Is Google adding the letters ‘CRM’ to its Alphabet soup? Ask HubSpot

AWS and Salesforce are pals.

The soiree started back in 2023 when the two announced an expanded partnership designed to streamline the building of AI apps and bring more Salesforce products to the AWS Marketplace. It’s what they call a “Global Strategic Partnership.”

But hang on. Before Benioff got cozy with Selipsky, you might remember that long, hot-and-cold dalliance with Microsoft. Mostly cold, if we’re being honest.

As far back as 2010 (ancient history), Microsoft was offering cash to attract Salesforce users to its Microsoft Dynamics CRM, which it planned to heat up. At the time, there was a legal fracas betwixt the two, with Microsoft claiming Salesforce had violated patents.

Despite the setbacks and the full-speed-ahead plans for Dynamics, Salesforce kept booming – and Microsoft figured, hey, if you can’t beat ‘em… buy ‘em.

In 2015, they tendered an offer of $55 billion to devour the CRM juggernaut. Benioff asked for $70. Everyone walked.

There was already bad blood, but that many billions? Spill, baby. Spill.

Just a year later, the two went head-to-head over LinkedIn, and this time, Microsoft prevailed. For a paltry $26.2 billion, they now had the world’s largest business network to pair with its growing Dynamics footprint – enabling the best set of universal data. More importantly, they had an advantage over Salesforce in a heated race for Top Dog in CRM.

I said “hot and cold,” and that’s been true. The companies tried to bury the hatchet in 2019 when Salesforce announced that Azure would power its Salesforce Marketing Cloud. But then came the infamous Slack Slugfest. In 2020, Salesforce threw down a little over $27 billion to buy the workplace communication platform – the one that haunts your dreams with its incessant “knock brush” alert. (Hear it? You know you do…)

Microsoft wanted it in a bad way. This one hurt.

There were rumblings in Redmond and a souring in San Fran, and that led Salesforce into the arms of another. Right away at AWS, there was clear guidance to promote and support Salesforce solutions to block Microsoft from gaining ground. Suddenly, the battle shifted to the cloud players leveraging CRM, martech, and data as competitive levers.

Of course, everything changed in 2023, when ChatGPT became the belle of the ball. Microsoft doubled down on OpenAI, Google famously fumbled Bard, and AWS just… well, waited… and waited… and then pounced on Anthropic, hoping to deal a blow to Microsoft. With the stakes so high, that pause might have been perilous.

On the Great Cloud Chessboard, AI is proving to be a decisive piece. But what it powers is even more important. As CRM and martech solutions remain crucial to almost every business, it’s obvious why AWS, Microsoft, and Google are so interested in these categories.

Now, Alphabet – Google’s parent – is dipping its spoon into the soup. According to Reuters, the company is consulting its “advisers” (mental image: mythologized god philosophers in long robes carrying lanterns) about purchasing HubSpot, a platform with CRM, CMS, and online marketing tools. According to HubSpot, it’s all speculative, but the discussions are happening. And that alone has driven its stock price north of $670.

Oh, HubSpot. The darling of the inbound marketing movement. Over the years, the Cambridge-based unicorn has curated a network of digital agencies creating authoritative articles that read like the Internet’s breadcrumb trail for marketing resources.

Go ahead: search for a marketing-related topic. Odds are you’ll get a post from HubSpot or an affiliated agency at the top of your organic results, something like “50 Small Business Marketing Ideas for 2024.” An orange pedagogy has developed around its brand, stemming from this period of partner-fueled growth.

I should know: back when I owned a digital consultancy, I drank the orange Kool-aid and attended its annual partner conferences. My team watched a lot of training videos, every one of them ending with the same rally cry: “Let’s go sell some inbound!”

Things have changed since those days. In 2016, the company was dragged through the mud in a scathing book by former “Fake Steve Jobs” author Dan Lyons, rebuking its millennial-cannibalizing, cult-like culture and generally buggy software. It was considered by many to be overvalued, having never turned a profit. This was a wake-up call, and by focusing on high-utility tools for the mid-market, the company reversed its fortunes at a time when these categories were exploding.

If it happens, Google buying HubSpot will indeed disrupt the cloud and martech landscape. With big, hairy deals like this, who really wins? How will it benefit the customer? Is this legit crazy?

Maybe. But there are four reasons why I think both parties should roll – and a lot of it has to do with Salesforce, Microsoft, and AWS.

It’s a big soup of complexity that can be boiled down to one thing: growth.

1. The CRM train keeps a-rollin’ toward revenue

Maybe CRM should stand for “Cranked-up Revenue Machine,” because by all measures, this train ain’t slowin’ down.

According to Fortune Business Insights, the global Customer Relationship Management market is projected to grow from $71.06 billion in 2023 to $157.53 billion by 2030, at a CAGR of 12.0%. That’s a pretty sweet outlook.

Buying HubSpot would be the fastest onramp for Google to enter the CRM game, expanding its reach to a wider base of enterprise customers who spend big on martech. But for the CRM category specifically, this could be a huge moment for innovation. Combining Google’s search, video AI, and cloud delivery capabilities could further enhance HubSpot’s offerings, giving it a renewed posture against Salesforce and Dynamics – and by proxy, giving Google a better stance against AWS and Microsoft.

There are also some interesting legal arguments to be made for jumping on the CRM bandwagon. The search Goliath is facing several antitrust battles right now, including a major lawsuit that accuses it of abusing its search monopoly (I have my own thoughts, but I’m not a lawyer… I only play one on TV). As Reuters noted, Google might have a strong argument for regulators that a HubSpot acquisition benefits competition within marketing and sales software, countering the dominance of Salesforce and Microsoft.

Like CMS, CRM might feel like the “elder statesman” of the digital stack. But its relevance can’t be denied – and in a digital era where every customer interaction is critical and data is central to everything, having best-of-breed CRM and martech capabilities is essential. Alphabet has an opportunity to capture some of that market share at just the right level and ride the train uptown.

2. There’s “deal appeal” for everyone

Maybe we’re all still reeling after Adobe pulled the plug on its $20 billion offer to buy Figma, but it’s been a while since we’ve tasted extra-sweet M&A sugar. We’ve mentioned this previously, but in 2023, the total M&A market dropped 15% to $3.2 trillion – the lowest level in a decade. Strategic deals also withered on the vine as buyers and sellers struggled to close the gap on valuations, and deal multiples were the lowest they’ve been in 10 years.

But 2024 is already looking extra spicy, with new deals up significantly. And with Alphabet sitting on a cash stockpile of nearly $111 billion, there’s an appetite to buy something. And let’s face it: Google isn’t the Silicon Valley startup it used to be, and maintaining innovation at scale is expensive when disruptors are biting left and right. If there’s substantive growth potential, buying market share ain’t a bad move.

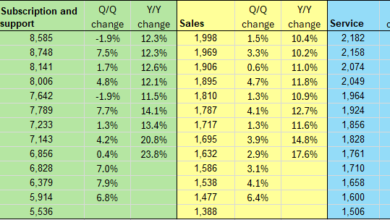

With a valuation of $35 billion, HubSpot is also a far more attractive deal in comparison to Benioff’s asking price to Microsoft in 2015. It’s worth noting that HubSpot’s revenue was around $2.2 billion last year, down by $176.3 million. That’s a hit, but not in fire sale territory, especially when the market keeps seeing green: shares of HubSpot surged 100.8% last year, driven by stronger market demand across its portfolio. The outlook for 2024 looks promising, especially as all signals point to a bull market.

Of course, HubSpot gets a big boost – and an even bigger payday. It’s hard to know how Google might deconstruct its parts and pieces: Will it maintain the brand? What will happen to its IP and workforce?? Will they keep the orange logo??? But this is a challenging market with lots of competition, and things can change quickly. Taking the deal would certainly be a windfall that potentially funds a pipeline of new product enhancements.

Finally, from a cultural perspective, HubSpot still harbors some of the allure of an up-and-comer, more like the underdog innovator. That’s especially true when compared to Salesforce – which is, frankly, is a bit more like Frankenstein than its mid-market counterpart. You just need to compare the UIs to spot where the bolts are.

3. It’s a smart hedge against rising competition in search, advertising, and social media

There’s more rationale to a HubSpot purchase when you consider the competitive pressure being exerted on Google’s existing products. First and foremost, its search engine dominance is being tested by the rise of AI, namely from Microsoft Bing – but others are champing at the bit. AI itself might pose the greatest existential threat to its core business, as it could deprecate Google’s search model. Precisely what OpenAI is taking a shot at.

Google’s advertising power can’t be argued. From search to display to video, it has owned a large portion of the historical market share for decades. But with recent changes in privacy laws from regulatory bodies and new targeting policies from Apple, ad spending forecasts have been in flux – with most of it shifting to other platforms, namely TikTok.

One of the jewels in Alphabet’s advertising crown is YouTube. Unfortunately, there’s a tarnish developing around the aging brand as more consumption shifts to social media platforms. Video formats account for more than half of ad spending on social networks in the US – and as legacy platforms defend market share against TikTok’s fury, advertisers have more social video options than ever.

YouTube TV is making gains in the cable-cutting era of one-stop solutions, but it’s still trailing the other popular streaming networks, which reminds us of the dangers of competing in established places like the social sphere (Google+ for those with short memories). There’s also contentious debate around OpenAI using YouTube’s content to train Sora, its generative video creation tool, so more lawyers are swarming while AI continues its march.

This might seem like a lot of headwinds, but remember: this is still the company that rules search, and it still has plenty ‘o tricks up its sleeve. With the addition of HubSpot to the mix, Alphabet and Google would have a platform for better leveraging their search IP, advertising, and social capabilities in a cookieless world – one where content marketing, testing, and other optimization features will be key. Fuel that with video, social, and some serious AI, and businesses will have even better tools for building integrated campaigns across channels.

HubSpot also offers rich analytics as part of its marketing and CRM offerings, which provide critical performance insight for advertisers and brands. While it created a whirlwind of problems with its forced migration to GA4 last year, Google could marry its analytics horsepower with HubSpot, providing new levels of performance.

Search, advertising, and social are like the three legs of this digital tripod, all interconnected and dependent on one another. Google has enjoyed a significant advantage over the last 20 years across all three, but competition is unavoidable. HubSpot presents an opportunity to further strengthen its standing and firm up Google’s position as it looks ahead.

4. It’s getting loud in the cloud, and Google needs to pump up the volume

It might already be clear, but this assessment wouldn’t be complete without considering the “Cloudageddon” being waged.

With AWS seeding its Marketplace with Salesforce and other partner solutions – and Microsoft juicing Dynamics 365 with its LinkedIn Sales Navigator – Google needs a missing piece on the chessboard. Bolstered by HubSpot’s IP and existing footprint, Alphabet could extend its cloud reach in a more meaningful way, namely through a recognized and trusted martech solution.

It’s not like the “cloud wars” is some new-fangled skirmish. The Big Three have duking it out for quite some time. A quick level set: AWS owns 32% of the public cloud market share, with Azure inching up at 23%. GCP is holding steady at 10%. The latter two have been steadily gaining ground as more of the cloud’s foundational services have become commoditized, but AWS has always maintained a healthy margin given its extensive services catalog.

But that’s the key word: commoditization. It’s inevitable and unavoidable. AWS has been hedging against this by expanding its managed service offerings in multiple directions (serverless with AWS Fargate as one example). But at the end of the day, much of what the cloud offers is being reduced in value – and what’s worse, the promise of cost savings with trading CapEx for OpEx is being eroded.

While the Big Three cloud providers are all investing treasure in AI, it’s important to remember that artificial intelligence isn’t just the product – it’s the enabler of products. At some point, it will likely be a part of the underlying plumbing and not a marketable differentiator. In this sense, bringing a CRM platform like HubSpot into the fold gives Google another tool for channeling its AI power, just as its competitors are doing.

Being the leader is great, as I’m sure Andy Jassy would claim. The good times rolled under his tenure – like really rolled, with the company reaching a market cap of $1.92 trillion. He now runs Amazon proper in the wake of Bezos, but being at the top always makes you a target. They haven’t been immune to Microsoft’s early jump with AI: AWS laid off 9,000 employees last year, and just today, Geekwire reported that the company shed hundreds of jobs as a result of customers cost-cutting across their cloud empires.

In this fiery race, HubSpot could help GCP cut through the noise and grow its market share. With a unified strategy, Google’s existing cloud services could benefit from the marketing power of HubSpot’s platform. Likewise, Google’s cloud services could augment how HubSpot’s products are scaled for enterprise applications, helping it aspire beyond the mid-market niche. Cross-merchandising could also be part of the mix.

Is this all enough to make up ground with AWS and Microsoft? Hard to say. There’s a lot of distance to close. This would be a huge acquisition for Google, sending the market a clear message about its ambitions. It would also fan the flames with its rivals – which, at the end of the day, benefits the buyer.

Bonus: Is Scott Brinker with a few billion?

At the very least, his Martech Supergraphic might be.

As one of the most vibrant and profound thought leaders in our space, Scott’s contribution to the HubSpot ecosystem can’t be ignored. A big part of his charter is nurturing HubSpot’s partner network, which has always been a big part of the company’s DNA. In the realm of intangible assets, I’d call that definite curb appeal.

Adding “Googler” to his resume? Might be apropos.

Why it matters

I remember reading a piece in Wired or Fast Company many moons ago that discussed Google’s walk-on-water innovation and stockpile of cash – and where to target both. One idea the author had was to buy Disney’s aging EPCOT theme park in Orlando and reimagine it as a physical-meets-digital playground.

I’m not sure what kinds of rides we could have expected, but they might have been decidedly boring and utilitarian – much like Google’s homepage. But that simple, direct, no-nonsense focus is part of what helped make it so successful. That, and some very shrewd acquisitions along the way.

After a year of slow M&A activity in the tech industry, the Alphabet/HubSpot rumors have excited the market to a fever pitch. We might call it irrational exuberance, although sometimes it’s not so irrational. I think this is one of those moments.

Some categories aren’t a good fit for acquisition or expansion, but the move into CRM is a logical one for Alphabet and Google. This is a long tale of battles waged betwixt Salesforce, Microsoft, and now AWS – and each has an established beachhead. Armed with a platform that fits more cohesively with its core products and values, Google will have another arrow in its quiver to help close the gap with its competitors and cross-sell services to more enterprise prospects.

With the addition of its powerful AI to the HubSpot ecosystem, Google will also reap further benefits from the platform’s features – not just CRM, but marketing tools, analytics, and more.

Google also has a reputation challenge on its hands. Along with its legal woes, it’s an aging brand that exhibits the old guard of big tech gluttony, flaunting its long-time stranglehold on search. Competition is helping to shake things up, and likewise, its own challenges to the other big tech entities are healthy. In this sense, entering the CRM game also feels like a check-and-balance as much as a revenue grab.

Finally, there’s a little thing called community. HubSpot has built its share along the way through partners and agencies, and Google would be investing in the user loyalty and agency channels that have blossomed over the years. This could further augment its reach and influence.

We started this epic journey with AWS and Salesforce because so much of this news feels driven by competitors’ actions. Staying in parity is key, to be sure. But it would also behoove Alphabet to remember what ingredients endeared customers to its recipe over the years – long before it became the de facto search soup on the shelf.

If Alphabet can’t remember what once made it taste so great, I guess they can try Googling it.

Upcoming conferences

CMS Connect 24

August 6-7, 2024 – Montreal, Canada

We are delighted to present our first annual summer edition of our prestigious international conference dedicated to the global content management community. Join us this August in Montreal, Canada, for a vendor-neutral conference focused on CMS. Tired of impersonal and overwhelming gatherings? Picture this event as a unique blend of masterclasses, insightful talks, interactive discussions, impactful learning sessions, and authentic networking opportunities.

CMS Kickoff 25

January 14-15, 2025 – Tampa Bay Area, Florida

Join us next January in the Tampa Bay area of Florida for the third annual CMS Kickoff – the industry’s premier global event. Similar to a traditional kickoff, we reflect on recent trends and share stories from the frontlines. Additionally, we will delve into the current happenings and shed light on the future. Prepare for an unparalleled in-person CMS conference experience that will equip you to move things forward. This is an exclusive event – space is limited, so secure your tickets today.