Is It Too Late to Buy Rivian Stock?

Rivian stock has been on a roller-coaster ride since going public in 2021. Is it too late to buy in?

Since going public in 2021, Rivian (RIVN 4.92%) has worked hard to become a household name. It’s not quite there, but it is gaining recognition. The company recently received a J.D. Power award for most satisfying ownership experience. And Consumer Reports just named it one of the most beloved car brands, with 86% of owners saying they’d buy a Rivian again.

The increased hype is driving impressive sales growth. Revenue is up 868% since the company’s initial public offering. Is it too late to invest in this emerging growth stock? You might be surprised at the answer.

2 reasons it’s not too late to buy Rivian stock

Across dozens of metrics, Rivian stock was a better buy a few years ago than it is today. Sales are growing at a good clip, manufacturing facilities expanded, margins are improving, and new models are being announced. Company executives forecast that Rivian could achieve a positive gross profit sometime this year, something it has never done in the past.

And yet, you couldn’t tell that any of these milestones were achieved if you only followed the stock price. Since going public, Rivian stock has lost an astounding 89% of its value. How do you square this circle? There are two factors to consider.

First, Rivian went public in 2021. That year, investor interest in renewable energy stocks was soaring, fueled in part by the massive Inflation Reduction Act that directed hundreds of billions of dollars in new spending to low-carbon technologies. Tesla (TSLA 3.17%) stock, for instance, surpassed $360 per share in 2021. Today, Tesla’s share price is below $175, demonstrating that it wasn’t just Rivian caught up in the hype.

This is perhaps the biggest reason it’s not too late to buy Rivian stock — shares were previously way overpriced in a market that was overpricing nearly every stock related to a low-carbon future.

RIVN Total Return Level data by YCharts

The second reason it’s not too late to buy Rivian stock is that its biggest days of growth may still be ahead of it. That’s great news for prospective investors considering the valuation. In 2021 — the year shares went public — Rivian stock traded at roughly 60 times sales. Today, the stock is valued at just 2 times sales. That reduction is the result of both skyrocketing sales and the massive drop in share price.

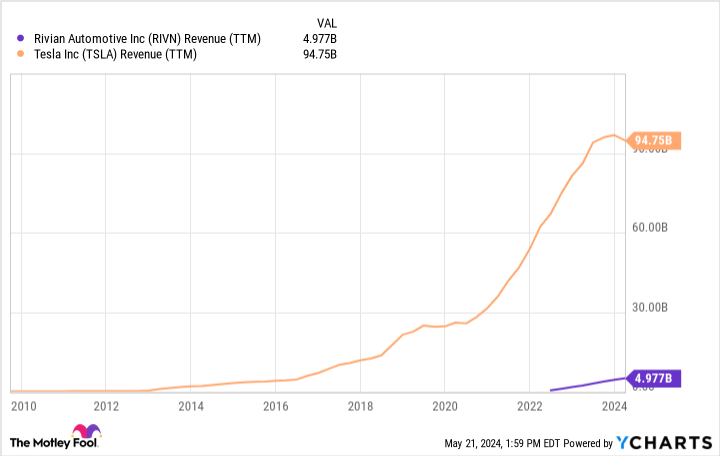

Why might Rivian’s best days still be ahead of it? The first thing to note is that its sales base is still quite small, even if it has grown significantly in recent years. Over the past 12 months, the company generated around $5 billion in sales. Tesla, for comparison, brought in nearly $100 billion over the past year. Rivian’s growth since it went public heavily outpaced Tesla’s initial years of growth. And if Tesla is any indication, the company could someday reach the $100 billion sales mark — roughly 20 times what the company pulls in today.

Rivian is currently putting the pieces in place to greatly expand its sales base over the long term. It recently unveiled its R2, R3, and R3X models, received $827 million in state funding to expand its manufacturing facilities in Illinois, and is expected to directly benefit from major new tariffs on Chinese electric vehicles. It will take years for these developments to be fully realized, but the company has a clear path forward to catching up with Tesla.

RIVN Revenue (TTM) data by YCharts

Should you buy Rivian stock right now?

Now that Rivian stock has come way down in price, is the stock right for your portfolio? That depends on two things: your risk tolerance and patience. As a capital-intensive, early-stage growth company, Rivian is losing a lot of money right now. Last quarter, it lost $38,784 for every vehicle it sold! But customer satisfaction and loyalty are high, and with greater scale and the introduction of new, lower-priced models, management believes margins will continue to improve dramatically. Still, this will take years, and the company is currently focused on reducing cash burn so that it can survive long enough to realize this future.

Will Rivian survive long enough to scale its business to Tesla proportions? It’s very possible. The company has proven its ability to execute, and it has a committed base of shareholders with deep pockets. Amazon, for example, is one of Rivian’s largest shareholders, owning more than 158 million shares. But there’s no doubt that it will take many years before Rivian’s fate is ultimately determined. However, it should be noted that Tesla’s stock also languished for years before becoming the giant it is today. Rivian may follow the same trajectory, but investors should only jump in if they’re willing to remain patient, holding through some strong volatility along the way.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Tesla. The Motley Fool has a disclosure policy.