Runner’s losses drop on cost cutting, subsidiary returning to profit

FE REPORT

| Published: April 28, 2024 22:22:13

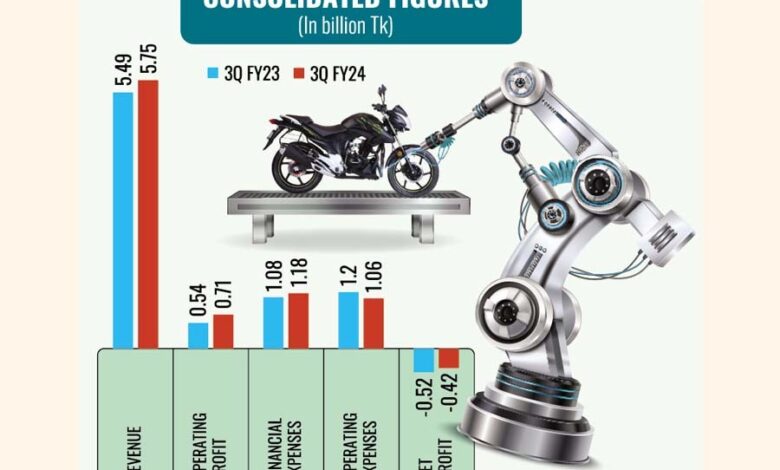

Runner Automobiles managed to reduce losses in the third quarter of FY24, compared to the same period a year ago, riding on higher revenue and a higher operating profit.

The company’s consolidated loss fell 19 per cent year-on-year to Tk 426.77 million in January-March this year.

Runner’s Chairman Hafizur Rahman Khan said the company’s cost-cutting mechanism played a role behind the loss reduction in the quarter through March, compared to the same quarter of the previous year.

While Runner Automobiles had to sell products of the old lots at discounts in the third quarter of FY23, it sold products in Q3, FY24 making profits.

It witnessed a year-on-year increase in demand in Q3 of FY24.

However, the company had limited products to offer this year since imports had been hampered by the devaluation of the local currency against the dollar and the surge in interest rate.

“Our production of three wheelers and their sales are on the rise, which will lead to a rise in revenue in the next quarter,” said the chairman.

The company said its major subsidiary Runner Motors had returned to profit and that early signs were ‘promising’.

Of the previous two quarters of FY24, the company secured profits in the second quarter through December after enduring losses in the first quarter.

The company’s three wheeler business led to a significant growth in revenue, leading to positive earnings in October-December, FY24.

“The company has experienced favorable developments in the overall business situation of the three wheeler market,” reads the earnings disclosure.

The consolidated loss per share was Tk 3.75 for July-March, FY24, down from Tk 4.31 for the same period of the previous fiscal year.

With an increased working capital and better fund management coupled with some other proactive measures, Runner Automobiles expects to do better in the next quarter.

Repayment for the supplies of substantial stocks resulted in a decline in the operating cash flow.

The company has reported a consolidated net operating cash flow per share (NOCFPS) of Tk. 13.18 for July 2023-March 2024 as against Tk. 25.57 for the same period of the previous fiscal year.

Runner Automobiles started counting losses in FY21 because of the local currency depreciation. In FY23, it experienced a loss of Tk 879 million, having dealt with Tk 1.42 billion worth of consolidated finance expenses.

The stock closed at Tk 38 per share on the Dhaka Stock Exchange on March 3 and then after a gradual decline closed at Tk 29.10 per share on Sunday.

mufazzal.fe@gmail.com