Partnerships and Collaborations, Innovation and CX, Growth of Fintech, Open Banking, Major Start-ups

Swiss Embedded Finance Business and Investment Opportunities Market

Dublin, May 21, 2024 (GLOBE NEWSWIRE) — The “Switzerland Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs on Embedded Lending, Insurance, Payment, and Wealth Segments – Q1 2024 Update” report has been added to ResearchAndMarkets.com’s offering.

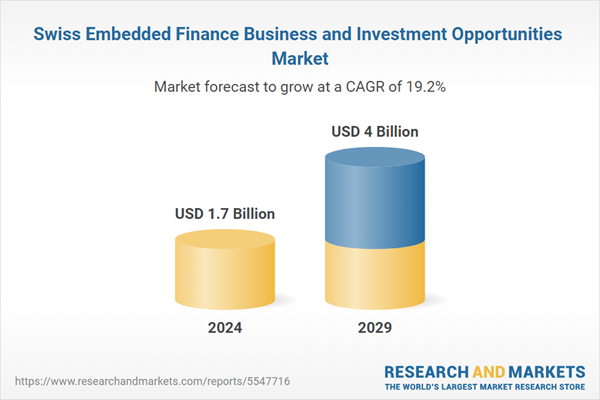

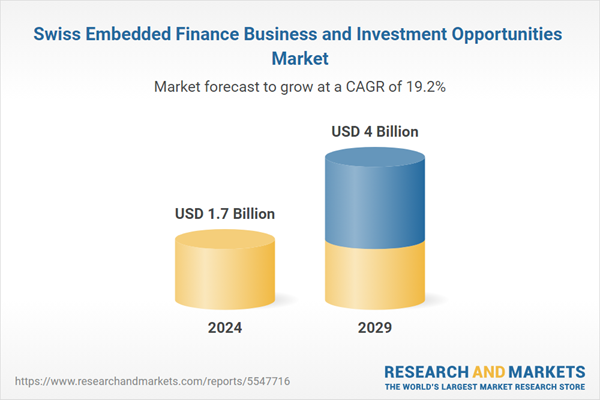

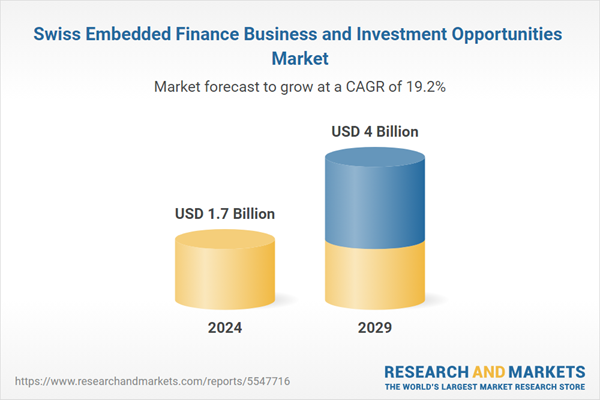

Embedded Finance industry in Switzerland is expected to grow by 26.9% on annual basis to reach US$ 1.67 billion in 2024.

The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 19.2% during 2024-2029. The embedded finance revenues in the country will increase from US$ 1.67 billion in 2024 to reach US$ 4.04 billion by 2029.

Key Market Drivers of Switzerland Embedded Finance: Switzerland has a well-established banking sector known for its stability and confidentiality. Traditional banks are gradually adapting to the digital era, offering online and mobile banking services. However, the pace of innovation has been relatively slower compared to fintech hubs like the UK or the US.

-

Innovation and Customer Experience: Embedded finance seamlessly integrates financial services within existing platforms, offering a convenient and frictionless customer experience. This resonates with the tech-savvy Swiss population, driving adoption.

-

Growth of Fintech: Switzerland boasts a thriving fintech ecosystem, fostering collaboration between traditional banks and innovative startups. This synergy fuels the development and implementation of embedded finance solutions.

-

Dubai’s largest lender Emirates NBD has made an equity investment in trade finance and treasury network Komgo. The firm currently claims to have 10,000 enterprise users worldwide, and a daily transaction processing value of $1bn.

-

Partnerships and Collaborations: Embedded finance often thrives on partnerships between fintech startups, traditional financial institutions, and non-financial companies such as e-commerce platforms, marketplaces, and ride-sharing services. These collaborations enable the integration of financial services into everyday consumer experiences.

-

On February, 2024, a landmark agreement was signed between Switzerland and Panama, marking a significant step forward in the fight against financial crimes, including money laundering, terrorism financing, and corruption.

Latest Innovations in Switzerland’s Embedded Finance Sector

Embedded Insurance: Integration of tailored insurance products within specific workflows is gaining traction. For example, embedded travel insurance offered within travel booking platforms. In Oct 2023, additiv, a global leader in embedded finance, announced that it is supporting Coop to launch Coop Finance+, a comprehensive new app for integrated financial services. At launch, Coop Finance+ offers banking products and individual pension solutions, with plans for further expansion in the coming months. Services are powered by Hypothekarbank Lenzburg for banking and Vanguard, OLZ, Liberty Vorsorge, and Glarner Kantonalbank for pensions.

-

Open Banking: Open banking regulations allow secure data sharing between financial institutions and third-party providers. This facilitates the development of innovative embedded finance solutions.

-

Artificial Intelligence (AI) and Machine Learning (ML): These technologies are being used for risk assessment, fraud detection, and personalized financial product recommendations within embedded finance platforms. Never have there been more active companies in the Swiss Fintech sector, totalling over 500 at the end of Q1 2024.

-

Major Start-ups of Switzerland Embedded Finance: In 2022, tech startups located in Zug raised about CHF 250 million in VC funding, making it the second biggest recipient of fintech investment that year. The canton is widely known as the “Crypto Valley,” owing to the high number of startups specializing in blockchain technology and cryptocurrencies located in the canton, including prominent names in the space such as the Ethereum Foundation, Amina Bank, formerly known as SEBA Bank, and Bitcoin Suisse.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

130 |

|

Forecast Period |

2024 – 2029 |

|

Estimated Market Value (USD) in 2024 |

$1.7 Billion |

|

Forecasted Market Value (USD) by 2029 |

$4 Billion |

|

Compound Annual Growth Rate |

19.2% |

|

Regions Covered |

Switzerland |

Scope

Switzerland Embedded Finance Market Size and Forecast

Embedded Finance by Key Sectors

-

Retail

-

Logistics

-

Telecommunications

-

Manufacturing

-

Consumer Health

-

Others

Embedded Finance by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

Embedded Finance by Distribution Model

-

Own Platforms

-

Third Party Platforms

Switzerland Embedded Insurance Market Size and Forecast

Embedded Insurance by Industry

-

Embedded Insurance in Consumer Products

-

Embedded Insurance in Travel & Hospitality

-

Embedded Insurance in Automotive

-

Embedded Insurance in Healthcare

-

Embedded Insurance in Real Estate

-

Embedded Insurance in Transport & Logistics

-

Embedded Insurance in Others

Embedded Insurance by Consumer Segments

Embedded Insurance by Type of Offering

Embedded Insurance by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

Embedded Insurance by Distribution Model

-

Own Platforms

-

Third Party Platforms

Embedded Insurance by Distribution Channel

-

Embedded Sales

-

Bancassurance

-

Broker’s/IFA’s

-

Tied Agents

Embedded Insurance by Insurance Type

Embedded Insurance in Non-Life Segment

Switzerland Embedded Lending Market Size and Forecast

Embedded Lending by Consumer Segments

-

Business Lending

-

Retail Lending

Embedded Lending by B2B Sectors

-

Embedded Lending in Retail & Consumer Goods

-

Embedded Lending in IT & Software Services

-

Embedded Lending in Media, Entertainment & Leisure

-

Embedded Lending in Manufacturing & Distribution

-

Embedded Lending in Real Estate

-

Embedded Lending in Other

Embedded Lending by B2C Sectors

-

Embedded Lending in Retail Shopping

-

Embedded Lending in Home Improvement

-

Embedded Lending in Leisure & Entertainment

-

Embedded Lending in Healthcare and Wellness

-

Embedded Lending in Other

Embedded Lending by Type

-

BNPL Lending

-

POS Lending

-

Personal Loans

Embedded Lending by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

Embedded Lending by Distribution Model

-

Own Platforms

-

Third Party Platforms

Switzerland Embedded Payment Market Size and Forecast

Embedded Payment by Consumer Segments

Embedded Payment by End-Use Sector

-

Embedded Payment in Retail & Consumer Goods

-

Embedded Payment in Digital Products & Services

-

Embedded Payment in Utility Bill Payment

-

Embedded Payment in Travel & Hospitality

-

Embedded Payment in Leisure & Entertainment

-

Embedded Payment in Health & Wellness

-

Embedded Payment in Office Supplies & Equipment

-

Embedded Payment in Other

Embedded Payment by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

Embedded Payment by Distribution Model

-

Own Platforms

-

Third Party Platforms

Switzerland Embedded Wealth Management Market Size and Forecast

Switzerland Asset Based Finance Management Industry Market Size and Forecast

Asset Based Finance by Type of Asset

Asset Based Finance by End Users

For more information about this report visit https://www.researchandmarkets.com/r/fig0fr

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900