in 2004, that $100,000 investment was worth at least $1 billion.

It wasn’t the money that made the story famous, however. It was the way it confirmed one of Silicon Valley’s most cherished beliefs about itself: that its genius is so blindingly obvious, questions are superfluous.

The dot-com boom was a disorienting period for longtime Valley leaders whose interest in money was muted. Mr. Bechtolsheim’s Sun colleague Mr. Joy left Silicon Valley.

“There’s so much money around, it’s clouding a lot of people’s ethics,” Mr. Joy said in a 1999 oral history with Mr. Bechtolsheim.

Mr. Bechtolsheim didn’t leave. In 2008, he co-founded Arista, a Silicon Valley computer networking company that went public and now has 4,000 employees and a stock market value of $100 billion.

Mr. Bechtolsheim was chair of Arista’s board when an executive from another company called in 2019, according to the S.E.C. Arista and the other company, which was not named in court documents, had a history of sharing confidential information under nondisclosure agreements.

This executive told Mr. Bechtolsheim that a smaller networking company, Acacia, was in play, according to the S.E.C. The executive’s company had been thinking of acquiring Acacia, but now another firm was making a bid. What to do?

Whatever counsel Mr. Bechtolsheim supplied was not mentioned in the S.E.C. complaint. But immediately after hanging up, the government said, he bought Acacia option contracts in the accounts of a close relative and a colleague. The next day, the deal was announced. Acacia shares jumped 35 percent.

Arista’s code of conduct states that “employees who possess material, nonpublic information gained through their work at Arista may not trade in Arista securities or the securities of another company to which the information pertains.”

Mr. Levy, the “In the Plex” author, said there were plenty of legal ways to make money in Silicon Valley. “Someone who is regarded as an influential funder and is very well connected gets nearly unlimited opportunities to make very desirable early investments,” he said.

Mr. Bechtolsheim is no longer chair of Arista’s board but has the title of “chief architect.” Arista issued a statement saying it “will respond appropriately to the situation,” but declined to say what that meant.

Mr. McNealy, the former Sun chief executive, said that he did not know the details but that Mr. Bechtolsheim’s overall career should be taken into account.

“While Andy may have knowingly or accidentally made a mistake,” he said, “he will always be able to say he did real good.”