Salesforce Q1 2025 Results: Look Beyond The Weak RPO That Drove The Sell-Off (CRM)

John M. Chase

Investment Thesis

Salesforce (NYSE:CRM) saw its stock slump on the back of its fiscal Q1 results.

Meanwhile, I argue that this sell-off is unjustified. Yes, investors didn’t take keenly to the fact that Salesforce’s growth rates are moderating. But this is old news. Even though, the fact that Salesforce wasn’t able to upwards revise its fiscal 2025 revenue growth outlook obviously took investors by surprise.

But in time, investors will shake off this shock. And they will once more reappraise Salesforce on its intrinsic value. And on that front, having to pay 23x forward non-GAAP EPS is a very fair entry point.

Therefore, I remain bullish on CRM.

Rapid Recap

In my previous analysis in November, I said:

[…] what I believe will distinguish Salesforce from many of its peers is that this business generates insanely strong cash flows and profits. Yes, clean, post-SBC, GAAP operating profits.

I stand by this statement.

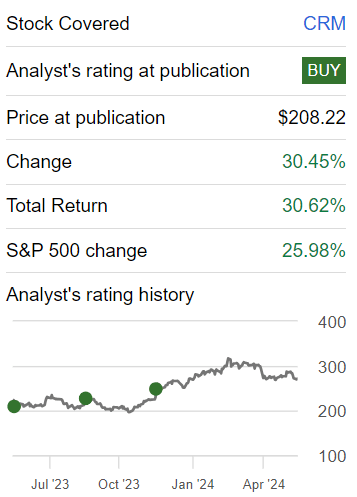

Author’s work on CRM

As you can see above, Salesforce is a stock that I’ve been bullish on for some time. In fact, I was tempted to repeat my title from my article this time last year, Do Not Throw in the Towel in this article. After all, it’s the same message again.

Moreover, inclusive of the premarket sell-off of 16%, following the advice from my title last year would have delivered investors with healthy gains. And indeed, I once more reaffirm this assertion that investors shouldn’t throw in the towel on CRM.

Salesforce’s Near-Term Prospects

Salesforce used its earnings call to highlight its use of strategic AI, as you’d expect. For instance, Salesforce stressed its leadership position in the CRM market, managing over 250 petabytes of customer data, which is crucial for its AI transformation.

Also, Salesforce declared that Data Cloud is emerging as the next billion-dollar product, with the need to integrate customer data seamlessly across platforms. Furthermore, Salesforce reminded investors of its partnerships with megatech, such as Amazon (AMZN), Google (GOOGL)(GOOG), and Microsoft (MSFT), further strengthening its position in the AI landscape.

However, Salesforce faces near-term challenges, particularly highlighted by its weak Remaining Performance Obligation (“RPO”) figure, a critical forward-looking indicator. The Q1 results fell short of expectations for CRPO growth, raising concerns about future revenue stability. Despite maintaining the full-year revenue guidance, this discrepancy indicates potential risks.

Case in point, customers are exhibiting measured buying behavior, leading to prolonged sales cycles, plus shorter project durations.

Given this backdrop, let’s now delve into its financials.

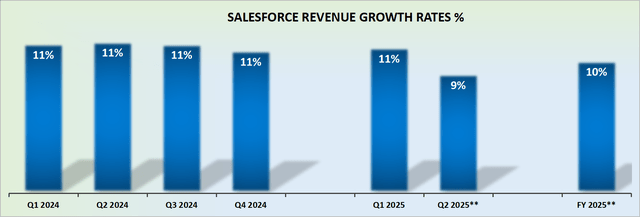

Saleforce’s Guidance Point to 10% CAGR

Salesforce appears to be growing ever-so-slightly slower than analysts had expected, with its RPO dipping sequentially, which investors have undoubtedly latched onto, as this is a key leading indicator.

Also, not only did Salesforce marginally miss revenue estimates for fiscal Q1 2025 but also its outlook for fiscal 2025 came in a hair below analysts’ expectations, at $38.00 billion at the high end versus $38.01 billion.

A minor miss and investors had a complete loss of faith, with the stock dropping 16% after hours. Overreaction? Clearly so. Ultimately, the fact that Salesforce’s growth prospects have moderated isn’t any news to anyone.

Instead, what, I believe, has happened here is that the stock was showing some weakness in the past several months, and investors wanted to be reassured that Salesforce still had more juice in the tank.

As a leader in its space, investors can be very forgiving of many different aspects of a company’s performance and prospects, but what investors don’t want to see is their company’s revenue growth rates slowing down. And that’s what’s happened here.

Given this context, let’s now discuss its valuation.

CRM Stock Valuation – 23x Forward Non-GAAP EPS

Salesforce upwards revised its non-GAAP EPS guidance for fiscal 2025 from $9.76 to $9.94, an increase of 2% since the start of this fiscal year.

Consequently, it’s only natural to assume that at some point in the coming twelve months, Salesforce EPS will deliver $10 of non-GAAP EPS, leaving the stock priced at 23x forward non-GAAP EPS, a figure that is far from stretched.

That being said, the fact that Salesforce has in the past twelve months been so aggressively focused on improving its profit margins has come at a cost, given that its growth rates have now moderated. And therein lies the problem.

Investors are cognizant that without supportive, stable, and strong topline growth there’s only so far that Salesforce’s EPS prospects can shine.

On the other hand, Salesforce notes that both its GAAP and non-GAAP EPS estimates for fiscal 2025, do not include any potential share repurchase. Therefore, it’s very possible that Salesforce’s non-GAAP EPS could reach $10 per share sooner than investors presently expect.

Altogether, this is not a thesis-breaking quarter.

The Bottom Line

As an investor who has been bullish on Salesforce for some time, I believe this sell-off to be an overreaction.

Despite concerns about slowing growth rates and the inability to revise fiscal 2025 revenue growth upward, the company’s intrinsic value remains strong. Salesforce’s strategic focus on AI, its leadership in the CRM market, and its robust financial performance, including significant cash flow and profit generation, reinforce my confidence.

Paying 23x forward non-GAAP EPS presents a fair entry point for investors. While the weak RPO figure and moderated growth rates pose near-term challenges, Salesforce is well for future growth. I stand by my assertion: don’t throw in the towel on CRM.