Nvidia Stock Slips. It Owns the AI World, Analyst Says.

stock is still tops for aJefferies analyst with a little more than a week to go before the chip titan reports earnings.

In midmorning trading on Monday, shares were down 0.7%, at $892.50. The stock closed up 1.3% on Friday.

Shares have drifted in a range of $850 to $950 since late March. The company posts its first-quarter results on May 22.

“We believe it’s too early to sift out winners and losers in the AI basket yet, but Nvidia is our favorite,” wrote Jefferies analyst Blayne Curtis in a Sunday research note.

“Nvidia maintains control over the entire ecosystem and is taking more pieces of the pie,” he said.

Advertisement – Scroll to Continue

Curtis has a Buy rating and $1,200 target price.

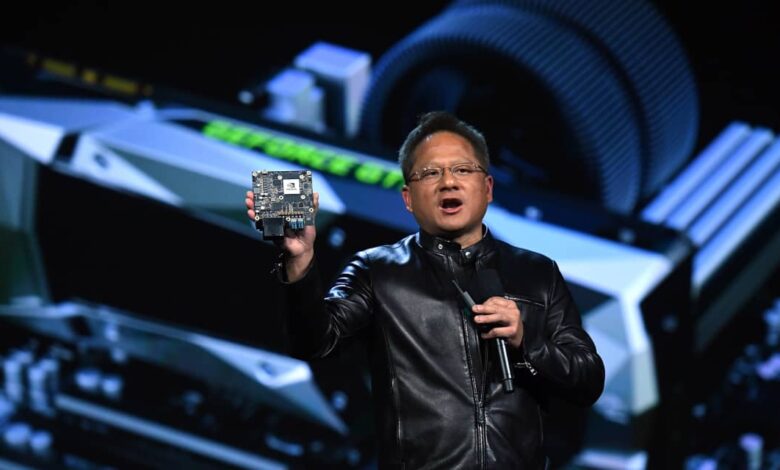

The analyst pointed to demand for Nvidia’s NVL72 liquid-cooled rack system, which contains 36 of its GB200 chips, as a way for the company to take even more of the AI infrastructure market in 2025.

On Sunday, Nvidia said nine new supercomputers worldwide are using its Grace Hopper Superchips. So-called superchips link together Nvidia’s Grace central processing unit, or CPU, and its Hopper GPU, or graphics-processing unit, so they work more efficiently together.

Advertisement – Scroll to Continue

Nvidia CEO Jensen Huang has said every country should have its own “sovereign” AI system—and the supercomputers are a sign that countries are taking his message seriously.

That could help the company keep expanding its market, despite efforts by various technology companies to develop their own artificial-intelligence chips.

The latest company to join the race is U.K.-based

which aims to launch its first AI chips in 2025, Nikkei Asia reported on Sunday.

Arm’s American depositary receipts were up 3.0%. Two other chip makers were also up—

0.2%, and

Intel

,

3.1%.

Nvidia shares have risen 81% so far this year through Friday’s close. That compares with a 9.5% rise in the

index and a 8.9% rise in the

Advertisement – Scroll to Continue

over the same period.

Write to Adam Clark at adam.clark@barrons.com