London fintech GoCardless taps shareholders for £131 million funding after losses widen

London fintech GoCardless has tapped shareholders for another £131 million in funding after it reported a deepening in losses.

The Google-backed business said it had completed a £90 million equity raise from its parent company, as well as a £41 million cash advance. It was not clear how the company’s valuation was impacted by the fresh funding, but the firm warned of “reduced appetite to invest in later-stage growth companies.”

GoCardless reported a loss of £78 million in the year to June 2023, a 24% increase on the previous year as the firm bemoaned a higher rate of customer cancellations “partly due to merchants that had gone into administration…an impact of the wider economic environment.”

The company has seen more than 200 staff exit the company since it began a redundancy programme at the end of June, representing a cut of around one quarter of the workforce. Four directors also left the board which GoCardless said was part of “a group-wide initiative to rationalise board composition.”

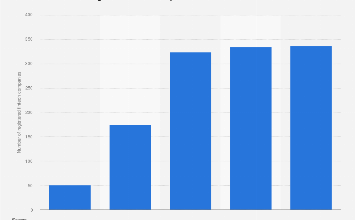

Revenues rose 30% over the period to £90 million as the company vowed to hit profitability within the next 12-18 months. Last month, the business spent 32 million euros (£30 million) acquiring payments firm Nuapay which it said would “unlock new vertical sectors and use cases in areas including payroll, financial services, utilities, insurance, gaming and gambling.”

“The directors see the prospects for the group as being healthy but in response to the tougher macro environment and reduced appetite to invest in later-stage growth companies,” GoCardless said.

“Management have taken the decision to focus on driving the business towards profitability as quickly as possible whilst ensuring that the group is still able to grow its market share and enhance the product offering, particularly in international markets.”