Salesforce: Slowing Growth & Declining Market Share Justify Correction (NYSE:CRM)

John M Lund Photography Inc

This CRM Investment Thesis Is A Lot More Compelling After The Deep Pullback

As we enter the next super cycle of cloud computing, Big Tech, and eCommerce boom, it is unsurprising that global businesses are increasingly searching for opportunities to better connect with their existing consumers while growing adoption across new markets.

And here is where Customer Relationship Management [CRM] comes into the picture since a trustworthy and highly reachable company is more likely to generate better sales while growing loyal consumers

This is while allowing companies to “organize, automate, and synchronize every facet of customer interactions across marketing, sales, customer service, and support,” with the end goal of helping companies work more effectively.

And here is where Salesforce, Inc. (NYSE:CRM) is highly relevant, with the company being the global leader with 21.7% in market share in 2023, based on the latest Worldwide Semiannual Software Tracker report released by International Data Corporation [IDC].

To avoid confusion, I shall be referring to the company as Salesforce and the sector as CRM.

CRM Total Addressable Market [TAM] Size

For now, Salesforce has highlighted a massive TAM of up to $290B by 2026, implying immense opportunities for the company, thanks to its multi-product cloud offerings, increased cross-selling/ CRM consolidation, and resulting lower churn rates among its existing consumer base.

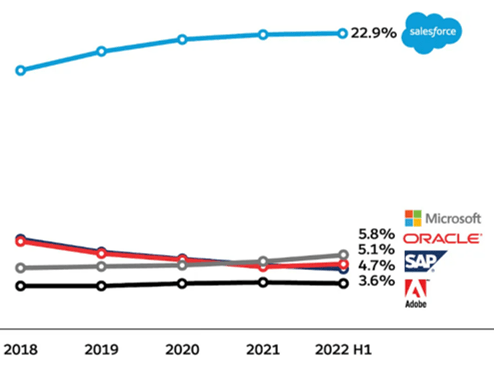

CRM Market Share

IDC

While this may seem promising, readers must also note that Salesforce’s market share has been consistently declining from the 22.1% reported in H1’23 to 22.9% in H1’22, the peak of 23.8% in 2021. While the growing TAM implies a sustained increase in absolute dollar sales, it is undeniable that the market share losses are worrying.

At the same time, while the new Einstein 1 platform is only recently launched in September 2023 and going live in Q1’24, it is apparent that monetization has been slower than expected, despite them “working with thousands of customers.”

This is because we have observed QoQ headwinds in Salesforce’s FQ1’25 top-line miss with decelerating Subscription & Support Revenues of $8.58B (-1.8% QoQ/ +12.3% YoY) and Total Remaining Performance Obligation [RPO] of $53.9B (-5.2% QoQ/ +15.4% YoY).

The QoQ misses in both metrics are concerning indeed since the management has also lowered their FY2025 Subscription & Support Revenue growth guidance to “slightly below +10% YoY & approximately +10% in constant currency.”

This is compared to the original guidance of “approximately +10% YoY/ above +10% YoY CC,” while down from the +12% YoY reported in FY2024 and +18% YoY in FY2023.

As a result of these developments, we can understand why Salesforce’s stock has plunged as it has after the recent earnings call, effectively losing $52.2B of its market cap at its worst.

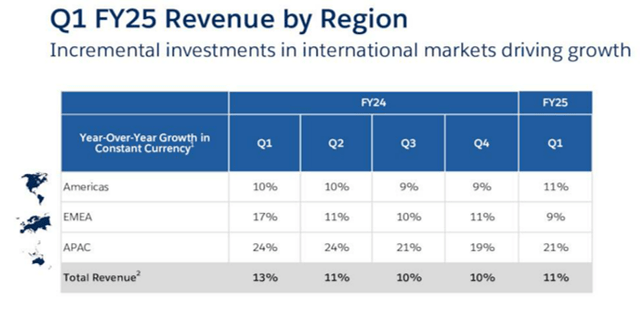

Salesforce’s Revenue By Region

While the management highlighted the stronger bookings in Q4’23 have impacted the Q1’24 numbers, it appears that the uncertain macroeconomic outlook has also impacted Salesforce’s ability to close deals, as it reports “elongated deal cycles, deal compression, and high levels of budget scrutiny” in LATAM and EMEA.

We believe that part of the EMEA headwind may also be attributed to the tougher YoY comparison, with the region reporting +17% YoY CC growth in FQ1’24 (Q1’23) and the +9% YoY growth in FQ1’25 (Q1’24) naturally paling in comparison, worsened by the ongoing conflict in the Middle East.

Therefore, while the EMEA region only comprises 23.4% of its overall revenues (-0.2 points YoY), readers may want to temper their near-term expectations, with Salesforce’s near-term subscription revenue growth likely to notably decelerate after recording an impressive 5Y CAGR growth rate of +19.6%.

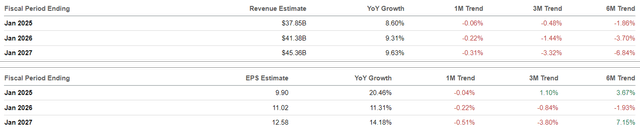

The Consensus Forward Estimates

While the robust multi-year RPO still offers a great insight into Salesforce’s top/ bottom lines, it remains to be seen if the market share losses and/ or deceleration in RPO growth may continue to occur as the consensus also downgraded their forward estimates.

With the SaaS company is expected to generate a top/ bottom line growth at a CAGR of +9.2%/ +15.3% through FY2027, compared to the historical growth of +22.6%/ +34.9% between FY2017 and FY2024, respectively, it is undeniable that the recent correction is justified.

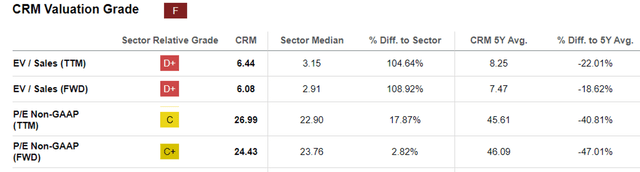

CRM Valuations

The same discount has also been observed in Salesforce’s FWD P/E valuations of 24.43x, compared to its 1Y mean of 27.53x and 5Y mean of 46.09x.

When compared to its CRM peers, such as Microsoft Corporation (MSFT) trading at 35.84x, Oracle Corporation (ORCL) at 22.53x, SAP SE (SAP) at 39.9x, and Adobe Inc. (ADBE) at 25.83x, we believe that Salesforce is a lot more attractive here.

This is after comparing Salesforce’s top/ bottom line growth projection through FY2027 (CY2026) to MSFT at +14.9%/ +16.9%, ORCL at +8.4%/ +11.8%, SAP at +10.4%/ +0.3%, and ADBE at +11.4%/ +13.5%, respectively, implying the former’s more reasonable valuations as its growth prospects mature.

At the same time, readers must note that Salesforce’s lowered guidance has also lowered market expectations, with any earnings beat/ raised guidance likely to trigger potential upgrades in the future.

Combined with the increasingly rich adj operating margin of 32.1% (+1.6 points QoQ/ +4.5 YoY), Free Cash Flow generation of $6.08B (+86.5% QoQ/ +43% YoY), and balance sheet at net cash position of $8.24B (+72.3% QoQ/ +88.5% YoY) in FQ1’25, we believe that the SaaS company remains well capitalized to survive the near-term elongated sales cycle.

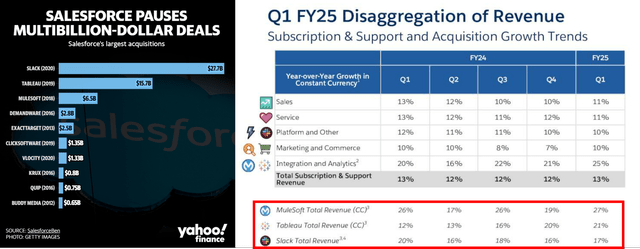

Salesforce’s Growth Opportunities Through Acquisitions

At the same time, readers must also note that Salesforce has sustained its acquisition sprees thus far, with Spiff recently closed for $419M, allowing the company to incrementally grow their vertically integrated SaaS offerings.

This builds upon the company’s $49.9B in acquisitions for Slack, Tableau, and Mulesoft since 2018, with these three segments continually generating robust double-digit growths thus far.

Therefore, while the slowing growth in EMEA continues to pose risks to Salesforce’s investment thesis, especially given the declining market share, we believe that the management remains highly focused on generating long-term growth.

At the same time, we believe that it may be more prudent to give the SaaS company a little more time during its AI monetization journey, along with ADBE, since the generative AI boom has just started to penetrate from the infrastructure to the SaaS layer.

As a result, we may see Salesforce report improved numbers in H2’24 or 2025 instead, further aided by the easier YoY comparison. Only time may tell.

So, Is CRM Stock A Buy, Sell, or Hold?

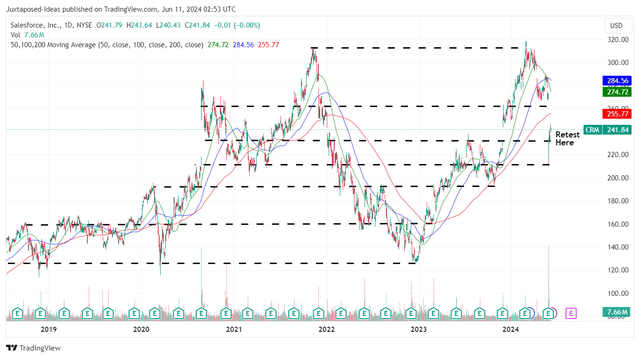

CRM 5Y Stock Price

For now, we have observed bullish support at the recent bottom of $210s, with the Salesforce stock currently also trading lower than its 50/100/200-day moving averages.

Based on the management’s raised FY2025 adj EPS from the original guidance of $9.72 (+18.2% YoY) to $9.90 at the midpoint (+20.4% YoY), and the more reasonable FWD P/E valuations of 24.43x, it is apparent that the stock is trading near our fair value estimates of $241.80.

Based on the consensus FY2027 adj EPS estimates of $12.58 (expanding at a relatively reasonable CAGR of +12.7%) and the same FWD P/E valuations of 24.43x, there seems to be an improved upside potential of +27% to our long-term price target of $307.30. This is attributed to the stock’s deep pullback and the robust visibility into the SaaS company’s top line recognition from the growing RPO, despite the decelerating growth rate.

With Salesforce also recently announcing regular quarterly dividends of $0.40, investors may also look forward to bonus payouts on top of the raised share repurchase program to $10B, negating the impact of the elevated Stock-Based Compensations at $2.84B over the LTM (-10.9% sequentially).

As a result of the attractive risk/ reward ratio and the stock’s promising recovery by +10.9% in the days after the correction, we are initiating a cautious Buy rating here.