Salesforce (NYSE:CRM) Pre-Earnings: Here’s What to Expect

Software firm Salesforce (NYSE:CRM) will report its Q1 earnings results on May 29 after the market closes. Analysts expect earnings per share to come in at $2.37 on revenue of $9.146 billion. According to TipRanks’ data, this equates to 40.2% and 10.9% year-over-year increases, respectively.

This would be a great result because earnings per share should ideally grow faster than revenue, as this demonstrates a high degree of operating and financial leverage in the business. In addition, it’s worth noting that Salesforce has beaten earnings estimates every quarter since August 2020. Therefore, it’s likely that EPS growth will surprise to the upside.

Options Traders Anticipate a Sizeable Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a sizeable 6.85% move in either direction.

Is CRM a Good Stock to Buy Now?

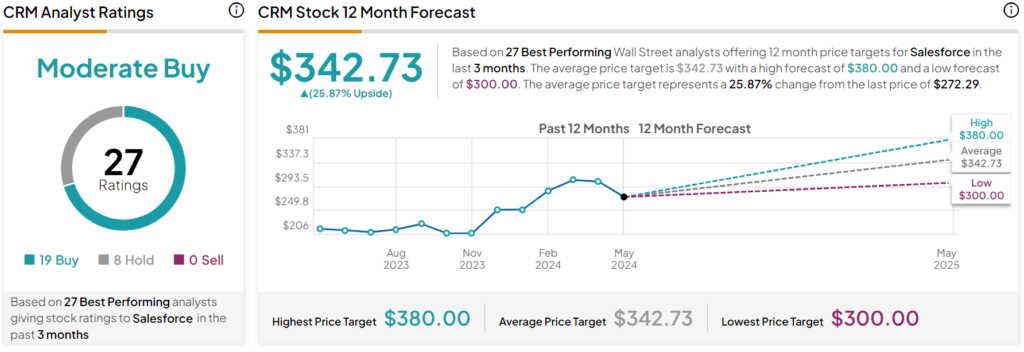

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRM stock based on 19 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 24% rally in its share price over the past year, the average CRM price target of $342.73 per share implies 25.87% upside potential.

Is CRM the Right Stock to Buy for Passive Income?

Before you hurry to invest in CRM, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Salesforce is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.

Get a FREE sample of dividend stock ideas! ➜