Shenandoah Telecommunications Reports Mixed Q1 2024 Results Amidst Major Transactions

-

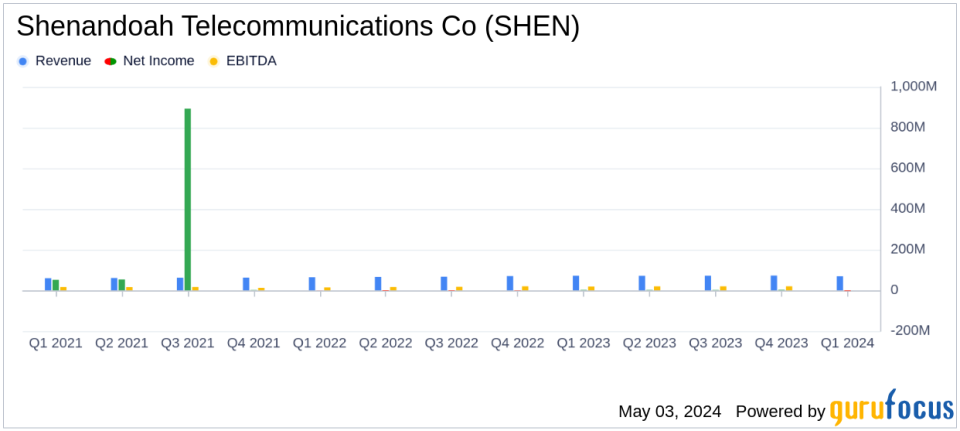

Revenue: Reported at $69.2 million for Q1 2024, up 3.1% year-over-year, falling short of the estimated $71.57 million.

-

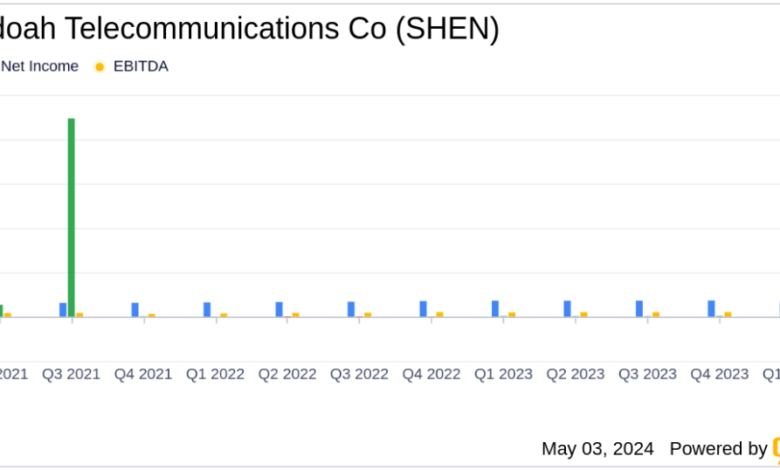

Net Loss from Continuing Operations: Increased to $4.1 million in Q1 2024 from a net income of $0.7 million in Q1 2023, exceeding the estimated net loss of $1.02 million.

-

Earnings Per Share (EPS): From continuing operations was -$0.08, below the estimated -$0.02.

-

Net Income from Discontinued Operations: Substantial increase to $218.8 million in Q1 2024, primarily from gains on the sale of the Tower Portfolio.

-

Adjusted EBITDA: Remained stable at $19.3 million, consistent with the previous year’s same quarter.

-

Capital Expenditures: Rose to $70.1 million, driven by inventory timing and technology upgrades in Cable Markets and Glo Fiber.

-

Liquidity and Financial Position: Ended the quarter with $389.7 million in cash and cash equivalents, significantly bolstered by the Tower Transaction.

On May 3, 2024, Shenandoah Telecommunications Co (NASDAQ:SHEN) disclosed its first-quarter financial outcomes through an 8-K filing. The company, which operates in the telecommunications sector providing broadband services, reported a revenue increase but faced a significant net loss in its continuing operations.

Company Overview

Shenandoah Telecommunications Company, known as Shentel, delivers a range of broadband communication products and services through its extensive wireless, cable, fiber optic, and fixed wireless networks in the Mid-Atlantic United States. The company recently streamlined its operations to focus primarily on its broadband segment, following the divestiture of its tower segment.

Financial Performance Highlights

For Q1 2024, Shentel reported a revenue of $69.2 million, a 3.1% increase from the $67.2 million recorded in the same quarter the previous year. This growth was primarily driven by a 73% increase in Glo Fiber Markets revenue, which totaled $12.1 million. Despite this, the company experienced a net loss from continuing operations of $4.1 million, a stark contrast to the net income of $0.7 million reported in Q1 2023. The loss was mainly due to higher interest expenses and operational costs associated with expanding the Glo Fiber network.

Operational and Strategic Developments

During the quarter, Shentel made significant strides in expanding its Glo Fiber network, adding approximately 5,000 subscribers and increasing passings by 25,700. The company also completed a major transaction, selling its tower portfolio for $309.9 million, which resulted in a substantial gain reflected in discontinued operations. Additionally, Shentel finalized the acquisition of Horizon Acquisition Parent LLC, enhancing its commercial fiber offerings.

Financial Position and Future Outlook

Shentel’s balance sheet remains robust with $389.7 million in cash and cash equivalents as of March 31, 2024. The company’s total assets stood at $1.45 billion. Looking forward, Shentel is focused on sustainable organic growth, with plans to expand its Glo Fiber passings to approximately 600,000 by the end of 2026.

Analysis and Investor Insights

While the revenue growth is a positive indicator, the deeper net losses from continuing operations could concern investors, particularly as they were significantly off the mark from analyst estimates of a $1.02 million loss. The substantial gains from the tower portfolio sale, although beneficial for short-term liquidity, may overshadow the underlying challenges in operational profitability and cost management in the broadband segment. Investors should closely monitor how the integration of recent acquisitions and the expansion of the Glo Fiber network impact the company’s financial health and operational efficiency moving forward.

Shentel’s strategic divestitures and acquisitions underscore its commitment to refining its core operations and expanding its market reach in the broadband sector. However, the company must navigate the increased costs and manage its debt levels carefully to ensure long-term profitability and shareholder value.

For detailed financial figures and future projections, investors and stakeholders are encouraged to view the full earnings report and tune into the upcoming earnings call scheduled for May 3, 2024, accessible through Shentel’s Investor Relations website.

Explore the complete 8-K earnings release (here) from Shenandoah Telecommunications Co for further details.

This article first appeared on GuruFocus.