Nvidia Is Conducting a 10-for-1 Stock Split: 7 Reasons to Completely Avoid Wall Street’s Hottest Artificial Intelligence (AI) Stock

Although nothing is more popular right now than artificial intelligence (AI) and stock splits, Wall Street’s darling AI stock is rife with red flags.

Over the last couple of years, the two hottest trends on Wall Street have been artificial intelligence (AI) and companies enacting stock splits. In the days to come, these two catalysts will collide for the hottest megacap stock of them all, Nvidia (NVDA 1.25%).

A “stock split” is a purely cosmetic event that allows a publicly traded company to change its share price and outstanding share count by the same factor. It’s cosmetic in the sense that it doesn’t impact a company’s market cap or operating performance.

On May 22, Nvidia announced that its board had approved a 10-for-1 forward split. In other words, shareholders will own 10 times as many shares, with the share price being reduced to 1/10th of what it is now. When the market opens for business on Monday, June 10, Nvidia will be trading at its split-adjusted share price.

Image source: Getty Images.

The reason investors have flocked to stock-split stocks — and more specifically, companies enacting forward splits, like Nvidia — is because they have lengthy track records of out-innovating and out-executing their competition.

Nvidia has consistently blown the door off of Wall Street’s sales and profit forecasts for more than a year, and there’s no question that artificial intelligence is the reason. The company’s H100 graphics processing units (GPUs) have become the standard choice of businesses looking to train large language models and run generative AI solutions. With demand swamping the supply of these high-compute chips, Nvidia has enjoyed exceptional pricing power. As a result, its gross margin clocked in at a jaw-dropping 78.4% in its latest quarter (ended April 28).

Although stock-split stocks have been mostly unstoppable, and AI is the hottest thing since sliced bread, I’m here to offer what I feel is a needed dose of reality. Namely, seven reasons to completely avoid Wall Street’s hottest AI stock and the newest member of the stock-split club, Nvidia.

1. AI-GPU pricing power has likely peaked

Let’s start with the obvious: new competitors are entering the AI-GPU arena. Intel (INTC -0.86%) is slated to launch its Gaudi 3 AI accelerator chip during the third quarter, while Advanced Micro Devices (AMD -2.18%) has been steadily ramping up the rollout of its MI300X GPU, which is a direct competitor to Nvidia’s H100 GPU.

Here’s the catch: Even if Nvidia’s H100 and successor chips retain a compute advantage over Intel, AMD, and other future contenders in AI-accelerated data centers, the mere presence of these chips on the market reduces the overwhelming supply scarcity that sent Nvidia’s GPU prices into the stratosphere in the first place.

Nvidia’s fiscal second-quarter forecast calls for its gross margin to retrace by 235 to 335 basis points, which may be indicative of a peak in pricing power for its AI infrastructure.

2. Internal competition is picking up

I’d argue the single biggest reason to avoid buying shares of Nvidia, upcoming stock split or not, is the rise we’re witnessing in internal competition.

While most people are focused on what Intel and AMD are doing to counter Nvidia’s dominance in high-compute data centers, they’re overlooking that Nvidia’s top customers are all developing AI-GPUs of their own. Microsoft, Meta Platforms, Amazon, and Alphabet account for about 40% of Nvidia’s net sales — and they all intend to deploy in-house Ai chips into their data centers.

Regardless of whether these internally developed chips are to complement Nvidia’s GPUs or to eventually replace them is irrelevant. The key point here is that we’re likely witnessing a peak in ordering activity from Wall Street’s most-influential businesses.

3. U.S. regulators have tightened export restrictions to China

U.S. regulators aren’t doing Nvidia any favors, either. In 2022, regulators clamped down on Nvidia’s ability to export its high-powered artificial intelligence chips to China, the world’s No. 2 market by gross domestic product.

In response to these restrictions, Nvidia developed the toned-down A800 and H800 GPUs specifically for China. Last year, U.S. regulators restricted the export of these chips to China, as well.

Not being able to export to China is potentially costing Nvidia billions of dollars in sales each quarter.

Image source: Getty Images.

4. Not a single insider purchase in more than three years

In December 2020, Nvidia’s Chief Financial Officer, Colette Kress, purchased 200 shares of her company’s stock. Since this open-market purchase, no other insider has bought a single share of Nvidia.

On the other hand, there have been dozens upon dozens of insider stock sales over the last 3.5 years. Although there are viable reasons to sell stock that are generally benign, such as for tax purposes, there’s pretty much only one reason to buy shares of a stock: the belief that it’s undervalued. With not one insider choosing to buy shares of Nvidia over the past 41 months, why should you?

5. History is undefeated

Past performance is no guarantee of future results. But when it comes to next-big-thing trends and innovations, history has been undefeated for more than three decades.

Every next-big-thing investment trend for 30 years has worked its way through a bubble-bursting event in the early stages of its adoption. Investors have consistently shown that they overestimate the uptake and utility of new trends and technologies, and it’s hard to believe that artificial intelligence won’t follow the same path.

No company has more directly benefited from the AI revolution than Nvidia. This means it would likely be hit the hardest if and when the AI bubble bursts and lofty investor expectations aren’t met.

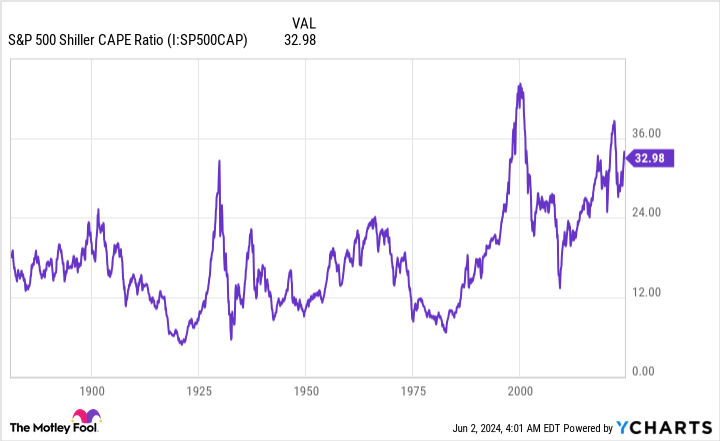

S&P 500 Shiller CAPE Ratio data by YCharts.

6. Recession/stock market correction signals are concerning

A sixth reason to leave Nvidia stock on the shelf, even with its highly anticipated stock split occurring in mere days, is because a combination of recession-predicting tools and stock market indicators are warning of potential trouble to come.

For instance, we’ve witnessed the first notable drop in U.S. M2 money supply since the Great Depression. The only four times since 1870 that M2 declined by at least 2% on a year-over-year basis correlated with periods of depression and high unemployment. While a depression is highly unlikely today, a drop in available capital in circulation is a key ingredient for an economic downturn.

Meanwhile, the S&P 500‘s Shiller price-to-earnings (P/E) ratio is at one of its highest readings (34.54, as of the closing bell on May 31) in history, when back-tested to 1871. The Shiller P/E is based on average inflation-adjusted earnings from the prior 10 years.

The five previous instances where the Shiller P/E surpassed 30 during a bull market run were eventually followed by declines in the S&P 500 and/or Dow Jones Industrial Average of at least 20%. Companies that trade at a premium, like Nvidia, would be the likeliest to tumble during a correction.

7. A stock split won’t mask dot-com bubble valuation comparisons

The seventh and final reason not to buy stock-split stock Nvidia is the company’s valuation.

On the surface, the argument could be made that Nvidia is still reasonably cheap. It trades for about 31 times Wall Street’s consensus earnings per share (EPS) in fiscal 2026 (Nvidia’s fiscal year ends in January), and Wall Street is counting on annualized earnings growth of roughly 46% over the next five years.

But on trailing-12-month (TTM) price-to-sales basis, Nvidia harkens to the peak of the dot-com bubble. Nvidia’s TTM sales multiples rival those of Amazon and Cisco Systems just months before the dot-com bubble burst.

Considering that no next-big-thing innovation has avoided an eventual bubble-bursting event, this valuation premium is a concern that shouldn’t be swept under the rug.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, Intel, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Cisco Systems, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.