Medrobotics puts surgical robotics IP up for sale with MA plant

Tiger Group and Liquidity Services today announced the availability of all surgical robotics assets from a Medrobotics plant at auction.

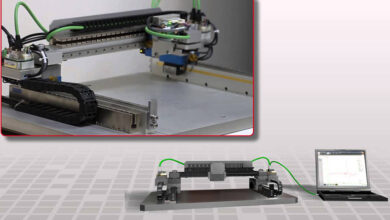

The companies say they’re offering all assets from the fully furnished, 40,000-square-foot plant in Raynham, Massachusetts, including the purchase or lease of the building. Assets, including surgical robotics platforms used by nearly 30 hospitals around the world, are available in a turnkey sale.

Medrobotics boasted an FDA-cleared, CE-marked surgical robotic platform for several years. The company designed its minimally invasive Flex system to access hard-to-reach anatomy for otolaryngology, colorectal and gastroenterology procedures.

However, the company hit a number of stumbling blocks over the past several years — including a significant IP case loss — leading to the sale of these assets. That involved legal battles, some of which remain ongoing. Just this week, the company’s Chapter 7 bankruptcy trustee agreed to a $2 million payout from the insurers of CEO Samuel Straface and other company officials to settle claims of breached fiduciary duties. (The settlement was not an acknowledgment of wrongdoing.)

A look at how Medrobotics got here

Medrobotics once generated buzz in the highly competitive surgical robotics space. (MassDevice‘s sibling Medical Design & Outsourcing site even had a feature article about Straface in early 2018.)

However, by March 2020, the local NBC 10 I-Team reported that the company faced state fines for not paying employees for more than one month. Officials reportedly attributed the issues to a cash flow problem and promised the payments, plus a day off and a $2,000 bonus once investor funds came through. Those payments never came through, according to NBC 10.

Maura Healey, then the Massachusetts attorney general, issued a $1.2 million citation for failing to pay wages on time.

Medrobotics faced further troubles later in 2020, with courts agreeing with Endobotics in a patent spat against the company. Endobotics first filed a lawsuit against the company in early 2019, followed by additional suits in 2020.

In December 2020, the U.S. District Court for the District of Delaware and the U.S. District Court for the District of Massachusetts granted two judgments in favor of Endobotics lawsuits alleging patent infringement and Defend Trade Secrets Act, Massachusetts trade secret law, breach of contract, unfair competition and state law tort claims.

The courts ruled that Medrobotics owed nearly $192 million in an award to Endobotics.

Creditors filed an involuntary bankruptcy petition against Medrobotics on Jan. 24, 2022. Shortly after, the court appointed a Chapter 7 trustee. By August 2023, that trustee filed a complaint against company leadership.

According to Law360, in March 2022, Pennsylvania physicians who invested in the company said Medrobotics executives hid and mishandled the Endobotics lawsuits that “effectively sank the company.” Those shareholders filed a derivative suit in Pennsylvania state court.

Details of the Endobotics suit that effectively brought Medrobotics down

In Endobotics’ suit, the company alleged that its predecessor-in-interest, Cambridge Endoscopic Devices, developed and manufactured minimally invasive surgical tools. Endobotics said it acquired the patents-in-suit and Cambridge’s know-how and trade secrets when Cambridge went bankrupt.

Medrobotics, meanwhile, manufactured its single-port surgery solution with a highly articulated multi-linked scope. Endobotics said this incorporated feature was claimed in a number of its patents.

The lawsuit alleges that from at least early 2017, Medrobotics knew about Endobotics’ patents. Endobotics said it sent letters and claim charts informing the company of the features claimed in its own patents.

According to Endobotics, Medrobotics designed and manufactured its product with Design Standards Corp. of Charlestown, New Hampshire. This same company designed and manufactured Cambridge’s tools, which eventually went to Endobotics.

The lawsuit said Medrobotics’ surgical tool “looks substantially similar to Cambridge’s surgical instrument” previously on the market. Design Standards Corp. had access to the know-how and trade secrets of Cambridge owned by Endobotics, the company said. Given the similarities, Endobotics said its know-how and trade secrets were misappropriated. The company claimed Medrobotics refused to negotiate in good faith to avoid the lawsuit.

Additionally, Endobotics said the company refused to discuss a license to cure the infringement.

A look at the company’s bankruptcy fallout

Around 20 months into Medrobotics’ Chapter 7 bankruptcy case, trustee David Madoff filed a complaint on behalf of the estate of Medrobotics against CEO Samuel Straface and other company officials. The complaint alleged breach of fiduciary duty and negligence in connection with certain acts and omissions as directors and officers of the company.

Madoff contended that Medrobotics reached a point where officials “knew or should have known” the company lacked the capital and operating income to continue producing a functional product. However, the suit says the leaders “continued to promote Medrobotics as a healthy and growing entity in an effort to secure investment, employee labor and vendor support.” At this point, the company grew to around 200 total employees.

Following the Endobotics suits, Madoff alleged that officials failed to inform shareholders, investors, employees, vendors and customers of the lawsuits or warn of the legal and financial risks posed to the company. Instead, Madoff said they continued to present an “optimistic” picture of the firm’s financial condition. He said this indicated positive cash flow, significant investment interest and solid sales projections.

However, the claim says the company’s actual financial condition was dire. Madoff even said Medrobotics didn’t have the funds to pay its attorneys to defend the Endobotics suit.

According to Madoff, in spite of the knowledge of legal reversals and the company’s financial condition, its leadership continued to operate. In doing so, he said the company incurred “staggering” amounts of debt to investors, employees and vendors.

Madoff’s claim said this conduct constitutes “egregious mismanagement of a business corporation.” He also alleged a dereliction of all duties of care, judgment, prudence and circumspection on the leadership team’s part. Because of the leaders’ failure to disclose information about these ongoing issues, interested parties were prevented from taking action to avert the effects of the company’s downfall.

“The defendants’ mismanagement and fiduciary breach have proximately caused Medrobotics to be destroyed as a going concern, and rendered the company worthless and unable to pay over $135 million in asserted creditor claims including $126,453,828.11 in unsecured claims,” Madoff’s claim said.

This month, Madoff reached a $2 million settlement over his claim. The settlement was not an admission of liability. A federal bankruptcy judge scheduled a hearing on June 11 to consider approving the settlement.

More on the asset sale

The sale includes 22 terabytes worth of technical specs, customer lists and other valuable IP, plus $12 million in hard assets, Tiger Commercial & Industrial Senior Director John Coelho said in the news release. That includes 23 complete Flex and next-gen Flex360 robotics systems.

“This turnkey sale represents an extraordinary growth opportunity for buyers that could include medical device-makers, robotics companies or venture capital firms,” Coelho said.

In addition to the robotics systems, the plant has general-utility medical, lab, assembly/manufacturing, plant support and material-handling assets. Coelho says that includes state-of-the-art 3D printers and a full machine shop. It also includes microscopes, incubators, lab ovens, test and measurement equipment and pallet jacks and racking.

“These systems, which are FDA-approved, were the first surgical platform to offer a steerable and shapeable robotic scope, which allows surgeons to operate on parts of the body that, in many cases, would otherwise have been unreachable,” said Nick Jimenez, VP of global business development at Liquidity Services. “The equipment and IP available in this turnkey opportunity could greatly benefit an expanding medical robotics enterprise.”

MassDevice reached out to former Medrobotics CEO Samuel Straface on LinkedIn for potential comment on the asset sale and Chapter 7 case settlement. This story may be updated.