Salesforce: This Is A Golden Buying Opportunity (NYSE:CRM)

BlackJack3D

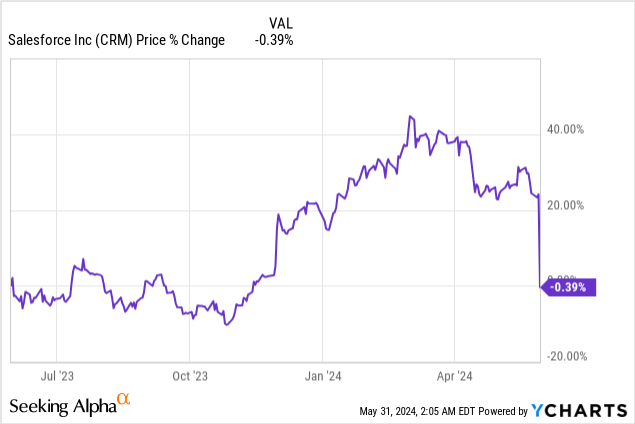

Shares of CRM applications provider Salesforce (NYSE:CRM) plunged 20% after the company disappointed with its FQ1’25 earnings sheet on Wednesday. Specifically, Salesforce missed top line estimates, which are especially important for fast-growing software companies, and the company’s outlook for the second fiscal quarter was also a bit weak. However, other metrics such as free cash flow and share repurchases looked very strong, and I really do believe that long term-minded investors are confronted with an extremely attractive engagement opportunity here!

Previous rating

I rated shares of Salesforce a strong buy in March 2024 due to the company’s strong execution in its core business which helps companies scale their IT applications and because CRM introduced a dividend for the first time ever: Now A Dividend Stock With Upside Potential. I am doubling down on my strong buy rating because the market currently seems to overreact to the firm’s revenue forecast for the second fiscal quarter while ignoring or discounting the considerable progress Salesforce has made in terms of growing its free cash flow (as well as expanding its free cash flow margins).

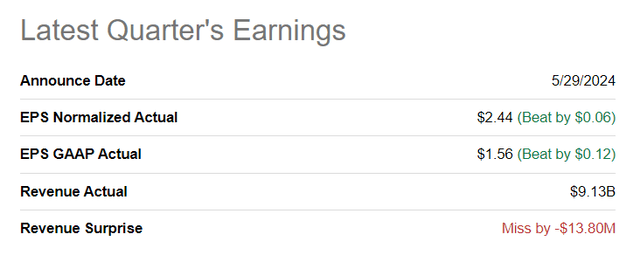

Salesforce misses on the top line

Salesforce reported adjusted earnings of $2.44 on revenues of $9.13B for the first fiscal quarter. While adjusted earnings beat consensus estimates by $0.06 per-share, revenues fell slightly short of Wall Street expectations, in part because revenue growth moderated in the Sales and Services segments and some customers became more budget-conscious. The top line miss combined with a light forecast for FQ2’25 revenue growth explains the large decline in Salesforce’s share price yesterday… which by the way eradicated the stock’s 20%+ year-to-date return completely.

A golden buying opportunity as the market overreacts

The market has a tendency to overreact to both positive and negative developments, and I believe oftentimes this creates an opportunity for investors. In the case of Salesforce, whose shares slumped 20% on Thursday after the company reported earnings for its first fiscal quarter of FY 2025, investors are facing a new strong buy opportunity, in my opinion.

Salesforce’s first fiscal quarter is typically a strong quarter for the company as clients extend their software contracts, which results in a boost to the top line. In FQ1’25, Salesforce generated $9.1B in revenues, showing 11% growth year over year… which was the same top line growth rate as in the previous quarter.

What really stood out in Salesforce’s earnings report, however, was the massive progress the company is seeing with its free cash flow ramp. In FQ1’25, Salesforce generated $6.1B in free cash flow on revenues of $9.1B, which calculates to an impressive free cash flow margin of 67% (+15 PP year over year).

|

$millions |

FQ1’24 |

FQ2’24 |

FQ3’24 |

FQ4’24 |

FQ1’25 |

Y/Y Growth |

|

Subscription and Support |

$7,642 |

$8,006 |

$8,141 |

$8,748 |

$8,585 |

12.3% |

|

Professional Services |

$605 |

$597 |

$579 |

$539 |

$548 |

-9.4% |

|

Revenues |

$8,247 |

$8,603 |

$8,720 |

$9,287 |

$9,133 |

10.7% |

|

Cash Flow From Operating Activities |

$4,491 |

$808 |

$1,532 |

$3,403 |

$6,247 |

39.1% |

|

Capital Expenditures |

($243) |

($180) |

($166) |

($147) |

($163) |

-32.9% |

|

Free Cash Flow |

$4,248 |

$628 |

$1,366 |

$3,256 |

$6,084 |

43.2% |

|

Free Cash Flow Margin |

51.5% |

7.3% |

15.7% |

35.1% |

66.6% |

+15.1PP |

(Source: Author)

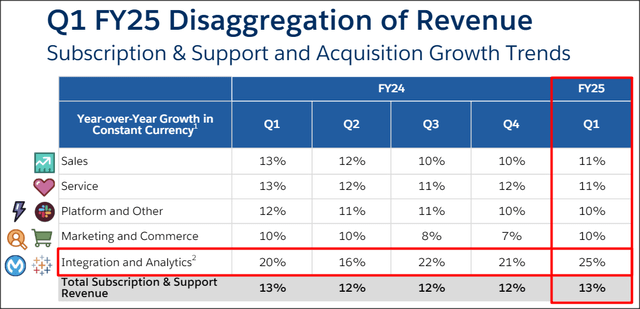

The strength in free cash flow growth is due to Salesforce bringing its expanding product suite to more customers as well as strong growth specially in Integration & Analytics… which offers enterprise customers business intelligence insights and automation services. This segment saw 25% top line growth in FQ1’25, the most of any segment, and includes MuleSoft which provides integration and automation solutions for the lucrative enterprise market. Integration and Analytics, especially using the lever of AI, has considerable growth potential going forward. Salesforce missed expectations, chiefly because growth was not as strong in the Sales and Services segments as expected (but still in the double-digits). Given that Salesforce confirmed its full-year revenue outlook and Integration & Analytics saw a 4 PP revenue acceleration in FQ1’25, I believe the outlook for the stock in the near term remains positive.

Salesforce returned $2.6B of this free cash flow in the March quarter to shareholders ($2.2B in the form of stock buybacks) which calculates to a free cash flow return percentage of 43%. With the software company generating a total of $11.0B in free cash flow in the last year, I would expect the company to return more cash to shareholders going forward. This would obviously make sense, in part because Salesforce’s shares are now trading at a much lower price-to-earnings ratio.

Investors overreact to top line guidance

The outlook for the second fiscal quarter was a travesty, in my opinion, not so much because the forecast was so bad, but because it took the spotlight off of where it belonged: Salesforce’s impressive free cash flow growth.

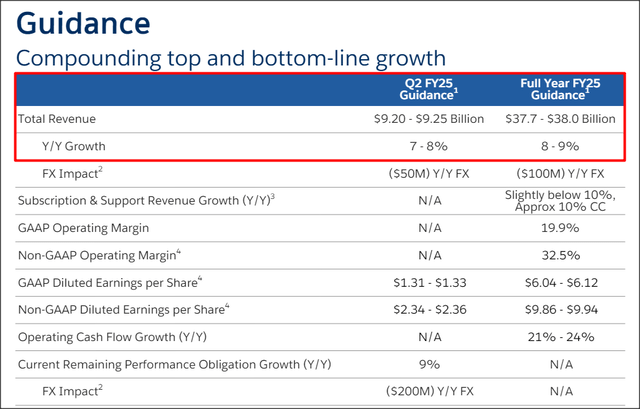

Salesforce projects $9.20-9.25B in top line growth in FQ2’25 which represents a growth rate of only 7-8%, meaning the software firm could see an up to 4 PP growth slowdown quarter over quarter. However, Salesforce also confirmed its previous full-year revenue guidance of $37.7-38.0B (implying an unchanged 8-9% top line growth rate) which also indicates that investors are a bit overreacting here.

3 catalysts for an upside revaluation

I see three catalysts that could drive a share price revaluation to the upside (and towards the longer term P/E average, which I discuss in the next section) within the next year:

- Strong execution in the Integration & Analytics segments, supported by Salesforce’s organic AI solutions — Einstein AI, which I discussed in my last work on Salesforce in March — that help businesses gain cheap insights into the efficiency of their operations. A continual acceleration in this segment’s revenue growth could help change the narrative that Salesforce’s growth is ‘moderating’. Growing product adoption of Einstein AI, which is included in Integration & Analytics, is one strong catalyst that could drive a return to a higher valuation multiplier

- Continual gains in free cash flow and an expansion in the customer base

- Higher stock buybacks for shareholders (both in absolute dollars and as a percentage of revenues) as well as higher dividend returns. Salesforce recently introduced a dividend for the first time, which makes the software company’s shares more attractive from a capital return point of view. If Salesforce decides to raise its dividend aggressively (which would make sense given the upsurge in free cash flow), a lot more money could be returned to shareholders through distributions.

Salesforce’s valuation

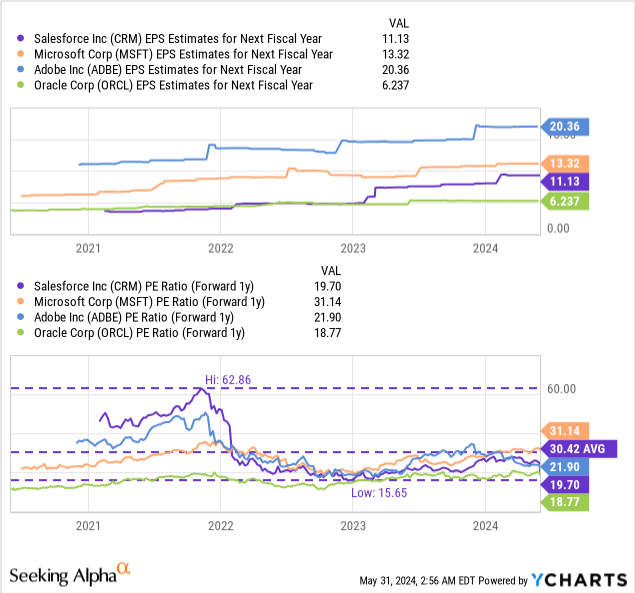

Besides strong free cash flow growth and truly impressive free cash flow margins, I believe Salesforce’s 20% valuation drop-off now makes shares a golden investment opportunity.

The company has said that it will strive to achieve up to $38B in revenues in FY 2024 and Salesforce is hugely profitable, something that investors seem to sometimes forget. Salesforce is currently trading at a price-to-earnings ratio of 19.7X which represents a 35% discount to the longer term (3-year) price-to-earnings ratio and a 14% discount to the industry group average of 22.9X which includes Microsoft (MSFT), Adobe (ADBE) and Oracle (ORCL).

In my opinion, I believe Salesforce could return to its 3-year average P/E level as investors really didn’t have much of a reason to sell shares on Thursday especially when realizing that the software company confirmed its full-year revenue outlook. With free cash flow booming, I believe a revaluation could take place quickly as well. If Salesforce revalues to a 30.4X P/E ratio — which is not a high ratio for a company that is growing its free cash flow 43% Y/Y — the software company could have a fair value of $336 per-share, representing 54% upside revaluation potential.

Risks with Salesforce

The obvious risk for Salesforce is a continual slowdown in the growth rate in its core businesses. The second fiscal quarter forecast indicated that moderating top line growth is a real headwind for the software company. However, an offsetting effect, in my opinion, is that the company’s free cash flow growth is accelerating… which should give Salesforce another powerful lever to create value for shareholders: stock buybacks. All things considered, I believe that the risk profile has significantly improved on Thursday, not deteriorated.

Closing thoughts

I believe that Salesforce didn’t deserve this aggressive sell-off on Thursday, and I am a buyer here. Although it is true that the forecast for FQ2’25 was a bit light, and the slowdown in top line growth should not be ignored, the real progress is the massive ramp in free cash flow that indicates that Salesforce is a highly profitable (and still growing) software enterprise… and as far as I can tell Salesforce didn’t get any credit for this at all. Therefore, I believe investors focused on the wrong things on Thursday, which in turn creates a very attractive engagement opportunity for long term investors. With Salesforce also seeing a massive expansion in its free cash flow margin, the software firm has considerable stock buyback potential in FY 2024 and beyond!