Salesforce: Assessing Potential Informatica Acquisition Impact On Thesis (NYSE:CRM)

Jemal Countess

On Friday after the close, it was reported that Salesforce (NYSE:CRM) was in advanced talks to acquire the data processing company Informatica (INFA). This news likely took many investors by surprise given that CRM management had seemingly committed to a singular focus on profitable growth and capital returns. This acquisition, which would likely carry around a $11 billion price tag, is reminiscent of the company’s previous high volume of M&A activity, something that many investors might not be so approving of following the tech crash of 2022. I do not expect this deal to lead the stock to stray off course, and view any volatility coming out of the deal as further buying opportunities. I reiterate my buy rating for the stock but await any further details on a final price tag.

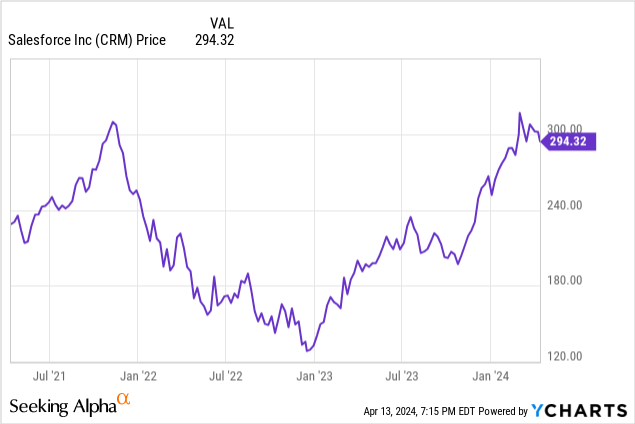

CRM Stock Price

I last covered CRM in January, where I rated the stock a buy on account of the strong focus on profitable growth and capital returns coupled with the GARP valuation. The stock has delivered around market-level returns since then, though this potential deal is likely to add some volatility.

INFA appears to have solid financial metrics, though the last remaining variable may be the final price tag.

CRM Stock Key Metrics

CRM is an enterprise tech company best known for its customer relationship management products, which I view to be a mission-critical service as it helps companies to manage their relationships with their customers.

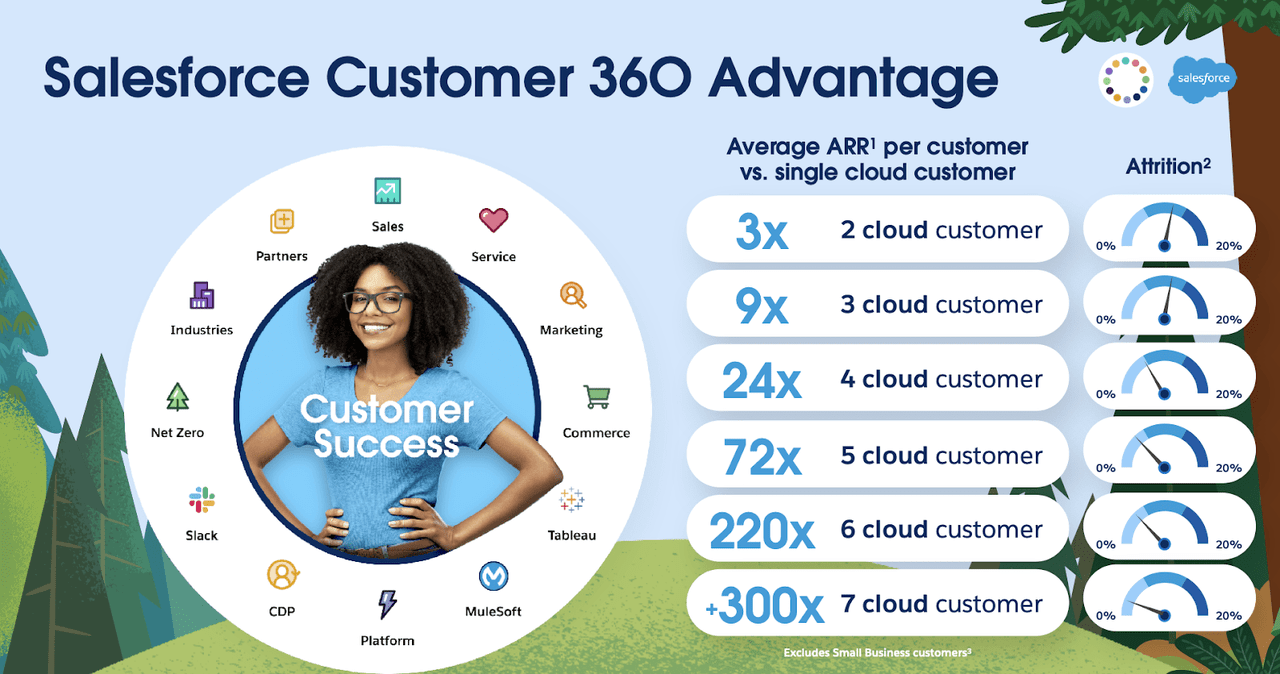

CRM has since bolstered its product portfolio through a long string of M&A, making it a true “platform company.” While the past M&A had come at a high price tag for investors, the company’s deep portfolio proved invaluable following the rise of interest rates, as the company was able to rely on upselling existing customers to drive growth during this difficult period.

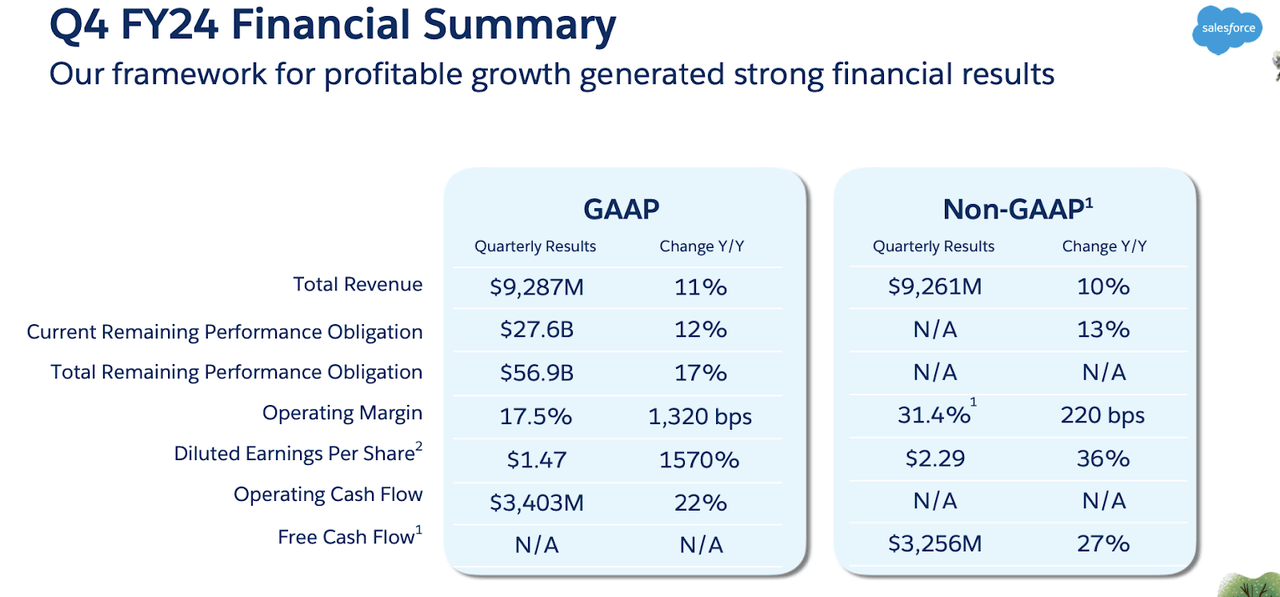

In its most recent quarter, CRM delivered 11% YoY revenue growth to $9.287 billion, surpassing guidance for $9.23 billion. The company generated $2.29 in non-GAAP EPS, surpassing guidance for $2.26. It is worth mentioning that the company generated a 17.5% GAAP operating margin (31.4% non-GAAP) as the company is often viewed as a bellwether for the tech sector. Many tech companies had responded to the 2022 tech crash and higher interest rate environment by dramatically boosting profit margins – this may have helped increase the prospective investor base who might be interested in their stocks.

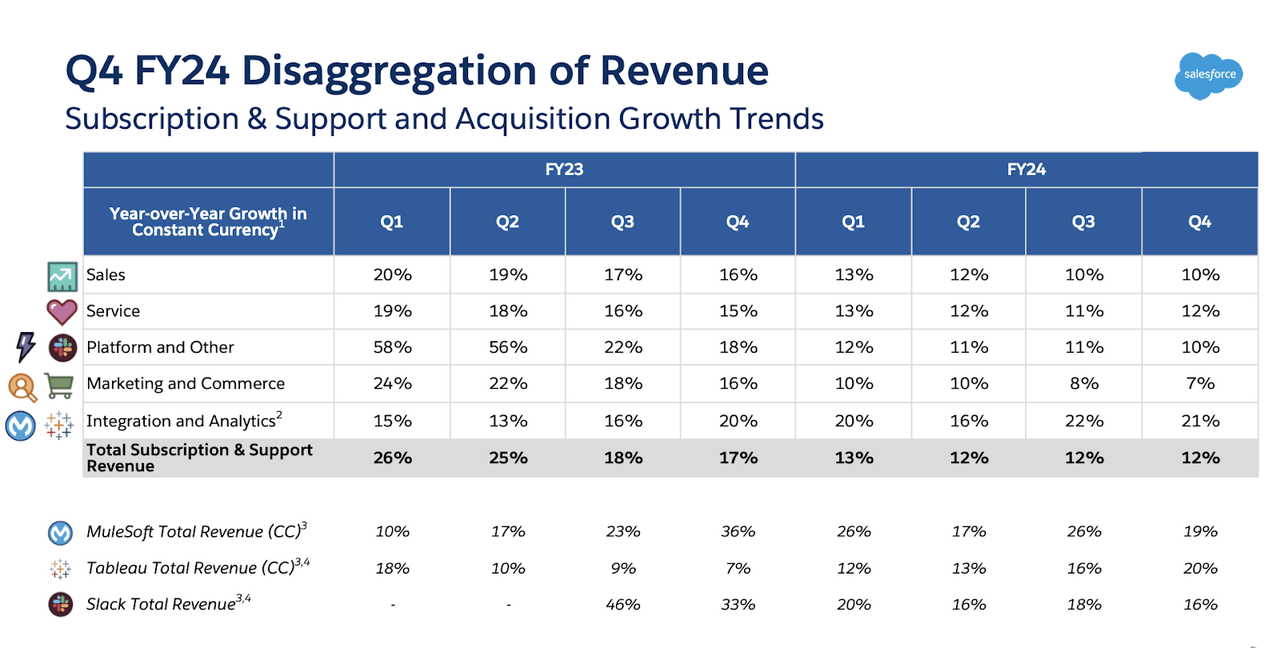

I found it notable that CRM saw revenue growth remain rather consistent across its various business lines – I suspect that integration of generative AI is helping the company to sustain such resilient growth rates even in its more mature businesses.

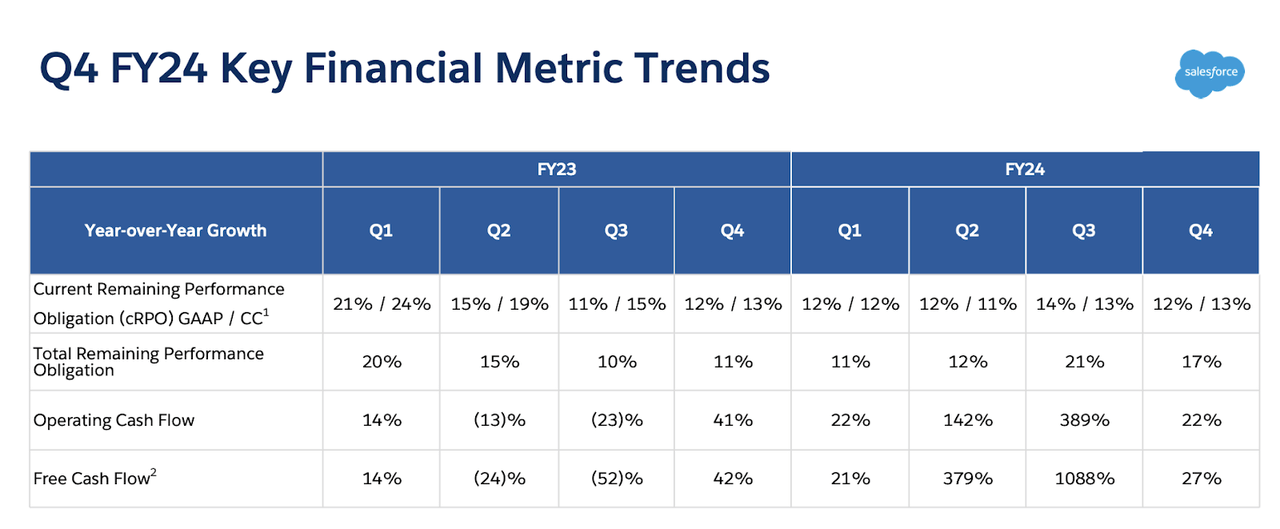

The company reported 13% YoY growth in current remaining performance obligations (‘cRPOs’), surpassing guidance for 10% growth. Many investors view cRPO growth as a potential leading indicator for revenue growth.

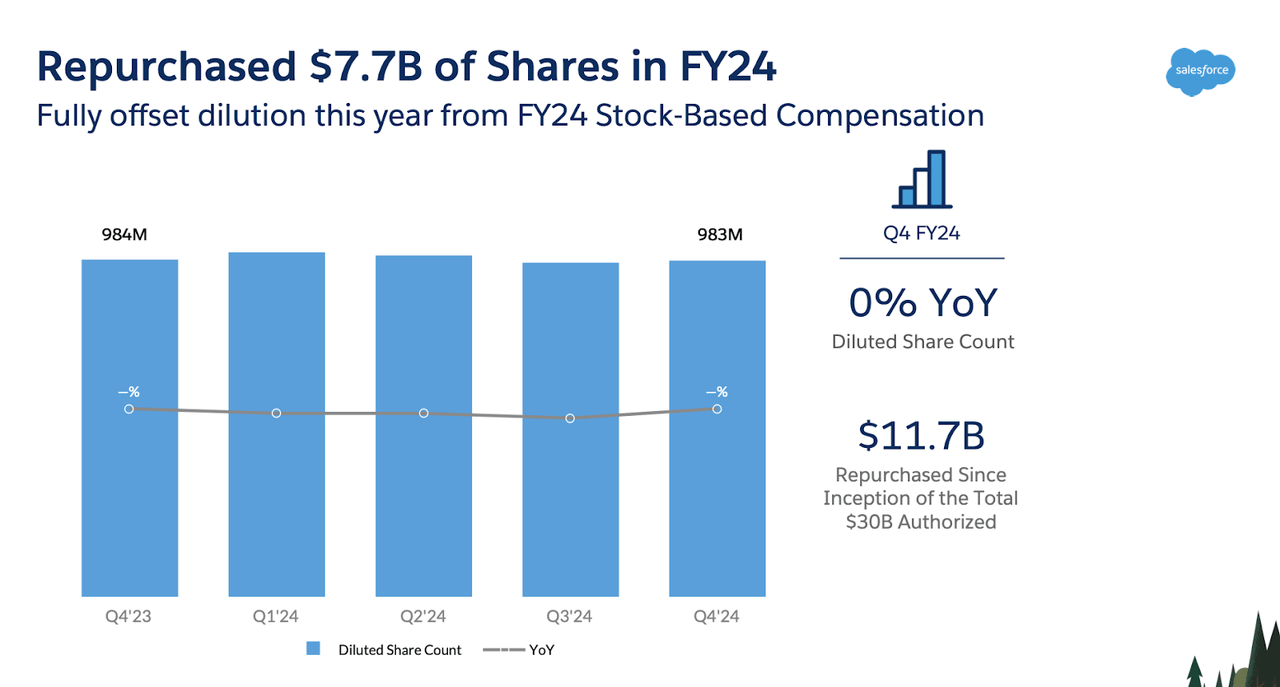

The company repurchased $7.7 billion in the past year, helping it to fully offset stock-based compensation – diluted shares outstanding was flat on a year-over-year basis.

The company ended the quarter with $14.2 billion of cash and $4.8 billion of strategic investments versus $9.4 billion of debt. That represents a big jump from the $2.5 billion net cash position reported in the third quarter and mainly represents an improvement in contract deal sizes, as unearned revenues jumped $6.5 billion QoQ.

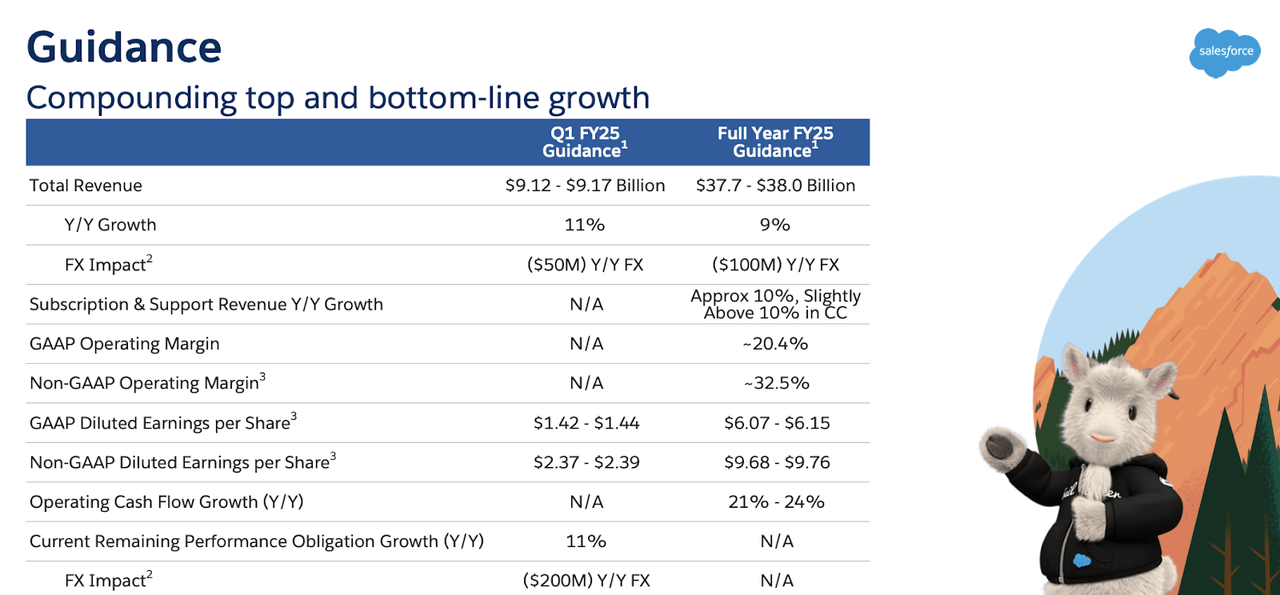

Looking forward, management has guided for the first quarter to see up to 11% YoY revenue growth to $9.17 billion (versus consensus estimates of $9.15 billion) and for the full year to see 9% YoY revenue growth and 20.4% GAAP operating margins.

On the conference call, management discussed their reasoning behind their first ever quarterly dividend of $0.40 per share. Management noted that in conjunction with their share repurchase program, the dividend is “reflective of the confidence we have in the future of our business and our ability to drive long-term cash flow.” The capital return policies and commitment to profitable growth appeared to be evidence of maturity and potential influence from activist investors.

Yet, some investors might be experiencing cognitive dissonance, as the Wall Street Journal reported that CRM was in advanced talks to purchase INFA.

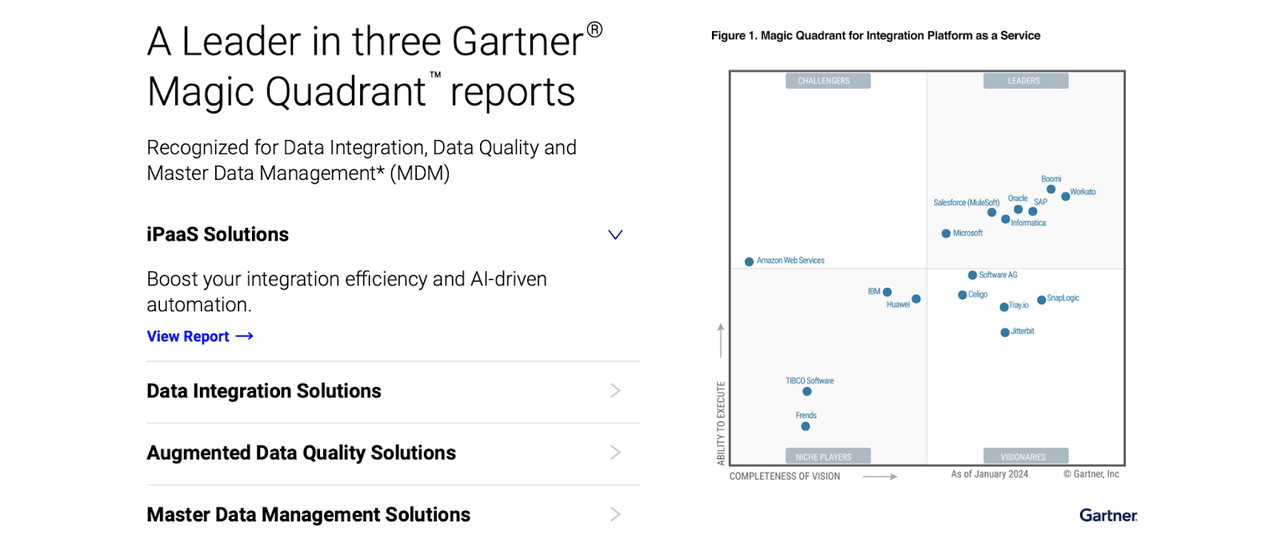

Informatica is a data processing platform which also offers data integration capabilities, making some of its product lines already in competition with CRM, as seen below.

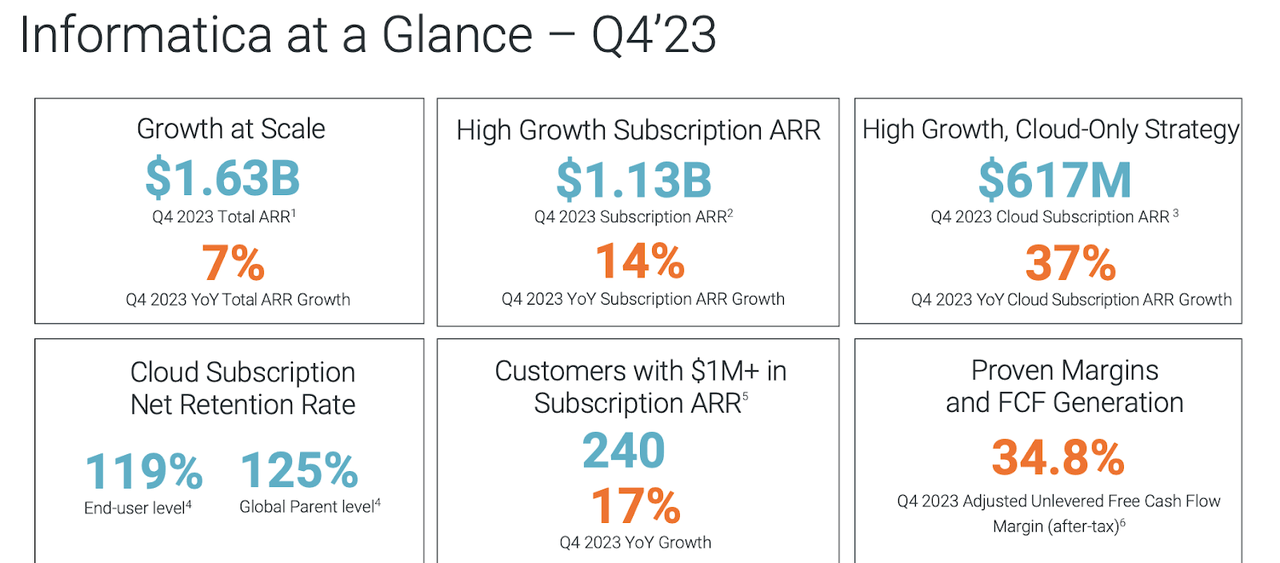

INFA has seen top-line growth slow down to the single-digit level, though its cloud offerings are growing rapidly. The company is quite profitable with a 34.8% free cash flow margin and posted positive GAAP operating margins for the full year.

Informatica 2023 Q4 Presentation

INFA management has guided for the next year to see 7.3% YoY revenue growth to $1.772 billion. INFA ended the year with $800 million in net debt, which, in conjunction with the $11 billion market cap, suggests that CRM may have to pay at least 6.7x sales for the company. Sure, this acquisition would seem to detract from the consistent messaging about a commitment to capital returns, but the potential valuation represents a substantial improvement from the company’s past deals, including the $27 billion acquisition of Slack, which came at a 24x revenue multiple. This deal would add further depth to CRM’s platform portfolio, and the company might be able to drive synergies with its Mulesoft segment (but it is unclear if there are overlapping revenues). I do not view this deal in itself to pose any threat to the bullish thesis.

Is CRM Stock A Buy, Sell, or Hold?

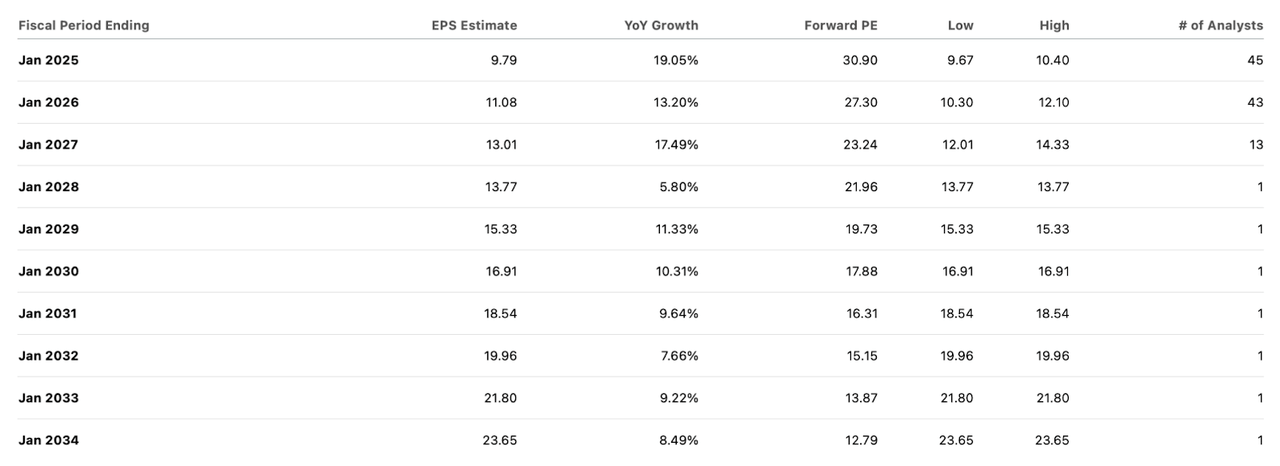

At recent prices, CRM was trading at 31x this year’s earnings estimates (non-GAAP).

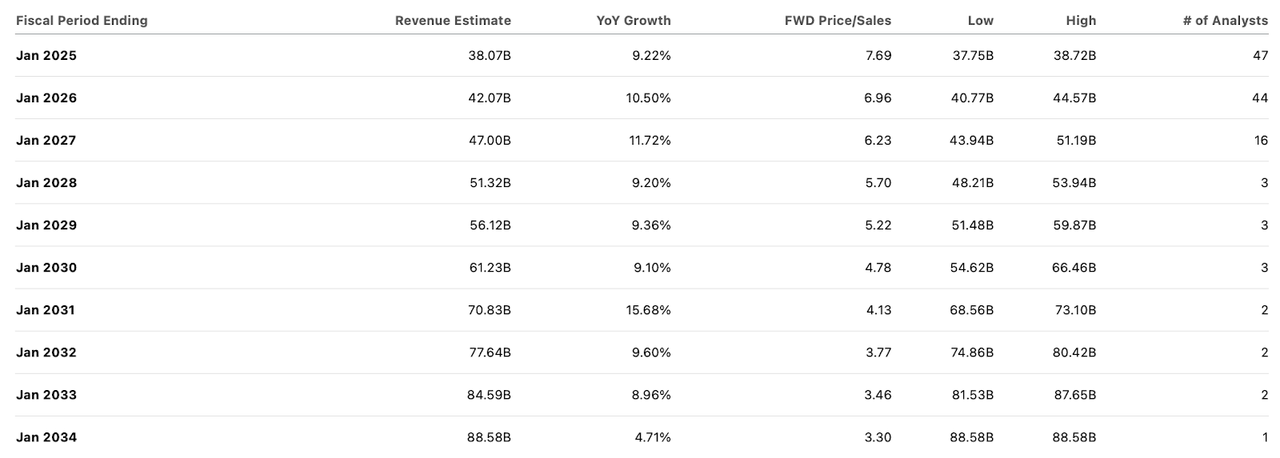

Consensus estimates call for the company to sustain near-double-digit top-line growth for many years.

I expect there to be a stock component to any potential INFA deal, but wouldn’t rule out the company finally making a push into net leverage by financing the deal with debt. That might boost the near term top and bottom-line growth rates, but I will value the company excluding the deal. I expect CRM to command a 30x earnings multiple over the long term given the company’s long-term secular growth profile. This would bring the company in-line with a stock like Microsoft (MSFT) or Apple (AAPL). I assume that CRM can generate a 33% GAAP net margin over the long term, meaning that the stock might trade at a 10x price to sales multiple upon maturity. With the stock trading at 7.7x this year’s sales, this implies 30% potential upside from multiple expansion in conjunction with the projected 9% to 10% forward top-line growth rates.

What are the key risks? It is possible that revenue growth rates decelerate faster than expected. This would not be necessarily hard to fathom given the company’s large revenue base. It is possible that management engages in further M&A activity that is dilutive to shareholders. I could see CRM stock experience volatility if the broader tech sector experiences a re-rating downwards. It is not clear how generative AI might affect CRM’s business, as it might end up leading to lower headcount growth among its customer base.

Conclusion

A potential takeover of INFA is likely to lead to volatility in CRM stock. However, this deal looks far more reasonable than past deals, and I am doubtful that it would prove dilutive to shareholders. I continue to see CRM progressing towards driving expanding profit margins while rewarding shareholders with share repurchases and dividends. I reiterate my buy rating for the stock.