Roivant, Acorda, Merz, and Freenome

Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Today we talk about how biopharma plans to harness AI for clinical trial design, why two experts think Medicare ought to cover the costly GLP-1 drugs, and what news from Roivant means for its business strategy.

The need-to-know this morning:

- Danish drugmaker Genmab said it would acquire ProfoundBio for $1.8 billion in cash, the latest in a string of deals tied to the booming field of antibody-drug conjugate therapies for cancer.

- Oruka Therapeutics is going public via a reverse merger with ARCA Biopharma. Oruka is developing long-lasting antibodies that target IL-23 and IL-17 for the treatment of chronic skin conditions like psoriasis. Concurrent with the merger, Oruka raised $275 million via a PIPE with a syndicate of health care investment funds.

- Diaganol Therapeutics launched with $128 million in new funding to develop a new class of antibody medicines that activate, rather than block, cell-signaling pathways to treat severe diseases.

How AI will be used in biopharma clinical trials

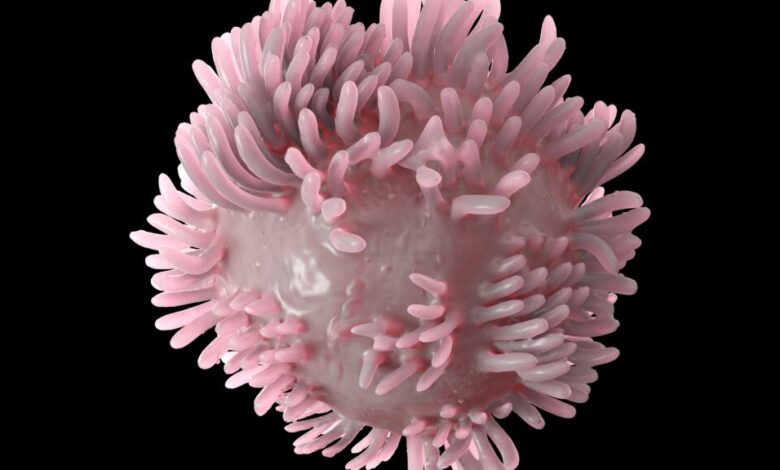

Biopharma companies are increasingly turning to the startups that use artificial intelligence to analyze data from past clinical trials, genomic data banks, and other health records to predict how therapies might work. The calculus here is to help optimize clinical trials — helping select which patients might be more likely to respond to a given therapy, or to even create surrogate trial participants called digital twins.

For example, last year AstraZeneca and Bayer began working with the Toronto-based Altis Labs to test how digital twins might respond in placebo arms of early-stage drug testing. Another startup, Nucleai, uses AI to map out the relationships between cancer cells, healthy cells, and proteins, pits it against old clinical data, and determines which patients might respond to experimental therapies.

“This is really where the industry will go,” one investor in this space told STAT. “We look at a future that is more digital, is more computerized, and AI is just another tool to do it better.”

What the Roivant news means for its business model

Roivants’s eye drug brepocitinib, which it licensed from Pfizer, recently read out in a small study. The company also announced that it will buy back $1.5 billion in stock. These two bits of news make us ask the question: Will the company’s approach, which is to license shelved experimental drugs from large firms and further develop them, work?

“Look, I think the truth is, there are pharma companies that, out of fear of looking stupid, don’t out license or partner their drugs,” Roivant CEO Matt Gline told STAT. “They just stick them in a bin somewhere.”

But companies like Pfizer, he said, “take a principled stance that if there’s something that could benefit patients, they will want to maximize the footprint.” And that’s why he believes the Roivant approach could help bigger pharma companies deliver more value to investors.

New data on liquid biopsy for colorectal cancer detection still underwhelms

A look at Freenome’s data on its colorectal cancer liquid biopsy test suggests that blood-based tests won’t be preventing cancer — but rather catching it at later stages.

Freenome’s trial showed that their blood-based screen has a 79.2% sensitivity in detecting colorectal cancer across all stages. Broken down, that’s a 57.1% sensitivity for detecting cancers at stage 1, 100% sensitivity at stage 2, 82.4% sensitivity at stage 3, and 100% sensitivity at stage 4. The results trail noticeably behind Guardant’s blood-based colorectal cancer test, which also showed a low sensitivity for detecting stage 1 cancers at 65% but 100% sensitivity for stages 2 through 4. That suggests that stool-based colorectal cancer screenings and screening colonoscopy will remain the best way to catch cancers at the earliest stages or at precancerous stages.

Like Guardant, Freenome’s test appears to only be able to reliably detect problems once patients already have colorectal cancer. The performance for detecting precancerous polyps ranged at a particularly dismal 12.5% to 29% sensitivity, depending on the type of polyp. That means for patients who hope that colorectal cancer screening will help them prevent tumors before they actually form, liquid biopsies as they currently are won’t suit their preferences.

The financial upside of Medicare covering GLP-1 drugs

If Medicare covered obesity drugs like Zepbound and Wegovy, the U.S. could ultimately save billions of dollars, opine two health policy experts at USC. They modeled the impact of GLP-1 drugs — and found that estimates that they could financially cripple Medicare are “alarmist,” since competition will quickly drive down the prices of these drugs. Take the hepatitis C drug Sovaldi: Although it was listed for $84,000, costing $1,000 per pill, generic versions now sell for $69.

“GLP-1 drugs present a historic opportunity to create value for people with obesity, their families, and the nation as long as society can effectively share them across the health care marketplace,” they write.

Acorda goes bankrupt, sells assets to Merz for $180 million

Acorda Therapeutics, which makes drugs to improve to improve neurological function in diseases like Parkinson’s and multiple sclerosis, just filed for bankruptcy. It will sell its assets to Germany’s Merz Therapeutics for $185 million.

The New York-based company has been struggling for years, thanks largely to competition from generic drug makers and lower sales than expected, FiercePharma writes. For example, its Parkinson’s drug Inbrija was approved in 2018 for Parkinson’s, and peak sales were projected to be $800 million. Yet in 2022, global sales were a mere $30.9 million.

More reads

- U.S. takes next step in Medicare drug price negotiations with pharmaceutical companies, Reuters

- AbbVie commits to ‘making the big bets’ in new corporate campaign, Endpoints

- J&J targets rare maternal-fetal diseases: ‘We’re going for this. No one else has,’ FierceBiotech