Monday’s sell-off in longtime holding CRM looks overblown. Here’s why

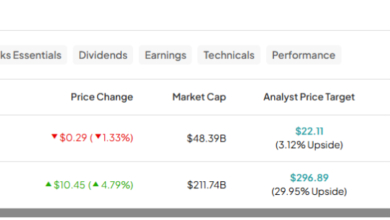

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Monday’s key moments. U.S. stocks edged higher Monday as the market attempted to rebound from last week’s sell-off on hopes that geopolitical tensions in the Middle East won’t escalate further. But there’s a lot of uncertainty around the situation. Friday’s big pullback moved the S & P 500 Short Range Oscillator into oversold territory for the first time since late October. As usual in an oversold market, the Club looked for opportunities to scoop up shares of quality companies at a discount. We added to our Best Buy position earlier Monday. The stock has drifted lower since we took a stake in late March, despite additional indications that the personal computer market is poised to return to growth. Meanwhile, Citigroup opened up a 90-day catalyst watch on Nvidia and argued that shares will see more upside on upbeat supply chain commentary. Analysts cited upcoming earnings calls of high bandwidth memory suppliers like Micron , along with Nvidia CEO Jensen Huang’s June keynote at the Computex Taipei conference. Demand for Nvidia’s offerings remains incredibly high, and investors want to be sure Nvidia has the supply to fulfill all its orders and meet Wall Street’s financial expectations. Salesforce shares fell more than 5% Monday after The Wall Street Journal reported that the longtime tech holding is in advanced talks to buy cloud data management company Informatica . Investors may be concerned that the news signals Salesforce returning to large-scale acquisitions and the pace of buybacks could slow as a result. While we understand wariness around Salesforce returning to its aggressive dealmaking of the past, we think the market’s reaction Monday is overblown. Informatica trades at a relatively similar revenue multiple to Salesforce, and its margins also are close, so potential dilution would be very manageable. Additionally, The Journal reported the price being discussed is below where Informatica’s stock closed Friday, which suggests Salesforce is exercising some discipline. (Jim Cramer’s Charitable Trust is long NVDA, CRM, BBY. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

![113 Most Critical CRM Statistics to Know [2023 Facts and Trends] 113 Most Critical CRM Statistics to Know [2023 Facts and Trends]](https://europeantech.news/wp-content/uploads/2024/05/CRM-Statistics-and-facts-1-scaled-390x220.jpg)