Salesforce: After Its 20% Post-Q1 Decline Is Not A Bargain (Rating Downgrade) (NYSE:CRM)

wdstock

Salesforce, Inc. (NYSE:CRM) stock has yet to regain its recently lost ground following speculation over the potential Informatica (INFA) acquisition in April, which has since fallen through. The stock’s tepid performance recently is likely the combined outcome of steadily rising capital costs in response to an increasingly structural higher for longer policy stance, as well as muted improvements in the broader enterprise spending environment.

This was further exacerbated by Salesforce’s persistently weak growth outlook. Specifically, Q1 results highlighted protracted headwinds from an extended measured spending environment, deal compression, and lengthened sales cycles. Management expects a similar demand backdrop through FY 2025, which brings investors’ greatest concern – namely, the gradual decline to a single-digit growth trajectory – front and center.

However, Data Cloud remains a bright spot for the business, with the product’s annual recurring revenue (“ARR”) likely topping the $400 million last reported exiting F4Q24, as management highlights consumption growth in F1Q25. Note that Data Cloud is billed under a consumption-based model, meaning continued growth in records ingested and processed is directly accretive to sales.

Meanwhile, Salesforce’s pivot to a bundling sales strategy is also favorable for compensating a tepid industry spending environment. Despite the lower per product price for bundles, the strategy continues to unlock efficiency gains by reducing costs to sell at Salesforce, while also improving upselling opportunities to drive additive growth. The shift to bundling is also addressing increasingly structural optimization trends in the enterprise spending environment, without compromising Salesforce’s reach into accelerating AI opportunities.

Looking ahead, we expect elevated execution risks to Salesforce’s AI roadmap in the near-term, especially as the broader enterprise spending segment remains constrained due to the combination of an uncertain macro backdrop and ongoing optimization. Admittedly, Salesforce’s AI products that have recently become generally available (“GA”) are expected to be accretive to its top- and bottom-lines as they start to ramp through F2H25. However, the extent of said benefits remain overshadowed by Salesforce’s extended exposure to a measured spending environment. As such, we believe the stock remains prone to a downward valuation adjustment for the underlying business’ potential decline to a sustained single-digit growth trajectory, until there is consistent positive progress in capturing enterprise AI opportunities ahead.

Data Cloud has a Place in the Sun

Despite nominal contributions to Salesforce’s sales mix, Data Cloud continues to demonstrate strong uptake. The product’s ARR likely grew from $400 million last reported in F4Q24, supported by robust y/y expansion in volumes processed. Recall that Data Cloud sales are generated under a consumption-based model. Hence, the 42% y/y growth in records ingested and 217% y/y growth in records processed in F1Q25 is likely accretive to Data Cloud sales. Resilient consumption of Data Cloud also highlights its mission-critical role in the generative AI product cycle. While Data Cloud was initially introduced 18 months ago as a customer data platform (“CDP”) product, it has now found itself at the center of Salesforce’s AI strategy.

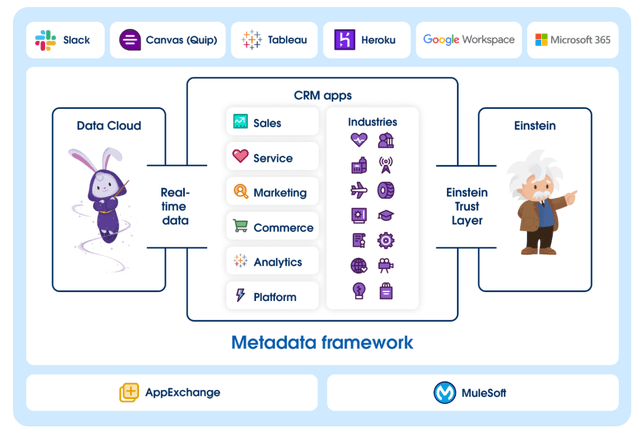

Specifically, Data Cloud connects deep troves of enterprise data with Salesforce’s other clouds and solutions, thus enabling the deployment of AI use cases for its customers. As previously discussed, Data Cloud essentially unifies disparate data sources for customers, and enables a “common language” that allows different applications built on Salesforce Platforms to interact and generate insight.

With data being a critical component to enterprise AI strategies, Data Cloud offers a unique value proposition to customers by enabling seamless integration with other Salesforce solutions. And this is evident in the product’s strong uptake rate, with Data Cloud remaining Salesforce’s “fastest growing product ever.” More than half of Salesforce’s 25 largest deals and more than a quarter of the company’s $1+ million contracts now include Data Cloud.

We believe continued momentum in Data Cloud adoption will unlock a greater penetration into enterprise AI opportunities for Salesforce. Specifically, management had previously highlighted three layers to addressing the AI problem – namely, the user interface (“UI”) layer, the foundation model layer (“LLM”), and the data layer.

Only Salesforce offers these critical layers of AI for our customers. The UI, the model and the deep integration of the data and the metadata and make the AI smart and intelligent and insightful and without the hallucinations…

While Data Cloud is key to addressing the data layer, the product also paves the foundation for Salesforce to better address opportunities in the UI and end market application layer. Specifically, Salesforce has rolled out a series of enterprise AI products in recent quarters, spanning the Einstein GPT and Copilot. And strong Data Cloud adoption to date is essentially a gauge of customers’ interest in driving further integration and incorporation of said adjacent generative AI offerings within the Salesforce platform.

For instance, Salesforce’s newest Einstein Copilot feature has only recently entered GA. Einstein Copilot is a generative AI assistant that leverages customer data to generate curated insight within enterprise settings. The conversational AI solution can assist by answering questions based on customer data, summarizing information, creating content, automate tasks, and generate action plans. During its pilot phase, management had disclosed a 17% adoption rate for Copilot among the Fortune 100, with the feature heavily reliant on integration with Data Cloud.

This accordingly highlights the mission-critical role of Data Cloud in reinforcing adoption of products within Salesforce’s AI product roadmap, and ensuring the company’s capture of relevant opportunities in the enterprise spending segment. We believe strong Data Cloud uptake harbingers robust AI contributions as relevant Salesforce products start to scale. This accordingly underscores favorable growth prospects for Salesforce, underpinned by enterprise AI market share gains heading into the back half of fiscal 2025 and through fiscal 2026.

Bundling to the Top

Meanwhile, Salesforce increasing adoption of a bundling strategy continues to bode favorably with industry optimization trends. For customers, the lower per product price offered through bundles, such as the Einstein 1 Platform, are a value for money choice. It also helps customers “do more with fewer vendors” – a key optimization consideration. Specifically, Einstein 1 Platform includes two core elements offered by Salesforce in facilitating customers’ respective AI roadmaps – namely, Data Cloud and Einstein. The bundle also includes other Salesforce clouds and apps, spanning Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Slack, Tableau and MuleSoft. And Data Cloud essentially powers the underlying integration of customer-specific data across all the Salesforce apps, helping customers deploy their respective AI roadmaps with a faster time to market and lower cost at scale.

And for Salesforce, we view the shift to bundling as both a growth and margin accretive strategy. It is not only increasing customer stickiness to Salesforce’s platform, but also reducing the company’s costs to sell. Specifically, Einstein 1 Platform is providing Salesforce with a greater upselling opportunity. This is evident in management’s recent disclosures of a “significant average sales price uplift” across existing customers who have graduated from disparate adoption of Salesforce products to integrating the Einstein 1 Platform.

The product’s roll-out has also improved Salesforce’s overall penetration into enterprise AI opportunities. This is evidenced through the growing mix of Einstein 1 Platform customers who are new to Salesforce, which reached 15% exiting FY 2024 and still growing.

Meanwhile, the bundle has also helped to further operational efficiency within Salesforce. The Einstein 1 Platform essentially makes it easier for the company to sell its expansive product portfolio that spans across 76 main offerings. We believe this will continue to complement Salesforce’s ongoing efforts in ensuring discipline in sales spending, building on job cuts and a greater shift to self-service observed in the past year.

Fundamental Considerations

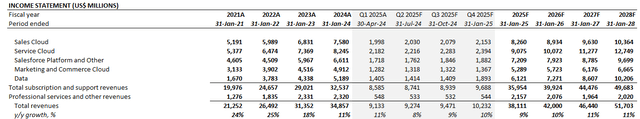

Adjusting our previous forecast for Salesforce’s actual F1Q results and near-term outlook in capturing additive enterprise AI opportunities, we expect the company to grow revenue by 9% y/y to $37.9 billion in FY 2025.

The forecast considers 10% y/y growth in subscription and support revenues, driven primarily by the continued ramp of Salesforce’s AI roadmap. As discussed in the earlier section, Data Cloud opportunities remain underpenetrated, while continued enterprise adoption will also underpin favorable growth prospects for adjacent AI products such as Copilot. This accordingly improves confidence in Salesforce’s ability to maintain a sustained double-digit percentage growth outlook, which is critical to ensuring continued margin expansion at scale.

We expect AI-related growth contributions to proliferate in the second half of FY 2025, as products that have recently entered GA, such as Copilot, continue to ramp and become more accretive to Salesforce’s top- and bottom-line performance. This will also coincide favorably with the upcoming realization of stronger cRPO in recent quarters into P&L, which is expected to reverse the previous drag on growth due to comparatively softer bookings observed in the past two years.

The robust subscription and support revenue growth outlook also considers management’s revenue guidance for FY 2025, which we view as potentially conservative. Specifically, management continues to warn of a “measured buying environment” with extended sales cycles and deal compression being a persistent theme. As such, management’s revenue guidance continues to reflect anticipated growth driven solely by company-specific execution, and without contributions from a positive shift in the underlying enterprise segment spending environment. This accordingly leaves room for an upside surprise, in our opinion, as AI-related investments in the industry remains strong. And Salesforce remains well-positioned as a key beneficiary given its product portfolio’s unique value proposition for front office, revenue center use cases.

Resilient subscription and support revenue growth is also expected to be a key compensatory factor against persistent headwinds in professional services sales. Specifically, management continues to caution slow uptake in professional services due to the ongoing shift in customer preference from fixed fee contracts to shorter-term time- and material-based contracts.

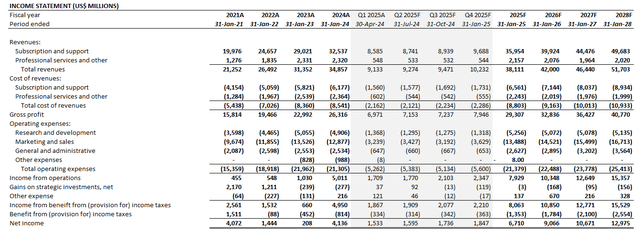

Meanwhile, we expect a lesser extent of profit upside going forward, as Salesforce pivots from aggressive cost cuts to further disciplined spend management in driving its next stage of margin expansion. Specifically, management had detailed that Salesforce aims at maintaining efficiencies enabled through job cuts and real estate reduction implemented in FY 2023, while also unlocking new gains through improved operating leverage and penetrating new opportunities in the long-run. This includes leaning in further on its bundling strategy, which reduces overall selling and marketing costs – its largest operating expense – for the company.

Price Considerations

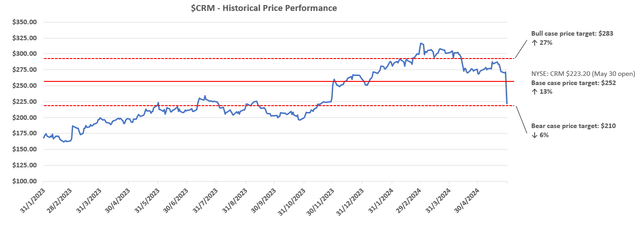

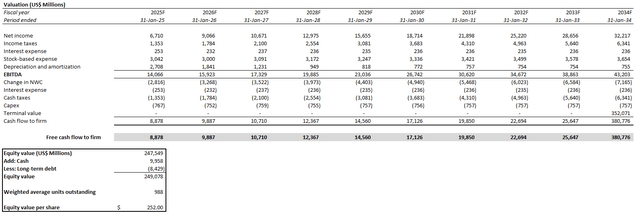

Under the scenario where Salesforce continues to deliver consistent positive progress in Data Cloud uptake among its customers, which underpins the company’s penetration into longer-term enterprise AI opportunities, the stock could reach $252 (previously $249).

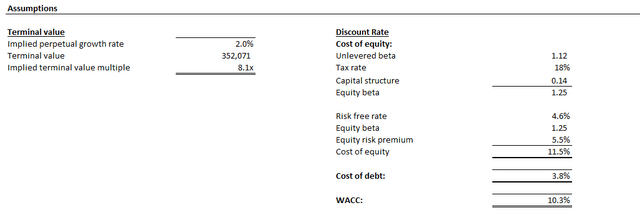

The price target is derived using the discounted cash flow (“DCF”) approach, which considers cash flow projections taken with the foregoing fundamental analysis on Salesforce. The analysis considers a 10.3% WACC in line with Salesforce’s capital structure and risk profile. An estimated perpetual growth rate of 2% applied to FY 2034E EBITDA to determine the terminal value, which is consistent with the pace of economic growth across Salesforce’s core operating regions and reflective of its normalized outlook at steady-state.

Downside Scenario Considerations

However, we believe the downside scenario is likely in the near-term. Specifically, the stock’s post-earnings performance reflects the downside scenario in which Salesforce’s growth outlook gradually declines to sustained single-digits.

Management’s guidance for 9% y/y growth in FY 2025 revenue would represent Salesforce’s first single-digit growth year. The company has identified both macroeconomic concerns and internal changes to Salesforce’s go-to-market strategy as underlying drivers of slower growth in the near-term. Yet, it remains difficult to gauge which is causing a more prevalent impact and how much of it will be temporary or structural. This accordingly leaves the risk of an extended single-digit growth trajectory for Salesforce, which could result in an adverse impact to the extent of operating leverage improvement over the longer-term.

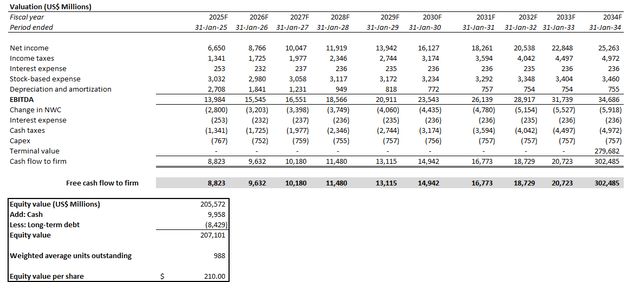

Under the downside scenario, which considers single-digit percentage revenue growth, we believe the stock will price closer to $210 apiece, which is consistent with current post-earnings declines. The price is derived from applying the same key valuation assumptions (10.3% WACC; 2% implied perpetual growth rate) as the base case on downside scenario cash flow projections.

Conclusion

Ongoing margin expansion and consistent positive progress in penetrating enterprise AI opportunities ahead will be key to restoring Salesforce’s valuation prospects. Much of Salesforce’s next stage of profitable growth will likely come from furthering Data Cloud penetration, which is expected to pave the way for the company’s capture of emerging enterprise AI opportunities. Robust Data Cloud adoption will also underpin pent-up opportunity for upselling, in our opinion, which bodes well with Salesforce’s increasingly effective bundling sales strategy observed through strong Einstein 1 Platform uptake rates.

However, the extended measured spending environment that Salesforce, Inc. faces is likely becoming increasingly structural, which accordingly raises risks of a sustained single-digit growth trajectory. Looking ahead, Salesforce has much credibility left to restore as investors pivot from applauding its impressive pace of margin expansion over the past year to demanding consistently tangible progress in capturing emerging enterprise AI opportunities. This will likely take several quarters to materialize, thus exposing the stock to further volatility ahead.