SoFi and MoneyLion: Needham Chooses the Best Fintech Stocks to Buy

We live in the digital age, with information and online technology growing more important every day. The changes are visible, in everything from the spread of 5G networks to the advance of a cashless society. And for investors, these changes are bringing a wide range of opportunities.

Prominent among those opportunities are the fintech stocks. According to Boston Consulting Group, the financial services revenue from the global fintech sector could hit as high as $1.5 trillion – and when a market hits that size, investors should take notice.

Wall Street’s analysts already have. Covering fintech from Needham, analyst Kyle Peterson has taken the measure of the industry – and he’s selected SoFi Technologies (NASDAQ:SOFI) and MoneyLion (NYSE:ML) as two of the best fintech stocks to buy.

We’ve opened up the TipRanks database to find the broader picture of each of Peterson’s picks; here’s a closer look at them.

SoFi Technologies

We’ll start in San Francisco, arguably at the heart of the tech industry, with SoFi Technologies. The fintech’s very name defines what it does; it is derived from ‘Social Finance,’ and the company specializes in bringing the advantages of social media’s online interaction into the fintech industry. It’s a take on banking that’s fully modern and well adapted to the expanding role of digital tech in today’s world.

What SoFi has done, simply, is take banking fully online. The company is a licensed bank and provides its customers with the usual full range of banking services, everything from home and personal loans to credit cards and credit scoring to investment banking. SoFi can even facilitate refinancing on existing loan balances, from student, car, or home loans. The company boasts over 7.5 million current members who have earned $35 million-plus in rewards while paying off over $34 billion in debt.

SoFi is an online bank, and members access their accounts through the app, either by PC or mobile device. The company has made online security a priority and includes round-the-clock accounting monitoring among its service offerings, with alerts available to notify customers if there is any suspicious activity. The bank also falls under FDIC protections, with customer accounts insured up to the statutory $250,000.

Looking at results, we find that SoFi has been successful at the top line. The company’s revenues have shown consistent quarterly gains over the past several years, culminating in the last reported quarter, 4Q23, in which the top line came to $594.25 million for a 34% year-over-year gain. The quarterly revenue was $22.74 million better than had been anticipated. At the bottom line, SoFi’s Q4 showed a small non-GAAP net profit of 2 cents per share, beating the forecast by 2 cents.

For Needham analyst Peterson, they key here is SoFi’s ability to build itself as a ‘leading player’ in the shift to digital finance.

“We believe SOFI has established itself as a leading player in the digital lending/neobank space, building a sizable and profitable user base. In addition, we believe that SOFI’s bank charter helps widen its competitive moat and improves the unit economics on lending products. Finally, we believe that the company’s rapidly growing technology products and solutions division adds a multi-year tailwind to growth and provides opportunities for multiple expansion as the business scales,” Peterson opined.

“We view SOFI as a long-term winner in the digital lending/neobank space,” Peterson repeats, “largely due to its focus on prime and super-prime consumers and possession of a full banking license, which we believe provides the company superior unit economics compared to other consumer finance platforms that focus on lower income borrowers and/or lack a banking license.”

To this end, the Needham analyst puts a Buy rating on SOFI shares, with a $10 price target that indicates his confidence in a 35% upside on the one-year horizon. (To watch Peterson’s track record, click here)

While the Needham view is bullish, the wider market stance here is less so. SOFI shares have a Hold consensus rating, based on 16 recent reviews that include a 4-8-4 split among Buy-Hold-Sell. Yet, the stock is selling for $7.40 and its $8.91 average target price suggests ~20% gain in the coming year. (See SoFi stock forecast)

MoneyLion (ML)

Next up is MoneyLion, another fintech with a focus on personal banking. This company’s client services include lending, financial advisories, and investing options, all oriented toward the consumer market. MoneyLion has defined its target customer base as ‘the average American,’ that large slice of the US consumer population that lives from paycheck-to-paycheck, and can’t always access high-end financial services. MoneyLion streamlines the financial options available to these customers, to provide a winning combination of improved money management and improved credit-worthiness.

This is a fintech created to serve the masses, and it prides itself on that point. MoneyLion states its mission as providing its customers with the power – and information – needed to make the best financial decisions; the company works to make online banking a win-win situation for both the banker and customer. The model has clearly proven attractive – MoneyLion has 14 million total customers, and handles over 60 million customer queries every quarter.

The customer base is growing, and growing fast. MoneyLion’s total of 14 million customers was reported in the 4Q23 financial release, and represents a 115% increase year-over-year. Revenues in the quarter came to $112.96 million, a gain of 19% year-over-year, and a modest $1.49 million better than the estimates. The company’s earnings came to a net loss, of $4.2 million for the quarter.

On a note of particular interest, MoneyLion’s full-year 2023 revenue was reported at $423.4 million, growing 24% y/y and reaching a company record for annual revenues.

Turning again to Needhan’s Peterson, we find the analyst laying out a simply bullish prospect for MoneyLion in his write-up on the stock. Peterson says of the company, “We believe that MoneyLion has developed a comprehensive personal financial services platform, with offerings that span banking, financial management, lending, and investing products. In addition, we like the scaling enterprise platform that we believe will provide additional growth opportunities and better match consumers with appropriate financial products. Finally, we like that profitability is improving consistently, which we believe sets the table for the shares to re-rate higher within the next 12 months.”

Peterson follows this up with a Buy rating and a $90 price target that implies a one-year gain of nearly 17% for the shares.

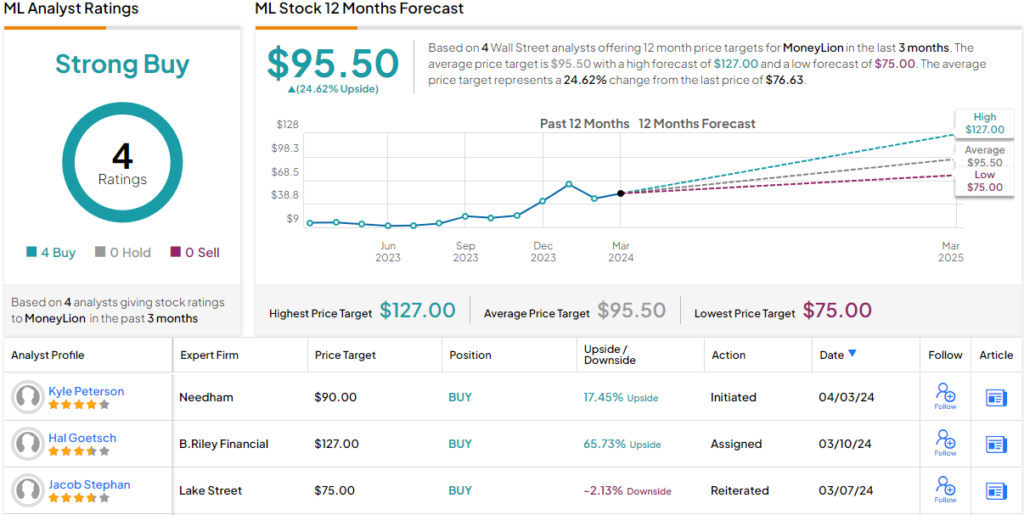

The broader view from his Wall Street peers is also upbeat. The stock has a unanimous Strong Buy consensus rating, based on 4 positive reviews, and the $95.50 average price target suggests a gain of ~25% from the current share price of $76.63. (See MoneyLion stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.