Sea’s fintech arm was once just its sidekick. Now, it’s a budding star

During Sea Limited’s earnings call on 15 May, the Singapore-headquartered tech conglomerate made it clear: it is ditching its old playbook, and it is paying off.

Its digital financial-services arm, Seamoney, logged nearly US$149 million in

adjusted Ebitda

Adjusted Ebitda

A financial metric calculated by removing the one-time, irregular, and non-recurring items from Ebitda (Earnings before interest, taxes, depreciation, and amortisation)

adjusted Ebitda

Adjusted Ebitda

A financial metric calculated by removing the one-time, irregular, and non-recurring items from Ebitda (Earnings before interest, taxes, depreciation, and amortisation)

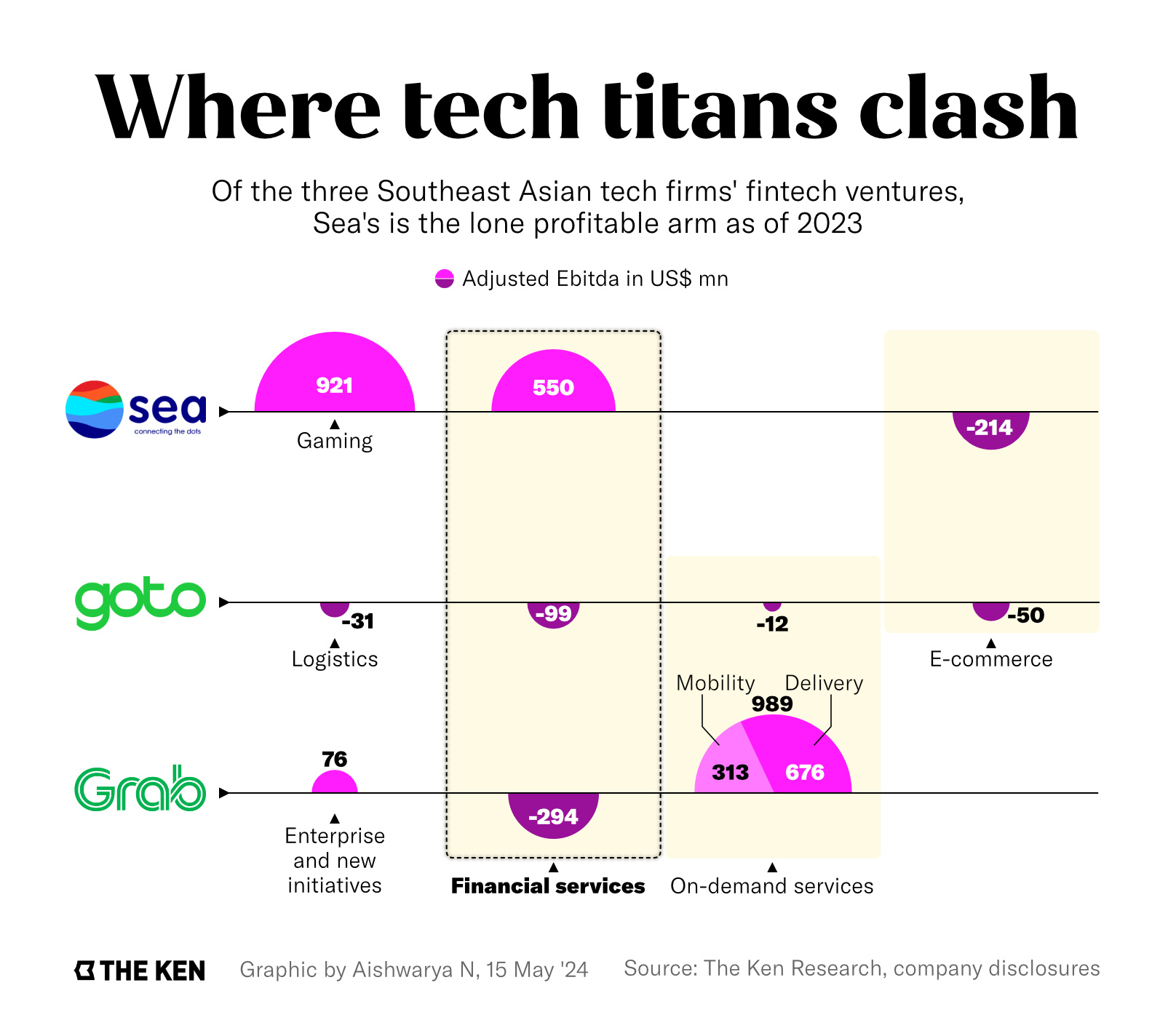

Overall, the company’s gaming arm Garena has done well—still drawing the biggest quarterly earnings. Although, its e-commerce arm, Shopee, registered losses for the quarter ended March. What sets Seamoney’s growth apart is that, even in 2023, it was the only digital financial-services arm among Southeast Asian tech giants to achieve positive adjusted Ebitda.

Sea, Grab, and Goto, each operate in diverse segments, including e-commerce, ride-hailing, and delivery services. But given their customer-centric nature, one area where they all intersect is digital financial services.

Initially, these digital arms were set up just to cater to their own platforms. For instance, Seamoney started as a payments-service provider for Shopee.

But now, it is pulling ahead of the pack by establishing a diversified identity.

The company’s notable performance has roots in a conscious “strategic differentiation”, said Helena Wang, research analyst at Phillip Securities, a Singapore-based wealth-management firm.

“While Grab and Goto also integrate e-commerce and other features with financial services, Sea has been proactive in offering unique features and expanding its fintech offerings beyond traditional payment solutions.”