Should You Scoop Up This AI Fintech Stock Before It Joins the Russell 2000?

The impact of artificial intelligence (AI) continues to ripple across multiple sectors, with tech giants confirming plans to continue ramping up their AI investments on the latest round of corporate earnings calls. Notably, one area where AI is expected to make a significant impact is financial technology, or fintech. According to this report, the market size for AI in fintech is forecast to be about $51 billion by 2029, up from $44.08 billion in 2024.

One up-and-comer in this niche segment is Pagaya Technologies (PGY), which is set to join the benchmark Russell 2000 Index (RUT) on July 1 as part of its annual rebalancing. Not only could this RUT upgrade draw more institutional buyers to the stock, but PGY is also a favorite among the analyst community, too.

About Pagaya Technologies Stock

Founded in 2016 and based out of New York City, Pagaya Technologies (PGY) is a fintech company that utilizes machine learning and big data analytics to provide a more efficient and comprehensive credit risk assessment and loan origination process. The company leverages its proprietary technology to partner with financial institutions to improve the credit decision-making process and expand access to credit. The company’s market cap currently stands at $821.7 million.

On a YTD basis, Pagaya stock is down 28.6%. However, the shares rallied more than 21% during the month of May.

At current levels, PGY looks like a bargain. The stock is priced at 10.36x forward adjusted earnings, and 0.82x sales – comfortably below most of its tech sector peers.

As for its impending inclusion in the Russell 2000 Index, company CFO Evangelos Perros said, “Inclusion reflects our team’s efforts to improve our stock’s marketability, as we adopt U.S. capital markets best practices while continuing to deliver strong financial results for our shareholders.”

The Russell index rebalancing is a yearly event, and typically drives higher volumes as institutional investors and fund managers adjust their holdings to better reflect the new index makeup.

Upbeat Q1 Earnings

News of the RUT addition capped off a strong May for Pagaya. The company’s results for the recently reported first quarter were impressive, and featured significant growth in revenue alongside narrower losses. Total revenues for the quarter came in at $245.28 million, up 31.4% from the year-ago period. Adjusted EPS of $0.20 topped estimates, as well.

The fintech firm also reported a positive cash flow from operations of $20.47 million in the quarter, reversing its year-ago outflow of $23.67 million. This marked the third consecutive quarter of positive operating cash flow for the company.

Pagaya closed the quarter with a cash balance of $274.49 million, an increase from $186.48 million at the beginning of the year. Additionally, the cash balance was higher than the long-term debt level of $222.3 million.

For the second quarter, management expects to see revenues between $235-$245 million, compared to Wall Street’s consensus estimate of $240 million. For FY24, revenue is projected between $925 million and $1.05 billion, while analysts are targeting $950 million.

Longer term, Pagaya’s revenue has expanded at a CAGR of 69.91% over the past three years. Analysts are targeting forward revenue growth of 15.8%, well above the tech sector median of 6.5%.

Inside Pagaya’s Growth Drivers

Pagaya’s success is primarily due to its AI expertise, which results in low delinquencies. Their core technology uses AI to rapidly analyze millions of credit applications in the FICO 685-710 range at the point of sale, typically at banks or car dealerships. This allows their platform to identify creditworthy borrowers who might be missed by traditional methods.

Once a customer is approved, Pagaya quickly sells the credit to a large network of investors seeking reliable debt tranches. Pagaya retains minimal risk (under 5%) by holding a small portion of the transaction on its books. This approach has led to their current ABS delinquencies being the lowest in 3 years.

And Pagaya has been expanding operations to grow its business significantly, with a particular focus on the fast-growing POS financing vertical.

Their fintech network got a boost in Q1 with the addition of regional lender U.S. Bancorp (USB) and its subsidiary Elavon, the third-largest U.S. payment processor, to their network. Elavon processes over 1 billion transactions annually for over 1 million merchants, and its integration – set for the second half of this year – will significantly increase Pagaya’s network volume.

Pagaya says its pipeline of payments providers is “robust,” and it expects to integrate several of them within the next 12-18 months. Negotiations are also underway with 6 large lenders across personal loans, auto loans, and POS verticals.

What’s the Analyst Forecast for PGY Stock?

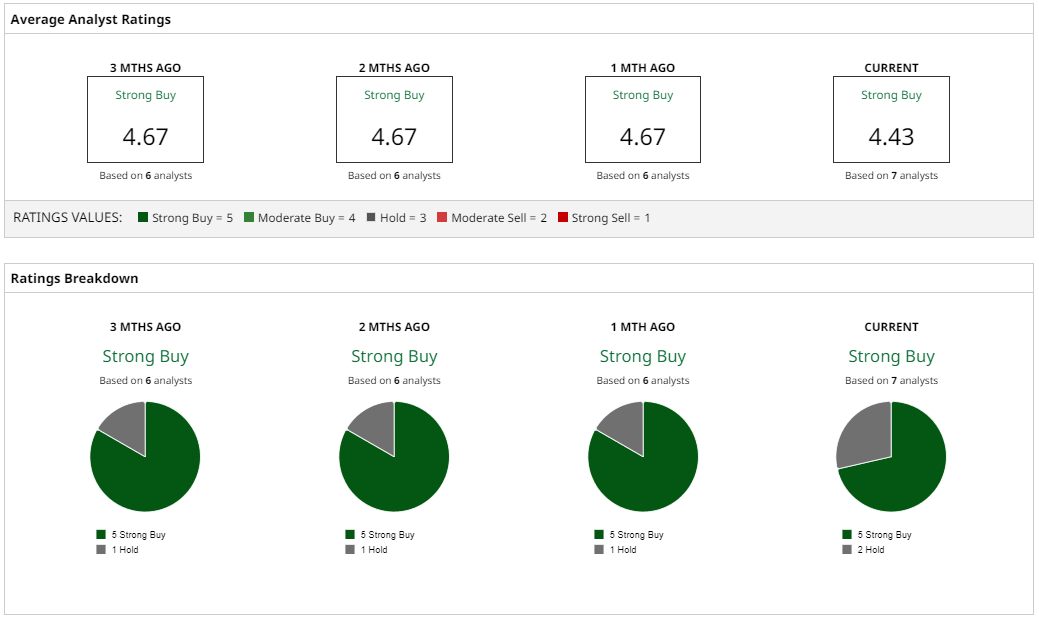

Analysts have a consensus rating of “Strong Buy” for Pagaya stock, with a mean target price of $27.71. This denotes an impressive upside potential of about 134.6% from current levels.

Out of 7 analysts covering the stock, 5 have a “Strong Buy” rating and 2 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.