Nio or XPeng: Goldman Sachs Chooses the Superior EV Stock to Buy in a Challenging Market

Electric vehicles, EVs, are still generating headlines – but the tone is getting mixed. There’s still a strong social and political push to shift the global automotive market from gas-powered cars to EVs, and the electric cars themselves are rapidly becoming more sophisticated. Batteries are improving, giving increased range and reliability, while styling, features, and other upgrades are a match for the industry’s best. And yet – there are serious headwinds.

Disruptions in supply chains and fluctuations in demand have resulted in both delivery delays and crowded dealer lots. High prices in the EV segment discourage the average consumer, and there are indications that wealthier buyers have already purchased their EVs. Nevertheless, industry experts are still predicting that more than 25% of new cars will be EVs by 2030. Even with a slowdown in sales, it’s expected that global passenger EV sales (battery-electrics and plug-in hybrids) will reach 16.7 million this year, for a 21% year-over-year increase.

From an investor’s perspective, this means that the doorway to opportunity remains open. EV stocks are trading low right now, due to the headwinds, but are likely to see gains in the long-term. This is the theory Goldman Sachs analyst Tino Hou is using to support her upbeat stance on some Chinese EVs. Asia’s largest economy is going all-in on electric cars, and Chinese EV companies have the built-in advantage of domesticity in the world’s largest car market.

However, not all stocks are created equal, and some offer better opportunities than others. Against this backdrop, Hou has evaluated two prominent players in the Chinese EV market, Nio (NYSE:NIO) and XPeng (NYSE:XPEV), and outlines which is the superior EV stock to buy in today’s challenging market. Let’s take a closer look.

Nio

We’ll start with Nio, one of China’s top EV sellers. The company spent its first five years on the necessary work of prototype design and facility development; regular production began in 2019 with the release of the company’s first two marketable EVs. Today, Nio has 9 vehicle models on the market, including SUVs, sedans, and coupes, in both mid- and full-size vehicle classes.

Nio offers several attractive features for buyers, including stylish design and improvements in battery technology, but the company’s most important service innovation may be its Battery-as-a-Service charging model. Vehicle owners can buy a subscription, and when the car’s battery runs low, they can simply take it to one of Nio’s 2,300 battery swapping stations, where the old battery pack is swapped out for a new one. It’s billed as a convenient alternative to spending long periods of time with the car plugged in to recharge.

The company is also working to develop subscription models for its intelligent and assisted driving systems, designed to improve vehicle safety through autonomous driving capabilities. While these features are not fully available yet, Nio’s work on them and its aim to make them available on an as-a-Service model represent a creative and innovative approach to integrating autonomous driving tech.

In early April, Nio released its production and delivery updates for March and the first quarter of 2023. For the quarter as a whole, vehicle deliveries totaled 30,053; for the month of March, that figure was 11,866. While the March total was up more than 14% year-over-year, it’s worth noting that the company revised its full-quarter outlook downward just a few days before the numbers were released. The previous outlook, set between 31,000 and 33,000, was adjusted to 30,000. The actual figures for the full quarter exceeded the revised outlook by a narrow margin.

Nio shares have sharply declined this year, losing 54% year-to-date, a sharp contrast to the 7% gain on the S&P 500 over the same period.

Turning to Goldman Sachs analyst Tina Hou and her notes on the stock, we find her taking a cautious approach to Nio. She believes the company faces a difficult time in the near-term, and writes, “Compared with the rest of the industry, Nio has refrained from aggressive price cuts on its models given the more premium price segment of the brand’s positioning. However, this has dragged down its sales volume and market share… Although the company is offering other benefits to customers such as lower fees for battery swap services, etc., the effect on sales is not meaningful. As the market is getting more competitive with new model launches and price cuts from competitors, we lower our 2024E-2026E sales volume assumptions for Nio by 16%-21%, leading to 23%-31% lower gross profit estimates…”

Hou supports her stance with a Neutral (i.e. Hold) rating, setting a $4.10 price target implying a modest 1% downside for the coming year. (To see Hou’s track record, click here)

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 7 Buys, 7 Holds and 2 Sell recommendations add up to a Moderate Buy consensus. Overall, with shares trading at $4.15 and an average price target of $6.92, analysts suggest a strong 67% share price appreciation over the next 12 months. (See Nio stock forecast)

XPeng

Now we’ll turn our sights to XPeng, another of China’s leading EV makers. Operating out of Guangzhou, in southern China, XPeng got its regular production started in 2019. The company’s current vehicle line-up includes elegant forms such as P7 and P5, as well as larger SUV models like the G3i and G9. The company’s cars feature luxury interiors, high battery range, and intelligent tech – advanced driver assistance systems, flat-screen cockpits, a voice-activated assistant – to provide a smarter car for a safer drive.

XPeng is targeting its vehicles at China’s growing middle class, a demographic that has both the funds to buy an electric vehicle and the tech savvy to appreciate smarter cars. The company’s smart tech is integrated with its electric powertrains and with the vehicles’ electrical/electronic architecture, all aimed at providing the optimal driving experience.

As of the end of 2023, XPeng supported its vehicles through a network of 500 stores in 181 cities across China. These were backed up by 1,108 charging stations, a total that included XPeng’s 902 self-operated supercharging stations.

Turning to the company’s delivery numbers, we find that XPeng counted 9,026 smart EV deliveries in March of this year. This total was up 99% from the previous month, and 29% year-over-year. The company’s best-selling model, the X9, is also the best-selling pure-play electric MPV in the Chinese market, with 3,946 deliveries in the month. For 1Q24 as a whole, XPeng delivered 21,821 smart EVs, representing a 20% year-over-year increase.

XPeng unveiled its 4Q23 results last month, revealing a revenue of $1.84 billion. This represents an impressive 153.9% surge compared to the previous year and exceeded expectations by $90 million. Additionally, the company reported a non-GAAP earnings loss of 28 cents per share, surpassing estimates by 14 cents per share.

Once again, we check in with Goldman analyst Hou, who writes of this EV maker: “XPeng is a fast-growing pure EV maker in China with a focus on intelligent vehicle features. In the near term, we expect the company’s vehicle delivery volume to regain momentum with the latest G6 model launch, and margin to improve on larger vehicle delivery scale together with battery pricing decline. In the longer-term, we believe XPeng’s leading position in NOA (navigation on autopilot) with strong R&D focus could provide further upside to its revenue growth and margin profile. We expect G6, together with P7/P7i, to be major volume contributors going forward, driving a 63% CAGR in vehicle sales and market share gain from 1.8% to 2.7% over 2023-2025E.”

Hou goes on to give XPEV shares a Buy rating, and her price target, of $11.50, implies the stock will gain ~62% by the end of this year.

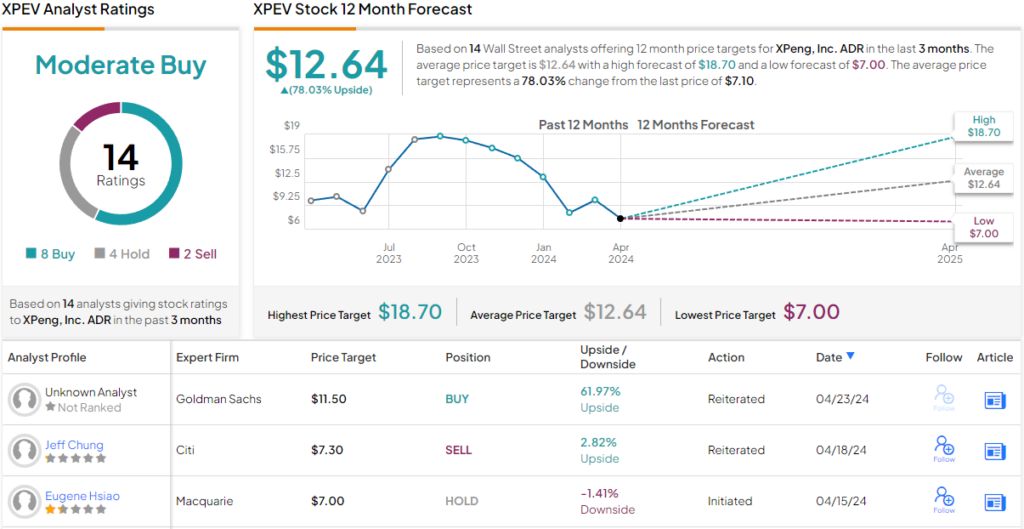

While the Goldman view is bullish, the Street generally is even more so. The stock’s Moderate Buy consensus rating rests on 14 recent recommendations, including 8 Buy, 4 Holds, and 2 Sell, and the $12.64 average price target suggests a 78% one-year increase from the current share price of $7.11. (See XPEV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.