Shhh! 3 Secret EV Stocks Flying Below Wall Street’s Radar

EV stocks aim to represent 16.2% of 2024 vehicle sales, driven by strong performances from top manufacturers

Electric vehicle (EV) stocks are in a good place after having a hard time growing last year due to slowing demand in major markets like the U.S. and China. However, sales of battery electric vehicles (BEVs) around the world are expected to reach 13.3 million units in 2024, up from 12% in 2023. They will account for 16.2% of all private car sales.

There were more than a million EV sales around the world in January 2024. Most of those sales happened in the U.S. As of now, there are more than 40 million electric cars on the roads around the world. In 2022, 26 million EVs were sold, which shows how quickly they are becoming hot.

In this kind of market, one North American company is known for its competitive price and creative ways of boosting output and fixing money problems.

At the same time, a Chinese market winner is quickly spreading around the world. In the past few months, this company has sold more batteries than any Western rival.

And finally, a global tech giant is making more high-capacity batteries to help EVs run. This company wants to make more things in a lot more places, and they want all of their products to help electric vehicles and the energy economy.

Lion Electric (LEV)

Source: shutterstock.com/Dmytro_Yushchenko

Lion Electric (NYSE:LEV) starts this list of quality EV stocks, and its name might strike several investors as odd. it’s not exactly a Tesla (NASDAQ:TSLA) or a Nio (NYSE:NIO). LEV is a penny stock at 92 cents, yet it has a 206% upside.

In Q4 2023, LEV delivered 188 automobiles, up from 174 in 2022. With 852 automobiles delivered in 2023, up from 519 in 2022, production and sales were excellent.

The firm lost $56.5 million in Q4 2023 and $103.8 million overall owing to heavy expenditure that outweighed revenue growth. Delivery and sales have slowed due to government subsidy delays complicating operations.

Lion Electric lost money in 2023 despite expanding sales due to manufacturing and raw material costs. To save money, the corporation cut staff, mainly on the Saint-Jerome night shift.

On a brighter note, Lion Electric established a Mirabel battery factory to boost output. A $50 million government loan will support this project.

Moreover, Lion Electric wants to increase orders and deliveries in 2024 while decreasing costs and managing liquidity in a challenging market. The factory will certainly help.

Finally, Lion Electric won $38 million from the EPA Clean School Bus Program. This financing will help U.S. school districts buy 97 electric school buses and charging infrastructure, decreasing greenhouse gas emissions and enhancing zero-emission transportation. The government deal boosts its legitimacy among EV stocks.

BYD (BYDDF)

Source: T. Schneider / Shutterstock

In China, BYD (OTCMKTS: BYDDF) sold more electric cars than Tesla (526,409 to 484,507) from October to December, justifying its 22% upside and strong buy rating.

EV sales went up by 48% in January 2024, according to BYD. The data indicates it, once again, pulled ahead of Tesla. This rise is due to exports, which shows that BYD has a world reach and it’s now targeting 3.6 million unit sales for 2024.

Powering forward, BYDDF is investing in battery technology by building its first sodium-ion battery plant. This $1.4 billion plant will produce EV batteries that are smaller and cheaper than lithium-ion ones.

The next-generation Blade Battery, set to come out in 2024, will increase range and drop costs by making BYD’s EVs easier to obtain. This battery will use BYD’s Electrok program to reduce the use of gas-powered cars.

At 2024 Dream Day, BYD showed off its XUANJI Architecture and Integrated Vehicle Intelligence. Using information and energy, this technology makes cars safer, more comfortable and better at what they do.

At the Indonesia International Motor Show 2024, BYD showcased four cars for the Indonesian market. This was part of the company’s plan to expand worldwide and promote green transportation.

All in all, BYD is steadily improving battery technology, smart driving technologies, EV sales and market share among competitive EV stocks.

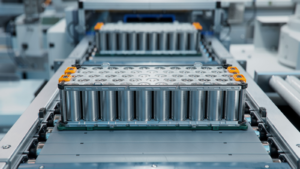

Panasonic (PCRFY)

Source: IM Imagery / Shutterstock.com

Panasonic (OTCMKTS:PCRFY) wants to be able to make 200 gigawatt hours (GWh) of EV battery cells every year by 2031, which is four times what it does now. Two or more new plants will be built as part of this development to make 4,680 battery cells by 2030.

The company is about to start mass production of a battery with a higher capacity, which will probably make EVs go farther and run better. This includes both the older 2170 cells in current Tesla models and the 4680 cells, predicted to have a lot more energy and a lot more power.

Panasonic is also going to manufacture sustainable graphite for its electric vehicle batteries in factories in the United States. This is part of Panasonic’s plan to improve its supply chain and lower its impact on the environment.

In De Soto, Kansas, a new battery factory is being built. Panasonic plans to use it to make cylindrical Li-ion batteries for EVs, which will increase its production capacity and help Tesla and other automakers.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.