Meet the Newest Artificial Intelligence (AI) Stock in the S&P 500. It Ranks Among the Fastest-Growing Enterprise Software Companies.

The S&P 500 (SNPINDEX: ^GSPC) is commonly regarded as the best benchmark for the overall U.S. stock market. The index tracks 500 large American companies that cover 80% of domestic equities by market capitalization. To be considered for inclusion, a company must be worth at least $18 billion, it must be profitable, and the stock must be sufficiently liquid.

On Monday, June 24, the S&P 500 will undergo its quarterly rebalancing. Before the market opens, CrowdStrike (NASDAQ: CRWD), GoDaddy, and KKR will be added to the index, while Robert Half, Comerica, and Illumina will be removed. Of the new additions, CrowdStrike stands out for several reasons.

It is the company best positioned to monetize generative artificial intelligence software, a market forecasted to grow at 58% annually through 2028. It is also one of only three enterprise software companies guiding for 30%-plus revenue growth this year, according to Morgan Stanley. Finally, CrowdStrike ranked third on the 2023 Fortune Future 50 List, an annual assessment of the world’s largest companies based on long-term growth prospects.

Is the stock worth buying?

CrowdStrike is building momentum beyond endpoint security

CrowdStrike is the leader in modern endpoint security software, a cybersecurity category focused on protecting hardware like desktops, laptops, and mobile devices. Additionally, CrowdStrike is also gaining market share in modern endpoint security faster than any other vendor. The company will account for 28% of spending in fiscal 2027 (ends Jan. 31), up from 21% in fiscal 2024, according to estimates from JPMorgan Chase.

Strength in endpoint security is particularly advantageous for two reasons. First, endpoint devices are the richest source of threat intelligence for enterprises. CrowdStrike uses its vast data to train “the industry’s most effective and accurate” artificial intelligence (AI) models, according to CEO George Kurtz. Second, brand authority garnered from success in endpoint security is helping the company gain share in other cybersecurity markets.

For instance, CrowdStrike is the market leader in MDR (managed detection and response) services. Analysts have also praised the company as a technology leader in identity threat detection and cloud security. Additionally, CrowdStrike is seeing strong demand for new data protection and IT automation modules, and it has one of the fastest-growing SIEM (security information and event management) products on the market, according to CEO George Kurtz.

To further tap its data advantage, CrowdStrike recently debuted a generative AI assistant. The product, Charlotte AI, accelerates and streamlines security workflows by allowing users to ask questions in natural language. It can assess security posture, summarize threat intelligence, assist with investigations, and provide prescriptive guidance. Morgan Stanley analysts see CrowdStrike as one of the software companies best positioned to monetize generative AI due to its endpoint leadership and robust data.

CrowdStrike continued to execute in the first quarter

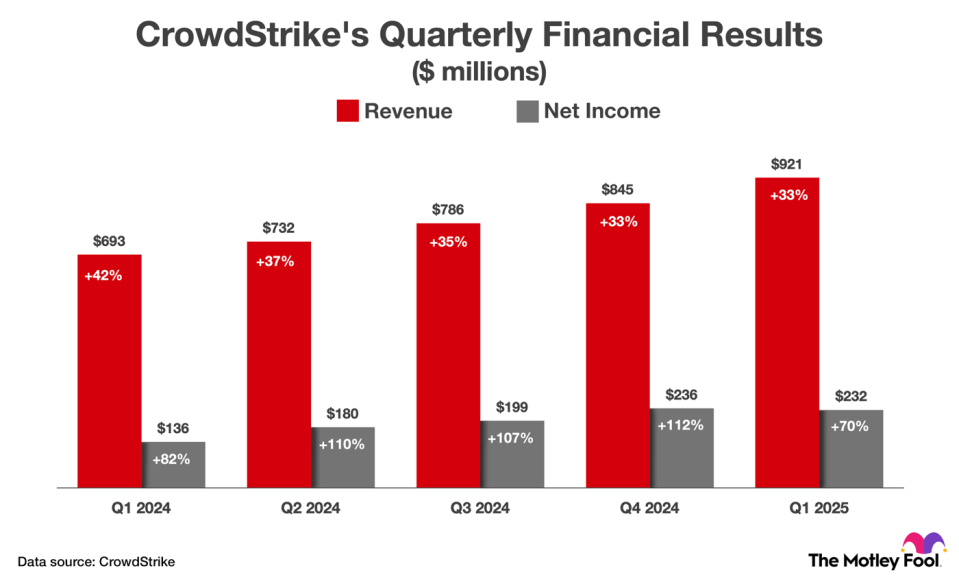

CrowdStrike reported strong financial results in the first quarter of fiscal 2025 (ended April 30), beating expectations on the top and bottom lines. Revenue increased 33% to $921 million and non-GAAP net income increased 70% to $232 million. Management guided for 31% revenue growth in the second quarter.

CEO George Kurtz said CrowdStrike’s ability to consolidate a broad range of security workloads on a single platform is resonating with the market. He also said the number of deals involving cloud security, identity protection, and SIEM modules more than doubled compared to the prior year, highlighting momentum beyond endpoint security.

The chart shows CrowdStrike’s revenue and non-GAAP net income over the last five quarters.

CrowdStrike stock looks expensive compared to Wall Street’s sales forecast

Cybersecurity is the IT budget category projected to see the second-largest increase in spending in 2024, according to a CIO survey from Morgan Stanley. Artificial intelligence is the only IT budget category expected to see a greater increase in spending.

CrowdStrike is well positioned to benefit in both cases. Its purview is expanding beyond endpoint security, and Charlotte AI could evolve into a material revenue stream. To that end, Wall Street expects sales to grow at 27% annually over the next three years. That estimate leaves room for upside, but CrowdStrike still trades at an expensive valuation of 28 times sales.

Personally, I would wait for that multiple to drop a few points before purchasing the stock. That said, I am a CrowdStrike shareholder and I have no plans to sell my position.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,068!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $36,491!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $347,573!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of June 11, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike, JPMorgan Chase, and KKR. The Motley Fool recommends GoDaddy, Illumina, and Robert Half. The Motley Fool has a disclosure policy.

Meet the Newest Artificial Intelligence (AI) Stock in the S&P 500. It Ranks Among the Fastest-Growing Enterprise Software Companies. was originally published by The Motley Fool