Should Investors Buy the Artificial Intelligence & Technology ETF Instead of Individual AI Stocks?

The fund has typically outperformed the S&P 500 over time.

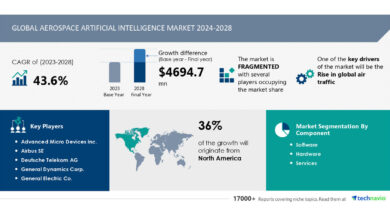

The demand for artificial intelligence (AI) stocks may lead investors to ponder how to invest in this sector with minimal risk. This is a critical concern as AI stocks like Nvidia and Tesla have experienced massive sell-offs when those stocks fell out of favor.

Moreover, the AI industry is comprised of smaller stocks such as DigitalOcean and C3.ai. Although investors may see considerable potential for gains, unexpected occurrences often derail such growth stories.

Fortunately for investors, exchange-traded funds (ETFs) quickly capitalized on AI, and one of the better-performing funds is the Global X Artificial Intelligence & Technology ETF (AIQ 1.58%). The question for investors is whether the tech ETF can generate sufficient returns while reducing risk to minimal levels.

The Global X Artificial Intelligence & Technology ETF described

The Global X Artificial Intelligence and Technology ETF existed since May 2018. It owns more than 80 stocks associated with AI. Not surprisingly, its top holding is Nvidia.

Still, it invests in all of the so-called “Fab Four” stocks and Nvidia’s server partner Super Micro Computer, which has delivered considerable returns in recent months.

Additionally, it owns some stocks not strongly associated with AI, such as streaming giant Netflix, healthcare tech company GE Healthcare Technologies, and Brazilian fintech StoneCo. It also does not limit itself to stocks on U.S. exchanges, looking abroad to names like Samsung or Siemens.

Furthermore, its expense ratio of 0.68% is well above the average expense ratio, which, according to Morningstar, was 0.37% in 2022. Investors can expect to pay $68 annually in fees for each $10,000 invested.

How it has performed

However, some investors may believe it is worth its management fee. As of the time of this writing, the ETF returned more than 130% since inception, slightly exceeding the total return of the S&P 500.

Moreover, it diversified to the point that it is a safe investment. Its largest holding, Nvidia, makes up just over 4% of its portfolio.

Indeed, it owns far fewer companies than the 500 names in the S&P 500. The S&P 500 also comprises all major industries.

Nonetheless, the safety of the Global X Fund stands out due to its smaller positions. For example, the largest holding of the SPDR S&P 500 ETF Trust is Apple at about 7%. In comparison, Apple makes up around 2.4% of the Global X ETF. Amid such allocations, the higher returns are likely a testament to the Global X Fund’s management team.

Should investors buy the Global X Fund?

Ultimately, the suitability of the Global X Fund will depend on the individual investors. However, for investors who want exposure to AI without having to worry about risk, the fund looks like an excellent choice.

Despite its relatively expensive management fees, it managed to outperform the S&P 500 on a long-term basis. Moreover, it prevents investors from taking on the difficult task of finding the next Nvidia or Supermicro before its unprecedented increases, a task where most individual investors fail.

Admittedly, such funds are unlikely to deliver record-breaking returns. But for those who want AI-driven returns without worry, the Global X fund will serve them well.

Will Healy has positions in DigitalOcean. The Motley Fool has positions in and recommends Apple, DigitalOcean, Netflix, Nvidia, StoneCo, and Tesla. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.