Runner Automobiles trims losses | The Daily Star

Runner Automobiles, one of the largest listed automobile companies, has continued to suffer from losses due to a decline in revenue and increase in financing costs.

The manufacturer of motorcycles and three-wheelers said its losses per share declined 4 percent year-on-year to Tk 1.35 in the January-March period of fiscal year 2023-24.

This led to losses per share reducing 17 percent year-on-year to Tk 3.51 in the July-March period of the fiscal year, according to the company’s disclosure on its website on Thursday.

“Overall downturn in the national economy has affected performance of the company like many other manufacturing entities,” it read.

The company did not publish its financial statement.

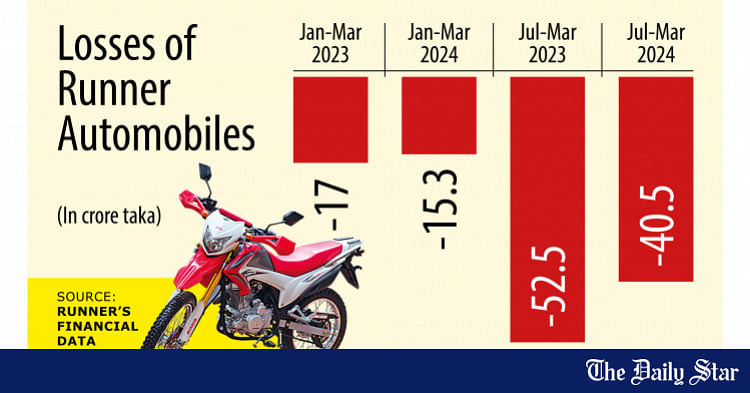

But based on the fact that it has 11.35 crore stocks currently held by all its shareholders, its total loss amounts to Tk 15 crore in the third quarter of fiscal year 2023-24, down from Tk 17 crore a year ago.

The automobile company’s losses declined to Tk 40.5 crore in the three quarters of the current financial year compared to Tk 52.5 crore in the same period of the previous year.

The company had incurred a loss of Tk 96 crore for the first time in 2022-23 since being listed with the stock exchange in 2019, mainly due to lower sales as a consequence of the tight macroeconomic situation and the Ukraine-Russia war.

Its shares fell 2.96 percent to Tk 29.5 on the Dhaka Stock Exchange last Thursday.

Runner said it established its three-wheeler (3W) manufacturing plant based on future prospects.

“The company also experienced favourable developments in the overall business situation of the 3W market,” the company said.

The company added that it could not fulfil the demand for its products mainly due to strict import restrictions, the devaluation of the local currency against the US dollar, and a surge in the interest rate.

“All these factors led to negative earnings for the period,” the company said, adding that its major subsidiary, Runner Motors, returned to profit and “early signs are promising”.

“Also, with increased investment in working capital with better fund management coupled with some other proactive measures, the company expects to do better in the next quarter,” it said.

The automobile company blamed the negative earnings per share (EPS) on the drop in revenue and higher finance costs.

It said its net operating cash flow per share (NOCPS) was in the negative in the January-March period of this fiscal year.

In the three quarters till the end of March, the NOCPS dipped to Tk 13.18 from Tk 25.57 in the same period a year ago.