Profits surge propels fintech firm Trustly towards IPO milestone

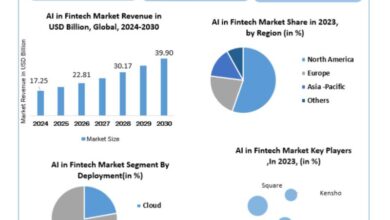

The global digital payment landscape has surged in recent years, reflecting in the surges in profits for companies in this space. The mixture of cutting edge technology and innovative business models supported this surge, as witnessed by Trustly revealing a remarkable 51% jump in profit.

The remarkable growth of Trustly

Trustly, the Swedish-based fintech company, has reported a stellar 51% profit jump. Along with this substantial growth, the company also unveiled its plans for an Initial Public Offering (IPO) – estimated to be around two years away. This decision is a testament to the impressive growth and profitability that this fintech firm has been able to achieve in a relatively short period.

The phenomenal growth can be attributed to the fact that an increasing number of consumers are turning to digital payments for their daily transactions. Trustly has effectively harnessed this trend, offering secure, efficient online banking solutions that have proven incredibly popular.

Looking forward to an Initial Public Offering (IPO)

While celebrating the current success, Trustly also spotlights their future plans. They project to list their shares in an IPO in at least two years. Through this public offering, they aim to raise enough capital that will enable them to continue building upon their innovative solutions and further extend their reach globally.

This strategic move evidences the company’s faith in its business model and a bullish outlook on the promising fintech space. It showcases a desire to keep delivering superior digital payment solutions that will keep them ahead of their competitors.

Moving forward, all eyes will be on Trustly as it prepares for this significant milestone. An IPO can be a complex process, requiring meticulous planning and a stable financial performance. Trustly’s ability to maintain its impressive growth trajectory in this interim period will be crucial to their ultimate success on the public markets.

With the fintech space becoming more competitive, Trustly’s decision to go public might be the catalyst the company needs to secure its position in the global market. The combination of the profit surge and the projected IPO reflects a confident stride in a direction that indicates an even brighter future for the firm.

The journey to the anticipated IPO promises exciting times ahead, both for Trustly and the wider fintech industry. Digital revolution has redefined the finance industry, and fintech companies like Trustly have become key players in this transformation. This trend doesn’t appear to be slowing down anytime soon. Rather the journey ahead unveils a growing digital landscape offering services that challenge traditional banking models and setting a path for a future where digital currencies become mainstream.

Liam Nguyen is a tech enthusiast and writer with a genuine passion for all things related to technology and the web. At the age of 32, Liam has already carved out a niche for himself as a go-to source for insights on emerging tech trends, gadget reviews, and practical advice for navigating the digital age. With a Bachelor’s degree in Computer Science from a well-known tech university, Liam combines his technical expertise with a clear, accessible writing style.

Starting his career as a software developer, Liam quickly realized that his true calling was in demystifying technology for the masses. He transitioned to tech journalism, where he now serves as a contributor to a popular online technology news platform. In his articles, Liam covers a broad spectrum of topics, from the latest smartphone releases to in-depth guides on cybersecurity, aiming to keep his readers informed and ahead of the curve.

Liam’s approach to writing is grounded in the belief that technology should empower and connect people. He has a particular interest in open-source projects and the democratization of technology, themes that frequently appear in his work. Liam’s ability to explain complex technical concepts in an engaging and straightforward manner has endeared him to a diverse audience, from tech aficionados to novices looking to get the most out of their devices.

Aside from his written work, Liam is active in online tech communities, participating in forums and social media discussions. He’s also been known to guest lecture at his alma mater, sharing his journey and inspiring the next generation of tech enthusiasts.

Liam’s dedication to the tech community and his knack for clear communication make him an influential voice in the tech and web category, always eager to explore how technology can make our lives better and more connected.