Pritzker doubles down with $827 million of taxpayer money for expansion by troubled electric vehicle maker, Rivian – Wirepoints

By: Mark Glennon*

Gov. JB Pritzker announced Thursday that the State of Illinois will provide $827 million incentive package for Rivian to invest $1.5 billion for Rivian to expand its electric vehicle factory in Normal, Illinois. The expansion is expected to create at least 550 full-time jobs within the next five years, and will build Rivian’s next model EV, the R2. Rivian initially got $49.5 million under Gov. Bruce Rauner in 2017 to create 1,000 jobs at the same location.

The new deal is $1.5 million per job created, which is astronomical in the world of world of location incentives. Estimated average location incentives paid by state and local governments around the nation range from $13,000 to $84,000 per job, though sometimes go as high as $100,000 per job for capital intensive projects.

Even using that high end, Rivian’s package will be 15 times what’s typical.

Moreover, Rivian is on shaky wheels, along with the rest of the U.S. EV industry. Rivian loses over $43,000 for every vehicle it sells and has had two rounds of layoffs this year. The decision to move its R2 production to Illinois is a further reflection of the company’s need to preserve cash. R2 production was initially planned for a new $5 billion plant in Georgia, heavily subsidized by the state. But Rivian concluded that moving production to the existing Illinois facility would save cash.

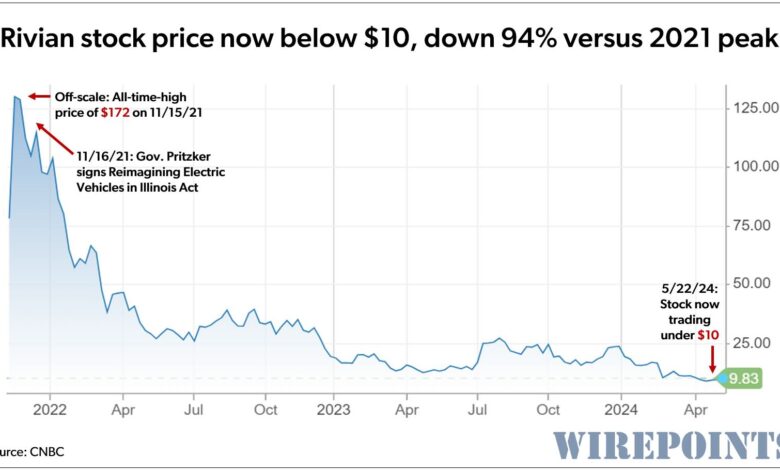

Its sock price has consequently been hammered. It reached a high of $146 per share in 2021 but now trades at less than $10 per share.

Rivian is not alone. As a CNBC headline declared last month, “EV euphoria is dead. Automakers are scaling back or delaying their electric vehicle plans..” Since then, the news is no better. Ford announced last week that it is losing a stunning $132,000 per vehicle. Hertz announced last week a second round of sales of its EV fleet due to heavy maintenance and depreciation costs. For the first quarter of this year, EV sales continued to slow and the share of EV sales for all autos actually decreased. While total EV sales are still up a bit from last year, the growth rate is not nearly enough to put EV makers on a path to profitability.

EV makers pin their hopes on less expensive models that they promise soon, and on more public charging stations, into which Illinois last month announced it would invest an additional $50 million. Rivian hopes its new R2 will be among the new, lower priced models. However, its starting price is expected to be about $45,000 and it won’t come out until the first half of 2026.

Regarding the astronomical incentive package to be paid by Illinois, in fairness, it should be noted that most of it is in the form of tax credits to be granted, conditioned on employment levels, over the next 30 years. However, a less charitable way to look at it would be that future taxpayers will be on the hook for high cost of the incentive package — if it works.

Aside from thinking that the incentive package is too low, my first instinct was to ask, “Where’s the warrant coverage.” That is, I know from working as a lawyer and then as an investor, often with troubled companies, that it’s not unusual to make risky bets. However, it’s routine for the investor to get part of the upside if the venture succeeds, usually in the form of stock or warrants (basically, options) on stock that pay off nicely if things turn around. The federal government, for example, got stock and warrants as part of the deal for its 2010 bailout of the auto industry.

This new Rivian deal has nothing like that. Since the job creation per dollar is minimal, it’s just not worth the price.

*Mark Glennon is founder of Wirepoints.