Salesforce: AI Opportunities And Challenges (NYSE:CRM)

J Studios

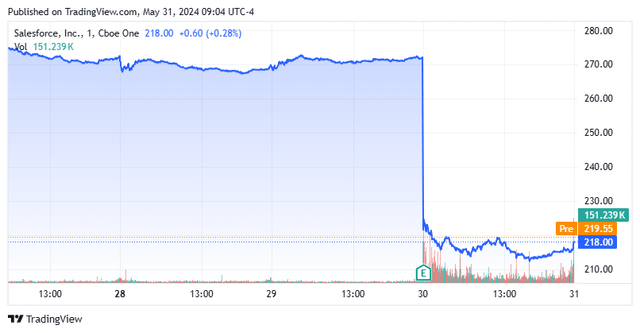

Salesforce, Inc. (NYSE:CRM) got taken out to the woodshed on Thursday and beaten like a rented mule. The shares fell nearly 20% on the day, which helped trigger a one percent sell-off on the Nasdaq (COMP.IND) yesterday. It was the biggest one-day drop for the equity since 2008, the year of the Great Financial Crisis.

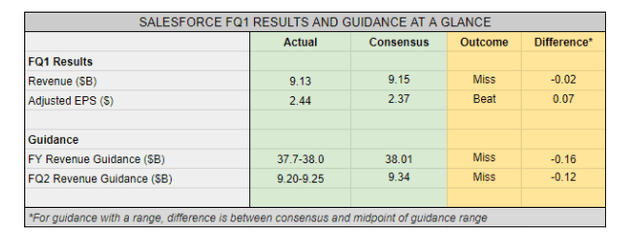

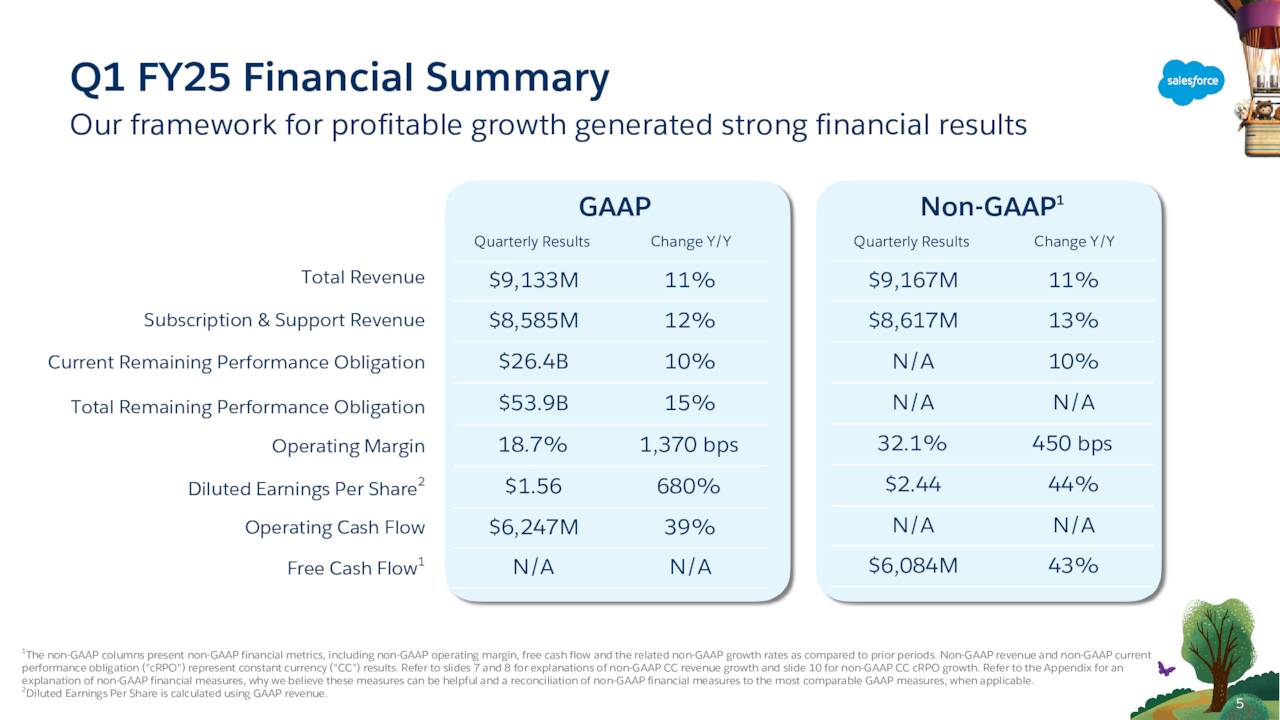

This trigger for the massive pullback was the posting of first quarter results. Revenues rose 10.7% on a year-over-year basis to $9.13 billion. This was light of the consensus by some $20 million and the first time Salesforce has missed top-line quarterly expectations since George W. Bush was in the White House. Compounding the disappointment for investors was management issued softer than expected guidance for Q2 and FY2024 (below).

Earnings press release via Seeking Alpha

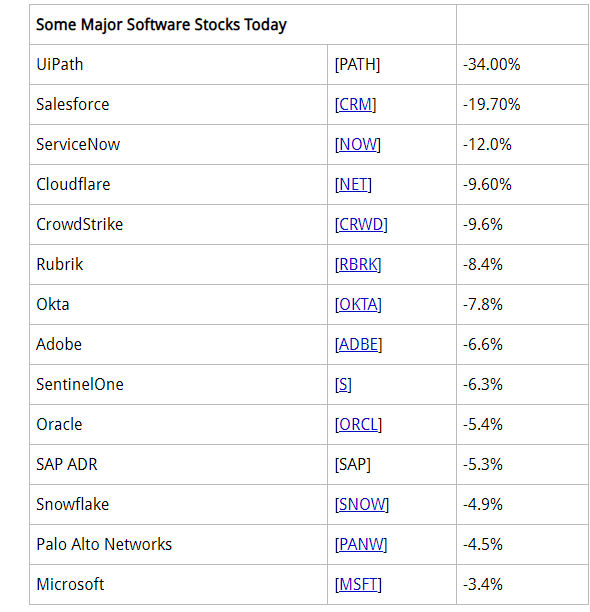

Salesforce is hardly the only tech firm that has disappointed shareholders this earnings season. ServiceNow (NOW) also plunged in late April after beating Q1 expectations but issuing disappointing guidance. UiPath (PATH) lost a third of its value Thursday as well after it posted Q1 results. Salesforce’s guidance Thursday helped cause a sharp sell-off in many similar tech concerns, as can be seen below.

Thursday’s Market Performance (Wolf Street)

I think Wall Street had an interesting take on what is causing so many tech firms to disappoint and issued cautious guidance recently. And frankly, as a former Technology Director for the better part of a decade at a Fortune 50 company, it should have occurred to me earlier (I have been out of the technology game since 2008, in my defense).

Nothing has been more covered over the past year than the AI revolution, which looks like it will become the biggest economic paradigm shift since the birth of the Internet in the 1990s. You can’t turn on CNBC or open your email and not be flooded with stories around “The top five AI stocks to own now” or some similar headline.

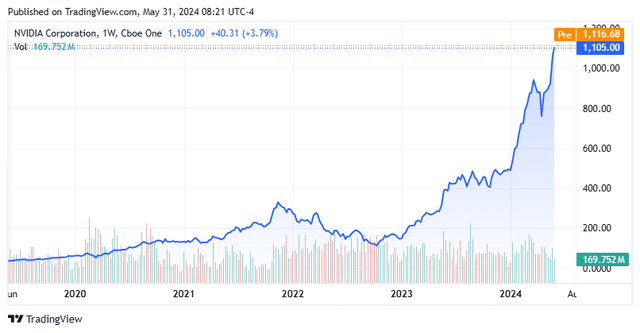

The AI build out has triggered a massive amount of new spending across the corporate universe. This has benefited names like Nvidia Corporation (NVDA) that has seen an absolute explosion of new AI related sales. This also has triggered a huge rally in NVDA, to the point the company now has a market capitalization that is more than all the energy sector stocks in the S&P 500 combined, with approximately $1 trillion in market cap to spare.

While analysts have been intently focused on which firms will be the beneficiaries of the huge increase in spending on AI by Corporate America, they largely haven’t asked the logical second level question. Where is all this additional money coming from?

Unlike the Federal Government that can print money to cover unforeseen/unplanned expenses, corporations have actual budgets and P/L statements to manage. To increase funding in one area, costs have to be cut somewhere else. Based on recent results and guidance from numerous tech firms like Salesforce, that somewhere seems to be other parts of corporate tech budgets. Salesforce management mentioned some deals were taking longer to close, quite likely due to these budgeting shifts.

It should be noted that Salesforce is driving deeper into AI within its product offerings. It is uniquely positioned to do this, given that their customer relationship management platform manages some 250 petabytes of data that can feed into AI models. The company’s Data Cloud was incorporated into a quarter of company’s $1 million and greater deals in the first quarter and management spent a good portion of the conference call following Q1 numbers talking about how Salesforce was leveraging and intently focused on incorporating AI into its offerings.

Unfortunately, that did not stop many analyst firms from cutting price targets on CRM following Q1 results on Thursday. Morgan Stanley had an interesting and positive take on CRM, even as it cut its price target $30 to $320 a share while maintaining its Overweight rating on the stock:

Bottom line, operational discipline and positioning as a core system of record in the enterprise sustain earnings power at Salesforce, which is not priced into the stock at 1.2X PEG versus GARP peers at 2.0X. We continue to view GenAI as a tailwind for Salesforce, with benefits likely coming in CY25, but at these levels, GenAI represents a call option.“

May 2024 Company Presentation

One thing that stuck out to me was the company delivered nearly $6.1 billion in free cash flow in the first quarter, which was up 43% over the same period a year ago. More importantly, using first quarter free cash flow run rate on an annual basis provides a free cash flow yield in the low teens, given Salesforce’s market cap is a bit over $210 billion after Thursday’s haircut. It also should be noted that CRM did deliver non-GAAP earnings of $2.44 a share in the first quarter, seven cents a share above expectations. Salesforce also ended the first quarter with just over $17 billion in cash and marketable securities on its balance sheet, according to the 10-Q filed for the quarter.

While the challenges and opportunities presented to the company via the paradigm shift are likely to cause several “hiccups” in the quarters and years ahead, that is a cheap enough valuation for me to take an initial “starter” position in CRM via covered call orders at these lower entry points.