Kinder Morgan Sees Artificial Intelligence (AI) Driving Growth, but Not How You Think

Kinder Morgan’s stock actually could be a huge beneficiary of this AI trend.

During its most recent earnings conference call, midstream giant Kinder Morgan (KMI -0.64%) discussed the benefits that artificial intelligence (AI) will bring to its business. This perhaps is not surprising, as companies from all types of different industries have waxed eloquent about how AI will help their businesses. Some of the uses of AI in non-tech industries have been pretty creative; Wendy’s, for example, announced it would use AI to dynamically change menu prices throughout the day to help drive sales.

In the future, Kinder Morgan might use AI to help monitor its pipelines for safety. Or perhaps it will use the technology for arbitrage opportunities, using AI to help better direct hydrocarbons through its system to get the best prices. But the big opportunity the company sees from AI at this moment is very different.

AI applications consume a lot of power

Kinder Morgan sees itself benefiting from AI because it consumes a tremendous amount of power. Generative AI in particular takes a lot of computing power, which is leading to more and bigger data centers.

The company noted that one recent survey predicted electricity demand for data centers will increase at a 13%-to-15% compounded annual rate through 2030. In 2022, data centers accounted for about 2.5% of electricity usage in the U.S., but that number is projected to rise to 20% of all U.S. electricity usage by 2030. Most of that power demand will be driven by AI, which is forecast to be about 15% of total U.S. electricity demand by then. While Kinder doesn’t cite its source, it projections seem to be backed by a report by the Boston Consulting Group, which sees U.S. data center electricity usage tripling by 2030 and being the equivalent of 40 million homes.

On its earnings call, Kinder Morgan said that while renewables will play a big role in meeting future energy needs, they are not enough. It argues that using batteries to make up for the shortfalls of renewables is not economically feasible, while building transmission lines to connect renewables to the grid takes years. It sees natural gas playing a major role in meeting future power needs.

How Kinder Morgan and others would benefit

Kinder Morgan said on its earnings call that if only 40% of future AI electricity demand comes from natural gas, that would increase natural gas demand by 7 billion cubic feet (Bcf) a day to 10 Bcf. In 2022, the U.S. used 12.12 trillion cubic feet (Tcf) of natural gas for electricity and 32.31 Tcf overall. An addition of between 2.5 tcf and 3.7 tcf a year to that wouldn’t be trivial.

As one of the largest natural gas pipeline operators in the U.S., Kinder Morgan would benefit. With about 70,000 miles of natural gas pipelines, the company’s system transports about 40% of the natural gas produced in the U.S. Kinder Morgan’s natural gas pipeline system is like a toll road, and 89% of its natural gas pipeline contracts are “take or pay.” This means that customers pay Kinder Morgan for the right to use its pipelines, so it gets paid whether they do or not.

More natural gas usage from the buildout of data centers for AI will lead to more volumes and the need to build more pipelines. Given that its system touches more than 40% of the natural gas produced in the U.S., Kinder should be well positioned, as it is easier to expand and make pipeline connects as part of an integrated system than building a stand-alone pipeline. Meanwhile, building pipelines in the Northeast has proven difficult, as evidenced by the problems completing the Mountain Valley Pipeline owned by Equitrans Midstream. Kinder’s system, meanwhile, is well positioned for data centers hotspots in Texas and the Southeast. New data centers being built will need to be near cheap energy sources, which should lead to future growth for the company.

Image source: Getty Images.

Now, Kinder Morgan won’t be the only pipeline company to benefit. Energy Transfer (NYSE: ET) is one of the largest natural gas transporters in the country with about 90,000 miles of natural gas pipelines. Another great option is Williams Companies (NYSE: WMB), which handles about a third of the country’s natural gas production and owns one of the most important long-haul natural gas pipelines in the U.S., Transco. This pipeline transports natural gas from the prolific natural gas basins in Appalachia to markets in the southeast U.S. Given that these companies have some of the largest integrated natural gas pipeline systems in the country, they will be the best positioned to build any needed connections through growth projects to handle increased natural gas volumes.

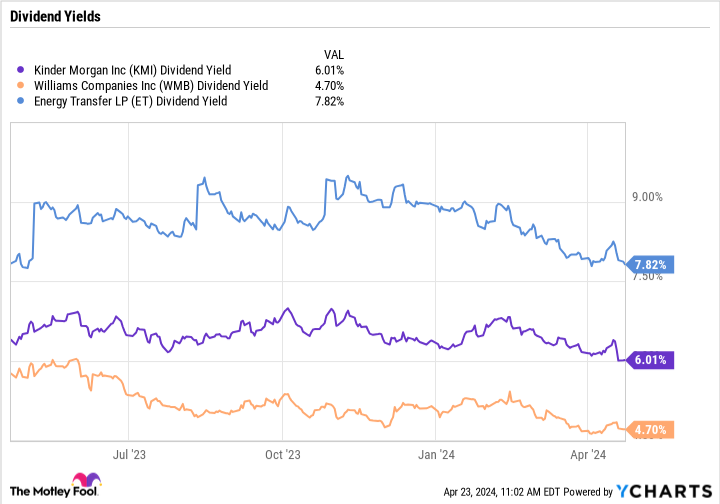

Overall, buying any of these companies is a great way to play the trend of increased power consumption from AI. All three companies’ assets are well positioned, and their stocks should benefit from this growth over the next several years. As a bonus, all three also offer some nice dividend yields, so investors can get paid to wait as this trend unfolds.

KMI Dividend Yield data by YCharts