Salesforce (NYSE:CRM) Given New $230.00 Price Target at DA Davidson

Salesforce (NYSE:CRM – Free Report) had its price target lowered by DA Davidson from $300.00 to $230.00 in a report released on Thursday, Benzinga reports. The firm currently has a neutral rating on the CRM provider’s stock.

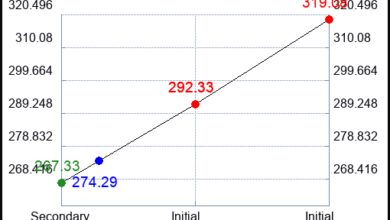

CRM has been the subject of a number of other reports. Wedbush cut their price target on Salesforce from $325.00 to $315.00 and set an outperform rating for the company in a report on Wednesday. JPMorgan Chase & Co. raised their price objective on Salesforce from $260.00 to $310.00 and gave the company an overweight rating in a research note on Thursday, February 29th. TD Cowen cut their price objective on Salesforce from $330.00 to $285.00 and set a hold rating on the stock in a research note on Thursday. Stifel Nicolaus lowered their price objective on shares of Salesforce from $350.00 to $300.00 and set a buy rating for the company in a research report on Thursday. Finally, JMP Securities reiterated a market outperform rating and issued a $342.00 target price on shares of Salesforce in a research note on Monday, April 15th. One research analyst has rated the stock with a sell rating, ten have issued a hold rating, twenty-five have assigned a buy rating and one has issued a strong buy rating to the company’s stock. According to data from MarketBeat, Salesforce presently has a consensus rating of Moderate Buy and a consensus target price of $293.33.

Check Out Our Latest Report on Salesforce

Salesforce Stock Down 19.7 %

Salesforce stock opened at $218.04 on Thursday. Salesforce has a fifty-two week low of $193.68 and a fifty-two week high of $318.71. The firm has a 50 day moving average price of $283.26 and a 200 day moving average price of $275.45. The company has a market capitalization of $211.06 billion, a PE ratio of 39.22, a price-to-earnings-growth ratio of 2.40 and a beta of 1.30. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.09 and a current ratio of 1.09.

Salesforce (NYSE:CRM – Get Free Report) last released its quarterly earnings results on Wednesday, May 29th. The CRM provider reported $2.44 EPS for the quarter, topping the consensus estimate of $2.38 by $0.06. Salesforce had a return on equity of 11.62% and a net margin of 15.30%. The company had revenue of $9.13 billion for the quarter, compared to analyst estimates of $9.15 billion. During the same quarter in the previous year, the company posted $1.15 earnings per share. The firm’s revenue was up 10.7% compared to the same quarter last year. Research analysts expect that Salesforce will post 7.45 earnings per share for the current year.

Insider Transactions at Salesforce

In other news, CEO Marc Benioff sold 15,000 shares of the stock in a transaction dated Tuesday, May 28th. The shares were sold at an average price of $269.32, for a total value of $4,039,800.00. Following the completion of the transaction, the chief executive officer now owns 12,437,327 shares in the company, valued at approximately $3,349,620,907.64. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, CEO Marc Benioff sold 15,000 shares of the business’s stock in a transaction dated Tuesday, May 28th. The shares were sold at an average price of $269.32, for a total value of $4,039,800.00. Following the completion of the transaction, the chief executive officer now owns 12,437,327 shares of the company’s stock, valued at approximately $3,349,620,907.64. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Parker Harris sold 4,200 shares of the company’s stock in a transaction on Tuesday, May 28th. The shares were sold at an average price of $269.26, for a total value of $1,130,892.00. Following the completion of the transaction, the insider now owns 115,762 shares of the company’s stock, valued at $31,170,076.12. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 623,070 shares of company stock worth $179,662,826. Corporate insiders own 3.20% of the company’s stock.

Institutional Trading of Salesforce

Hedge funds have recently made changes to their positions in the stock. Graypoint LLC boosted its stake in shares of Salesforce by 0.3% in the 4th quarter. Graypoint LLC now owns 10,504 shares of the CRM provider’s stock valued at $2,764,000 after purchasing an additional 36 shares in the last quarter. Chase Investment Counsel Corp boosted its stake in shares of Salesforce by 0.3% during the fourth quarter. Chase Investment Counsel Corp now owns 10,377 shares of the CRM provider’s stock valued at $2,730,000 after purchasing an additional 36 shares in the last quarter. JFS Wealth Advisors LLC grew its holdings in shares of Salesforce by 11.4% during the fourth quarter. JFS Wealth Advisors LLC now owns 353 shares of the CRM provider’s stock worth $93,000 after purchasing an additional 36 shares during the last quarter. Opes Wealth Management LLC increased its stake in shares of Salesforce by 2.9% in the fourth quarter. Opes Wealth Management LLC now owns 1,295 shares of the CRM provider’s stock valued at $341,000 after buying an additional 37 shares during the period. Finally, Prentice Wealth Management LLC raised its holdings in Salesforce by 1.7% in the 4th quarter. Prentice Wealth Management LLC now owns 2,294 shares of the CRM provider’s stock valued at $604,000 after buying an additional 38 shares during the last quarter. Institutional investors and hedge funds own 80.43% of the company’s stock.

Salesforce Company Profile

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company’s service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

See Also

Receive News & Ratings for Salesforce Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Salesforce and related companies with MarketBeat.com’s FREE daily email newsletter.