Roaring Kitty Came Back to Talk GameStop. Shares Plunged.

Around lunchtime Friday, on a YouTube livestream watched by half a million people, a bandanna-clad man in white sunglasses grinned into his webcam and teased: “I’m about to show it.”

Oh, stop it. He meant his brokerage account.

Keith Gill, the man better known as Roaring Kitty, who became one of Wall Street’s unlikeliest celebrities during the meme stock mania of 2021 before disappearing from public view, was onscreen — and in his signature fashion, mixing beer, comedy and market commentary.

A quick refresher: Three years ago, Mr. Gill’s unrestrained cheerleading of GameStop and other companies on social media made him a kind of rabbi to thousands of day traders stuck at home during the pandemic — people who bought loads of shares and drove those stock prices to nosebleed levels. These traders’ use of internet memes and social platforms like Reddit to trade stock tips ushered in a new class of investors.

Mr. Gill, 37, whose renown was such that he testified for Congress and inspired a film, “Dumb Money,” had been out of the spotlight for the better part of three years, having come under some regulatory scrutiny. He vaulted back into prominence last month by posting on X a cryptic illustration that many took as a sign that he had returned to day trading.

That post was followed by more cryptic social media messages and the leak on Reddit of a screenshot showing that Mr. Gill held more than $100 million of stock and options betting on GameStop. Its shares immediately soared — “to the moon,” in meme speak. The videogame retailer used the opportunity to sell new shares, raising more than $900 million.

Thus, anticipation was high when Mr. Gill’s dormant YouTube account on Thursday carried an announcement that he would host a noon stream the next day. CNBC put talking heads on the air to speculate on what he might say. The Wall Street Journal set up a live blog.

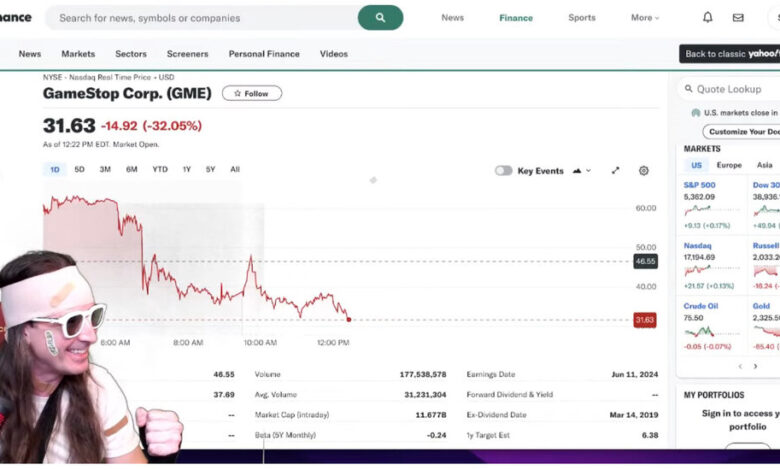

And then the unexpected happened. On Friday morning, GameStop released an earnings report earlier than scheduled that revealed disappointing sales and a surprise plan to sell even more shares publicly. Its stock nose-dived.

By noon, when Mr. Gill’s livestream was expected to start, GameStop shares were down more than 30 percent. It wasn’t until close to 12:30 p.m. when — after a preamble of rock Muzak — Mr. Gill’s camera lit up.

Wearing his signature bandanna, Mr. Gill also sported a fake sling, sitting in front of a projection of Gamestop’s plunging stock price, as the sound of a heart monitor beeped in the background.

“Am I OK?” he said. “That was a close call.”

Mr. Gill immediately started with his specific brand of comedy: “Yo, there’s mad heads here,” he marveled to the 650,000 viewers present. He joked that he wasn’t Paul Dano, the actor who played him on the big screen. He drank a beer.

A few minutes later, Mr. Gill progressed to a discussion of GameStop, complimenting its management team and saying he saw potential for its stock. That apparently wasn’t what everyone had tuned in to see, because the company’s shares continued to languish as he spoke.

“Oh no, I’m causing it to go down,” Mr. Gill said at one point. More than 100,000 fans logged off the stream.

About half-hour into the show, Mr. Gill unveiled the big reveal. He switched the projection on his screen from GameStop’s stock to an image that he identified as his personal E-Trade account, revealing what appeared to be his vast bets on the stock.

The image showed holdings of about $350 million — a significant amount, although it might have been much more; on Friday alone, Mr. Gill was down $235 million.

There wasn’t much more to say after that. Mr. Gill, who was known to stream for hours on end during the pandemic, logged off Friday after 48 minutes.

“It was a lot of mindlessness for not a lot of content,” said Lorne Bycoff, an investor in New York.

GameStop shares closed down 39 percent for the day, around $22 a share — lower than they were when Mr. Gill started talking.

Kitty Bennett contributed research.