Lesaka: An Undervalued Fintech Gem (NASDAQ:LSAK)

FG Trade

Investment Thesis

Since we last covered Lesaka Technologies, Inc. (NASDAQ:LSAK), the largest fintech company in South Africa, the company has made significant progress in its turnaround efforts, made another acquisition, upgraded management, and is now ready to accelerate growth. However, the stock price has not yet fully reflected these developments.

Outgoing CEO Chris Meyer has successfully turned the business around, and the reins are now being handed over to new Executive Chairman Ali Mazanderani, a successful emerging markets payments investor and entrepreneur. Now that the company is profitable in EBITDA and the balance sheet has been de-leveraged, Lesaka is ready to accelerate revenue growth and take advantage of the huge fintech opportunity in Africa.

Furthermore, LSAK has a significant near-term upside catalyst that will likely be realized by 2024. Specifically, LSAK owns a 10% equity stake in one of the largest fintech companies in India, MobiKwik, which recently filed to go public. LSAK’s stake is roughly $76 million, or ~30% of Lesaka’s current market capitalization.

Finally, the macro set-up in South Africa is increasingly favorable. On March 11, 2024, the Financial Times published an article entitled “The Bullish Case for South Africa,” signaling several tailwinds for the market: load-shedding is abating, inflation is subsiding, and the government is expected to start cutting interest rates, further bolstering the company’s prospects.

Therefore, despite the ongoing geopolitical and economic challenges in South Africa, LSAK’s notable accomplishments, combined with a more favorable macroeconomic forecast, have prompted us to upgrade our stock rating to buy.

Ali Mazanderani becomes Executive Chairman

There’s an expression in investing: “Bet on the jockey, not the horse.” This essentially means buying stocks managed by outstanding executives. Now that outgoing CEO Chris Meyer has successfully turned around the company, a leader with experience growing payment businesses in emerging markets is required.

Ali Mazanderani has become Executive Chairman to take the company to the next level. He has a solid track record of building successful emerging market payment businesses worldwide as an investor, operator, and board member.

As per his employment agreement, Mazanderani will spend 50% of his time working for Lesaka. Mazanderani’s recent purchase of roughly $1 million worth of LSAK shares-322,476 shares at $3.30 each-in December 2023 reflects his strong belief in the company’s potential and aligns his interests with shareholders.

Ali Mazanderani’s Relevant Fintech and Payments Experience |

|||

|

Company |

Position |

Tenure |

Company’s Focus and Scale |

|

StoneCo |

Investor and Board Member |

2016-2022 |

Publicly traded payments company (STNE) catering to SMBs in Brazil with a market cap of $5.8 billion |

|

Network International |

Board Member |

2020-21 |

Publicly traded payments company (LN: NETW) in the Middle East and Africa with a market cap of $2.6 billion. Ali sold EMP Payments to NETW and then was appointed to the board. |

|

Teya |

Co-founder & Chairman |

2019-Present |

Provides payment solutions to SMBs across Europe Estimated annual revenue of roughly $300 million. Has raised over $1 billion from blue-chip VCs. Last valued at over $1 billion. |

|

Pine Labs |

Investor |

2018-Now |

Provides payment solutions to SMBs in India. Has raised over $1 billion from blue-chip VCs. Last valued at roughly $3 billion. |

|

Kushki |

Investor and Board Member |

2023 – Present |

Payment solutions in Latin America Annual revenue of $136.5 million and was valued at $1.5 billion in June 2022 after raising $100 million from VCs |

|

Thunes |

Investors and Board Member |

2020-Present |

Global payments network targeting cross-border transactions Raised a total of $130 million in funding since its inception Valuation over $900 million as of July 2023 |

|

Actis |

Partner & Head of Fintech Group |

2010-2019 |

London-based Private Equity firm. $12.5 billion in AUM |

|

Lesaka Technologies |

Chairman |

2020-Present |

Fintech solutions in Africa Market Cap: USD 240 million as of Feb ’24 |

Source: LinkedIn and Crunchbase

Near-term catalyst: IPO of MobiKwik (~30% of LSAK’s market cap)

Lesaka has an upcoming catalyst that will unlock some of its value over the next 6-9 months. Lesaka owns roughly 10% of MobiKwik, one of the largest fintechs in India, which recently filed to go public. MobiKwik offers payments, credit, and investment products to consumers and merchants. According to its website, as of September 2023, it has nearly 147 million registered users and 3.8 million merchants in its network.

Additionally, FT Partners has published research about the MobiKwik IPO. For the six months ending September 30ber, 2023, according to MobiKwik’s website financial statements, MobiKwik’s revenue jumped 58% year-over-year (YoY) to Rs 358 crore (roughly $47 million), while it recorded positive net profit. That’s an annualized revenue run rate of roughly $95 million in revenues as of six months ago.

Recent regulatory problems in January at larger competitor Paytm Mobile Solutions Private Limited (PAYTM) have resulted in a surge in MobiKwik’s business. According to recent press, MobiKwik saw a 50-60% rise in new merchants onboarding its platform in February 2024, compared to a similar period in January. The gross merchandise value of offline merchants using their platform jumped 40% during this time, while that of online merchants rose ~30%.

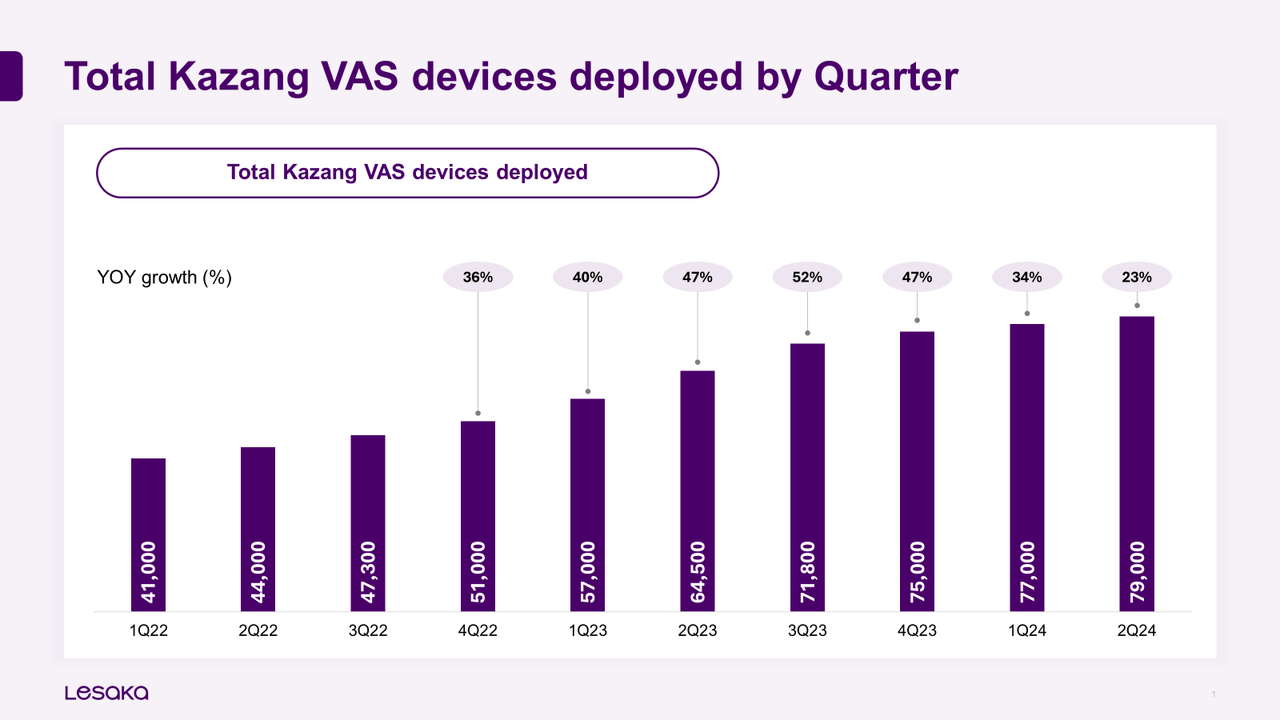

Lastly, as per their SEC filing below, Lesaka values its 10% stake in MobiKwik at $76 million (~30% of LSAK’s market cap), with a cost value of $27 million and an unrealized gain of $49 million.

Finally, Paytm, the closest public comparable to MobiKwik in India, currently trades at around 1.5x EV/Sales, down from roughly 4-6x EV/Sales over the past few years due to their previously mentioned regulatory problems. Recent sales of shares of MobiKwik on the Altius online secondary platform in India suggest a valuation in line with LSAK’s estimate, especially considering the surge in MobiKwik’s business due to recent troubles at Paytm.

Lesaka Acquires Touchsides

In January, Lesaka acquired a South African software business called Touchsides, which sells payments and software-based consumer loyalty solutions to 10,000 liquor stores in the informal market in South Africa. Lesaka’s Kazang merchant division already has roughly 78,000 SME merchant customers. This acquisition will increase the YOY growth in the number of merchant customers in the quarter ending 3/30 by 12% to roughly 88,000, excluding organic growth.

The synergistic deal presents multiple cross-selling opportunities to increase ARPU per merchant and expand LSAK’s total addressable market (there are 45,000 other taverns in the informal market that are not currently Touchsides customers). Finally, by putting the Touchsides card acquiring business on the LSAK payments switch, Lesaka can immediately increase margins.

Capturing Africa’s Booming Fintech Future

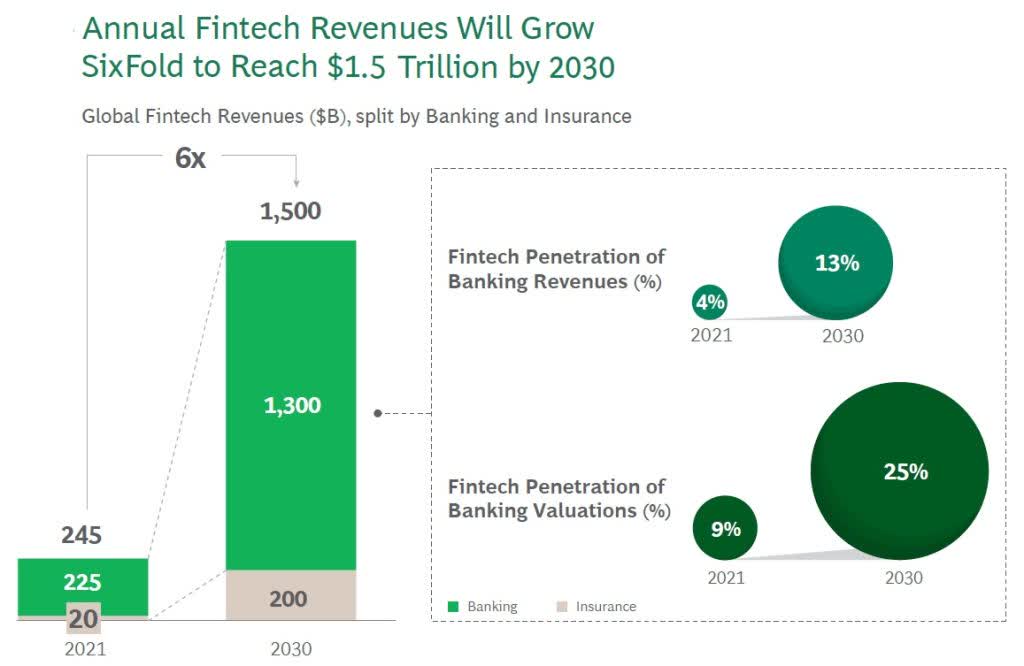

Lesaka is riding the secular tailwind of businesses and consumers who are switching from doing business in cash to digitally. Just as fintech companies have been disrupting traditional banks in the United States since the first internet wave in the late 1990s, and then fintech swept through Asia and Latin America, fintech is now beginning to penetrate Africa.

With 42% projected growth in Africa’s 15-24 age population by 2030, 65% being unbanked, 80% mobile penetration, and 47% internet penetration, Africa’s fintech industry is primed for years of double-digit growth. We estimate South Africa is roughly 5-10 years behind the rest of the world.

Additionally, the investment community increasingly recognizes the potential of fintech in Africa. The largest fintech investment bank, FT Partners, just released a 200-page research report on the fintech opportunity in Africa, a great primer. Just last month, FT Partners held its conference on fintech in Africa, attended by over 250 people.

Furthermore, QED Investors, the largest fintech VC firm, published a report forecasting that fintech in Africa will grow faster than on any other continent over the next few years (page 18). Visa chairman John Yoo just gave a presentation on fintech in Africa at Bloomberg’s first Africa summit.

Similarly, Forbes published an article entitled “5 Reasons The Future Of FinTech Is African”. McKinsey recently published a report entitled “Fintech in Africa: The End of the Beginning”. Moreover, Global Finance magazine has a new article entitled “African Fintech: Untapped Potential.”

Finally, according to BCG (they released a report entitled “Unlocking the Fintech Potential in Africa.”) Africa will be the fastest-growing region in fintech, with a compound annual growth rate (CAGR) of 32% from now until 2030, and it will become a $65 billion market.

www.bcg.com/publications/2023/future-of-fintech-and-banking

Why Lesaka Has A Good Chance of Winning

Lesaka has multiple competitive advantages over its competitors. It owns at least four important financial licenses in South Africa and three others in three other countries that are difficult to procure.

They also own the largest bill pay switch in South Africa (EasyPay) and the only payment switch not owned by a bank. Lesaka has a license that enables it to offer a digital bank account to small merchants who don’t already have one. Some competitors can only offer their services to merchants with bank accounts.

Lesaka’s cost of capital is lower than its VC-backed competition; because it has audited financials due to being listed on the Nasdaq, it can borrow debt from banks, which it does, or issue stock on the open market to raise capital.

Lastly, LSAK’s merchant business has the broadest suite of products in the market, which appeals to the merchant (more ways to make money), increases average revenue per user (ARPU) for LSAK, and increases the lifetime value of the customer relationship.

Graphing Lesaka’s Turnaround

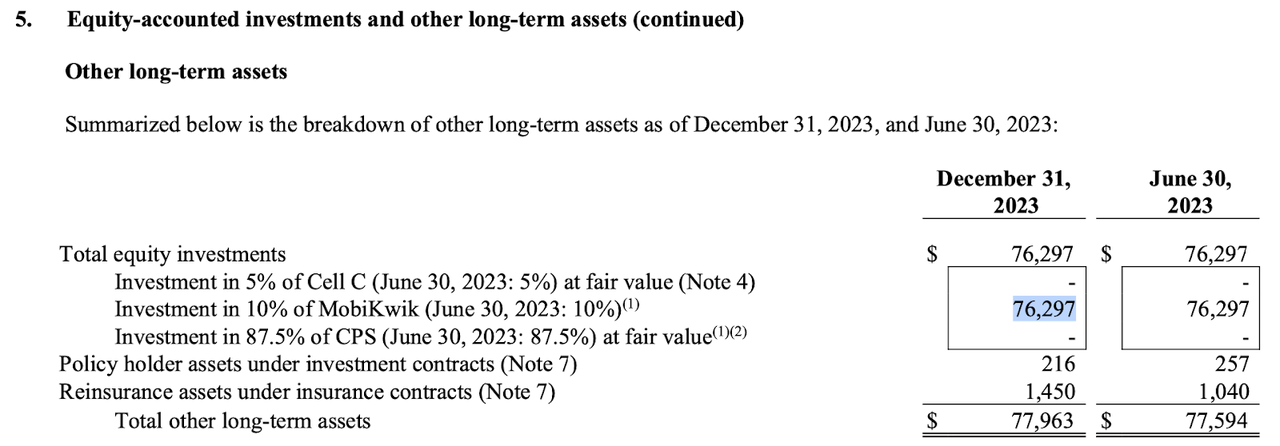

In recent years, management has been focusing on turning around the business and focusing on profitability, as we can see in the growth of Group Adjusted EBITDA by quarter.

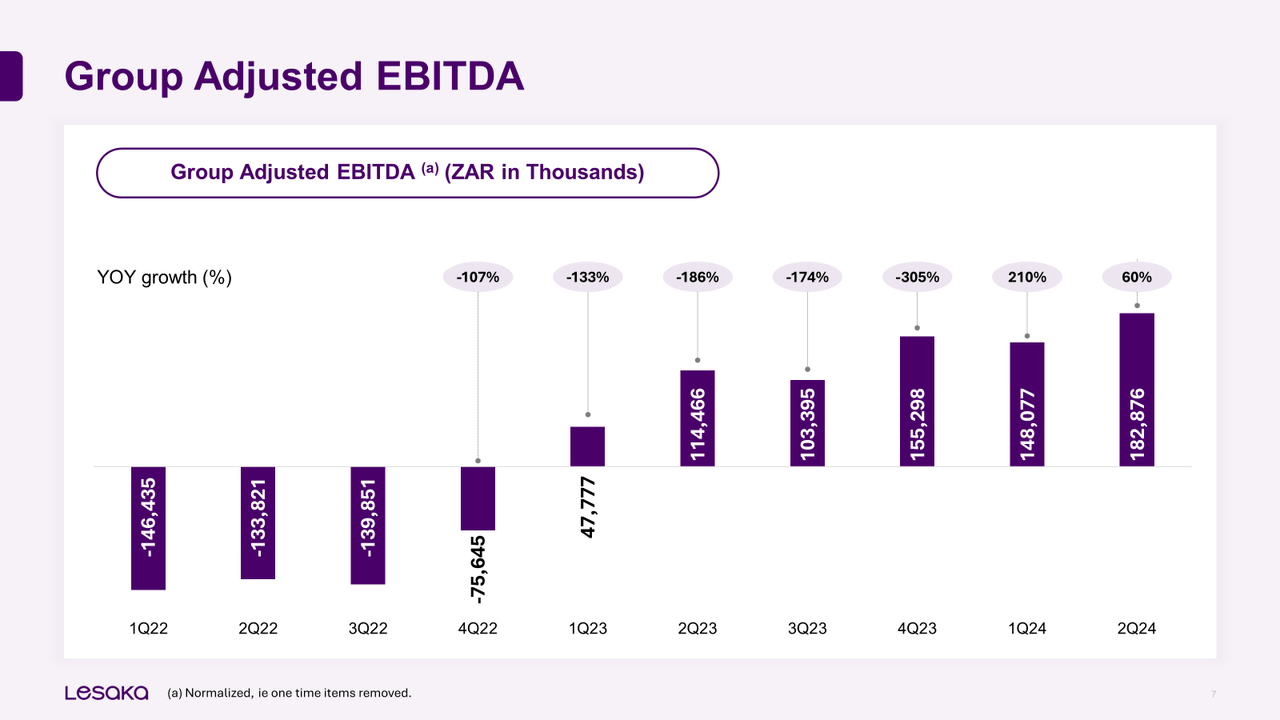

Group Adjusted EBITDA is the sum of the EBITDA of the two operating divisions, merchant, and consumer. Merchant EBITDA is the majority:

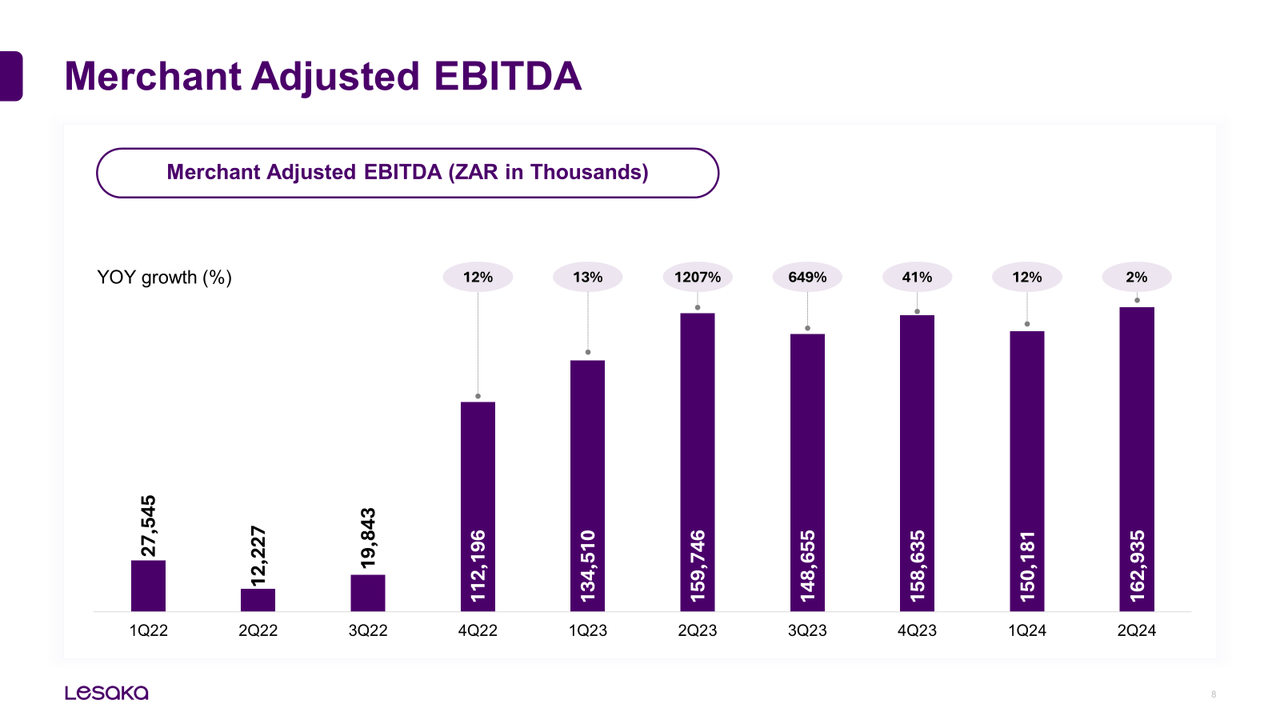

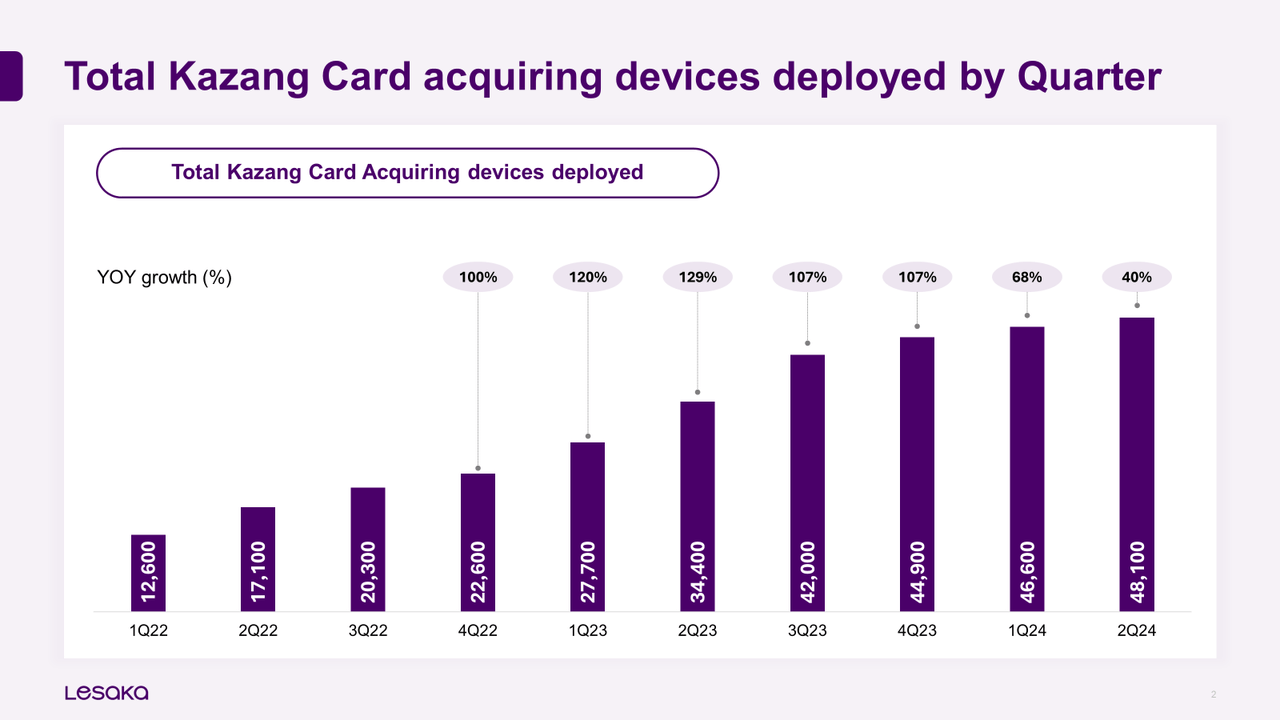

The merchant division’s growth has been driven by the number of Kazang Value Added Service (VAS) mobile POS devices given to merchants. These devices enable merchants to download the Kazang app and start selling digital value-added services to consumers, such as mobile top-ups, paying bills, selling tickets, acting like an ATM, transferring money, etc.

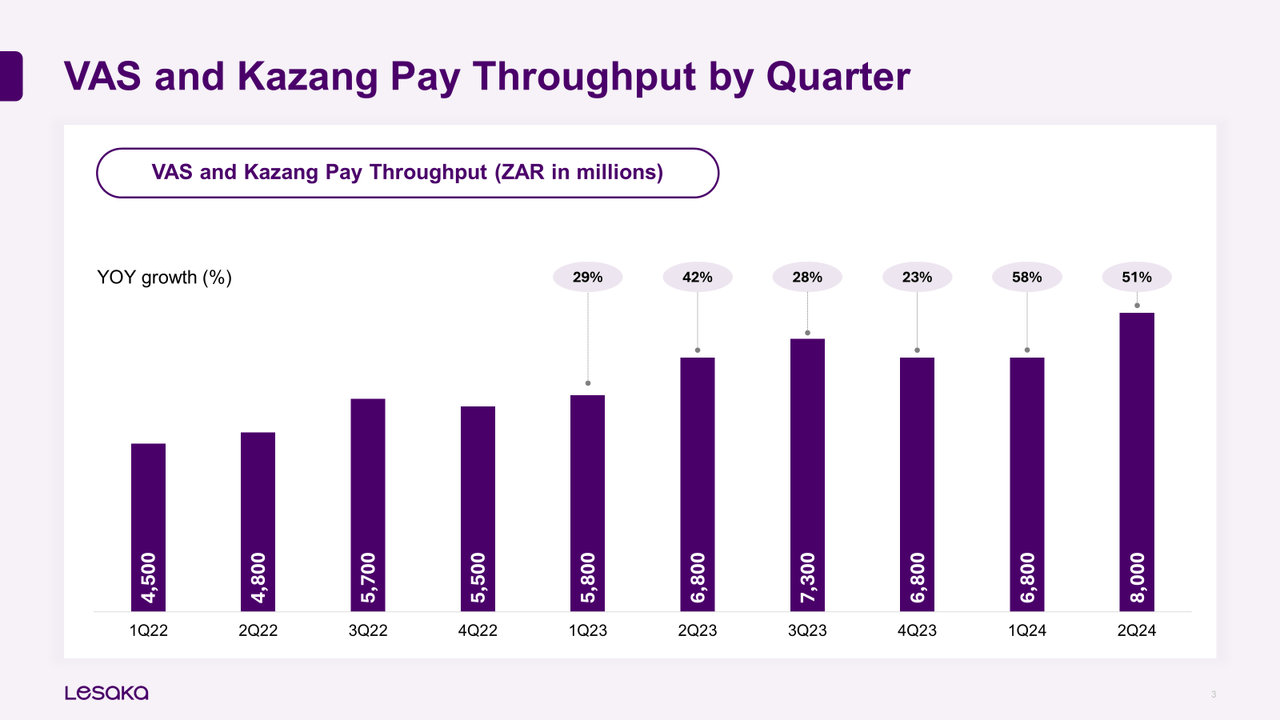

As the # of Kazang branded VAS devices increases, VAS and Kazang Pay throughput steadily ramps:

Additionally, Kazang card-acquiring mobile POS devices enable a merchant to download the app and start accepting credit cards. The number of card-acquiring devices is smaller than the number of VAS devices distributed. That gap will narrow as more merchants with VAS-enabled POS devices are given card-acquiring devices, increasing the merchant ARPU.

LSAK has a competitive advantage because Kazang devices enable merchants to accept credit cards (card acquiring) and sell value-added services to consumers (VAS). This means the merchant has more ways to make money and generate more foot traffic in their stores.

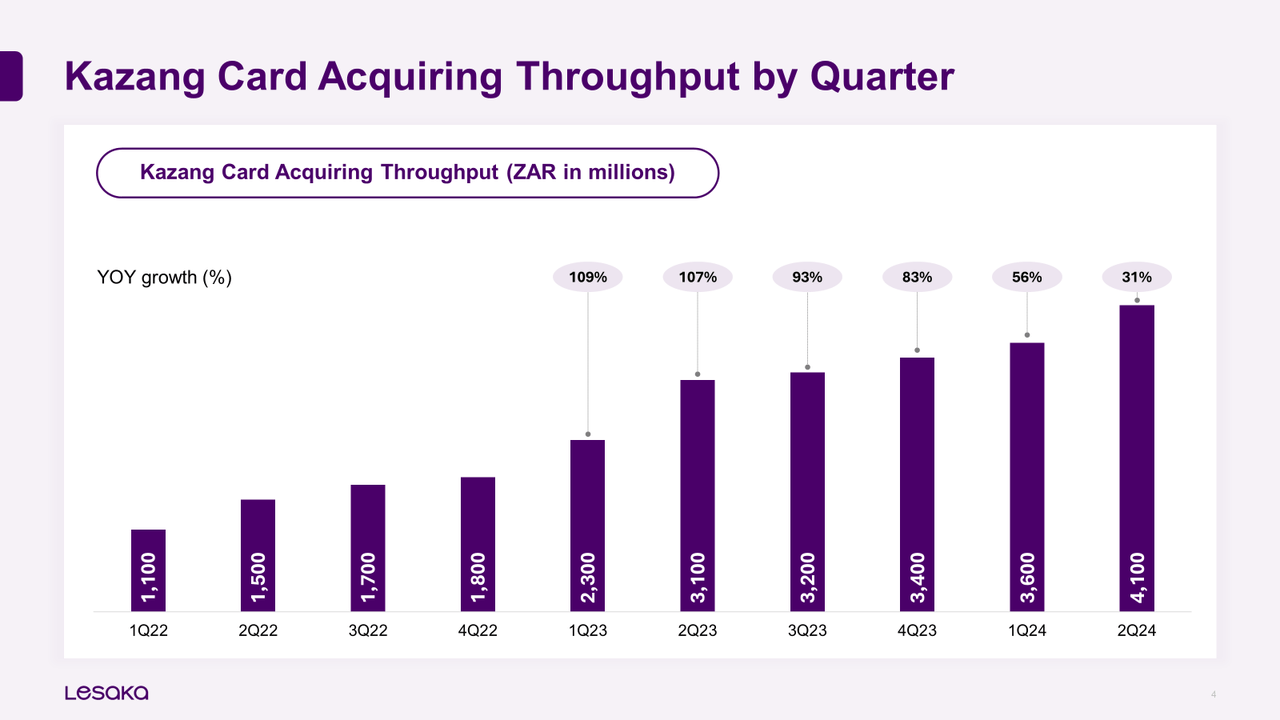

Commensurate with the increased number of Kazang card-enabled mobile POS devices in the field, more goods and services are being bought with credit cards, increasing Kazang card acquiring throughput, or TPV:

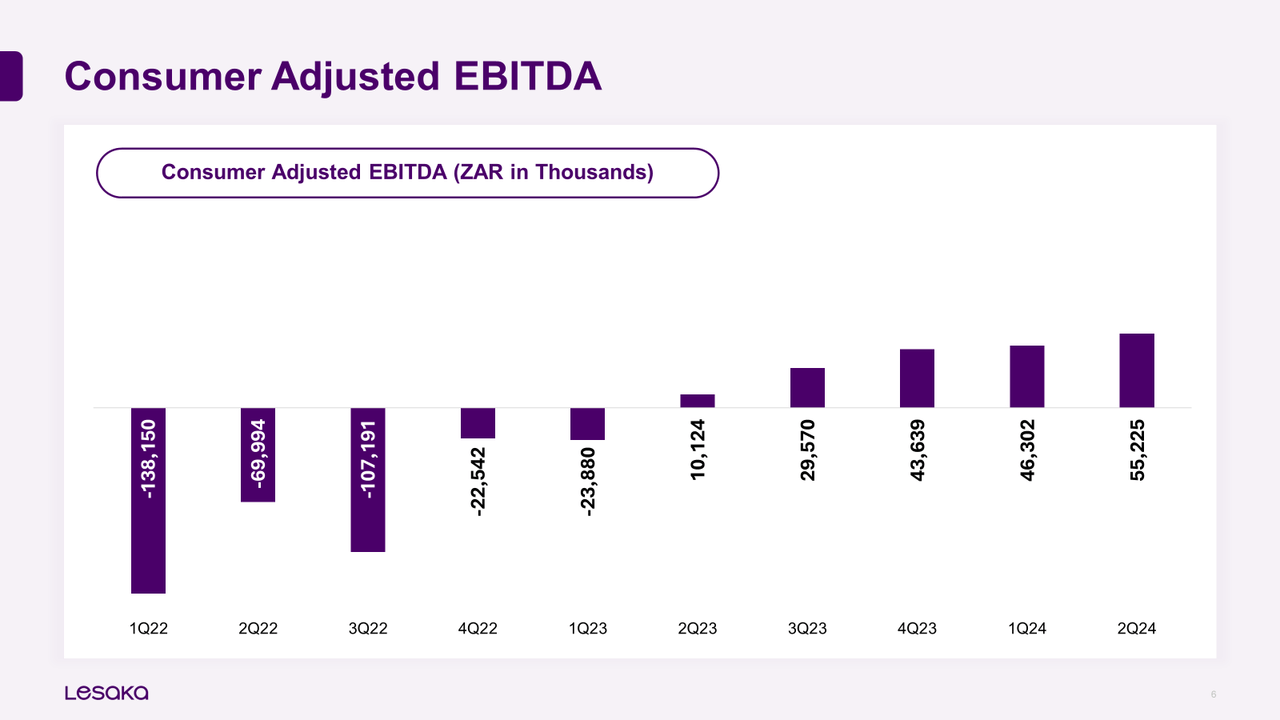

But the increase in Group Adjusted EBITDA has been helped by the turnaround in the consumer division Adjusted EBITDA:

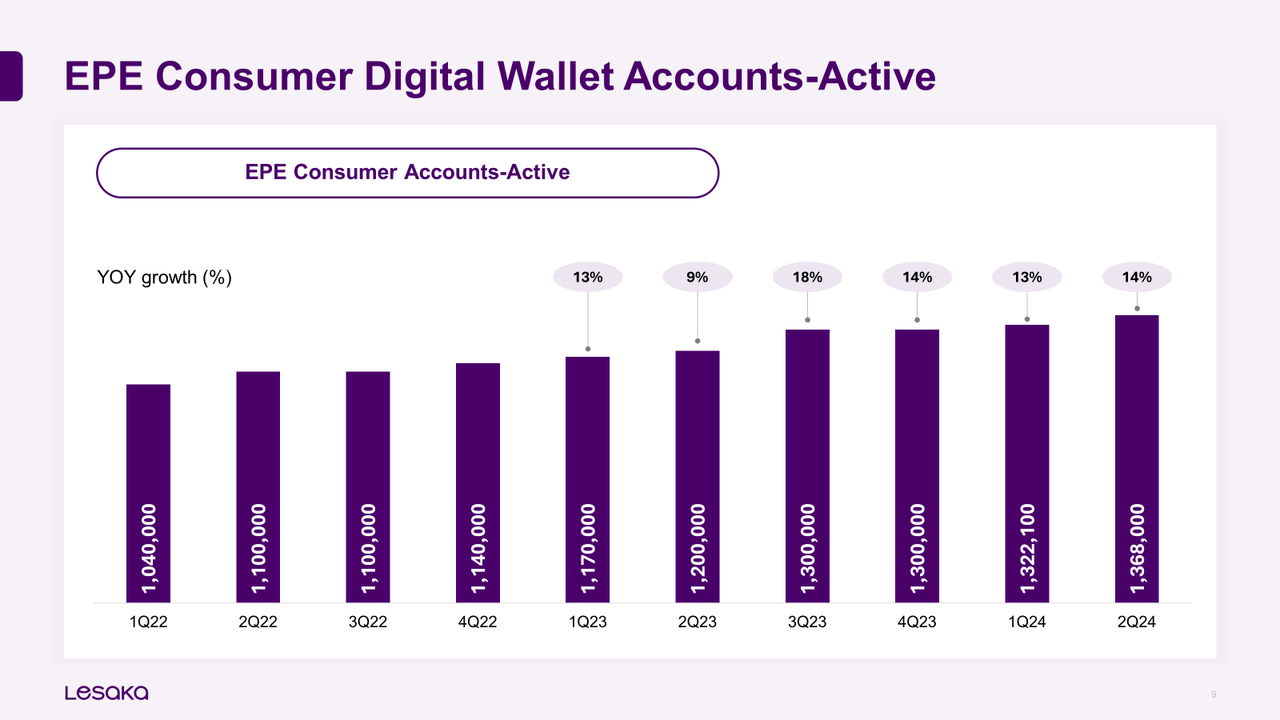

The consumer division’s growth is being driven by the growth of the EasyPay Everywhere (EPE) digital wallet/bank account:

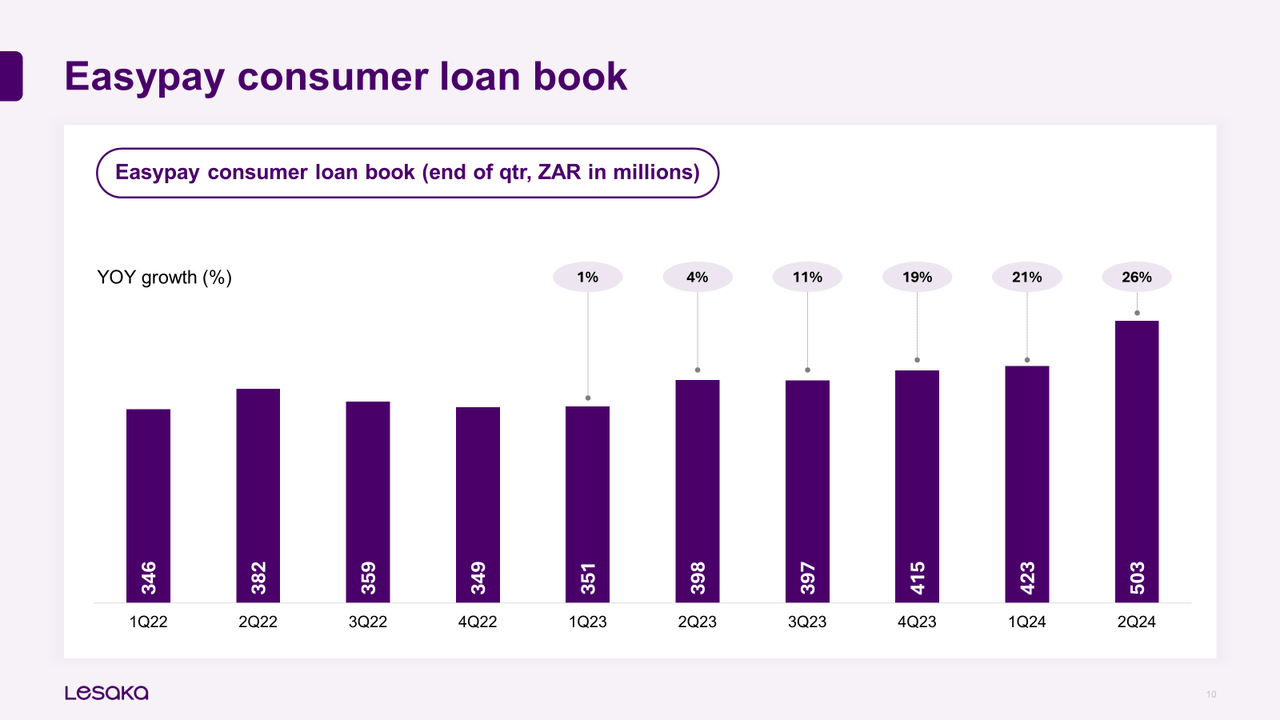

These new EasyPay Everywhere (EPE) digital bank account holders are then upsold other products, such as consumer unsecured loans under the EasyPay brand:

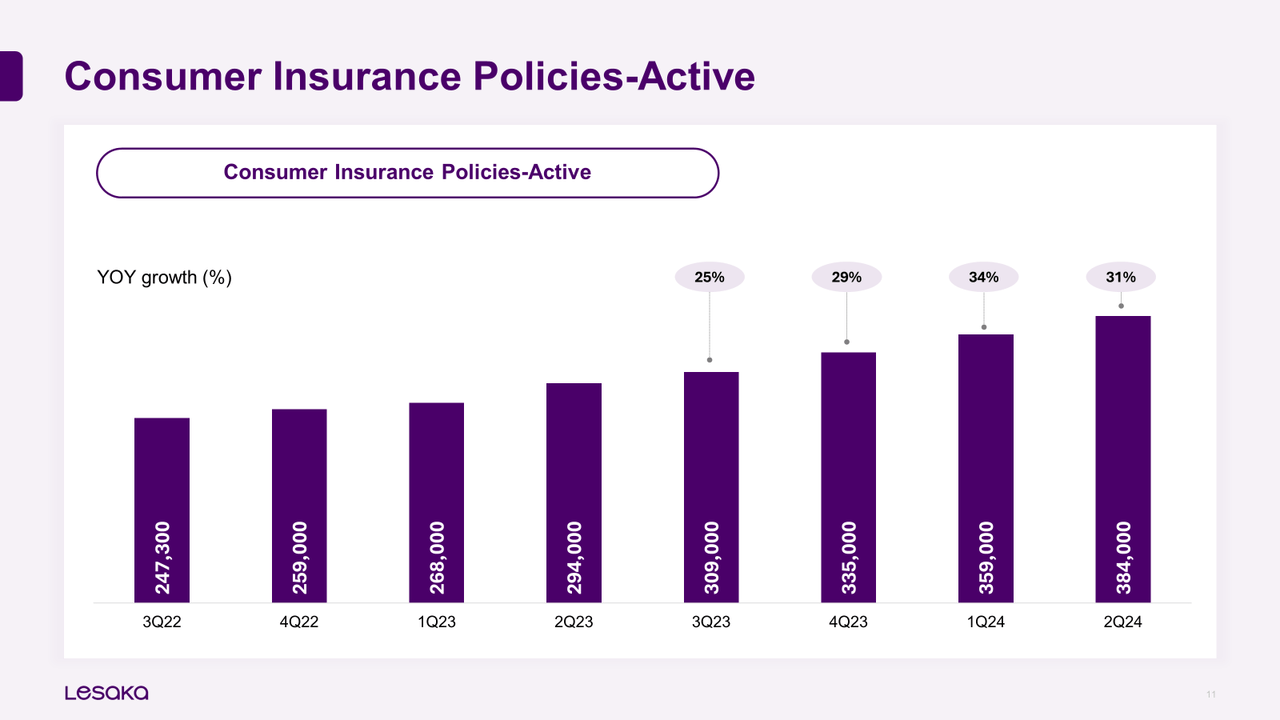

The other consumer finance product sold to EasyPay Everywhere account holders is consumer insurance:

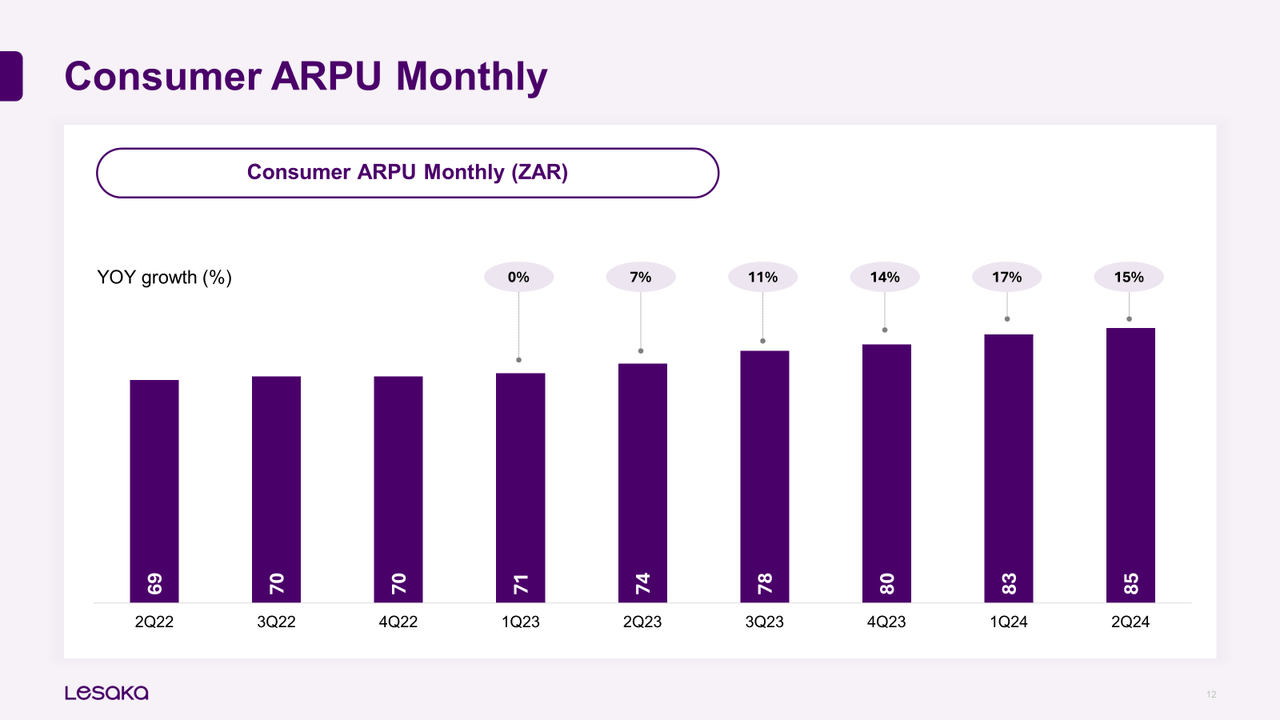

This cross-selling has helped the consumer division’s monthly ARPU steadily increase:

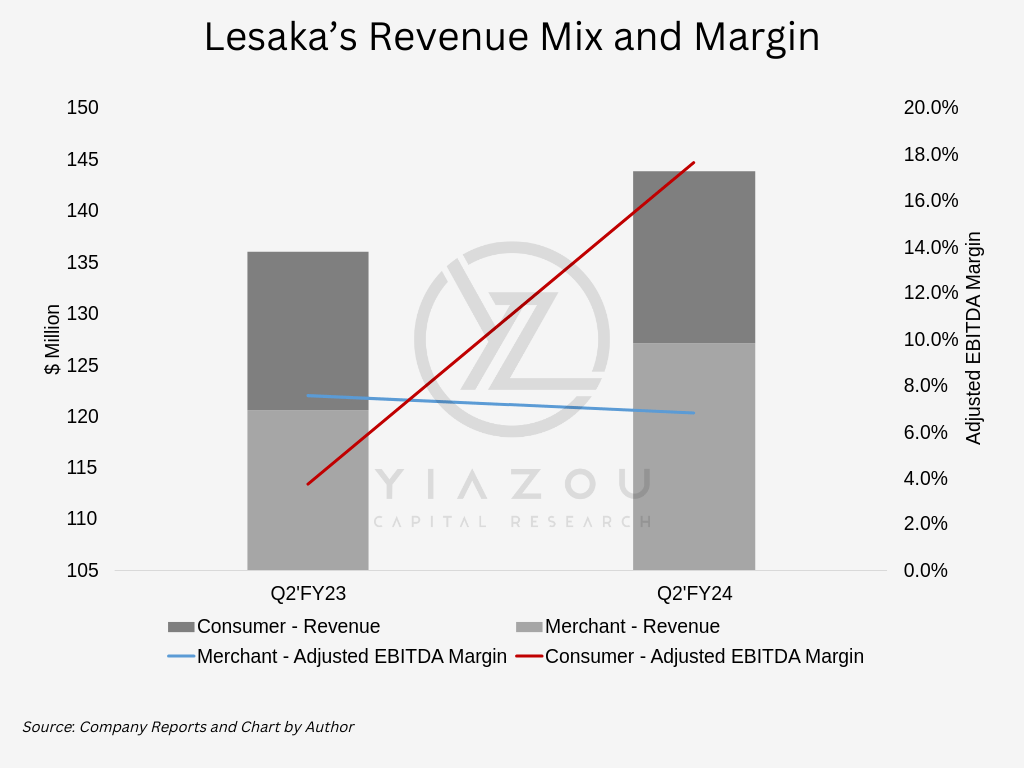

Lesaka’s Q2’FY24 Earnings Showcase Profitability Surge

Lesaka produced solid earnings in Q2’FY24 ending Dec ’23 as it focused on increasing profitability. Lesaka’s revenue grew 13% YoY to ZAR 2.7 billion (~$ $142 million) despite a temporary pullback in issuing credit in the merchant division.

Additionally, Lesaka generated an operating income of ZAR 42 million compared to an operating loss of ZAR 38 million in the previous year. Moreover, cash flow from the operations of Lesaka grew by 25% YoY to ZAR 75 million (after adjusting for the abnormally high interest payment of ZAR 64 million). Similarly, the free cash flow also turned positive and stood at ZAR 34 million during Q4’FY24, compared to negative ZAR 10 million in the previous year.

One key indicator of Lesaka’s improving financial performance is its incremental operating margin, which reached an impressive 57% in the quarter ended 12/31/23. This margin is calculated as the dollar increase in operating profit over the prior year, expressed as a percentage of the dollar increase in revenues over the prior year. This metric provides a clear picture of the company’s ability to generate more profit from each additional dollar of revenue.

Over the past three quarters, Lesaka has consistently shown a positive trend in its incremental operating margins, indicating its potential for sustained profitability and future growth.

|

Incremental Operating Margin |

|

|

Quarter ended 6/30/23: |

31% |

|

Quarter ended 9/30/23: |

43% |

|

Quarter ended 12/31/23: |

57% |

Generally, payment businesses have a high percentage of fixed costs; once revenues cover those costs, the incremental revenues have very high margins and are, therefore, highly profitable. This results in EBITDA potentially growing much faster than revenues over time. LSAK is at this inflection point and will likely produce positive earnings in the next few quarters.

During the quarter, Lesaka strategically divested its equity stake in public financial services company Findbond. This decision proved beneficial as the proceeds substantially reduced the company’s net debt/EBITDA ratio to a manageable 2.7x. This debt reduction has enabled Lesaka to secure a lower interest rate, bringing them closer to the threshold of positive earnings.

Author

Valuation: Trading at a Discount Despite Strategic Wins and Growth Trajectory

Assuming Lesaka successfully divests its MobiKwik stake for ~$76 million and the proceeds (assuming no taxes) are used to pay down debt, that would decrease its Enterprise Value from the current estimate of approximately $390 million to roughly $315 million.

If we assume Lesaka can grow its EBITDA by 25% from approximately $40 million this year to $50 million next year, LSAK’s pro forma EV/EBITDA multiple would be roughly 6x. This multiple is significantly below what emerging market payments stocks trade for in the open market and what African payments businesses trade for in M&A transactions.

Network International Holdings plc (OTCPK:NWITY), a publicly traded payments business in Africa and the Middle East, announced in June 2023 that it will be taken private by the PE firm Brookfield for an enterprise value multiple of approximately 16x Network International’s EBITDA for the financial year ended December 31, 2022 (Source: page 23 of the Scheme Document dated July 12, 2023).

Additionally, Fawry, a publicly traded fintech and payments business in Egypt, trades at ~5x 2024 sales and ~10x 2024 EBITDA. We believe that LSAK deserves a higher multiple than the public comps and M&A examples used above because the company’s EBITDA is growing faster, but let’s be conservative and apply a 10x EV/EBITDA multiple to LSAK.

Thus, with a 10x 2025 EBITDA 2025, $50 million is $500 million in Enterprise Value. If we then subtract the current Net Debt of $61 million pro forma for the MobiKwik sale ($181 million of debt, less $44 million of current cash, less $76 million proceeds from Mobikiwk) from that $400 million number, we are left with an equity value of $439 million. Assuming 63.8 million shares, our target price is ~$6.88, which is ~65% higher than the current price.

Concluding Thoughts

Lesaka remains undervalued, and the MobiKwik IPO is a catalyst that will unlock value in the next 6-9 months. Meanwhile, the company is making significant strides in South Africa’s large fintech ecosystem. The board has proven it can make sound acquisitions and has said it will continue to make more of them.

The company is now helmed by a successful fintech investor who is likely to accelerate Lesaka’s successful trajectory. With Ali Mazanderani’s appointment as executive chairperson, Lesaka has a good chance of being one of Africa’s largest fintech companies.

Finally, the macroeconomic picture in South Africa continues to improve. Load-shedding (government-mandated blackouts) is decreasing due to the increasing adoption of solar energy. Hence, this could be a tailwind for economic growth as businesses are open more hours of the day. Interest rates are also expected to decrease as inflation abates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.