Pagaya: An Undervalued Fintech Powerhouse (NASDAQ:PGY)

Daniel Grizelj

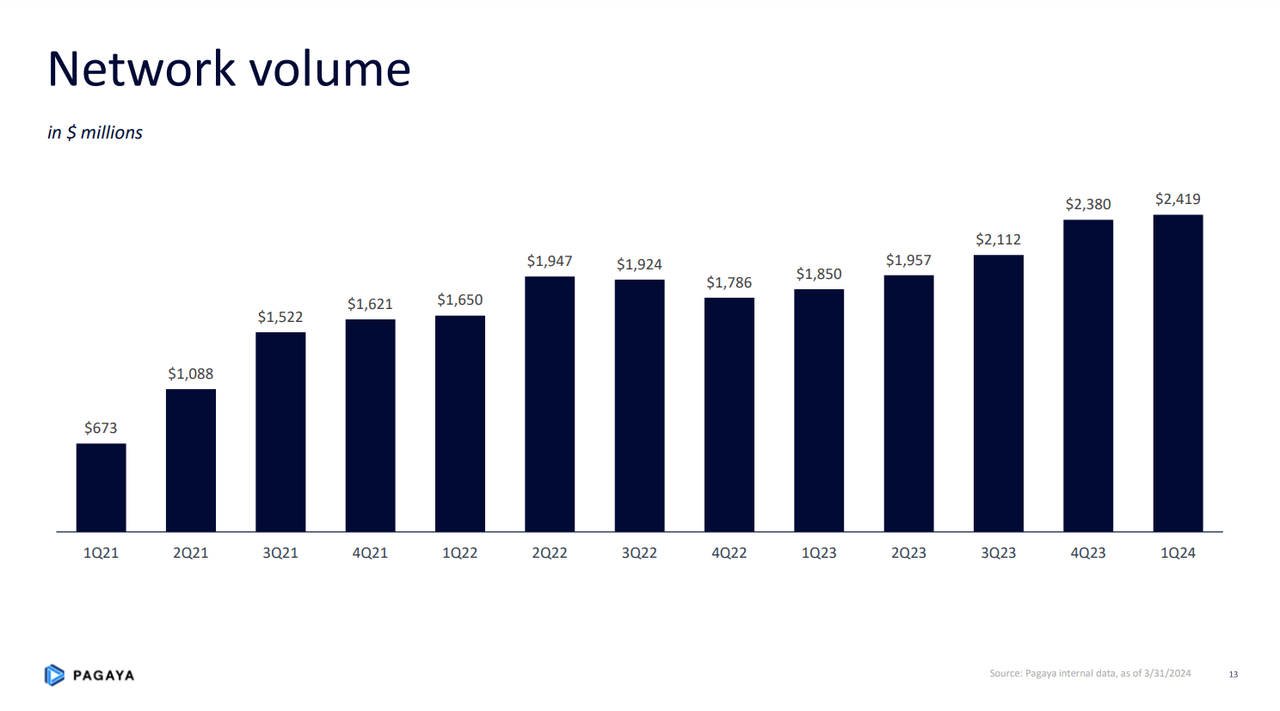

Since posting strong Q1 results, Pagaya Technologies Ltd. (NASDAQ:PGY) has climbed nearly 21%. The company showed strong growth in network volume, revenues, and adjusted EBITDA, while also sharing a strong full year guidance. In my opinion, Pagaya could continue witnessing substantial growth due to its expansion in the fast growing POS financing vertical, with 3 banks and POS providers set to be integrated into its network in the next 12 to 18 months. In addition, Pagaya could benefit from potential interest rate cuts since it could increase its conversion rate due to banks potentially loosening their lending standards. These factors could be tailwinds to Pagaya’s network volume, which would reflect on its future revenues.

Pagaya is also working to reduce its risk exposure by introducing new funding models and changing its retention method from horizontal to a mix between vertical and horizontal retention. In light of these factors, I’m rating Pagaya as a buy with a price target of $30.6, representing 141% upside from its current valuation.

Q1 Overview

In Q1 2024, Pagaya reported revenues of $245.2 million, representing 31.4% YoY growth, and a net loss of $21.2 million, an improvement from a net loss of $61 million in the same year ago period. Pagaya’s revenue growth was driven by record network volume of $2.42 billion in Q1, representing 31% YoY growth.

Moreover, Pagaya posted record revenue from fees less production costs (FRLPC) of $92 million, representing an FRLPC margin of 3.8%. Based on this, Pagaya reported record adjusted EBITDA of $40 million, leading to an adjusted EBITDA margin of 16.3%, and reported $20 million in operating cash flow, its third consecutive quarter with positive OCF.

Moving on to Pagaya’s balance sheet, the fintech exited Q1 with a cash balance of $274.5 million and held $892.8 million of investments in loans and securities. The loans that Pagaya holds on its balance sheet are due to the 5% minimum requirement for its ABS issuances. Meanwhile, it has $222.3 million in long term debt, of which $191.25 million have maturities beyond 2028. For the full year, Pagaya is guiding network volume between $9 and $10.5 billion, revenues between $925 million and $1.05 billion, and adjusted EBITDA between $150 and $190 million.

More Room To Grow

The core of my bullish thesis on Pagaya is its potential to grow its network volume, which has seen impressive growth over the past quarters despite the interest rate hikes.

Q1 Earnings Supplement

The main reason Pagaya’s network volume has been growing is the addition of new partners to its network. In Q1, Pagaya added U.S. Bancorp (USB) to its network, and a quarter later, it added US Bank’s POS arm, Elavon, to the network which is set to go live in the second half of the year. Elavon is the third largest payment processor in the US, as it processes more than 1 billion transactions annually for more than 1 million merchants. As such, Pagaya’s network volume will definitely benefit from the amount of transactions processed through Elavon once it goes live on its platform.

Pagaya is also in talks with several large POS providers and banks in its pipeline that are looking to enter the POS space and expects to integrate 3 of them into its network over the next 12-18 months. Overall, Pagaya is in late stage negotiations with 6 large lenders across the personal loan, auto, and POS verticals.

In my opinion, Pagaya’s expansion in the POS segment of the consumer credit market is a bullish indication for its future prospects. POS financing is one of the fastest growing consumer credit markets in the US, which could be attributed to the increasing popularity of BNPL loans.

By the end of 2023, 82.1 million US consumers had used BNPL for their spending and lending needs, and that figure is forecasted to reach 112.7 million by 2027. At the same time, BNPL sales volumes are expected to increase from $71.9 billion to $124.8 billion by 2027.

Given that Pagaya already has Klarna in its network, which has 37 million users in the US, onboarding more players in the POS sector could result in Pagaya processing most of the POS financing transactions.

Assuming Pagaya processes 50% of the BNPL transactions in 2027 due to having Klarna, Elavon, and other POS financing providers in its network, it could generate around $6.1 billion in revenues from the POS vertical alone at its current take rate of 9.8%. This doesn’t take into account Pagaya’s ability to increase its take rate over time considering the value it provides to its lending partners which gives it a strong pricing power in my opinion.

|

Forecasted BNPL Market Size |

$124,800,000,000 |

|

Forecasted PGY POS Volume |

$62,400,000,000 |

|

Take Rate |

9.80% |

|

Forecasted POS Revenue |

$6,113,703,845 |

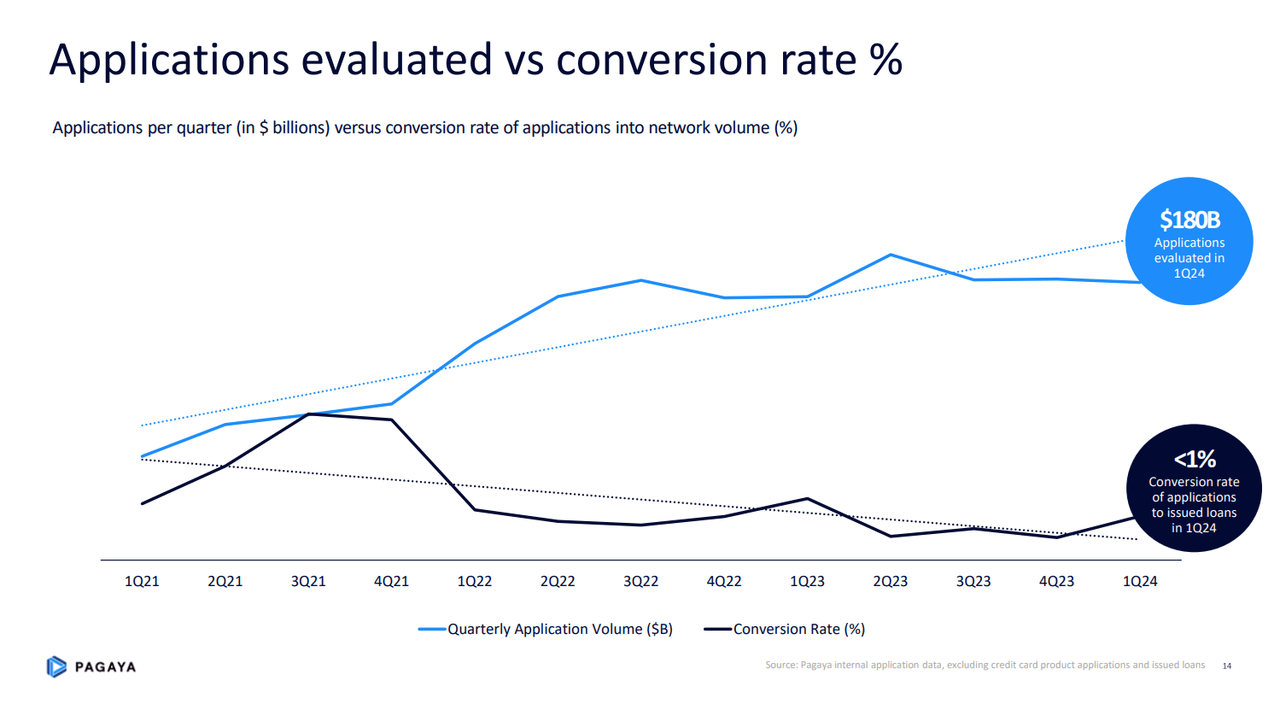

Another factor that could boost Pagaya’s network volume is potential interest rate cuts. Since the Fed started the interest rate hike cycle to curb rising inflation, Pagaya tightened its models, leading its conversion rate to be less than 1% of total applications volume.

Q1 Earnings Supplement

While inflation is down sharply from its peak of 7.1%, it remains above the Fed’s 2% target at 3.5%. This stubborn inflation has led the Fed’s policymakers to revise their forecast of 3 rate cuts in 2024 as 9 of the 19 policymakers are now forecasting 2 or fewer cuts this year. According to a Reuters poll, most economists expect the first rate cut to occur in the September FOMC meeting. Based on this, it appears that interest rates are very likely to be lower than the current 5.25% to 5.5% range by the end of the year.

When interest rate cuts happen, banks will likely start to loosen their lending standards, stimulating consumer borrowing. This is already happening to a degree as the Fed’s Senior Loan Officer Opinion Survey showed that while banks continued with restrictive lending standards in Q4 2023, they were less tight than before.

For households, the survey found that 23% of banks tightened their standards for consumer credit cards, an improvement from 29% in Q3 2023. For residential real estate loans, 10% of banks tightened standards, compared to 16% in the prior quarter. For auto loans, that figure was 6% in Q4 2023 compared to 15% in the prior 2 quarters. This is a promising sign for what could happen when the Fed starts cutting rates.

Given that Pagaya reduced its conversion rate during the rate hike cycle, lower lending standards could encourage the company to gradually increase its conversion rate. In that case, Pagaya’s network volume would increase, which would be a tailwind to its revenues.

Reducing Risk Retention

Another reason I’m bullish on Pagaya is its efforts to reduce risk retention, as it is targeting to reach a risk retention rate between 2% to 3% in the long-term. Since Pagaya is an ABS issuer, it is obliged to retain at least 5% of its ABS issuances on its balance sheet. In Q1, Pagaya reported $261.6 million in investments in loans and securities. This means that Pagaya retained around 10.8% of its loan originations of $2.4 billion, which is an unsustainable figure in my opinion given the company’s asset light business model.

Therefore, Pagaya is attempting to reduce its risk exposure and the upfront capital required to fund new network volume. To that point, Pagaya secured a $100 million secured borrowing facility and executed a $50 million securitization in March that was structured to mimic a whole loan sale to investors, resulting in a 1% net risk retention.

At the same time, Pagaya is changing the way it retains loans on its balance sheet, as it is shifting from horizontal retention to a mixed retention method. In fact, the company’s latest ABS deal was a mix of 54% vertical retention and 46% horizontal retention. In the long term, the company intends to achieve a 50/50 mix between vertical and horizontal retention. The significance of this new direction is that horizontal retention carries more credit risk compared to vertical retention.

Vertical retention implies withholding at least 5% of each tranche in an ABS issuance, ranging from the first loss piece to all mezzanine tranches, and the senior-most tranche. Meanwhile, horizontal retention refers to withholding the junior-most tranche and, if needed, the higher tranches in ascending order until the retained volume reaches the 5% threshold. As such, achieving a mix between both retention methods would significantly reduce Pagaya’s risk exposure, since it will carry a mix of low and high quality loans on its balance sheet.

In addition to the new structure and retention method, Pagaya’s management shared in the Q1 earnings call that they’re in talks with multiple parties to execute forward flow agreements or whole loan sales that could exceed $1 billion. In forward flow agreements, once the loan is made, it is sold to investors, and as such, Pagaya would no longer be exposed to the risk of defaults. As for whole loan sales, Pagaya would be selling the loans originated through its platform to investors instead of retaining them on its balance sheet.

Valuation

Given Pagaya’s growth potential and efforts to reduce its risk exposure, I believe its stock is undervalued at the current share price of $12.68. According to the company’s full year adjusted EBITDA guidance, Pagaya is trading at a 7.7 EV/adjusted EBITDA multiple at the low end of the guidance, 6.8 at the midpoint, and 6.08 at the high end, compared to a sector median of 14.75.

As such, by applying the sector median EV/adjusted EBITDA multiple, Pagaya’s implied EV would be $2.2 billion at the low end, $2.5 billion at the midpoint, and $2.8 billion at the high end. Then by subtracting its net debt of $338.9 million, Pagaya’s implied equity value would be $1.8 billion at the low end, $2.1 billion at the midpoint, and $2.4 billion at the high end. This would translate to price targets of $26.4 at the low end, $30.6 at the midpoint, and $34.8 at the high end, representing upside of 108%, 141%, and 174%, respectively.

|

Low End |

Midpoint |

High End |

|

|

Revenue |

$925,000,000 |

$987,500,000 |

$1,050,000,000 |

|

EBITDA |

$150,000,000 |

$170,000,000 |

$190,000,000 |

|

EBITDA Margin |

16.2% |

17.2% |

18.1% |

|

EV/EBITDA |

8.25 |

7.28 |

6.52 |

|

Target Multiple |

14.75 |

14.75 |

14.75 |

|

Implied EV |

$2,212,500,000 |

$2,507,500,000 |

$2,802,500,000 |

|

Net Debt |

$338,920,000 |

$338,920,000 |

$338,920,000 |

|

Equity Value |

$1,873,580,000 |

$2,168,580,000 |

$2,463,580,000 |

|

OS |

70,900,219 |

70,900,219 |

70,900,219 |

|

Price Target |

$26.43 |

$30.59 |

$34.75 |

|

Share Price |

$12.68 |

$12.68 |

$12.68 |

|

Upside |

108% |

141% |

174% |

Risks

As I mentioned earlier, Pagaya retained 10.8% of the loans originated through its platform in Q1, which is a high figure, in my opinion, given its asset light business model. As such, if these loans perform poorly, Pagaya could face substantial losses. Another risk to consider is possible regulatory hurdles due to Pagaya’s use of AI. This would be a similar scenario to Upstart (UPST) which recently received a subpoena from the SEC, seeking information regarding its use of AI models and loans, among other things. In that case, demand for loans originated through Pagaya’s platform could see lower demand from investors due to the potential uncertainty regarding its loans.

Conclusion

In summary, I’m bullish on Pagaya due to its expansion in the fast growing POS vertical as it’s on track to integrate 3 banks and POS providers into its network over the coming 12 to 18 months. This endeavor could result in Pagaya generating $6 billion in revenue from the POS vertical, considering that it already has Klarna in its network with its 37 million users.

Moreover, potential interest rate cuts could allow Pagaya to increase its conversion rate due to banks potentially loosening their lending standards. As such, both factors could lead to substantial network growth, which would reflect on Pagaya’s revenues thanks to its strong pricing power that could allow it to increase its take rate in the future.

Pagaya is also in the process of reducing its risk exposure by introducing new funding models such as forward flow agreements and whole loan sales. The company is currently in talks with several parties for forward flow agreements and whole loan sales that would exceed $1 billion. In this way, Pagaya would retain less loans on its balance sheet, reducing its credit risk.

Additionally, Pagaya is changing the way it retains loans on its balance sheet from horizontal retention to a mix of vertical and horizontal retention, meaning that it will retain higher quality loans on its balance sheet. In light of Pagaya’s growth potential and risk reduction endeavors, I’m rating it as a buy with a price target of $30.6, representing 141% upside from current levels.