Mullen Announces New CARB Approval for 2025 Class 3 EV Cab Chassis Truck

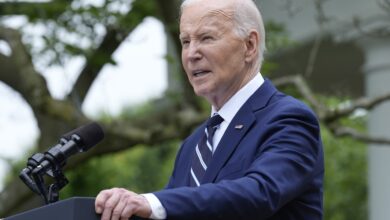

Mullen Class 3 Production in Tunica, Mississippi

Company now in receipt of CARB approval for both 2024 and 2025 Class 3 Model Years

CARB certification takes on even more significance with the recent Advanced Clean Fleets (“ACF”) regulation, which requires state and local government fleets, including city, county, special district, and state agency fleets, to ensure 50% of vehicle purchases are zero-emission beginning in 2024 and 100% of vehicle purchases are zero-emission by 2027

BREA, Calif., April 25, 2024 (GLOBE NEWSWIRE) — via IBN — Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an emerging electric vehicle (“EV”) manufacturer, today announces certification from the California Air Resources Board (“CARB”) on the 2025 Mullen THREE, Class 3 all-electric low cab forward chassis truck. The certification is awarded to vehicle manufacturers who meet specific emissions standards in compliance with CARB regulations. The District of Columbia and 14 states, including California, have adopted vehicle standards under Section 177 of the Clean Air Act (42 U.S.C. §7507), which requires additional approvals beyond EPA regulations.

A copy of Mullen’s 2025 Class 3 CARB certification can be found on MullenUSA.com. The Company previously received 2024 Model Year CARB certification for the Mullen THREE in January 2024.

CARB certification opens the Mullen THREE to critical state EV incentive programs, which vary by each eligible CARB-compliant state. The certification takes on even more significance with CARB’s recent Advanced Clean Fleets (“ACF”) regulation, which will have a requirement that state and local government fleets, including city, county, special district, and state agency fleets, ensure 50% of vehicle purchases are zero-emission beginning in 2024 and 100% of vehicle purchases are zero-emission by 2027. Fleets that fall under high priority may also elect to utilize ZEV milestones as an option to meet overall ZEV targets.

CARB-compliant states and locations include: California, Connecticut, Colorado, Delaware, Maine, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Vermont and the District of Columbia

California’s HVIP project is an example of a valuable state incentive program available to CARB-certified vehicles. Under HVIP, the Mullen THREE EV truck, with a suggested MSRP of $68,500.00, may qualify for a rebate of up to $45,000.00 and, when combined with the available $7,500.00 federal tax credit, the net effective cost of the Mullen THREE would be less than $20,000.00.

“Our vehicles are CARB approved and ready for delivery with many states and local governments offering very strong incentives to electrify commercial fleets,” said David Michery, CEO and chairman of Mullen Automotive.

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based automotive company building the next generation of commercial electric vehicles (“EVs”) with two United States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen began commercial vehicle production in Tunica. In September 2023, Mullen received IRS approval for federal EV tax credits on its commercial vehicles with a Qualified Manufacturer designation that offers eligible customers up to $7,500 per vehicle. As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis truck, are California Air Resource Board (“CARB”) and EPA certified and available for sale in the U.S.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking statements. Words such as “continue,” “will,” “may,” “could,” “should,” “expect,” “expected,” “plans,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential” and similar expressions are intended to identify such forward-looking statements. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include but are not limited to what extent, if any, the Mullen Class 1 and 3 will benefit from state or federal cash or other incentive programs, the total cost of these vehicles to purchasers and the impact on sales, if any, due to the CARB certifications. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive, Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

InvestorBrandNetwork (IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

Attachment