Serve Robotics, An Uber Spinoff, Is A Promising But Speculative Stock (NASDAQ:SERV)

Devrimb/iStock via Getty Images

Investment thesis

“Why move 2 pound burritos in 2 ton cars?”

That’s both the challenge to existing last-mile deliveries and the promise of a new public company, Serve Robotics Inc. (NASDAQ:SERV). The quotation comes from the home page of its website.

Spun out from Uber Technologies, Inc. (UBER), the firm develops and operates small, AI-powered robots being used in the food delivery business.

Serve has power backers such as Uber, proven technology, and potential price-per-delivery that is significantly lower than the costs of car + driver deliveries.

Still, this is a young company that began trading roughly two months ago, and management must show it can deliver for shareholders as effectively as it promises to deliver food. For now, Serve is a speculative, albeit promising, stock.

About Serve

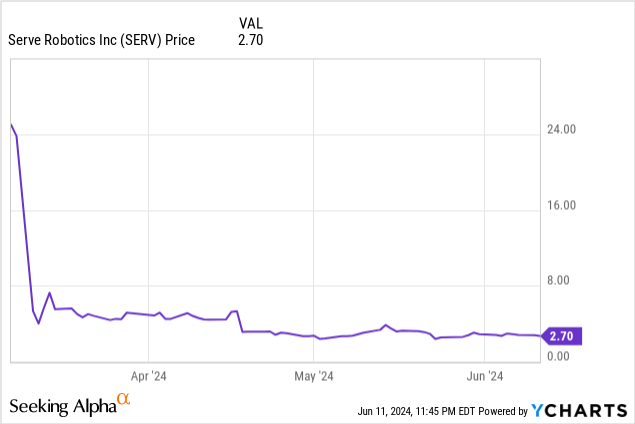

As a result of a merger with an acquisition corporation, Serve Operating Co. transitioned to Serve Robotics Inc. It subsequently became a public company on March 7, 2024, with its shares opening at $15.00.

Investors bid the price up to $25.00, only to see it fall to $5.32 two trading days later, and since then, it has drifted down, closing at $2.80 on June 10.

The firm has significant backers and/or partners:

- Uber has invested $11.5 million to date, and because of the minority interest it retained when it spun off Serve in 2021 is the largest shareholder and commercial partner.

- Nvidia Corporation (NVDA) has been a technical partner since 2018 and has invested $12 million so far.

- Delivery Hero, a German food delivery platform, was an early investor in Serve.

- 7-Eleven was an early investor and the first convenience store partner, with 13,000 stores in the U.S. and Canada.

- Magna New Mobility and Magna International (MGA) have agreements in which Magna becomes the exclusive contract manufacturer of Serve’s robots. An earlier deal saw Magna paying Serve in connection with a Serve software services contract.

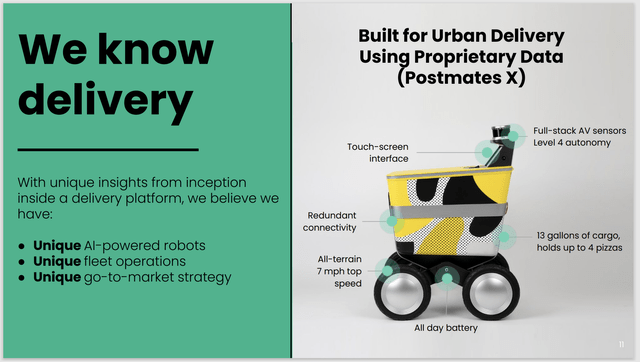

With these partners, Serve has developed and commercialized AI-powered sidewalk delivery robots. Its history includes over 10 thousand deliveries for partners, including Uber Eats and 7-Eleven. This slide from the firm’s May 2024 Investor Presentation shows one of its models and its claims of uniqueness:

SERV Robots (Serve May 2024 investor presentation)

Last mile tailwinds and headwinds

Serve operates in a niche known as last mile delivery, the final leg of the journey from product origin to arrival in the hands of the buyer. It has become increasingly important as ecommerce expands, as competition among food outlets increases, and as price competition intensifies in most retail environments.

Its robots address several common challenges in the last-mile industry. It is low emission, so it should have greater acceptance among consumers than automobile deliveries. It addresses the cost issue by eliminating the need for drivers and autos. And, these robots operate on sidewalks rather than streets, allowing them to avoid traffic slowdowns and stoppages.

Devices in this niche are limited to small items, such as food packages, because there isn’t a human who can assist with lifting or maneuvering large packages through doors or narrow areas. Because they use sidewalks rather than streets, robots may cause congestion that pedestrians object to, and eventually be limited or banned from sidewalks.

Serve is entering a large and growing market. A report from Grand View Research argues that the last mile delivery market was valued at $132.7 billion in 2022, and was expected to enjoy an 8.8% compound annual growth rate between 2023 and 2030. There are other, differing assessments, but it should be safe to estimate high single-digit growth through the rest of this decade.

Competition in robotic delivery

There was a flurry of media reports when Amazon.com, Inc. (AMZN) began testing Scout, a similar robot in 2019, but since then, little has been said about the project. The name does not appear in the retailer’s most recent 10-K or 10-Q. Those early reports indicated Scout would be used to deliver just its own packages.

Operating competitors include Starship Technologies, which claims to have made over six million autonomous deliveries, and Kiwibot, with its “versatile emotion AI multiplatform for tailored robots”.

Serve appears to have a competitive advantage over companies such as Starship and Kiwibot now that it has become a public company. That gives it access to patient capital that may not be available to other firms (although Amazon would be an exception, if Scout delivers for other companies). I used the word “appears” because it is possible other firms may have backing that is not known.

In its Form S-1 filing on June 7, 2024, Serve pointed out that, like all newer companies, it faces competition from existing and emerging companies. It also noted that competition is intense to recruit individuals with experience at designing, producing, and servicing robots and their software.

Competition with traditional last mile operators

Robot operators have several advantages over traditional car + driver networks. That starts with labor costs and extends to capital costs, the extra costs connected with buying cars, and higher variable costs including fuel, insurance, and taxes.

Serve estimated, in its investor presentation, that it will be able to make deliveries for $1.00; that’s the “expected average cost of last mile delivery by Serve robots with increased autonomy and adoption.”

There’s another element that could give robots an edge, and that is tipping. Since inflation headed upward, I have seen many complaints about tipping, especially for pickup and delivery. For many consumers, it means paying extra for what is often an almost invisible service.

Overall, my take is that the company is getting into a currently competitive business and one that may become intensely competitive in coming years. Still, these small-package delivery robots serve useful purposes and the industry should flourish as a result. Part of that growth is likely to come at the expense of traditional delivery.

Growth

The company had over 100 robots when it filed its 10-Q for the first quarter, and eventually wants to grow that number to 2,000 through its partnership with Uber. It does not plan to add any more robots this year, because of capital constraints, and will add new devices as financing allows.

In the longer term, if it rolls out to at least all Uber Eats and 7-Eleven locations in the U.S., it will have a viable business. Both Uber and 7-Eleven also have extensive international operations, so that is another growth opportunity in the medium to long term.

There are other opportunities as well. The Spoon reported on April 4 that Chili’s parent company is “secretly” piloting a trial with Serve. Walmart is also testing Serve’s robots at its headquarters in Arkansas, according to AutomatedWarehouse.

Serve also sees future revenue from licensing its technology to companies that want to create their own robots for other applications. That was part of its deal with Magna.

Having already performed tens of thousands of deliveries, Serve has proof that its robots can do the jobs for which they were designed. While the company will no doubt continue research and development on the hardware and software, its immediate challenge is in marketing and sales.

If the robots work well for Uber Eats and 7-Eleven, they should be able to compete with other industry players. Indeed, given these credentials, management needs to do better than the industry’s 8.8% average compound growth.

Finances

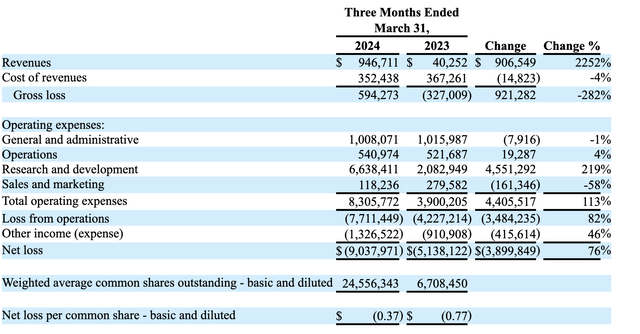

Serve filed a 10-Q for the first quarter of 2024 on May 15, and it showed a major revenue gain over the same period last year:

SERV Income Statement (10-Q for Q1-2024)

Of the $946,711 in Q1-2024 revenue, $850,000 came from its contract with Magna. That contract will end on June 30, and beyond that, Serve said, “Service revenue streams may be inconsistent in the future.”

A couple of other points to note:

- R&D costs were up, and the company explained, “This increase was due primarily to stock compensation attributable to the Magna Warrant for $4.2 million, as well as increased operating expenses for headcount and software as the company executed its technology roadmap.”

- As a result of its equity financing, its share count more than tripled year over year, from 6,708,450 in Q1-2023 to 24,556,343 this year. Expect more dilution as the company grows.

Management and strategy

Ali Kashani, a co-founder of Serve, is its Chief Executive Officer and a member of the board. Before becoming CEO in 2021, he was an executive at Postmates, an on-demand food delivery platform. Previously, he was a co-founder and Chief Technology Officer at Neurio Technology, Inc. In addition to having 15 granted or pending patents, he received a doctorate in Robotics from the University of British Columbia.

Chief Financial Officer Brian Read, who is a Certified Public Accountant, joined Serve about six weeks ago, after serving as Global Controller at REE Automotive Ltd (REE). Since being an associate at PricewaterhouseCoopers between 2011 and 2017, he has worked at four different firms in the past seven years. Investors will hope Serve has a commitment from Read that he will stay at the company for a meaningful number of years.

Serve’s business model is laid out in this slide from the May 2024 investor presentation:

SERV Strategy slide (investor presentation)

I’m pleased to see the company has a plan to have financial partners pick up at least the capital costs of (presumably) developing and building new robots. Lower capex means it should reach profitability sooner.

Valuation

Serve apparently went public amid bullish speculation, but its share price was dragged down by the reality of being a new public company with negative earnings:

We will need to see at least several more quarters, at least, to determine Serve’s valuation. The same holds for projecting future prices.

Overall, though, the company has a proven technology, a large and growing total addressable market, and perhaps most importantly, big and deep-pocketed backers. Given its agreement with Uber to deploy 2,000 robots, the odds are high that the share price will rise soon.

Since there is little history and no way to assess its valuation or project a share price, I rate Serve a Hold. I would have no trouble rating it a Buy after seeing a few quarters of growing revenue and earnings. There are no other ratings at this time.

Risks

No matter how bright the prospects of a young technology company, uncertainty remains. Will its backers be patient as the company expands its operations? Will management be able to consistently deliver on its promises?

More broadly, the industry faces several challenges, not the least of which is pedestrians complaining to their local governments. Such complaints might include safety, congestion, and more.

Similarly, all industry players have exposure to potential lawsuits from individuals who argue they have been injured in some way by unattended robots. Potential class action lawsuits could be even more damaging. Presumably, Serve has suitable insurance coverage, but high value lawsuits could cause its rates to jump.

Robotic delivery is a highly competitive industry, and Serve will need to recruit and keep technologically sophisticated scientists and technicians. And if they are in place, the board of directors will need to provide suitable targets for research and development.

As the first week of trading showed, its share price has been highly volatile and likely will be again. Every quarterly report may bring negative news that drives down the share price; it’s also possible the market will overreact to any news at any time.

Conclusion

I’m struck by Serve Robotics’ potential to make deliveries for just a dollar. Assuming sidewalk robots aren’t sidelined by unhappy pedestrians, this could kill conventional car + driver deliveries.

Its partnerships with heavy-weight backers also should impress future investors. Unlike most startups, it does not have to find new customers right away; between Uber and 7-Eleven alone, it has literally thousands of opportunities at hand.

Yet, unless you are a speculative investor or someone who wants a few high -risk, high-reward stocks in their portfolio, this will not be a stock for you. I rate it a Hold.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.