Salesforce, Inc. (NYSE:CRM) COO Brian Millham Sells 2,106 Shares

Salesforce, Inc. (NYSE:CRM – Get Free Report) COO Brian Millham sold 2,106 shares of the stock in a transaction that occurred on Wednesday, May 15th. The stock was sold at an average price of $280.00, for a total transaction of $589,680.00. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink.

Brian Millham also recently made the following trade(s):

- On Wednesday, April 24th, Brian Millham sold 4,204 shares of Salesforce stock. The shares were sold at an average price of $278.00, for a total transaction of $1,168,712.00.

- On Monday, April 22nd, Brian Millham sold 5,801 shares of Salesforce stock. The stock was sold at an average price of $279.10, for a total transaction of $1,619,059.10.

- On Monday, April 1st, Brian Millham sold 24,453 shares of Salesforce stock. The stock was sold at an average price of $302.08, for a total value of $7,386,762.24.

- On Monday, March 25th, Brian Millham sold 1,679 shares of Salesforce stock. The shares were sold at an average price of $305.46, for a total value of $512,867.34.

- On Friday, March 22nd, Brian Millham sold 14,516 shares of Salesforce stock. The shares were sold at an average price of $309.32, for a total transaction of $4,490,089.12.

- On Thursday, February 22nd, Brian Millham sold 14,517 shares of Salesforce stock. The stock was sold at an average price of $292.50, for a total transaction of $4,246,222.50.

Salesforce Price Performance

Shares of CRM opened at $285.61 on Friday. Salesforce, Inc. has a one year low of $193.68 and a one year high of $318.71. The stock’s fifty day moving average is $289.14 and its 200-day moving average is $271.54. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.09 and a current ratio of 1.09. The firm has a market capitalization of $276.47 billion, a price-to-earnings ratio of 68.00, a price-to-earnings-growth ratio of 2.21 and a beta of 1.30.

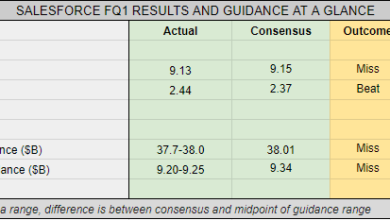

Salesforce (NYSE:CRM – Get Free Report) last released its earnings results on Wednesday, February 28th. The CRM provider reported $1.78 EPS for the quarter, beating the consensus estimate of $1.72 by $0.06. The firm had revenue of $9.29 billion for the quarter, compared to analysts’ expectations of $9.22 billion. Salesforce had a net margin of 11.87% and a return on equity of 10.42%. Salesforce’s quarterly revenue was up 10.8% on a year-over-year basis. During the same quarter last year, the company earned $1.01 EPS. Equities analysts anticipate that Salesforce, Inc. will post 7.45 EPS for the current year.

Salesforce Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, April 11th. Shareholders of record on Thursday, March 14th were paid a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 0.56%. The ex-dividend date was Wednesday, March 13th. Salesforce’s payout ratio is currently 9.52%.

Analyst Upgrades and Downgrades

CRM has been the topic of a number of recent analyst reports. Needham & Company LLC reiterated a “buy” rating and issued a $345.00 price objective on shares of Salesforce in a report on Monday, April 15th. TheStreet upgraded Salesforce from a “c+” rating to a “b-” rating in a research note on Friday, January 19th. JPMorgan Chase & Co. increased their target price on Salesforce from $260.00 to $310.00 and gave the company an “overweight” rating in a research note on Thursday, February 29th. KeyCorp initiated coverage on shares of Salesforce in a research note on Thursday, March 21st. They issued a “sector weight” rating for the company. Finally, Truist Financial reiterated a “buy” rating and set a $360.00 price objective (up from $275.00) on shares of Salesforce in a research note on Thursday, February 29th. Nine equities research analysts have rated the stock with a hold rating, twenty-four have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of “Moderate Buy” and an average target price of $310.61.

Get Our Latest Analysis on CRM

Hedge Funds Weigh In On Salesforce

Several hedge funds have recently modified their holdings of the company. Vanguard Group Inc. raised its holdings in shares of Salesforce by 1.2% in the 1st quarter. Vanguard Group Inc. now owns 84,635,254 shares of the CRM provider’s stock worth $25,490,446,000 after purchasing an additional 1,008,841 shares in the last quarter. Capital World Investors increased its holdings in shares of Salesforce by 2.4% in the fourth quarter. Capital World Investors now owns 19,561,325 shares of the CRM provider’s stock valued at $5,147,402,000 after buying an additional 457,463 shares in the last quarter. Fisher Asset Management LLC lifted its position in shares of Salesforce by 5.3% during the 4th quarter. Fisher Asset Management LLC now owns 14,921,042 shares of the CRM provider’s stock valued at $3,926,323,000 after acquiring an additional 752,566 shares during the last quarter. Capital Research Global Investors boosted its stake in shares of Salesforce by 26.9% during the 1st quarter. Capital Research Global Investors now owns 14,376,536 shares of the CRM provider’s stock worth $4,329,925,000 after acquiring an additional 3,044,611 shares in the last quarter. Finally, Capital International Investors grew its holdings in shares of Salesforce by 3.0% in the 1st quarter. Capital International Investors now owns 14,116,449 shares of the CRM provider’s stock worth $4,251,592,000 after acquiring an additional 407,834 shares during the last quarter. 80.43% of the stock is currently owned by institutional investors and hedge funds.

About Salesforce

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company’s service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

Recommended Stories

Receive News & Ratings for Salesforce Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Salesforce and related companies with MarketBeat.com’s FREE daily email newsletter.