Nikola Stock: Buy, Sell, or Hold?

The EV truck company’s stock is trading down over 99% from its peak price.

For a moment in time back in June 2020, Nikola (NKLA 0.34%) was one of the hottest stocks on Wall Street. After merging with a special purpose acquisition company (SPAC) around that time, the stock price for this manufacturer of electric and hydrogen-powered trucks briefly touched $94 per share.

It’s all been downhill since then.

Today, Nikola is the equivalent of a penny stock with shares priced at $0.51 (a 99.5% decline from its peak price). The electric vehicle (EV) company has faced its share of troubles, from missing production targets to its founder and former CEO, Trevor Milton, being convicted of securities fraud for making false and misleading statements to investors. Furthermore, the company has severely diluted shareholders as it continues to rack up losses.

Nikola has been much maligned, but things could be looking up for the electric vehicle (EV) maker. Could now finally be the time to buy stock? Let’s dive into its story and financials to find out more.

Reasons to buy or hold Nikola stock

Nikola is uniquely positioned in that it manufactures both hydrogen fuel cell electric vehicles (FCEVs) and battery electric vehicles (BEVs). Its FCEV truck can cover up to 500 miles, while its BEV range is 330 miles. Not only that, but the FCEV refuels in about 20 minutes, compared to the BEV, which takes up to 90 minutes to recharge.

Building out hydrogen fuel infrastructure could be key for Nikola’s future growth. Through its HYLA brand, Nikola will build hydrogen-fuel infrastructure to support its hydrogen-fueled trucks. Earlier this year it opened its first HYLA fueling station in Southern California. This station can fuel up to 40 of its FCEV trucks daily, and it plans to have 14 stations up and running by year-end.

The lack of hydrogen fuel infrastructure is an important headwind to Nikola’s growth. If hydrogen infrastructure develops, consisting of hydrogen supply, distribution, storage, and dispensing, Nikola could be well positioned with a first-mover advantage.

The growth potential is explosive. A report published by Precedence Research forecasts that the global hydrogen fuel cells market could grow 26% compounded annually through 2032. Carbon emission reduction goals, government initiatives to produce lower-carbon options, and an improving hydrogen fueling infrastructure would drive this growth.

In addition to its hydrogen infrastructure, Nikola is finally making progress on deliveries. In the first quarter, the company delivered 40 FCEV trucks. It expects to deliver 300 to 350 of these vehicles by year-end and the company expects deliveries to pick up as it builds out its infrastructure.

Image source: Getty Images.

Reasons to sell Nikola stock

The projected growth of the hydrogen fuel cell market is promising, but it’s important to remember that forecasts are just educated guesses. Nikola’s success depends on several factors, including hydrogen infrastructure development and ramping up vehicle production to generate positive cash flow.

The company has failed to deliver on its forecast production. In 2020, the company set production targets, which included delivering 3,500 BEVs and 2,000 FCEVs by 2023. The reality: Nikola delivered 114 vehicles in total last year.

While management has given numerous reasons for the slow production, as investors, it’s hard to trust a company that consistently comes up short in what it says it will do. Because of its delayed production and slow development of infrastructure, Nikola’s expenses have far outpaced its revenue and it continues to bleed money. Over the past three years, Nikola has lost a total of $2.6 billion on a generally accepted accounting principles (GAAP) basis.

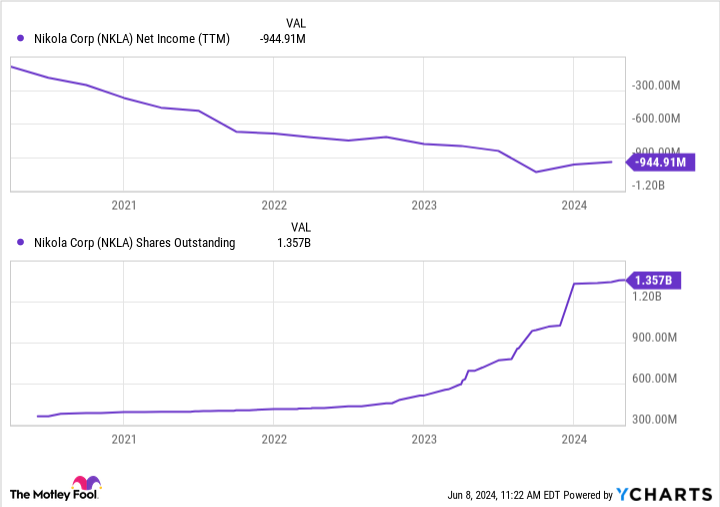

Then there is the matter of funding. At the end of the first quarter, Nikola had $345 million in unrestricted cash and cash equivalents. The company has consistently turned to equity markets to raise capital. Since the end of 2022, Nikola’s shares outstanding went from 513 million to over 1.3 billion, or a 161% increase. This has the effect of diluting existing shareholders and further driving down the value of the stock.

NKLA Net Income (TTM) data by YCharts

The final verdict

Nikola is making progress on deliveries and is expanding its hydrogen fuel infrastructure, which could make its FCEV trucks more appealing on a wider scale. However, there is a question of how the company can continue to fund operations if it doesn’t slow its cash burn.

With slowing demand and reduced customer spending impacting its most recent quarterly earnings, Nikola is in a difficult spot and could continue diluting shareholders. For that reason, I think the stock is a sell today.