Listed automobiles took a hit from inflation in March quarter

According to company insiders, inflation has led to an increase in business costs, compounded by rising interest rates. Additionally, the demand for commercial vehicles has decreased, while disruptions on the supply side, caused by problems in opening letters of credit due to the dollar crisis, have worsened the situation.

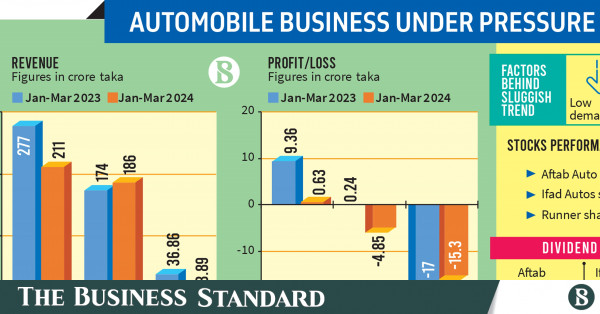

Automotive companies Aftab Automobiles, Ifad Autos, and Runner Automobiles, listed on the country’s capital market, experienced a downward trend in the January-March quarter as high inflation and supply disruptions weakened their profitability.

According to company insiders, inflation has led to an increase in business costs, compounded by rising interest rates. Additionally, the demand for commercial vehicles has decreased, while disruptions on the supply side, caused by problems in opening letters of credit due to the dollar crisis, have worsened the situation.

Investors in these companies experienced losses as the prices of their shares consistently declined at the Dhaka Stock Exchange (DSE). Aftab Auto shares dropped to a three-month low, while Runner’s stock hit a two-year low. Additionally, Ifad Autos shares closed at Tk34.80 on Tuesday (8 May), down from Tk44.10 in January.

Aftab Auto

The revenue of the Hino-branded commercial vehicle seller plummeted by 76% to Tk8.89 crore in the January-March quarter of FY24 compared to the previous year.

During this quarter, it incurred a loss of Tk4.85 crore, with the accumulated loss rising to Tk14.72 crore in the first three quarters through March.

Aftab Auto explained in its financial statement that the decrease in revenue was notably influenced by two factors: changes in chassis models and the persistent challenges associated with the dollar crisis affecting LC opening.

Its shares closed 2.91% lower at Tk40.10 each on Tuesday, compared to Tk61 in February.

Ifad Autos

In January-March, the revenue of the Ashok Leyland vehicle distributor declined by 24% to Tk211 crore.

According to its financial statement, sales of imported vehicles decreased by 4% to Tk70 crore, while sales of manufactured and assembled vehicles dropped by 29% to Tk131 crore compared to a year ago.

The company stated in its announcement that the decrease in sales was attributed to a decline in the demand for commercial vehicles during the period.

It further said the major reason for decreasing profit is the increase in finance costs and commodity inflation.

Its net profit also dropped over 93% to Tk0.63 crore in the January-March quarter.

At the end of the first three quarters of FY24, its total revenue stood at Tk532 crore, marking a significant drop from the previous year, and the net profit was Tk1.37 crore.

Its shares closed 2.25% lower at Tk34.80 each on Tuesday, down from Tk44.1 in January.

Runner

Runner Automobiles produces motorcycles under its own brand name, imports KTM branded motorcycles and is an authorised dealer of Eicher branded commercial vehicles. It also assembles Bajaj three-wheelers.

During the third quarter, the company experienced a 7% increase in revenue, amounting to Tk186 crore, attributed to rising sales of motorcycles and trucks.

However, it incurred a loss of Tk15.30 crore during the quarter due to the business cost hike.

At the end of the first three quarters of FY24, its total revenue stood at Tk575 crore, surging by 5% from the previous year at the same time. Its total loss was Tk42 crore at the end of March.

Last year, it could not pay any dividends to its shareholders due to incurring losses.

A senior officer of the company said that, due to the ongoing economic crisis, many people are delaying the purchase of new cars. Consequently, sales of two-wheelers, three-wheelers, and commercial vehicles could not reach the expected levels.

“Inflation has significantly impacted two-wheeler sales, as the target customers in this segment are middle- or lower-middle-class individuals struggling to meet their daily needs amidst rising costs, leading to postponement of their purchase decisions.”

Its share price closed at Tk29.40 each on Tuesday, slightly down from the previous session at the DSE.