ServiceNow Is A Generative AI Winner And Compounder (NYSE:NOW)

Komsann Saiipanya/iStock via Getty Images

Approximately one and half years following the public release of ChatGPT, investors should have some idea about the true beneficiaries of generative AI. Generative AI hype sent many tech stocks soaring in early 2023, but the last several quarters have shown that Wall Street will no longer believe in just hopes and dreams.

ServiceNow, Inc. (NYSE:NOW) is one of the few names which has fully earned its generative AI hype, though the stock has sold off in apparent sympathy with the broader correction.

Generative AI has helped the company to sustain above-market top-line growth rates even as it scales. While revenue growth rates must inevitably decelerate at some point, I expect NOW to sustain a premium valuation due to mission-critical product offerings as well as being a key enabler of a generative AI future. The stock is not cheap, but I still see market-beating return potential from here. I reiterate my buy rating for the stock.

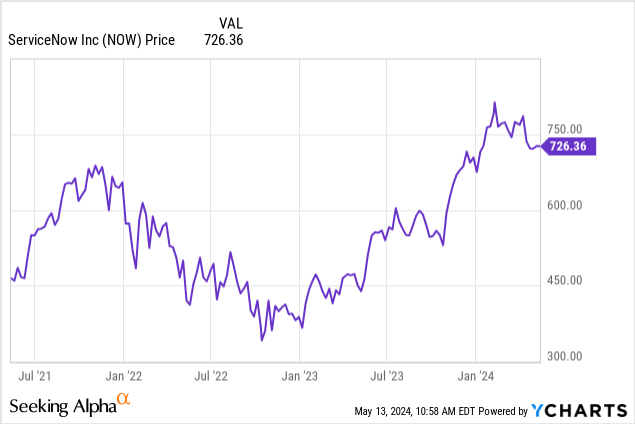

NOW Stock Price

I last covered NOW in February, where I explained why I was sticking with the name despite its furious rally.

The stock has since underperformed the broader market by double-digits, offering an attractive entry point.

NOW Stock Key Metrics

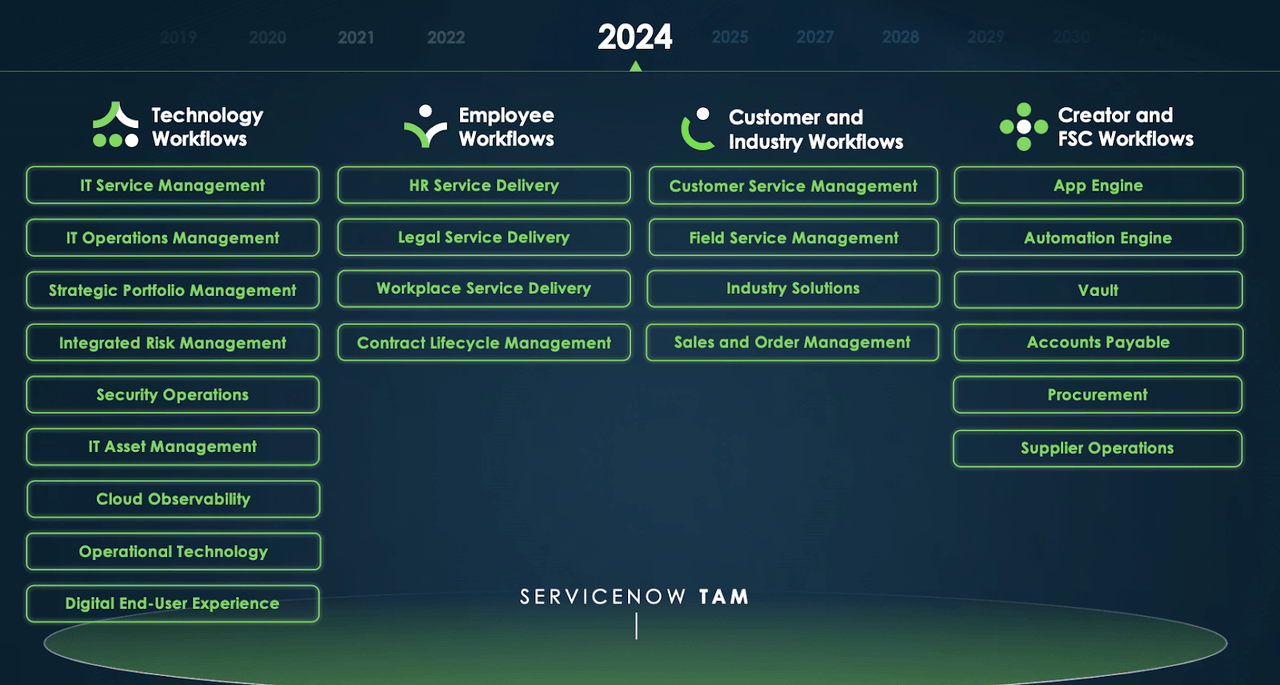

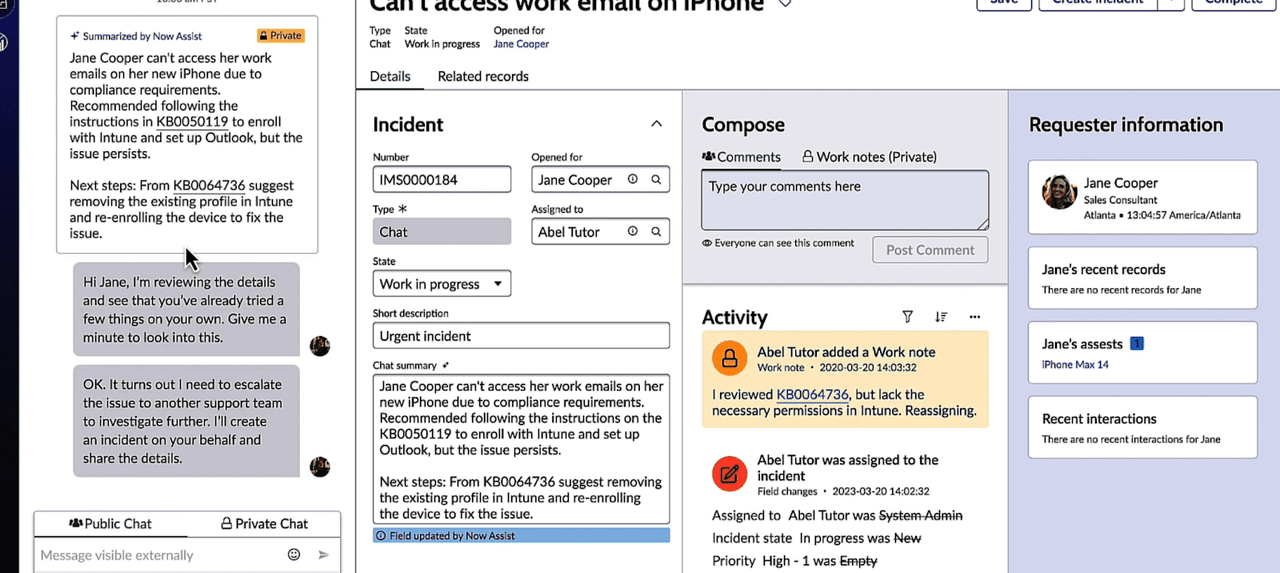

NOW is an enterprise tech company whose product is digital workflows. These workflows can range from things like connecting employees to the right person for HR questions, or for answering IT-related issues.

Even before the rise of generative AI, NOW was already central to a more digital and automated life. Generative AI has only helped to increase its addressable use cases, as well as enhancing their existing product offerings. For example, NOW offers generative AI-powered summaries to help service agents become more quickly familiar when taking over existing cases.

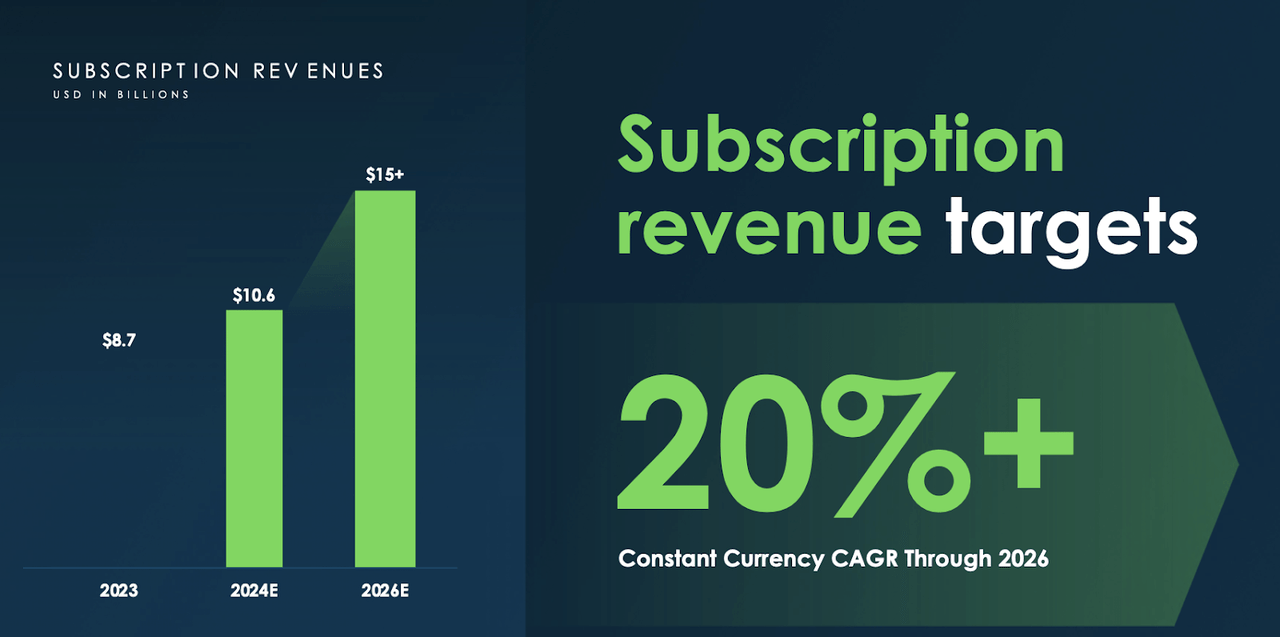

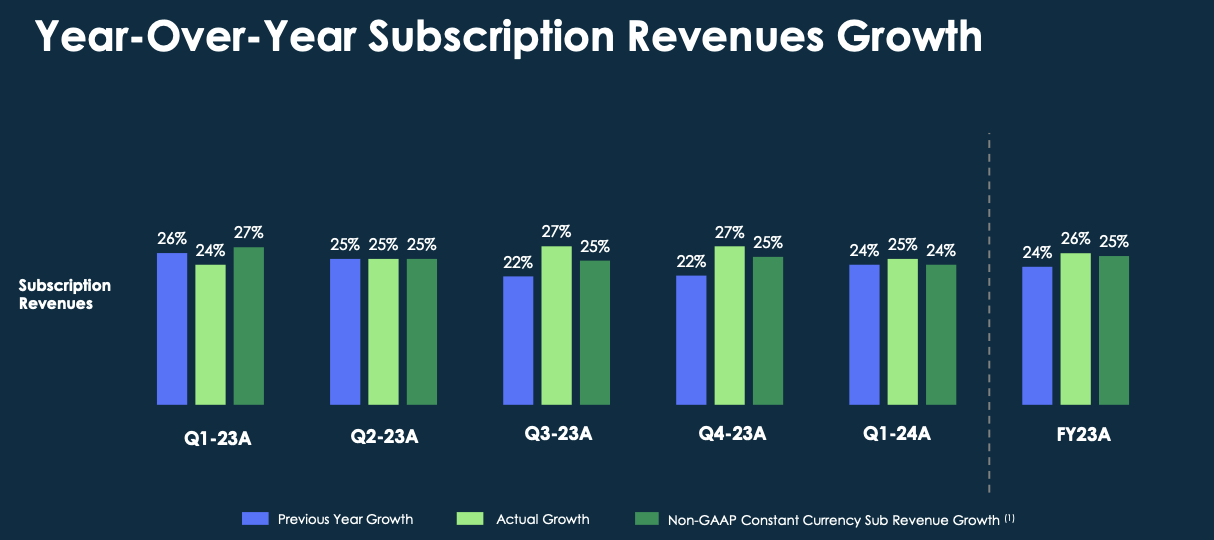

In the latest quarter, NOW delivered 25% YoY growth in subscription revenues to $2.52 billion, slightly surpassing guidance for $2.515 billion. The 24% constant currency growth rate was impressively equivalent to the growth rate posted in the prior year’s first quarter. There are many smaller tech peers who would kill to have this kind of top-line growth in the post-pandemic and higher interest rate world. NOW’s ability to sustain such aggressive top-line growth is highly indicative of the company’s compelling product offerings.

2024 Q1 Presentation

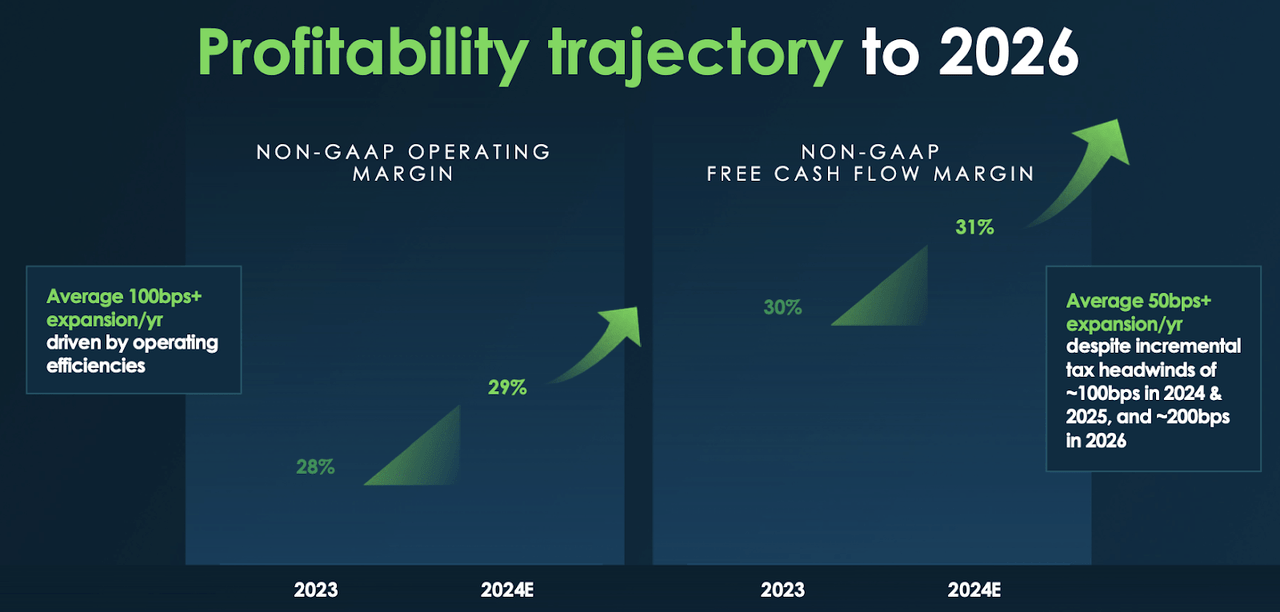

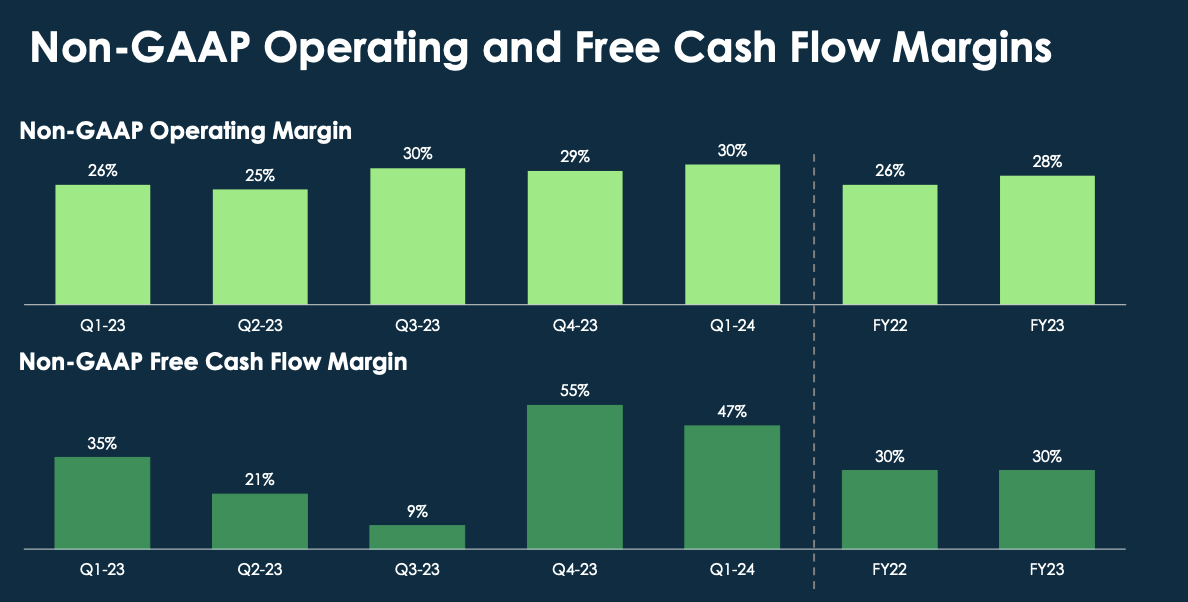

NOW paired the strong top-line growth with a 30% non-GAAP operating margin, exceeding guidance of 29%. I note that NOW remains profitable on a GAAP basis as well.

2024 Q1 Presentation

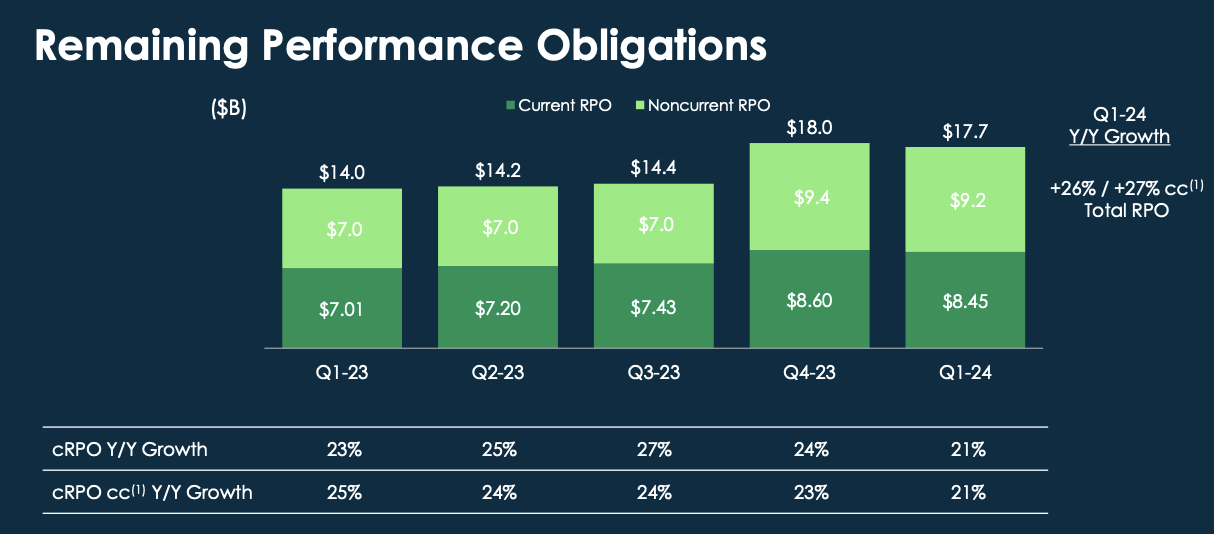

NOW delivered 21% YoY growth in current remaining performance obligations (“CRPOs”), exceeding guidance of 20%. Investors often view cRPO growth as a leading indicator for future revenue growth. The fact that NOW is pairing strong revenue growth with almost equally strong cRPO growth suggests that the company may be able to sustain its aggressive growth rates at least into the next year.

2024 Q1 Presentation

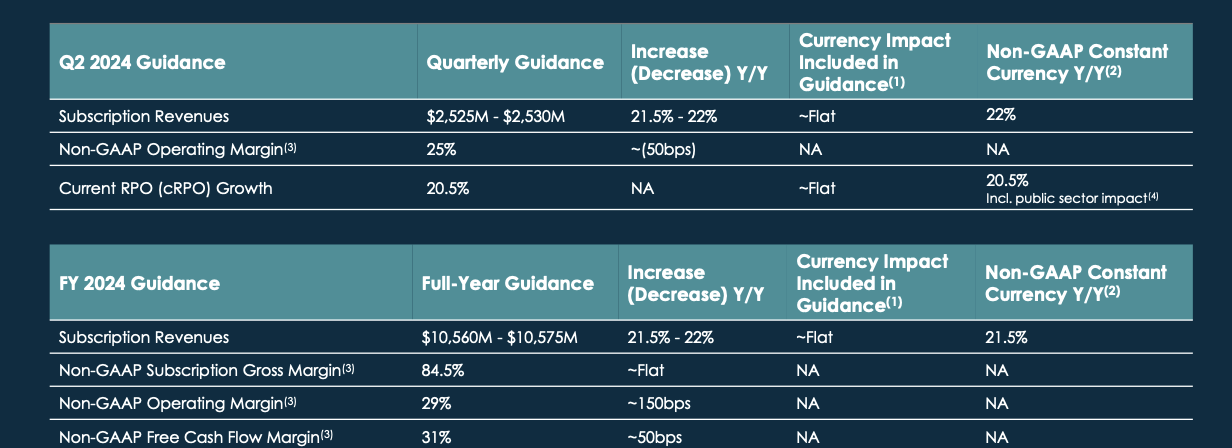

NOW ended the quarter with $8.8 billion of cash and investments versus $1.5 billion of debt, representing a bulletproof net cash balance sheet. The company repurchased 0.2 million shares for $175 million in the quarter. Recall that management had authorized the share repurchase program with the primary objective of offsetting dilution. Looking ahead, management has guided for the second quarter to see up to 22% YoY revenue growth to $2.53 billion, 25% non-GAAP operating margins (in-line with 2023), and 20.5% cRPO growth.

Given that the company just posted 30% non-GAAP operating margins, I expect this to be the easiest metric to beat. Management also raised full-year subscription revenue growth guidance slightly, expecting up to 22% YoY growth to $10.575 billion.

2024 Q1 Presentation

On the conference call, management reiterated confidence in their medium-term guidance of at least 20% annual subscription revenue growth through 2026, to end up at $15 billion in subscription revenues by then. The company also reiterated that target in their subsequent 2024 Investor Day.

Management has also guided for around 100 bps of annual operating margin expansion, implying around 31% non-GAAP operating margins by 2026.

ServiceNow, Inc. management expressed their belief that “process optimization is the number one Gen AI use case in the global economy today.” They cited their ability to help customers to consolidate technology governance, helping to reduce cybersecurity risk, all while offering “immediate business value from AI.” The company’s positioning explains why I view it to be one of the highest quality names in the tech sector and market overall today.

Is NOW Stock A Buy, Sell, or Hold?

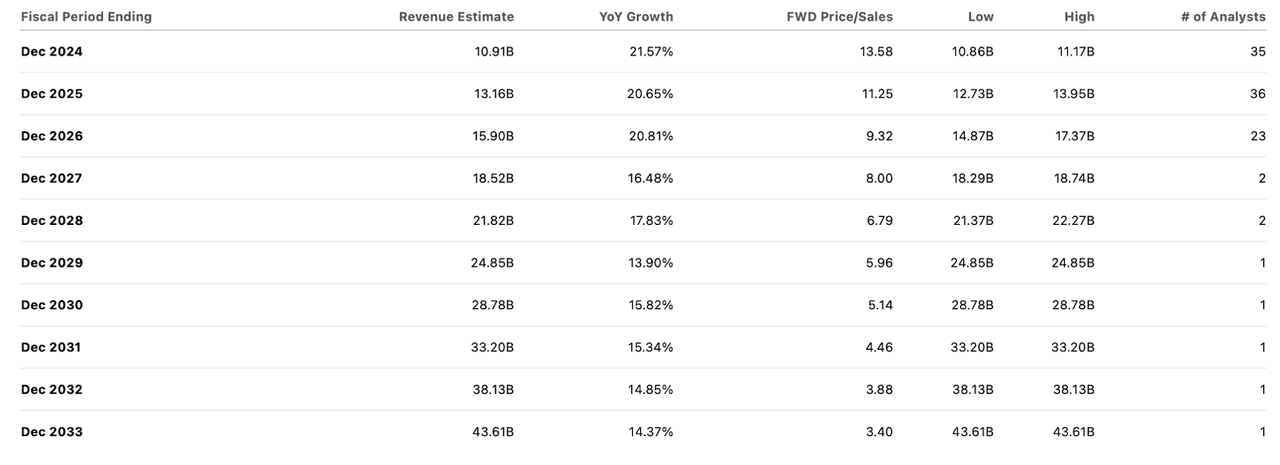

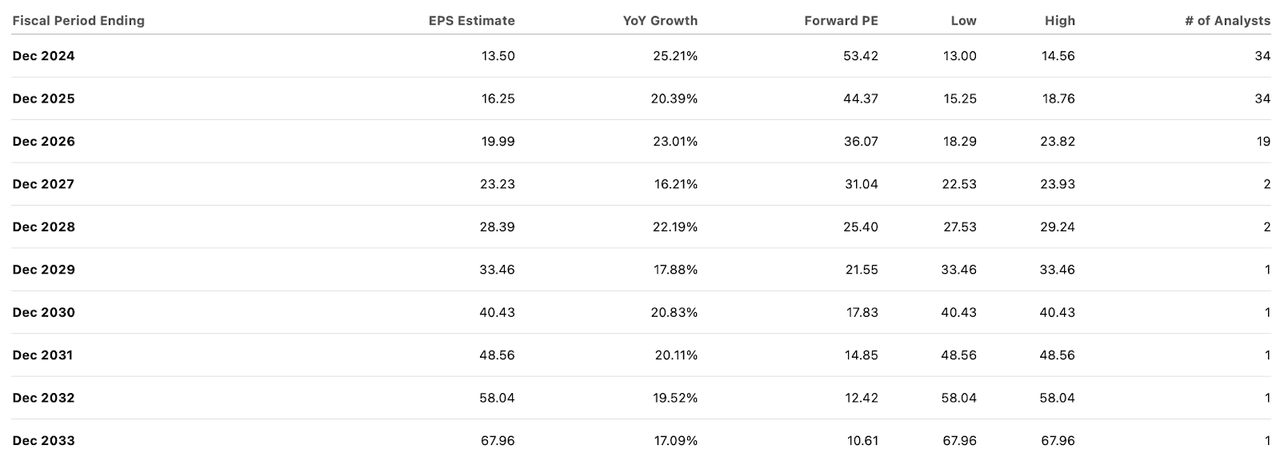

Consensus estimates call for NOW to sustain its low 20s growth rate for a handful of years before seeing gradual deceleration. It is notable that consensus estimates call for the company to smash its 2026 $15 billion target with $15.9 billion in projected revenues.

The stock trades at 53x forward earnings, but operating leverage is expected to lead to rapid earnings growth.

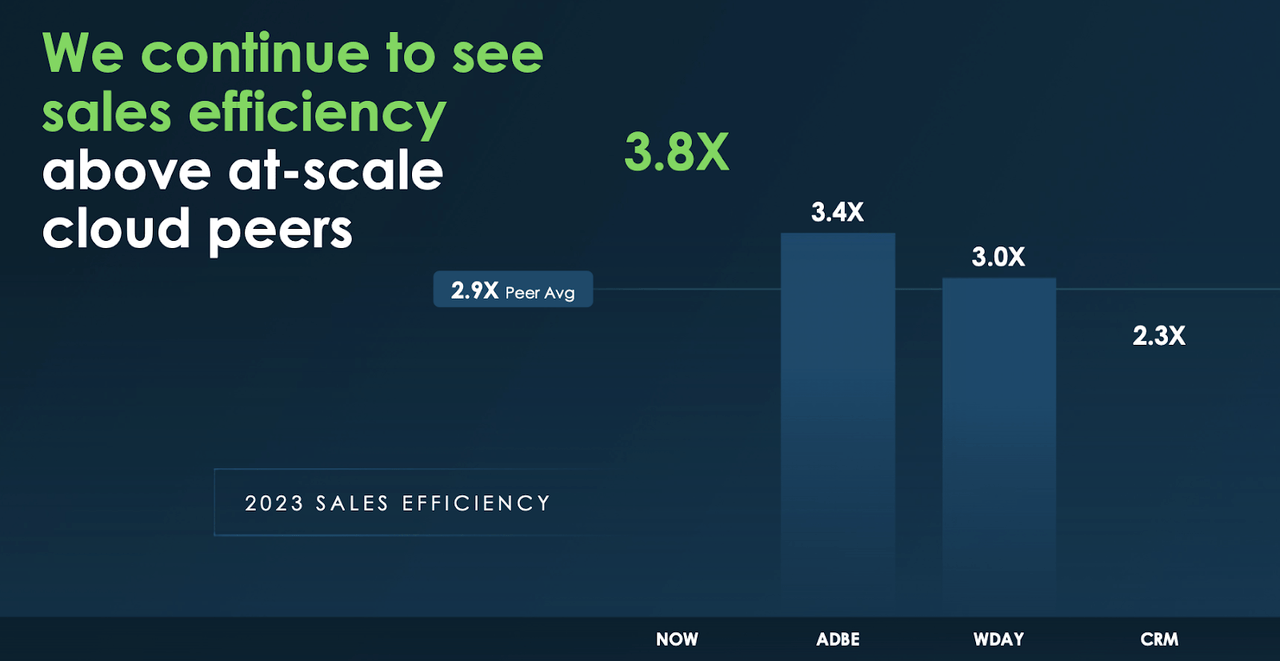

I typically model 30% long-term margins for high quality tech stocks, but I expect NOW to deliver a higher 40% number. In part due to the company’s mission-critical positioning, the company has shown an ability to drive greater sales efficiency relative to peers.

I expect the company to invest in generative AI in the near term, but for margins to expand consistently thereafter. Based on a 30x long-term earnings multiple, I can see the stock settling at around 12x sales. With the stock currently trading at just under 14x sales, that means that the stock might deliver shareholder returns almost in-line with its top-line growth rate, perhaps higher as GAAP profitability improves further.

With ServiceNow, Inc. stock trading at healthy valuations, it isn’t so easy to see a case for substantial multiple expansion, but I could see this stock delivering solid market-beating returns from growth alone. Even if we assume multiple compression to around 8x sales (implying a 20x earnings multiple), then the stock is still priced for around 9.5% annual return potential assuming it can hit what appears to be achievable consensus estimates. The company’s highly sticky business model, solid GAAP profitability and net cash balance sheet make the potential return profile quite attractive.

ServiceNow Stock Risks

It is possible that NOW eventually faces competitive threats, which may impact its top-line growth rates and retention rates. This would impact not only the financial numbers but also the stock valuation, as the stock may lose some of its relative premium to peers. Management might be too optimistic about their ability to sustain such aggressive top-line growth rates. In particular, it is possible that we still do not truly understand the long-term impacts of generative AI, and perhaps it eventually becomes a risk for the company. The stock trades at a rich premium to peers, and this might imply greater volatility in market downturns, even if the stock held up pretty well during the 2022 tech crash.

ServiceNow Stock Conclusion

ServiceNow, Inc. has proven itself to be a real generative AI winner and has somehow managed to sustain aggressive top-line growth rates even at scale. The company has a net cash balance sheet and is profitable on a GAAP basis. The valuation looks quite reasonable given the low-risk profile and aggressive forward growth rates. I reiterate my buy rating for ServiceNow, Inc. stock.