Should You Buy ChargePoint While More Money Is Going Out Than Coming In?

Like so many “good ideas”, ChargePoint has a long way to go before it has built a sustainable business.

ChargePoint (CHPT 9.21%) does something very important: It installs and provides services for electric vehicle (EV) charging sites. These are necessities if the world is going to shift from combustion engines to EVs. But there’s one problem for investors: The company isn’t profitable.

Is now the time to buy ChargePoint while it remains in the red?

ChargePoint has lots of points

ChargePoint has roughly 286,000 “activated” ChargePoint-branded EV charging ports, and subscribers to its service can access another 630,000-plus ports via roaming. That’s a big electric vehicle charging network. Its operations span multiple countries across North America and Europe. This is a good foundation, and ChargePoint has clearly achieved a great deal of growth since it started building out its business in 2007.

Image source: Getty Images.

In fact, the shift to EVs probably wouldn’t have been as quick if ChargePoint didn’t exist. One of the biggest fears among drivers is running out of juice in an EV, given that there are far more gas stations than EV charge ports and the fact that filling a gas tank is a lot quicker and easier than charging the battery of an EV.

From a long-term perspective, ChargePoint is clearly at the forefront of the push to electrify the world’s transportation system. That’s a good story — more and more EVs get on the road every year. But the shift away from gasoline-powered cars has been slow, and is likely to take a fairly long time. This is where the problem comes in for investors.

ChargePoint is spewing red ink

ChargePoint has a good story, since building a large charging network for EVs is a key foundation for the EV transition. But building out that network isn’t cheap or easy. The company continues to lose money quarter after quarter, as the chart above shows very clearly. What that chart also shows is that investors, after some initial excitement, have soured on the company’s shares. Given the ongoing red ink, that’s not surprising.

The company’s fiscal 2024 financial statements highlight the problem pretty clearly. ChargePoint brought in revenue of nearly $507 million with a cost of revenue of around $477 million. That’s a slim gross profit of $30 million or so. That was actually down from around $86 million in fiscal 2023, which is hardly a positive thing.

But the real problem comes when you see that operating expenses totaled $480 million, resulting in a loss from operations of about $450 million, up from a loss of roughly $428 million in fiscal 2023.

Operating expenses included about $221 million in research and development costs, sales and marketing costs of $150 million, and general and administrative costs of $109 million. It’s likely that ChargePoint could cut some fat here, but probably not $450 million dollars worth, which is what would be needed for the company to turn a profit. And that doesn’t even take into consideration other costs further down the income statement, like interest expenses.

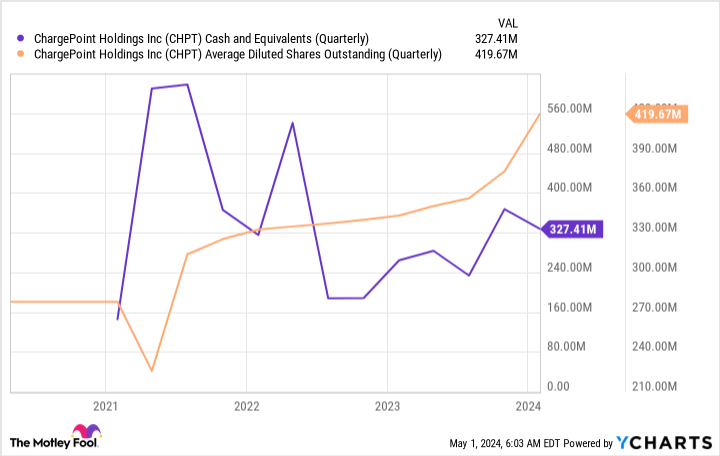

Basically, ChargePoint has a good story, but it is still nowhere near a sustainable business. The next interesting thing to consider is the company’s balance sheet. The company ended fiscal 2024 with around $327 million in cash. But, as noted above, it spent more than that on operating expenses alone during fiscal 2024. And the company is still building out its business. In other words, there’s still a lot more going out the door here than coming in.

CHPT Cash and Equivalents (Quarterly) data by YCharts

CharPoint is for aggressive investors only

ChargePoint could end up being a big winner in the race to support a growing EV market. But it is still a long way from being a sustainable business. That is why the company noted these risks in its 10-K: “ChargePoint operates in the early stage market of EV adoption and has a history of losses and negative cash flows from operating activities, and expects to incur significant expenses and continuing losses for the near term.” And “ChargePoint may need to raise additional funds and these funds may not be available when needed or may not be available on terms that are favorable to ChargePoint.”

In other words, buying today means betting that this money-losing company will some day manage to turn profitable. But taking that risk is highly likely to subject you to massive shareholder dilution as it tries to find the cash it needs to survive. Most investors will want to watch this stock from the roadside.