Salesforce: A Strong Buy Before Q1 Earnings (NYSE:CRM)

Sundry Photography

Introduction

Salesforce (NYSE:CRM) reports its Q1 FY 2025 earnings next week, on May 29. The company has a perfect history of quarterly earnings surprises over the last two years, and the management’s Q1 guidance appears excessively conservative to me. These two pivotal factors make me anticipate that CRM will once again outperform consensus expectations. I am not focusing solely on the upcoming earnings release, but also delved into CRM’s fundamentals. The company is an undisputed leader in its industry, firmly dedicated to innovation and keeping customers satisfied with tailored subscription-based solutions. An 18% upside potential uncovered by my valuation analysis makes CRM a clear ‘Strong Buy’ in my opinion.

Fundamental analysis

Salesforce is the global leader in providing Customer Relationship Management software, powering entities to streamline management of key operations including marketing, document management, analytics, and other. Salesforce’s dominance in the industry is underscored by its eleven-years streak as the #1 CRM provider in IDC’s annual rankings.

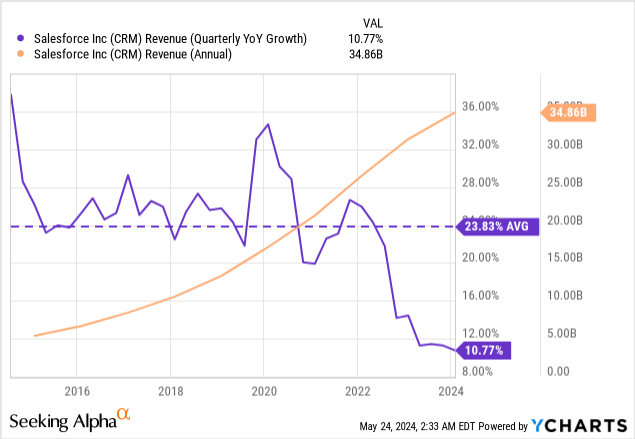

The company’s revenue increased by around seven times since 2015, from $5 billion to almost $35 billion, delivering a staggering 23.8% CAGR. CRM’s success is explained by the company’s subscription-as-a-service (‘SaaS’) based business model and dedication to delivering products tailored for customer needs.

SaaS generated more than 90% of CRM’s revenue during FY2024. The company invested around $5 billion in R&D during the last fiscal year. CRM is also well-known for its aggressive approach to acquisitions, which also helps to innovate and improve the company’s business mix. Wide diversity of applications allows CRM to aggressively exercise a land-and-expand strategy and cross-sell new services to existing customers within the company’s subscriptions ecosystem.

The introduction of Salesforce Einstein, an AI-powered tool for customers, seven years before the last year’s AI mania, underscores the management’s visionary talent and dedication to innovation. CRM continues to improve its AI-powered offerings amid the current wave of innovation as it partners with all the leading cloud and AI giants including AWS (AMZN), Azure (MSFT), and Google Cloud (GOOG).

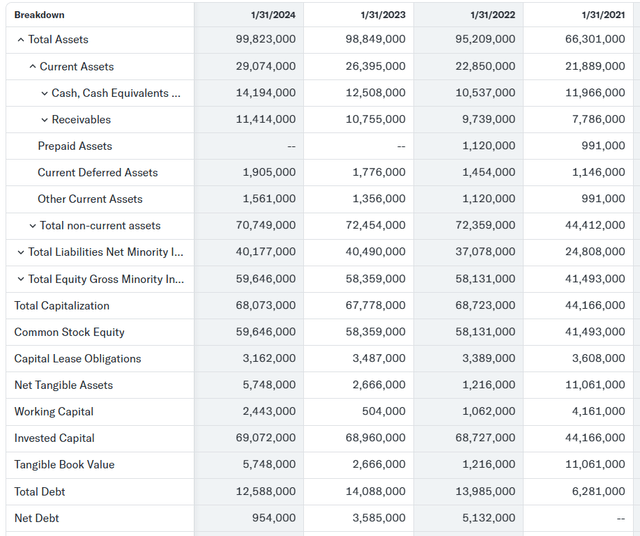

Leveraging cutting-edge solutions along with a strong commitment to delivering tailored customer experiences is likely to help CRM continue benefiting from the trend of enterprises embracing digital transformation. According to Grand View Research, the customer relationship management market is expected to grow at a significant CAGR of 13.9% from 2024 to 2030. Having been an undisputed industry leader for over eleven years, CRM is well-equipped to surpass industry growth. Moreover, CRM’s financial position is cash-rich with low leverage levels.

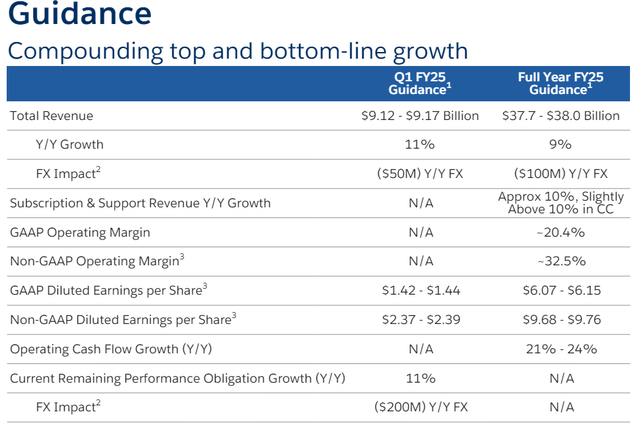

It is May 24 today and the next week (May 29) CRM releases its Q1 FY 2025 earnings. In the previous earnings presentation, the management shared its Q1 and full-fiscal year 2025 guidance. An 11% revenue growth is expected with a slight negative foreign exchange impact. A forecasted $2.38 non-GAAP EPS for Q1 2025 is notably higher compared to $1.69 delivered in Q1 2024.

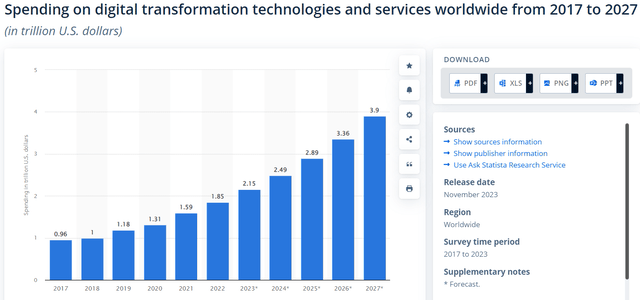

Although I do not have a crystal ball, certain trends which can help gauge the likelihood of delivering strong earnings by a company. As I said, CRM benefits from the global digital transformation trend. Global digital transformation spending is expected to grow from $2.15 trillion to $2.49 trillion in FY 2024, indicating a 15% growth. This is notably higher than CRM’s projected revenue growth, implying that the guidance is quite conservative and the probability of outperforming it is considerable. Moreover, over the last two years CRM had zero revenue or EPS misses, according to the earnings surprise history provided by Seeking Alpha.

Investors will not only look at the numbers, but also will likely pay attention to the management’s qualitative comments. I am also quite positive in this regard. CRM’s dedication to innovation remains intact, as the company recently unveiled several new AI-powered features to its Einstein Copilot. Earlier this week, CRM also announced expansion of its technological partnership with IBM (IBM) to expand its AI capabilities.

To wrap up, my stance is extremely bullish. CRM is an undisputed leader in its niche, and the management has strong dedication to sustain its leadership for as long as possible through continuous innovation and commitment to customer satisfaction. I am also quite bullish in regard of the upcoming earnings release.

Valuation analysis

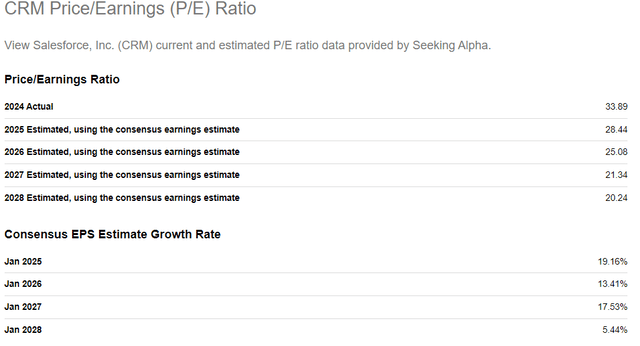

I find the projected by consensus forward dynamic of CRM’s P/E ratio to be quite attractive. The EPS growth incorporated by consensus appears realistic considering the company’s fundamental strength and secular tailwinds. A below 30 FY 2025 P/E ratio appears to be attractive for a company like CRM.

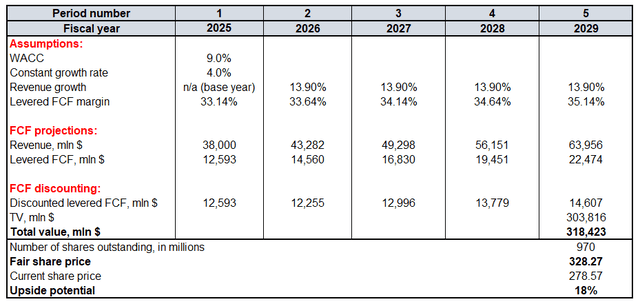

To cross-check my conclusions obtained from looking at CRM’s forward P/E ratio, I must run a discounted cash flow (‘DCF’) model. Future cash flows will be discounted using a 9% WACC. A $38 billion FY 2025 revenue for my model is the management’s guidance from one of the above screenshots. Revenue growth rate for the next five years is 13.9%. Levered FCF margin is 33.14% with an expectation that the metric will expand by at least 50 basis points every year between FY 2025 and 2029. According to Seeking Alpha, there are 970 million CRM shares outstanding. Constant growth rate for the terminal value (‘TV’) calculation is likely to be the most controversial assumption for all growth companies. I incorporate a 4% constant growth rate, twice the U.S. historical inflation levels because I believe that CRM’s undisputed leadership in its market and constant innovation will help to outpace inflation levels and continue delivering real growth.

The fair share price is $328, 18% higher than the current market price. An 18% undervaluation for an innovative market leader is highly appealing to me.

Mitigating factors

CRM’s market cap is $275 billion, and it is challenging to categorize the company as a small player competing with industry giants. However, Microsoft, CRM’s direct competitor in enterprise team collaboration niche, with a market cap of $3 trillion, operates on an entirely different scale of financial power. This means that the significant competition risk is obvious.

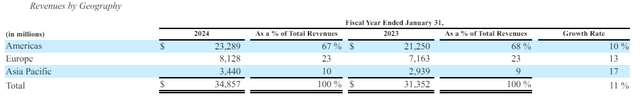

Due to facing larger comparatives and increased market penetration in the U.S., CRM’s domestic market growth will inevitably decelerate. Due to CRM’s already notable international footprint with impressive revenue growth, I think that further international expansion is a realistic strong future growth driver.

However, operating internationally is riskier than domestically due to numerous reasons, including geopolitical risks, complex web of international taxation and regulations, compliance risks, and substantial foreign exchange risks. Therefore, the larger the share of international revenue becomes, the more risks the company faces.

Conclusion

CRM’s 18% upside potential looks like a no-brainer to me because such a deep discount for a company dominating its niche for over a decade is a gift. I am also quite optimistic regarding the upcoming earnings release scheduled for May 29.