Singapore fintech firm Aspire enters Hong Kong, positioned for further growth across Asia

Aspire, a finance platform headquartered in Singapore, has on Wednesday announced that the company has successfully obtained a money service operator (MSO) license issued by the Hong Kong Customs and Excise Department.

The firm said in a statement that this achievement represents another key milestone in Aspire’s growth journey in Asia.

It said the acquisition of this operating license paves the way for Aspire’s broader strategic expansion across Asia, while emphasizing its strict adherence to the regulatory requirements of each country that it operates in.

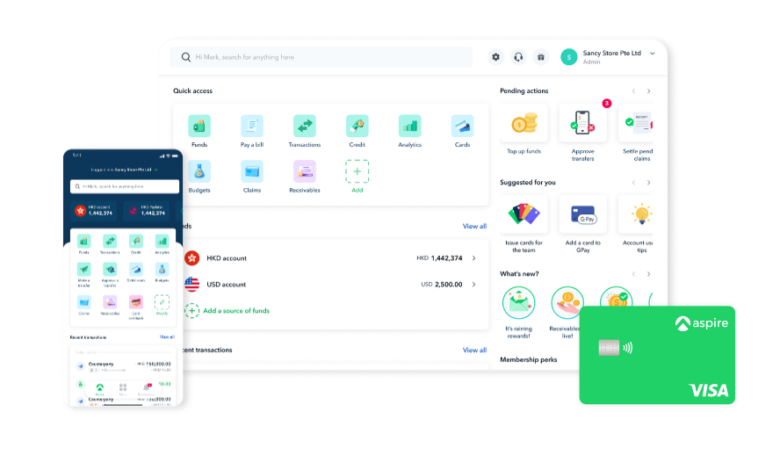

According to the statement, Aspire offers a unified suite of financial solutions to small and medium-sized enterprises (SMEs) in Hong Kong, including the ability to open local business accounts for payables and receivables management, international payments, as well as payment gateway solution.

It said the firm’s integrated solution is built to help Hong Kong’s fast-growing SME segment across industries facilitate multi-currency cash management, as well as domestic and cross-border money transfers.

It is noted that amidst the city’s macro challenges, Hong Kong is witnessing a local revisitation of business digitalization, with 93 percent of local SMEs recognizing digitalization as vital for their company’s growth.

Simultaneously, the city is witnessing an entrepreneurial boom, with the number of startups soaring over three-fold in the past decade, according to InvestHK.

Aspire said the firm is well poised to meet the needs of this new generation of increasingly digital-minded startups and SMEs, providing them with a robust and integrated platform to streamline their business finance operations, ultimately saving time and money.

“With Hong Kong’s digital economy growing exponentially, there’s a clear demand for dependable, integrated financial solutions,

“At Aspire, we’ve always believed in tailoring our offerings to the unique needs of each market and we’re proud to now be able to empower Hong Kong SMEs with the financial tools they need to drive their growth,” said Andrea Baronchelli, Chief Executive Officer and Co-Founder of Aspire.

Meanwhile, Aspire Chief Executive Officer Andrea Baronchelli said that Hong Kong stands as a dynamic and business-minded innovation hub for Asia with a strong commitment to building a highly secure and stable fintech infrastructure.

“We take great pride in collaborating closely with Hong Kong’s regulators as we embark on this exciting chapter,

“Looking forward, our vision remains steadfast: to build the future of business finance for modern businesses, guided by innovation, security, and reliability,” he added.

Aspire is the all-in-one finance platform for modern businesses, helping over 15,000 companies across Asia save time and money with international payments, expense management, payable management, and receivable management solutions – accessible via a single, user-friendly account.

The firm has over 450+ employees across five countries and is backed by global top tier venture capitals, including Sequoia, Lightspeed, Y-Combinator, Tencent and Paypal.

In 2023, Aspire closed an oversubscribed $100 million Series C round and announced that it has achieved profitability.

Since being founded in 2018, Aspire has raised more than $300 million from investors.

It has a client base of over 15,000 businesses across Asia including Air Asia, Carousell, Love Bonito, Endowus, and Tech In Asia, and announced that it achieved profitability in 2023.

Singapore’s Aspire hits profitability three months after closing $100M Series C funding