SoFi Technologies: A Deeply Undervalued Fintech (NASDAQ:SOFI)

Daniel Boczarski

Introduction

I think that fintech is one of the most promising megatrends which will likely disrupt the way we got used to obtaining financial services. Among the U.S. based fintech players, SoFi Technologies (NASDAQ:SOFI) demonstrates impressive revenue growth and is close to become profitable. Considering promising fintech industry’s prospects together with SOFI’s strong execution, I think that the company is poised to become a notable player in the evolving banking industry. I think that SOFI is a “Strong buy” because the stock looks deeply undervalued from the forward P/E perspective and compared to other fintech companies.

Fundamental analysis

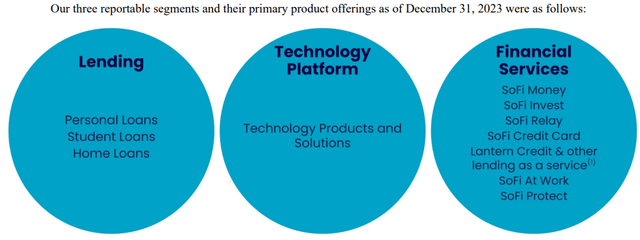

In its 10-K form, SoFi Technologies describes itself as a “a member-centric, one-stop shop for financial services that allows members to borrow, save, spend, invest and protect their money”. The company refers to its customers as “members”. Therefore, SoFi is a bank and the according license (National Bank Charter) has been obtained in January 2022. Despite obtaining the Charter just a couple years ago, SoFi offers its members a wide variety of financial services. This proves SoFi’s description of itself as a “one-stop shop” for financial services.

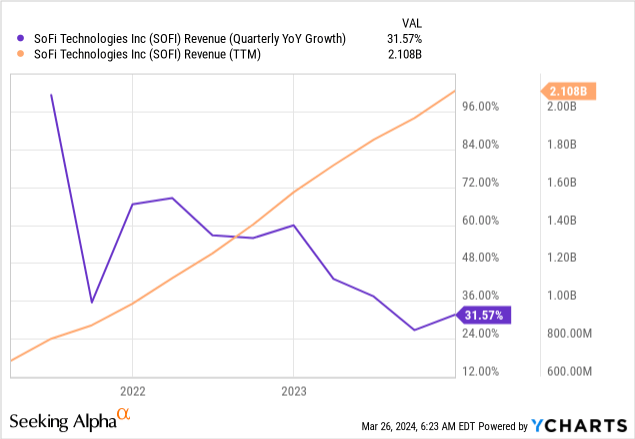

SoFi differentiates itself from traditional banking by leveraging technology, since all financial services are provided via the company’s digital platform. That is, SoFi is a fintech, a new approach to render financial services which already disrupts traditional banks in some emerging markets. When I look at how SoFi’s revenue grew in recent years I think that fintechs are likely ready to disrupt the largest banking industry in the world as well. Even with a $2 billion TTM revenue, it continues growing at a pace above 30% and it is impressive.

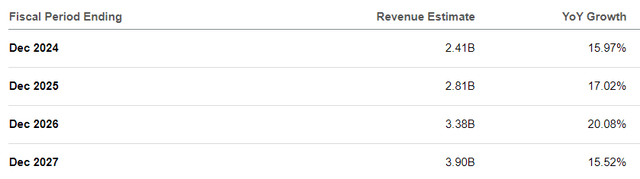

As fintech’s penetration expands, revenue growth is decelerating. This looks like a purely arithmetical issue and important factor is that Wall Street analysts expect SoFi to sustain double-digit revenue growth over the next four years, which is impressive. Revenue is expected to almost double by FY 2027 compared to the current TTM level.

The optimism around SoFi’s revenue growth potential is reasonable. The U.S. fintech market is expected to grow with a 14.7% CAGR between 2024 and 2032. As a pioneering U.S. fintech with a full banking Charter and rapidly growing revenue, I think that SoFi has solid potential to expand its business in line with the long-term industry growth rate.

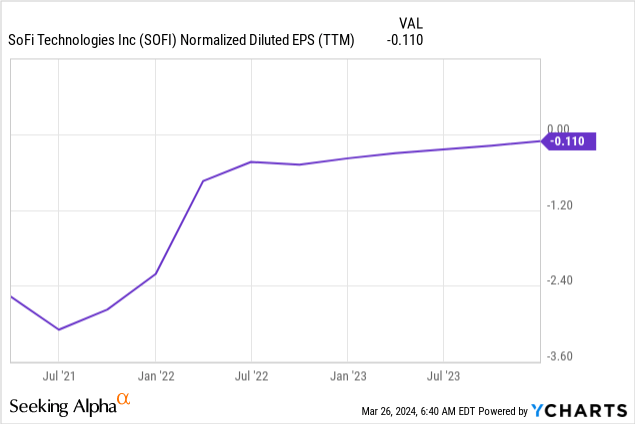

SoFi is still unprofitable, but the adjusted EPS dynamic is impressive and aligns with the strong revenue growth record. The company is close to break even in terms of the adjusted EPS and as it scales up I expect further profitability improvement and I agree with very optimistic long-term consensus forecasts for SoFi’s EPS.

To support future revenue and profitability growth SoFi needs to attract more members into its financial services ecosystem and maximize value of each customer. Generating more revenue per user is possible by selling additional products because increasing banking and service commissions might hurt SoFi’s image, especially considering that it is a young financial institution. I have no doubts about the future customer growth because the whole industry is expected to grow with a 14.7% CAGR and this looks easy to forecast. Therefore, I should focus more on the potential to expand services. As I mentioned before, SoFi already offers a solid array of various financial services. This is a solid basis to expect solid cross-selling potential, but I want to add few more positive notes here.

From other fintechs across the world we can see that their ecosystems expand beyond financial services. For example, Brazilian MercadoLibre (MELI) and Kaspi.kz (OTC:KSPI) from Kazakhstan have their own marketplaces and logistics services. I do not believe that SoFi will ever be able to compete with Amazon’s (AMZN) marketplace, but the U.S. e-commerce is a $757 billion industry where a player with rapidly growing customer base have good opportunities to find its niche and contribute to the long-term revenue growth. The ability to offer directly “buy now pay later” (“BNPL”) to customers looks like a solid potential competitive advantage if SoFi’s marketplace emerges at some point in future.

Valuation analysis

SoFi’s current market capitalization is $7.28 billion, which looks very low compared to other fintechs. For example, SoFi’s market cap is significantly lower than the valuation of even the last spot in the ranking of the 10 biggest private fintechs in the U.S. from Forbes. There is mostly no publicly available information regarding financial performance of these private fintechs, but Forbes says that OpenSea ($13.3 billion valuation) generated $472 million revenue in 2022. During the same year, SoFi generated around $1.5 billion in total revenue. To continue my peer valuation analysis I also want to mention the British fintech, Revolut. It is also a private company, and it still does not have banking license in the UK, but it’s valuation is at $23 billion. This is more than three times more expensive than SoFi, which is also an indication of SoFi’s undervaluation.

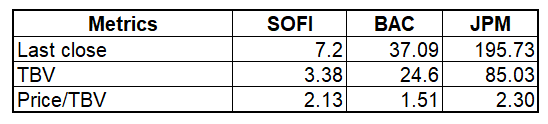

I also want to look at SoFi’s valuation from the second perspective, ratios. A Price-to-Book value is also a suitable valuation metric for a financial institution like SoFi. To be more conservative, I will use tangible book value (“TBV”) for my analysis, which is $3.38 per data from Seeking Alpha. Dividing the last close by TBV gives me a 2.13 ratio. This looks reasonable and within the P/TBV range spanning from Bank of America (BAC) to JPMorgan Chase (JPM). Selecting the two largest U.S. banks as benchmarks for SoFi’s Price/TBV analysis seems sound.

Calculated by the author

If we look from the P/E point of view, the stock also seems significantly undervalued. Considering SoFi’s growth potential, I think that using a 45 forward P/E (current Mercado Libre’s valuation) will be fair. Assuming this multiple and a $0.24 expected FY 2025 EPS, the target price for the next twelve months is $10.8.

Therefore, based on comparing SoFi’s market cap with other fintechs and P/TBV together with forward P/E ratio analysis, I can conclude that the stock is undervalued.

Mitigating factors

SoFi is a rapidly growing business, but it is still a tiny portion of the massive U.S. financial services industry. Its revenue is at the levels comparable with small regional banks, meaning that at the moment the company is still very young for one of the oldest sectors in the U.S. Being at early phases of the development means the high level of uncertainty and that SoFi still did not experience much competition from traditional banks. SoFi’s revenue is more than 40 times lower compared to Bank of America (BAC), meaning that large banks are unlikely to see competitor in fintech at this point of evolution. But in case BAC (or any other banking behemoth) decides to launch its own fintech platform, there is little certainty regarding whether SoFi could withstand competition from such a monster.

In determining my target price I use a $0.24 FY 2025 forward EPS estimate for consensus, which is more than three times higher than FY 2024 estimate. Such a rapid EPS expansion is a challenge even considering SoFi’s strong revenue growth and EPS improvement record. Moreover, FY 2025 is relatively far and the management’s guidance will likely change several times while SoFi reports each of its quarterly earnings this year. Considering the 45 P/E multiple used by me even a slight FY 2025 EPS downgrade might mean considerable target price deterioration.

Conclusion

The current share price looks very attractive, considering SoFi’s current revenue growth and future potential. The adjusted EPS is expected to turn positive in the current fiscal year, which is also likely to be a big positive catalyst. My target price is $10.8 and I consider SOFI a “Strong buy”.