Shenandoah Telecommunications Q1 Earnings Preview (NASDAQ:SHEN)

shaunl/E+ via Getty Images

I am updating my previous analysis on Shenandoah Telecommunications (NASDAQ:SHEN) in advance of Q1 2024 earnings, which will be released pre-market on Friday, May 3rd.

I previously rated Shenandoah a sell for the following reasons:

- ROI on fiber was too low due to slow customer acquisition and management didn’t seem to consider competition in their growth plans

- Balance sheet was weakened by the Horizon Acquisition

- DCF analysis showed that the stock was overvalued without historically high levels of growth

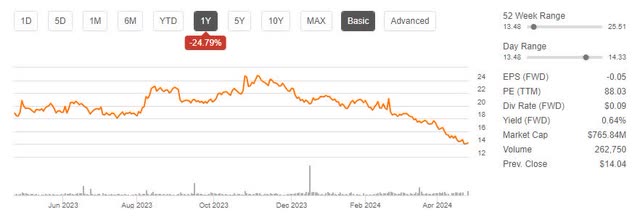

Since then, Shenandoah is down more than 30%, while the S&P 500 has yielded upwards of 6%.

SHEN price trend (Seeking Alpha)

I am bearish on Shenandoah as they continue to invest more and more into fiber expansion but are not delivering the growth or return needed to support the current share price. In addition, the balance sheet will weaken this year on the Horizon of acquisition directly already low cash flow away from investors.

DCF analysis yields a $1 price target on expected growth and would require unprecedented 36% growth to support the current price. With that said, a buyout becomes a likely scenario and a buyout could provide a full return if not some upside to investors. With the buyout value in mind, I raise my rating from sell to hold, as existing investors may benefit from a buyout.

Q1 Earnings Preview

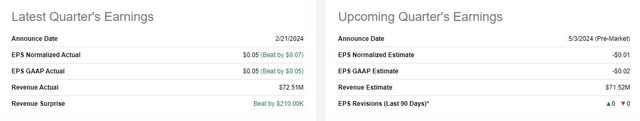

Shenandoah is expected to announce normalized EPS of—$0.01 and revenue of $71.52M, both of which are notable declines sequentially.

SHEN Earnings Estimate (Seeking Alpha)

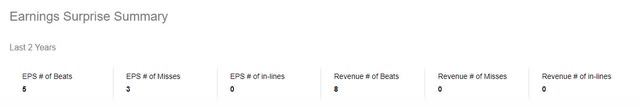

Shenandoah hits or exceeds the EPS consensus more often than not, but it has mixed revenue results, so it is possible that this will break either way.

SHEN Earnings Surprise (Seeking Alpha)

As earnings come out, I will first examine two things: Is the return on fiber investment accelerating, and how is the Horizon acquisition proceeding? Shenandoah has put essentially all of its eggs in the fiber basket, and this will determine the trajectory for the rest of the year.

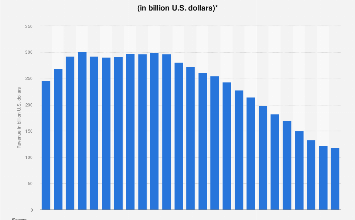

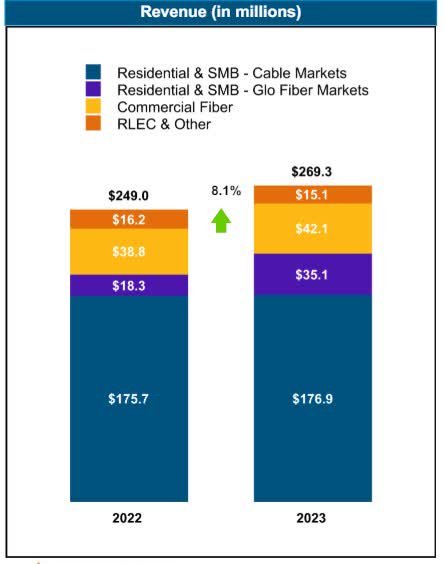

While fiber is scaling, it’s important to remember that it is still a small part of the business and needs to offset essentially flat revenue in broadband and declining revenue in towers.

Broadband revenue (SHEN Investor Relations)

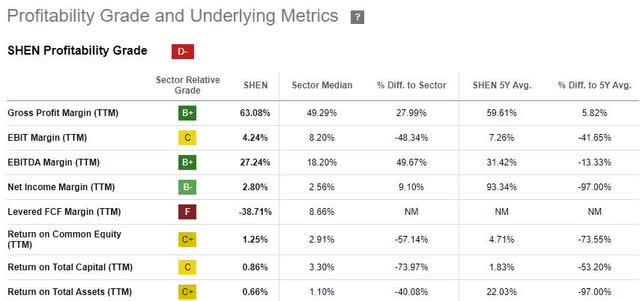

Shenandoah is also struggling to generate a return on their growing fiber investment, with returns on assets well below the overall industry and their own 5-year average.

Profitability Metrics (Seeking Alpha)

Valuation

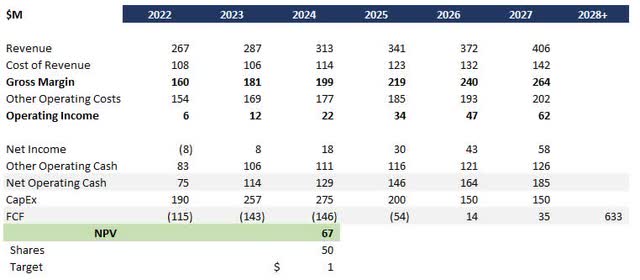

I updated my ongoing DCF analysis for Shenandoah using the following assumptions:

- 9% revenue growth and 4.5% expense growth based on 4-year CAGR from Q4 2023 earnings

- Mid-point of management capital guidance

- 12% discount rate with higher risk premium due to negative free cash flow

- 6% long-run growth rate based on fiber CAGR of 8% hedged down 2 percentage points for low to no growth in other businesses

This DCF yields a price target of $1, essentially 100% downside from today’s price.

SHEN DCF Base Case (Data: SA; Analysis: Mike Dion)

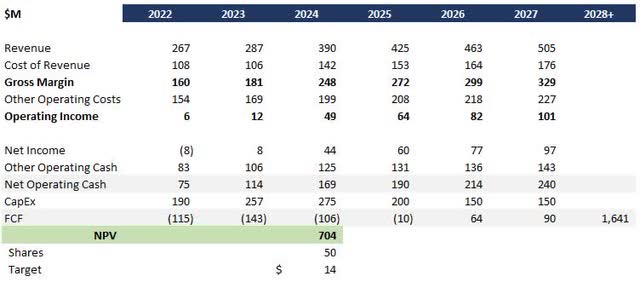

I ran an additional scenario to understand what the revenue growth would need to be to support today’s share price just north of $14. This share price would require a revenue growth of more than 30%, which is double the support revenue from my previous analysis, which required 15% growth. To me, this indicates the business has moved solidly in the wrong direction.

SHEN DCF High Case (Data: SA; Analysis: Mike Dion)

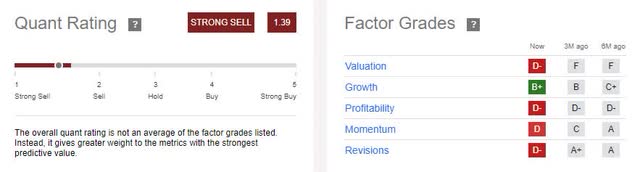

The quant rating is so poor at strong sell that it is warning investors about the stock.

SHEN Quant Rating (Seeking Alpha)

Potential Sale Price Exceeds Current Price

On evaluating the operation alone, my rating would be a strong sell. Before issuing that rating, I wanted to understand what Shenandoah may be worth in a sale to another telecom.

Starting with the value of infrastructure ($930 million) and intangibles like spectrum ($77 million) less debt load ($293 million) as of the end of 2023, fair value would be $714 million. Assuming a 10-20% premium on, this gives a sale range of $785 million to $857 million, just slightly above the current market cap.

Looking at similar sales, we saw Shenandoah purchase Horizon for 12.9x EBITDA and across the industry we are seeing 10-20x for tower assets and 8-9x for fiber assets. Based on the Horizon deal and industry multiples, 10-12x EBITDA continues to be a solid range. At that multiple, the range of value would be $783 million to $940 million, largely in line with the infrastructure value and above the current market cap.

Verdict

I do not believe Shenandoah can deliver the scale needed as a standalone company, and there is significant downside risk from the operation alone. However, this situation makes a sale likely and two methods to calculate the purchase price show some upside potential in the event of a sale.

With this in mind, I raise my rating from sell to hold, as investors with existing positions may consider holding out for a beneficial sale.