Nigerian fintech startup Brass acquired by Paystack-led consortium

Nigerian digital banking startup Brass has been acquired by a consortium led by fintech heavyweight Paystack to alleviate liquidity concerns and avoid closure.

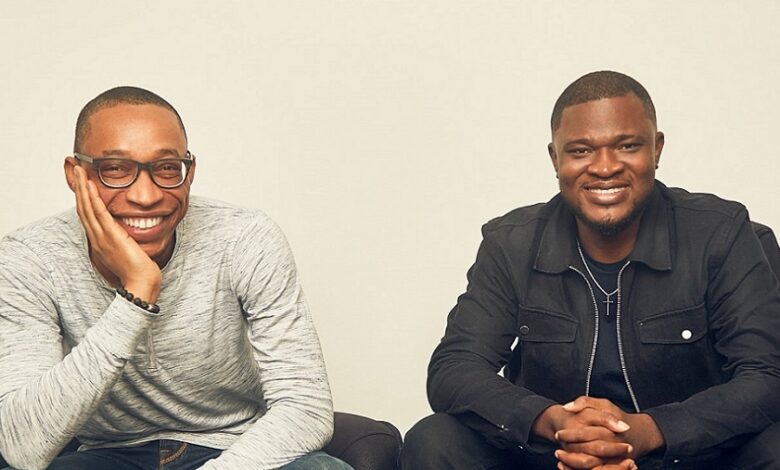

Launched in July 2020 by Sola Akindolu and Emmanuel Okeke, Brass equips SMEs with a full-stack, commercial-grade banking service across various business classes, enabling them to gain greater clarity and control over their money operations and the power to scale their enterprises.

Like other startups, Brass has been affected by global economic headwinds, and faced liquidity challenges that forced it to take on debt financing in order to process customer withdrawals. It has now been acquired by a consortium led by Paystack, and including Piggytech, Ventures Platform, and P1 Ventures.

The consortium will now take on the startup’s assets and liabilities, with Akindolu and Okeke leaving the business.

“Over the years, we have added and supported tens of thousands of businesses with top-end financial tools for local businesses, and we are just getting started. We have also had the incredible opportunity to build with some of the most brilliant and talented people we know.

Brass has grown tremendously since we started this incredible journey, and it continues to be an important player in Nigeria’s SMB economy,” said Akindolu.

“Following the acquisition, Brass will continue to build and support its customers and grow with a new leadership team, as the founding leadership team will leave to pursue other opportunities. The work of making entrepreneurship permission-less is far from finished, and we definitely look forward to what’s next from the new team.”

Amandine Lobelle, COO of Paystack, said Brass and Paystack had had a long working relationship since Brass’s founding.

“We’re thrilled today to announce a new chapter in our partnership,” she said. “Each member of the investment group brings several years’ worth of experience financing and building reliable financial service products, and together with a new infusion of capital, we’re excited for Brass’ next stage of growth.”