Salesforce (CRM) Stock: Here’s What Investor Sentiment Signals After the Pullback

Salesforce (NYSE:CRM) stock has declined about 23% in the past three months. The decline came after the company missed Q1 revenue estimates for the first time in 18 years. Despite this drop in share price, individual investors maintain a Very Positive view of the company. This suggests that these investors are capitalizing on the dip to take long positions in CRM stock.

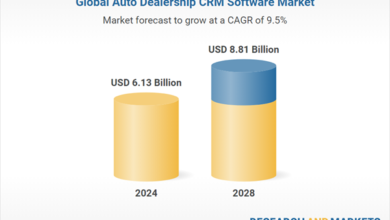

CRM is a cloud-based software company that provides customer relationship management solutions.

In the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 9.7%. Overall, among the 740,493 portfolios monitored by TipRanks, 2.2% have invested in Salesforce stock.

Not Just Investors

It is worth highlighting that, apart from the investors, one of the company’s key insiders also purchased CRM stock. In early June, Salesforce’s director, Mason Morfit, bought 428,000 shares of the company for a total transaction value of $99.8 million.

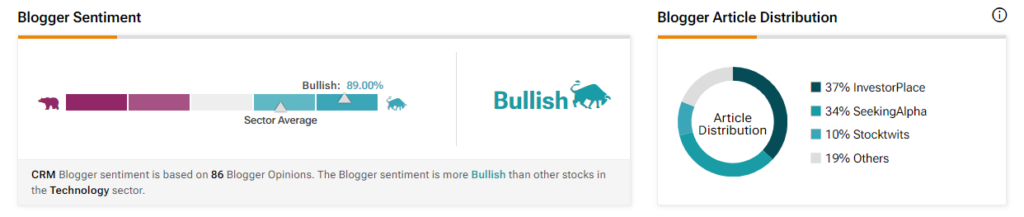

Furthermore, based on TipRanks’ Blogger Opinion tool, we can see that bloggers are bullish about CRM stock as well. Indeed, of the 86 bloggers tracked by TipRanks, 89% of them are optimistic, which is higher than the sector average, as pictured below.

Is CRM a Buy, Hold, or Sell?

Before moving ahead, it should be noted that CRM’s Q1 revenue miss might have seemed concerning to investors, especially considering the strong performance of many AI-powered tech stocks. However, it’s worth mentioning that the company’s revenue did grow by 10.7% year-over-year.

Looking forward, Salesforce’s diversified cloud product portfolio, increasing cross-selling opportunities, and a loyal customer base with low churn rates all point toward its sustainable growth prospects.

Turning to Wall Street, analysts have a Moderate Buy consensus rating based on 29 Buys, 10 Holds, and one Sell assigned in the past three months. The analysts’ average price target on CRM stock of $297.11 implies 28.1% upside potential.