SoFi reports strong Q1 revenue and profits

SoFi was the first fintech out of the gates for earnings season, reporting Q1 earnings before the bell this morning. Here is a summary of their earnings.

SoFi Q1 2024 Earnings Summary

SoFi held its earnings call at 8am EDT this morning, disclosing its financial results for the first quarter of 2024. For Q1 2024, SoFi reported net revenue of $645 million, up 37% year over year. The company also recorded net income of $88 million, up from a loss of $34 million in Q1 2023. This is the second consecutive quarter that SoFi has reported GAAP profitsSoFi CEO. These figures are pivotal as fintechs have struggled to make a profit and it looks like SoFi may have turned the corner now.

Key Growth Areas and Business Performance

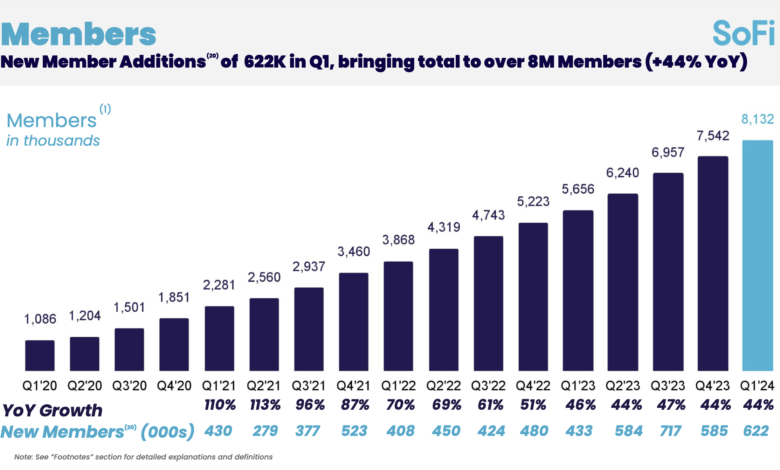

The earnings call outlined several areas contributing to SoFi’s growth. The increase in SoFi’s member base was highlighted as a key factor in its continued expansion with the total number of SoFi members increasing 622,000 in Q1. This brings the total number of members now to 8.1 million, up 44% year over year.

SoFi’s CEO, Anthony Noto, has this to say about Q1:

“Our first quarter was an exceptionally strong start to 2024, demonstrating significant momentum as we responsibly grow revenue and diversify toward our Financial Services and Tech Platform segments, sustain profitability, reinforce our balance sheet, and grow our member base. We delivered adjusted net revenue of $581 million, representing 26% year-over-year growth. Financial Services and Tech Platform segment revenue combined grew 54% and represented a record 42% of consolidated adjusted net revenue, offsetting flat Lending segment revenue given a more conservative approach in light of macroeconomic uncertainty.”

Strategic Developments and Outlook

During the call, SoFi’s management discussed its ongoing investment in technology and product development aimed at refining the platform’s capabilities and enhancing user experience. The focus on developing accessible and effective financial tools was emphasized as a priority to meet the growing demands of its user base.

Looking ahead, SoFi’s executives shared a positive outlook based on the company’s current financial health and strategic initiatives. They remain focused on advancing the platform’s technology and expanding its service offerings to support sustainable growth and competitive advantage.

Competitive Landscape

The fintech sector is highly competitive, with continuous innovation and new entrants challenging existing companies. SoFi’s latest financial results and strategic initiatives indicate its efforts to stay competitive in this dynamic market.

Overall, SoFi’s Q1 2024 earnings call presented a company that is navigating its business strategy through focused technological advancements and an expanding suite of financial products. The company’s management is keen on maintaining a trajectory that supports both growth and profitability in a competitive environment.

Investors are a fickle bunch. While the earnings report was objectively strong and full-year guidance for 2024 was above expectations, the stock closed down over 10% today because Q2 guidance was slightly lower than expected.

For more detailed information, including the full earnings call transcript and financial details, visit SoFi’s investor relations page here.