‘Some are parked here for a year, sometimes a year and a half’

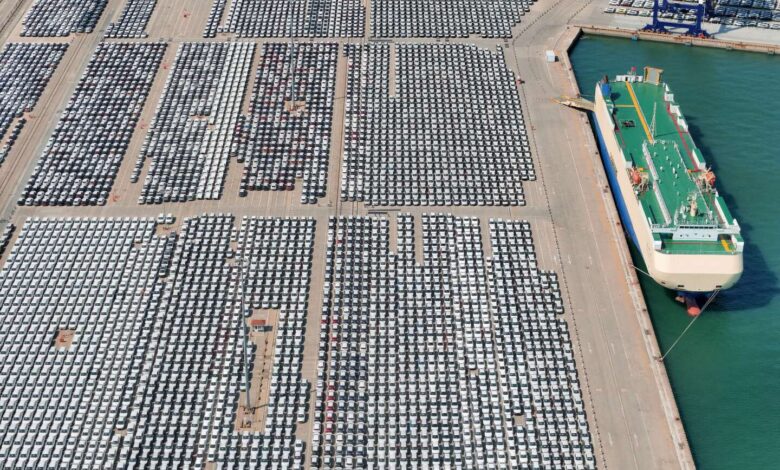

You probably need to see it to appreciate the challenges the automobile industry faces in transitioning to electricity. You also need to come here to see how the Chinese industry’s overcapacity is able to flood the European market. That morning, as the sun unexpectedly lit up the maze of highways leading to this remote arm of the port of Antwerp (Belgium), a huge cargo ship from the Norwegian company Höegh Autoliners unloaded thousands of cars at one of the terminals of International Car Operators (ICO), a subsidiary of the Japanese group Nippon Yusen Kaisha.

Alongside Swedish-Norwegian Wallenius Wilhelmsen, it is one of the main operators of the now merged port of Antwerp-Bruges, the world’s largest automotive terminal, through which the production of some 40 brands used to transit. But that was before the emergence of their Chinese competitors.

At Calloo, near Antwerp, and Zeebrugge, on the North Sea coast, huge parking lots can accommodate some 130,000 vehicles, but they now find themselves too cramped. In 2022, 3.4 million vehicles passed through the two ports. Since then, the market has evolved further, challenges have multiplied and operators are doing their best to resolve vehicle storage issues.

In front of the carefully guarded gates of ICO in Calloo, cars of all make are lined up as far as the eye can see before being loaded onto trucks from Italy, the UK, Poland, and Germany. In the foreground are models that are often still unknown to the general public. “All Chinese. I prefer German cars,” grumbled Rinus De Vries, a Dutch truck driver waiting in his cab.

MG, BYD, Nio, XPeng, Lynk & Co, Omoda, Hongqi, etc. A dozen Chinese automakers have launched a commercial offensive in order to export nearly 4.1 million cars by 2023 (+ 58% in one year). They aim to conquer a European market undergoing rapid change, thanks in part to the subsidies available in several countries for the purchase of electric vehicles.

‘An unmanageable chaos’

According to the port authorities’ forecasts, between 600,000 and 1 million Chinese-made vehicles, both electric and internal combustion-powered, will be unloaded at Antwerp-Bruges in 2024. Among them are Teslas, BMWs, and Polestars − the Swedish brand owned by the Chinese company Geely − all assembled in the Middle Kingdom. Audi recently started pre-production of an electric SUV at its new plant in Changchun (Jilin province).

In the wake of an article published by the Financial Times on April 9 that highlighted the congestion at several European ports, including Antwerp-Bruges and Bremerhaven in Germany, requests for interviews have gone unanswered. “We are not currently facing any such problems,” said David Hopkins, spokesman for Wallenius Wilhelmsen in Zeebrugge. ICO said they had “no further information” to offer. And yet, a simple visit to the parking lots managed by the two operators is enough to understand that they’re striving to downplay their difficulties so as not to damage their image.

You have 51.65% of this article left to read. The rest is for subscribers only.